Factoring Inflation Into Your Retirement Plan

How much should you be worried about inflation’s impact on your retirement income plan? If you plan right, you shouldn’t have to worry at all.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Right now, inflation is top of mind for everyone, perhaps especially retirees.

Inflation is important. But it is only one of the risks that retirees have to plan for and manage. And like the other risks you have to manage, you can build an income plan so that rising costs (both actual and feared) do not ruin your retirement.

Inflation and Your Budget

Remember that in retirement your budget is different than when you were working, so you will be impacted in different ways. And, of course, when you were working your salary and bonuses might have gone up with inflation, which helped offset long-term cost increases.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Much of your pre-retirement budget was spent on housing — an average of 30% to 40%. Retirees with smaller or paid-off mortgages will have lower housing costs even as their children are busy taking out loans to buy houses, and even home equity loans to pay for home improvements.

On the other hand, while health care looms as a big cost for everyone, for retirees these expenses can increase faster than income. John Wasik recently wrote an article for The New York Times that cited a recent study showing increases in Medicare Part B premiums alone will eat up a large part of the recent 5.9% cost of living increase in Social Security benefits. As Wasik wrote, “It’s difficult to keep up with the real cost of health care in retirement unless you plan ahead.”

Inflation and Your Sources of Income

To protect yourself in retirement means (A) creating an income plan that anticipates inflation over many years and (B) allowing yourself to adjust for inflation spikes that may affect your short-term budget.

First, when creating your income plan, it’s important to look at your sources of income to see how they respond directly or indirectly to inflation.

- Some income sources weather inflation quite well. Social Security benefits, once elected, increase with the CPI. And some retirees are fortunate enough to have a pension that provides some inflation protection.

- Dividends from stocks in high-dividend portfolios have grown over time at rates that compare favorably with long-term inflation.

- Interest payments from fixed-income securities, when invested long-term, have a fixed rate of return. But there are also TIPS bonds issued by the government that come with inflation protection.

- Annuity payments from lifetime income annuities are generally fixed, which makes them vulnerable to inflation. Although there are annuities available that allow for increasing payments to combat inflation.

- Withdrawals from a rollover IRA account are variable and must meet RMD requirements, which do not track inflation. The key in a plan for retirement income, however, is that withdrawals can make up any inflation deficit. In Go2Income planning, the IRA is invested in a balanced portfolio of growth stocks and fixed income securities. While the returns will fluctuate, the long-term objective is to have a return that exceeds inflation.

- Drawdowns from the equity in your house, which can be generated through various types of equity extraction vehicles, can be set by you either as level or increasing amounts. Use of these resources should be limited as a percentage of equity in the residence.

The challenge is that with these multiple sources of income, how do you create a plan that protects you against the inflation risk — as well as other retirement risks?

Key Risks That a Retirement Income Plan Should Address

A good plan for income in retirement considers the many risks we face as we age. Those include:

- Longevity risk. To help reduce the risk of outliving your savings, Social Security, pension income and annuity payments provide guaranteed income for life and become the foundation of your plan. As one example, you should be smart about your decision on when and how to claim your Social Security benefit in order to maximize it.

- Market risk. While occasional “corrections” in financial markets grab headlines and are cause for concern, you can manage your income plan by reducing your income’s dependence on these returns. By having a large percentage of your income safe and less dependent on current market returns, and by replanning periodically, you are pushing a significant part of the market risk (and reward) to your legacy. In other words, the kids may receive a legacy that reflects in part a down market, which can recover during their lifetimes.

- Inflation risk. While a portion of every retiree’s income should be for their lifetime and less dependent on market returns, you need to build in an explicit margin for inflation risk on your total income. The easiest way to do that is to accept lower income at the start. For example, under a Go2Income plan, our typical investor (a female, age 70 with $2 million of savings, of which 50% is in a rollover IRA) can plan on starting income of $114,000 per year under a 1% inflation assumption. It would be reduced to $103,000 under a 2% assumption.

So, what factors should you consider in making that critical assumption about how much inflation you need to account for in your plan?

