Stock Market Today: Oil Cools Off, But Stocks Remain Stymied

Peace talks were among several factors that weighed on crude prices Monday, but rising Treasury rates kept equities grounded.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Recently red-hot energy prices were hosed down on Monday, but that gave only limited relief to equities, and only in a few select quarters.

U.S. crude oil futures plunged 5.8% to $103.01 per barrel, heading lower early in the day as Ukraine and Russia conducted fresh peace talks. Further downward pressure came from COVID-related lockdowns in China's Shenzhen and Jilin provinces, as well as reports indicating that the U.S. might ease sanctions on Venezuela to get more oil on the market.

The drawdown in crude prices, which helped to soothe mounting inflation worries, lifted the broader equity indexes in the morning. Tempering that optimism, however, was a rise in Treasury rates ahead of the Federal Reserve's much-anticipated March 15-16 meeting to determine the direction of its benchmark rate.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Our view remains that Fed interest rate hikes will likely begin this week with a 25-basis-point (0.25%) increase and then three to four more rate hikes at subsequent meetings in 2022," say LPL Financial strategists Lawrence Gillum and Ryan Detrick. "However, if inflationary pressures remain stubbornly high and we start to see longer-term inflation expectations become unanchored, the Fed may be forced to move more aggressively than what is even already priced in."

As if that weren't worrisome enough, investors also must keep a wary eye on Europe, where several countries have detected a COVID variant dubbed "deltacron," that shares elements of both the delta and omicron strains. But while it's early days, scientists have seen little to indicate that it's more lethal or transmissible than prior versions.

