Berkshire Hathaway Class A Shares Pass the $500,000 Mark

The most expensive stock in the world has reached new heights, with Berkshire Hathaway's Class A shares closing above half a million dollars for the first time.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Warren Buffett's Berkshire Hathaway (BRK.B, $326.60) is having a great year in a down market, and on March 16, it quietly hit a milestone. The company's far-lesser-traded Class A shares closed above $500,000 for the first time in their history.

That’s right. A piece of Buffett’s holding company costs more than a cool half-million per share.

BRK.A, which crossed $5,000 way back in 1989, first broke $500,000 on an intraday basis on March 14, but closed just shy of that level. Two days later, however, it held on. The Class A shares have attained such a shocking dollar amount because Buffett has never split the stock. That’s intentional. The high price of admission to the Class A shares helps attract long-term investors and discourages speculation, is Buffett's thinking, and he told shareholders as much in 1984.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Of course, most investors still have access to Warren Buffett’s investing acumen via the more accessible Berkshire Hathaway Class B shares, which currently trade around $335 each. The Class B shares, created in 1996, remain at reasonable levels thanks to the 50-to-1 split required to facilitate Berkshire's acquisition of railroad operator Burlington Northern Santa Fe in 2010.

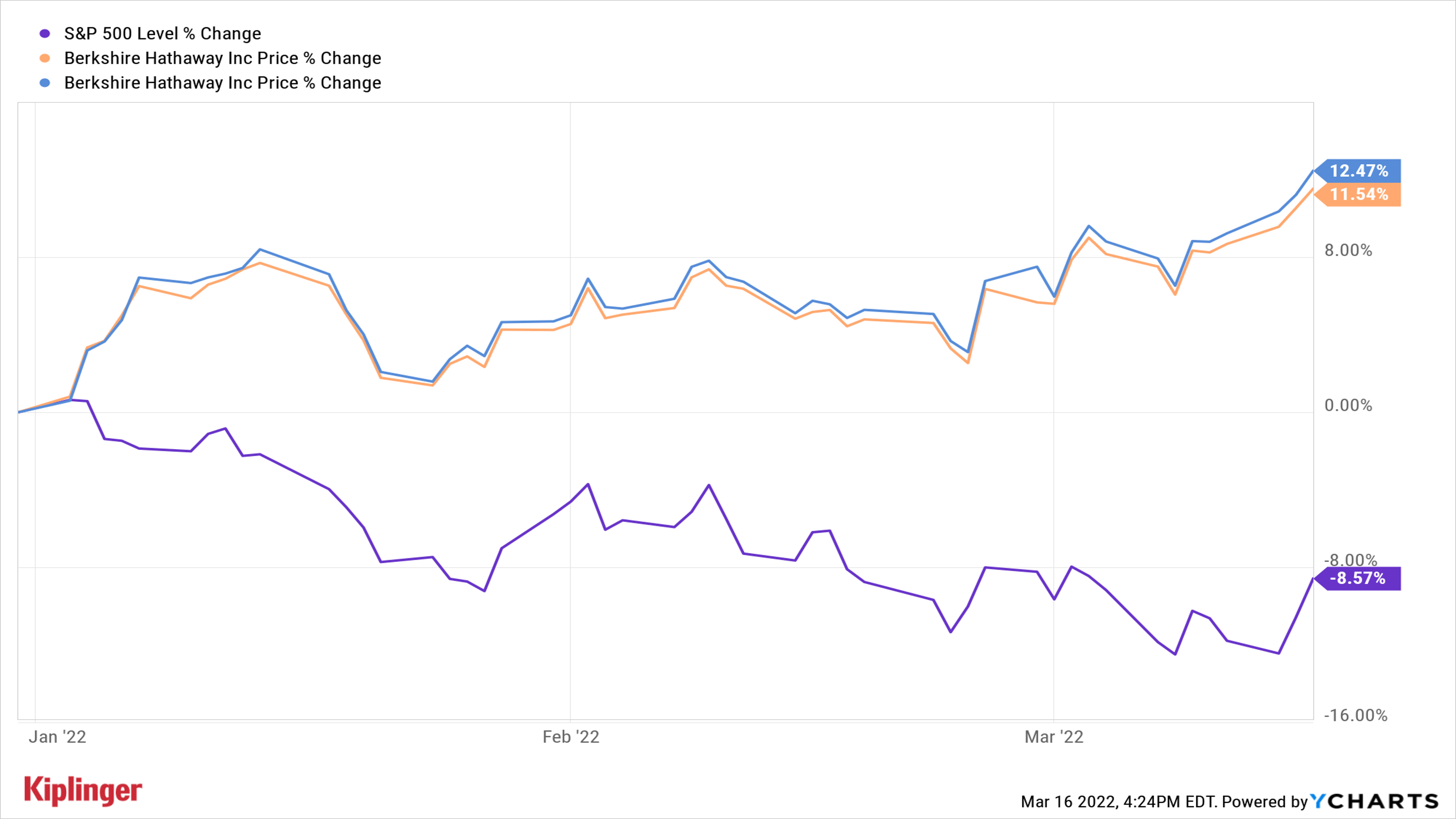

Happily, investors in both share classes are enjoying considerable outperformance amid an otherwise painful start to 2022. BRK.A was up 11.5% for the year-to-date through March 16, closing its record-breaking day at $504,036. BRK.B added 12.5% over that span.

The S&P 500? It’s off by 8.6%.

Berkshire Shares Are Long-Term Winners, Too

The fact that Class A shares have never split explains their half-million-dollar price tag, but that shouldn't diminish Buffett's role in getting them to their lofty level. Folks don't call him the greatest long-term investor of all time for nothing.

For one thing, Berkshire Hathaway is the 12th best stock of the past 30 years, according to Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University. Under Buffett's stewardship, BRK.A and BRK.B created $504.1 billion in wealth for shareholders, or 11.7% annualized, between January 1990 and December 2020.

Longer term, Buffett's performance is pretty much untouchable. Berkshire's return more than doubled that of the S&P 500 since 1965, notes Argus Research – or a compound annual growth rate of 20.1% vs. 10.5% for the index.

Putting it perhaps most evocatively is Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. He notes that if you had invested $10,000 in Berkshire Hathaway in 1968 and left it untouched for 50 years, your nut would have grown to $85 million.

Buffett's unparalleled investment returns and his refusal to split the Class A shares make them by far and away the most expensive stock in the world, per data from S&P Global Market Intelligence. For context, Swiss chocolate maker Lindt & Sprüngli AG (LDSVF) comes in a distant second, with a home exchange price of about 108,200 Swiss francs (or $115,078).

Here are some other ways to put BRK.A's $504,000 stock price in perspective. A single Berkshire Class A share is …

- 1.23 times the median sales price of a house in the U.S. (~$408,100).

- 2.5 times the average annual wage of an American CEO (~$198,000).

- 130,208 McDonald's hamburger Happy Meals.

To be sure, there's nothing special about BRK.A closing above $500,000 a share – not even psychologically. Only 615,160 shares are available for trading, average daily volume is 1,940 shares, and, uh, they cost around $500,000 a pop. It's not like retail investors are going to chase these prices higher on surging volume.

But it's a fun milestone to note and a tribute to the power of buy-and-hold (and hold and hold and hold) investing. And then some.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

4 Estate Planning Documents Every High-Net-Worth Family Needs

4 Estate Planning Documents Every High-Net-Worth Family NeedsThe key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.