Stock Market Today: Fastest Inflation in 40 Years Flattens Stocks' Rally

A white-hot January CPI report exceeded already high expectations, raising expectations for Fed intervention and lowering the boom on equity prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The much-awaited consumer price index (CPI) reading for January more than lived up to its billing, jumping by the fastest annual rate in four decades. Wall Street ultimately sold off on the news, but only after a few hours of waffling.

The Labor Department said Thursday that consumer prices rose by a whopping 7.5% annually in January, easily exceeding economists' estimates of 7.2% – the sharpest such increase since February 1982.

The headline number was driven by steeply higher prices for food and energy, but even "core" CPI, which backs out groceries and gasoline, was up 6.0% annually.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That in turn heightened expectations of a more aggressive approach from the Federal Reserve to tamp down inflation.

"The odds of a 50-basis point hike jumped to around 50/50 and the yield on the 10-year Treasury is now trading around 2%," says Brian Price, head of investment management for independent broker-dealer Commonwealth Financial Network. "Investors may want to buckle up. It could be a rough ride for risk assets until inflationary data starts to abate, and I expect that it will, as we move through the year."

However, Bill Adams, chief economist for Comerica Bank, notes that while price gains continued to overshoot the Fed's target last month, fundamental drivers of inflation are beginning to improve.

"Remember, a big part of the surge in prices was from shortages, and the economy is making big strides to reduce shortages," he says. "Businesses made a huge inventory build in the fourth quarter of last year, and surveys (ISM, NFIB) show that businesses continued to grow inventories, worked through order backlogs, and see less supplier delivery delays in January.

"Over time this will show up in inflation, but it wasn't enough to help in January."

A little more encouraging was the latest unemployment-benefits data, which showed 223,000 filings for the week ended Feb. 5, below 230,000 expected.

