Stock Market Today: 53-Year-Low Jobless Claims Lift the Market

Weekly unemployment claims add to a bevy of positive economic data points, driving a wide rebound across the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks logged a broad advance Thursday in the wake of the smallest weekly jobless claims number since John Lennon called it quits with the Beatles.

The Labor Department reported just 187,000 initial unemployment claims for the week ended March 19. That was 28,000 less than last week's revised claims report and the lowest such figure since September 1969.

"Before the pandemic, the number was hovering around 220,000, and we saw a complete recovery to these levels in the previous four weeks," says Alex Kuptsikevich, senior market analyst for forex broker FxPro. "The fresh data has marked a move into uncharted territory, indicating a further tightening in the labor market."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In other Thursday news, U.S. durable-goods orders for March fell by 2.2%. That was far below expectations for growth of 0.6% and represents the first decline in five months. Nevertheless, various economic readings are "still showing positive momentum overall on an absolute basis with the economy well above pre-pandemic highs," says Peter Essele, head of portfolio management for Commonwealth Financial Network.

Semiconductor stocks were at the fore of Thursday's rally, led by Nvidia (NVDA, +9.8%), which said late Wednesday that it would explore using Intel (INTC, +6.9%) as a foundry for the manufacture of its chips.

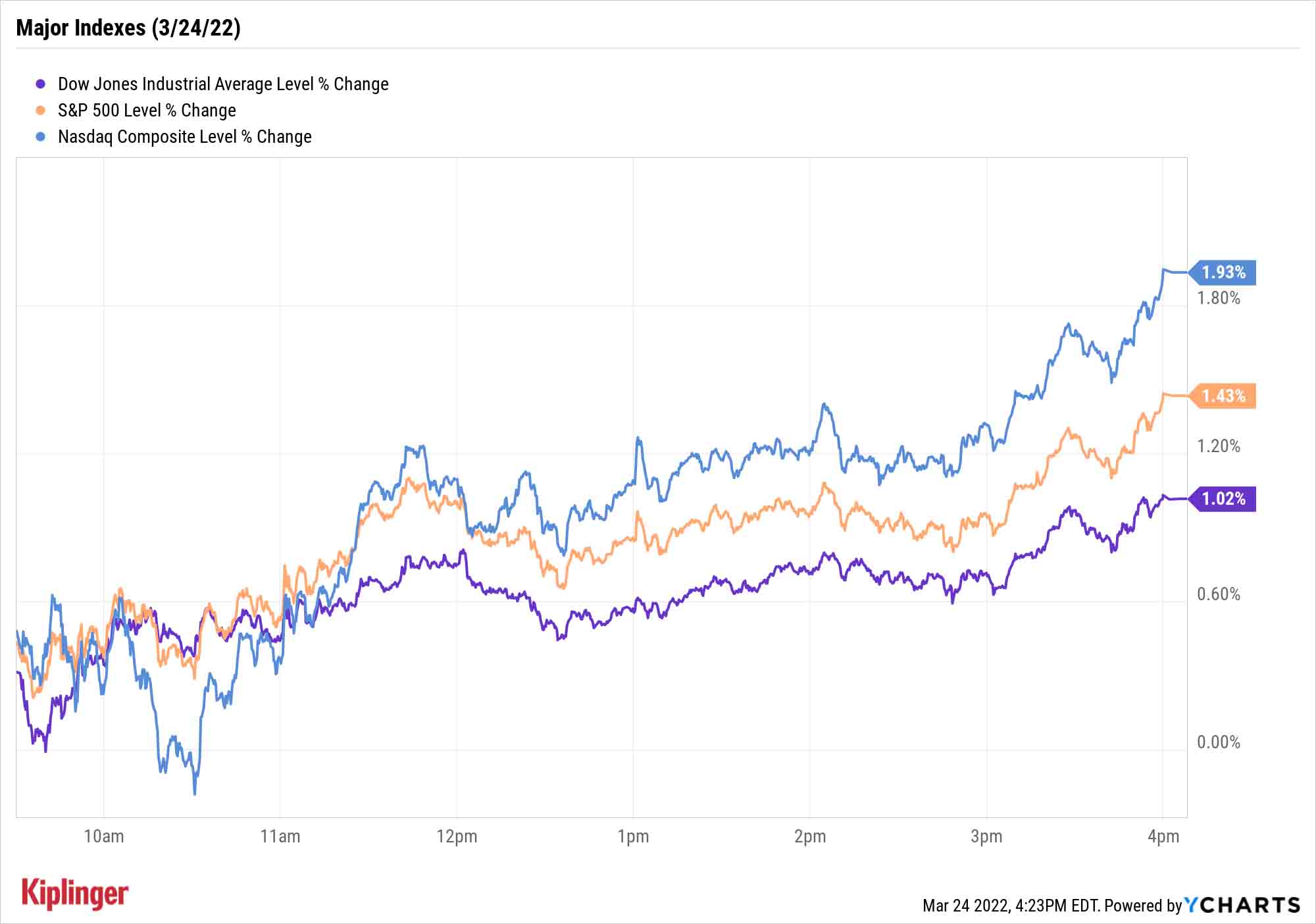

NVDA helped the Nasdaq Composite (+1.9% to 14,191) pace the major indexes, with the S&P 500 (+1.4% to 4,520) and Dow Jones Industrial Average (+1.0% to 34,707) also finishing well in the green.

Other news in the stock market today:

- The small-cap Russell 2000 gained 1.1% to 2,075.

- U.S. crude futures fell almost 2.3% to settle at $112.34 per barrel.

- Gold futures rose 1.3% to end at $1,962.20 an ounce.

- Bitcoin joined in Thursday's rally, jumping 4.1% to $43,946.42. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- KB Home (KBH) slid 4.6% after the homebuilder reported fiscal first-quarter adjusted earnings of $1.47 per share on $1.40 billion in revenue – lower than the $1.52 per share and $1.49 billion analysts were expecting. Still, the figures were up 44% and 23$, respectively, year-over-year, and CEO Jeffrey Mezger said KBH is well-positioned to hit its full-year financial targets. "KB Home is not seeing a slowdown in demand despite price increases and the recent spike in mortgage rates," says BofA Securities analyst Rafe Jadrosich, who reiterated a Buy rating. He also said KBH's valuation "looks very compelling with shares trading at a 12% discount to our year-end 2022 tangible book value forecast."