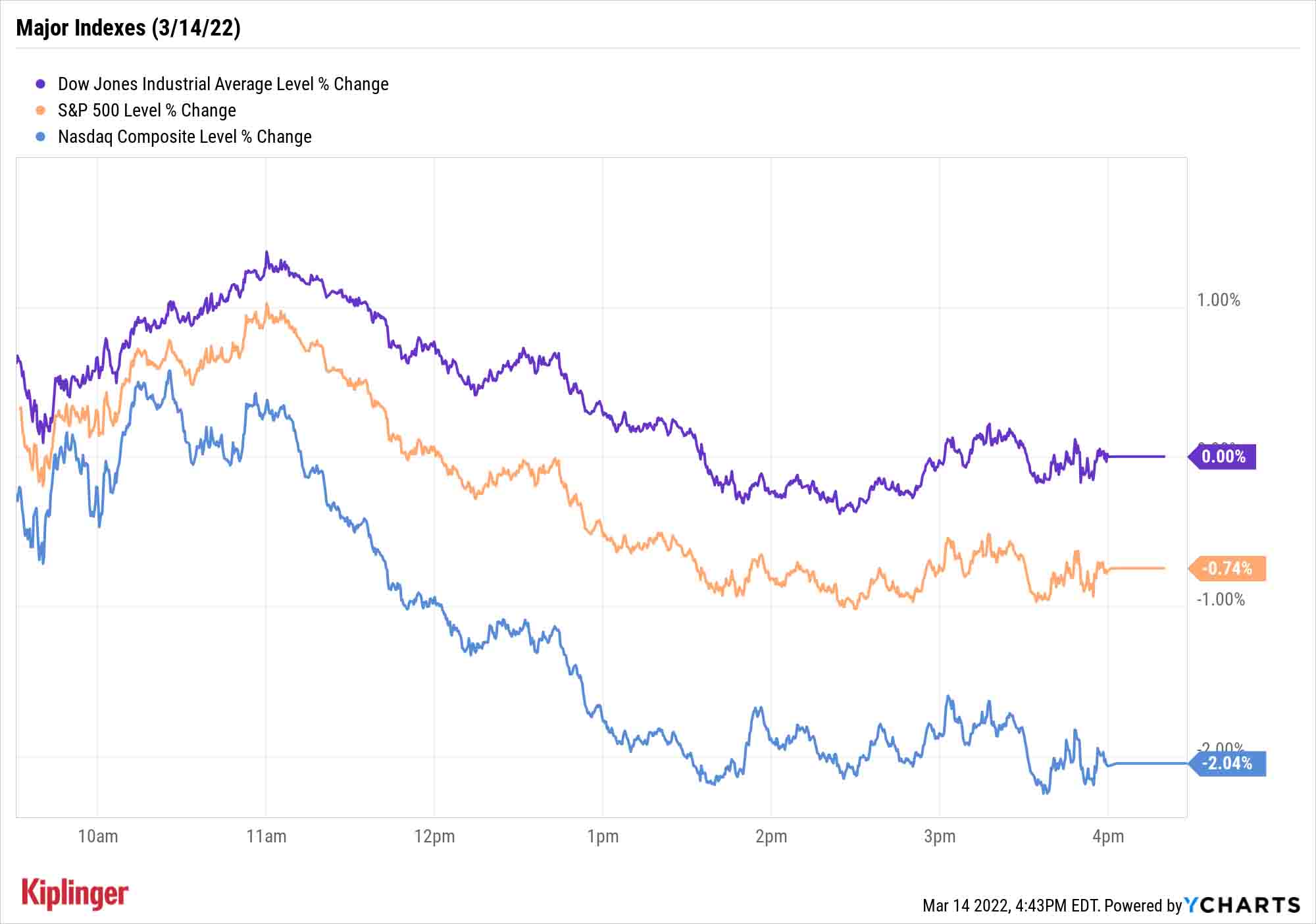

Higher yields on U.S. debt weighed on the growthy technology (-1.8%) and consumer discretionary (-1.7%) sectors, which in turn bogged down the Nasdaq Composite (-2.0% to 12,581). The S&P 500 finished with a more modest 0.7% decline to 4,173, while the Dow Jones Industrial Average managed to squeeze out a marginal, single-point gain to 32,945.

Even more volatility potential is just a couple days past the Fed meeting.

"The options market is telegraphing that it is more worried about expiration Friday than the outcome of the Federal Reserve's rate-setting committee on Wednesday," says Michael Oyster, chief investment officer for asset-management firm Options Solutions. The price of on the SPDR S&P 500 ETF (SPY) straddles – a trading strategy that investors use when they are unsure if stock prices will rise or fall – indicates the March expiration is potentially more disruptive to stocks than the closely watched Fed meeting."

"The straddle – that is buying an at-the-money put and call with the same strike price and expiration – suggests the stock market will move 2.3%, up or down, on Wednesday. On Friday, when standard March options expire, the straddle suggests the S&P 500 may move 3%, up or down. The options market has literally priced what a difference a day makes."

Other news in the stock market today:

- The small-cap Russell 2000 retreated by 1.9% to 1,941.

- Gold futures shed 1.2% to settle at $1,960.80 an ounce.

- Bitcoin earned a small 1.2% boost to $38,817.40. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Several Chinese stocks took it on the chin today amid the aforementioned COVID-19 lockdown in Shenzen, as well as last week's report from the Securities and Exchange Commission (SEC) that named five U.S. listed American depositary receipts (ADRs) that it says violated the Holding Foreign Companies Accountable Act (HFCAA) by not allowing American regulators to review their company audits – something that China has banned – putting them at risk of a potential delisting. Alibaba Group (BABA, -10.3%) and JD.com (JD, -10.5%) were among the day's biggest decliners, dragged even lower by a downgrade to Underweight (Sell) at J.P. Morgan Securities.

- Tyson Foods (TSN) fell 2.4% after BMO Research analyst Kenneth Zaslow downgraded shares of the meat processor to Market Weight (Hold). " Our downgrade does not reflect a change in our long-term view of TSN's ability to affect internal change through its actions, operational improvements, or capacity expansions, but rather our disciplined approach and a potential reduction to underlying fundamentals outside chicken, particularly beef," Zaslow says.

- Netflix (NFLX) shed 2.7% to end the day at $331.01, its lowest close since mid-March 2020. Shares of the streaming service have been hit especially hard in early 2022, down 45% for the year-to-date, and have now officially erased all of their pandemic-related gains. Still, Wedbush analyst Michael Pachter recently upgraded the stock to Neutral from Underperform (Hold and Sell, respectively). "The recent share price decline reflects that Netflix investors have begun to appreciate that the company's long-term prognosis is as a low growth, extremely profitable enterprise," Pachter writes in a note. "While we do not anticipate significant share price appreciation in the near-term, Netflix's first mover advantage and large subscriber base provides the company with a nearly insurmountable competitive advantage over its streaming peers."

Berkshire Stock Hits $500,000

Outperforming the broader indexes yet again in 2022 was none other than Warren Buffett, whose Berkshire Hathaway quietly reached a new milestone Monday.

His company’s Class B shares, traded as BRK.B, gained 1.0% today to bring their year-to-date gains to 10.4% – a far better pace than the S&P 500’s 12.4% loss so far in 2022.

Improving slightly less were Berkshire’s far-less-discussed Class A shares (BRK.A, +0.8%), but they accomplished something far more noteworthy: They crossed a whopping $500,000 per share on an intraday basis for the first time in their history.

The achievement is in part due to a refusal to split the Class A shares – a move meant to deter speculative trading. But it’s also a testimony to Warren Buffett’s investing acumen, which has made Berkshire one of the 30 best stocks of the past 30 years and kept investors glued to what the Oracle of Omaha is buying and selling every quarter.

Read on to learn more about BRK.A shares' ascent to $500,000.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The New Reality for Entertainment

The New Reality for EntertainmentThe Kiplinger Letter The entertainment industry is shifting as movie and TV companies face fierce competition, fight for attention and cope with artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost You

Betting on Super Bowl 2026? New IRS Tax Changes Could Cost YouTaxable Income When Super Bowl LX hype fades, some fans may be surprised to learn that sports betting tax rules have shifted.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.