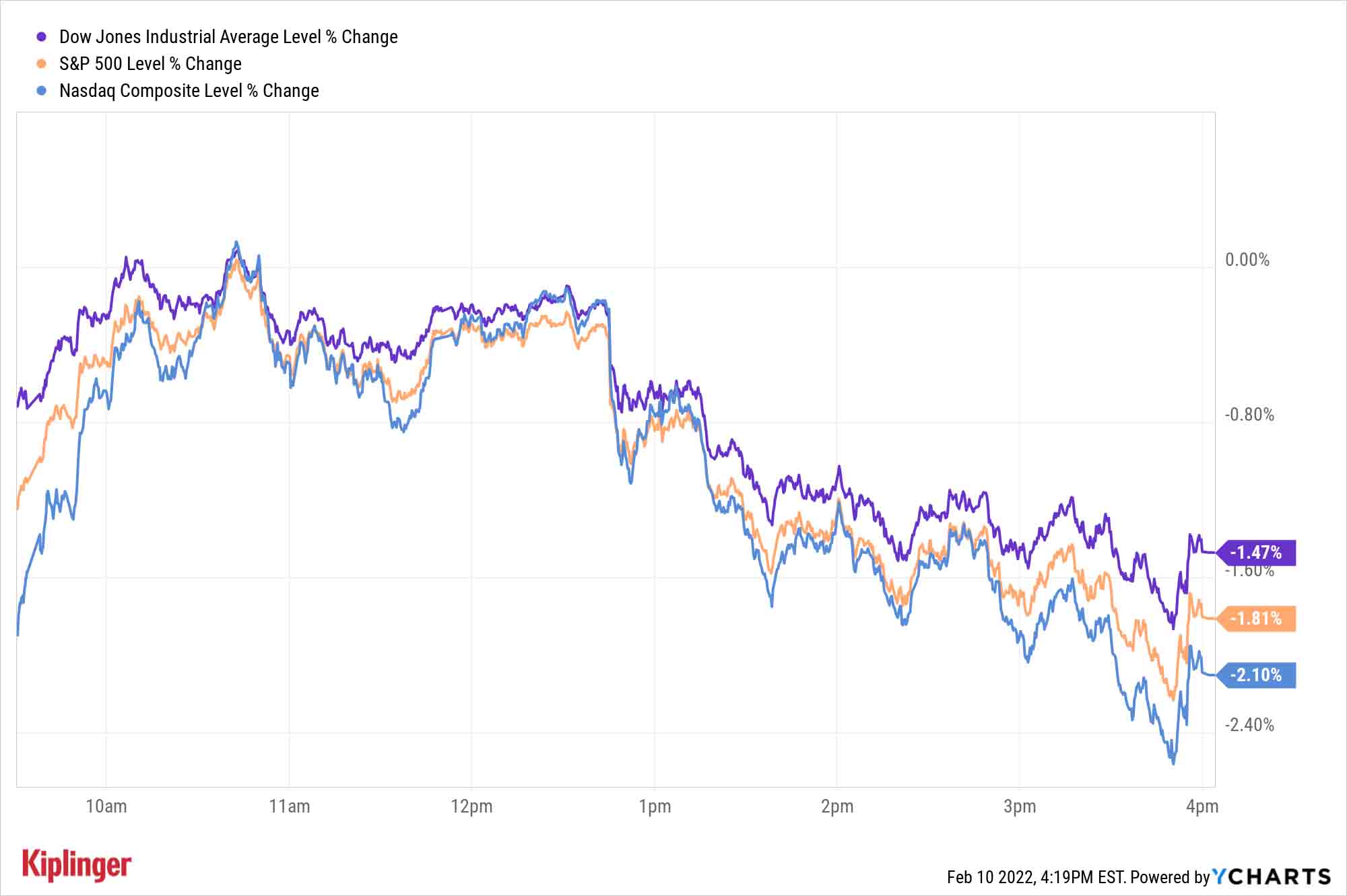

Stocks finished lower but hardly got there in a straight line; they opened well in the red, then flirted with gains an hour later before their legs gave out for the rest of the day. The Nasdaq Composite (-2.1% to 14,185) led the way lower, helped by sizable declines in its largest components, Apple (AAPL, -2.4%) and Microsoft (MSFT, -2.8%). The S&P 500 was off 1.8% to 4,504, and the Dow declined 1.5% to 35,241.

Other news in the stock market today:

- The small-cap Russell 2000 sank 1.6% to 2,051.

- U.S. crude futures rose nearly 0.3% to end at $89.88 per barrel.

- Gold futures posted a marginal gain to finish at $1,837.40 an ounce.

- Bitcoin was off 1.4% to $44,119.77. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Affirm Holdings (AFRM) plunged sharply in mid-afternoon trading after the company accidentally posted a now-deleted tweet that included details of its fiscal second-quarter results, which were not due out until after tonight's close. The buy now, pay later firm brought in revenue of $361 million for the three-month period – up 77% year-over-year and above the $328.8 consensus estimate – but reported a wider-than-expected per-share loss of 57 cents and gave lower-than-expected revenue guidance for the current quarter. After being down as much as 33% earlier, AFRM ended the day down a still-sizable 21.4%.

- Walt Disney (DIS) was the best Dow stock today with its 3.4% gain. This honor came as a result of the entertainment firm's solid fiscal first-quarter earnings report, which showed a higher-than-expected adjusted profit of $1.06 per share and revenue of $21.8 billion – also more than analysts were expecting. In addition, theme park revenue more than doubled year-over-year, while Disney+ net adds came in above estimates. "Fiscal first-quarter results were solid, highlighted by better financials (revenues 5%-10% ahead; operating income beat by 50%+ due to better parks) and stronger Disney+ sub growth," writes UBS Global Research analyst John Hodulik (Buy). "We expect further upside as int' parks get back up to speed and recent initiatives improve the long-term cost structure/sustain higher per cap spend."

A Bad Day All Around, But...

It was hard to find much that "worked" today: Every equity sector was lower, bonds turned tail, and popular gold and oil funds even managed to close in the red.

So it's natural, given 2022's market moves, to be worried about inflation's effect on your investments – and you'd hardly be alone.

Charles Schwab today released its latest Trader Sentiment Survey, based on answers collected from Charles Schwab and TD Ameritrade traders in early to mid-January. And it showed that while overall, market optimism is prevailing, consumer prices are on nearly everyone's mind.

"Bulls outnumber bears among active traders, with 46% reporting a bullish outlook for the U.S. stock market for the first three months of the year compared with 39% who are bearish," Charles Schwab says. "But nearly nine out of 10 (88%) traders are concerned about inflation, and many are taking action to hedge against it."

If there's any good news, it's that no matter how you prefer to invest, you have plenty of hedges against the two predominant worries of the day – inflation and resultant rising Fed rates – at your disposal.

These five mutual funds, for instance, are designed to protect against the market impact of climbing consumer prices. And these seven ETFs feature equities and bonds that can mitigate the effects of (or even benefit from) steadily rising interest rates.

We have stock investors covered, too. These five stocks represent five different sectors that traditionally have managed to weather inflation better than their peers, combining to form a protective mini-portfolio of sorts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.