- Freeport-McMoRan (FCX) rose 3.3% after Jefferies analyst Christopher LaFemina chimed in on the mining stock. "Freeport is in a strong competitive position in the midst of an earnings upgrade cycle that will take years to play out," LaFemina says. "The company has a clear path to grow its cash flow and capital returns and can create additional shareholder value by developing its unique organic growth pipeline." The analyst has a Buy rating on FCX, adding " the market continues to underappreciate the likely magnitude and duration of the ongoing cyclical upturn in copper." Several other basic materials stocks also traded higher today, including Cleveland-Cliffs (CLF, +12.0%), U.S. Steel (X, +6.5%) and Nucor (NUE, +4.3%).

The Third Year of the Bull Market

Yesterday marked the end of the bull market's second year, but investors might be in for a trying year three.

The post-COVID-19 bull market is the fastest bull market to double, at just under 18 months. However, "as this bull market reaches the third year of life, investors need to remember that year three of bull markets tend to be a little tamer, with the larger gains happening in year one and two," says Ryan Detrick, chief market strategist for LPL Financial.

"In fact, out of the 11 bull markets since World War II, we found that three of them ended during year three, while the ones that didn't end saw an average gain of only 5.2%."

In other words, at least historically speaking, we can expect some turbulence in the year to come.

The good news is that prepared investors can make the most of these challenges. Stocks that stave off sizzling inflation, for instance, or stocks that excel during periods of rising interest rates, afford investors relief from two of the market's biggest present pressures.

Meanwhile, a host of exchange-traded funds (ETFs) built to withstand this year's myriad challenges will also serve folks well. Our 22 best ETFs for 2022 include a little something for everyone: all-weather funds, ETFs constructed with inflation and rising interest rates in mind, and funds designed to withstand any additional complexities that could pop up soon enough.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.