Picking a Long-Term Assumed Inflation Rate

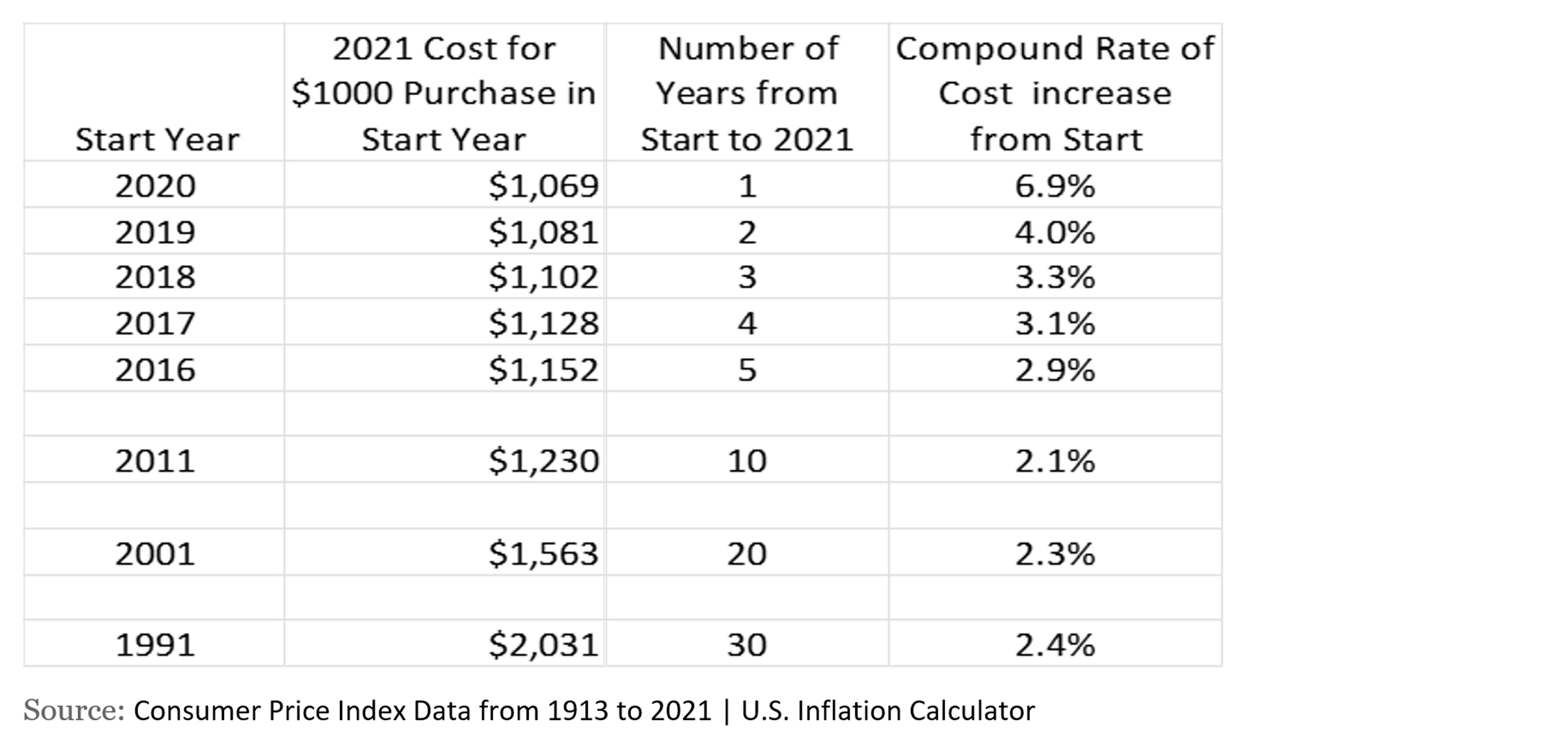

Financial writers often talk about the magic of compound interest; in real numbers, it translates to $1,000 growing at 3% a year for 30 years to reach $2,428. Sounds good when you’re saving or investing. But what about when you’re spending? The purchase that today costs $1,000 could cost $2,428 in 30 years if inflation were 3% a year.

When you design your plan, what rate of inflation do you assume? Here are some possible options (Hint: One option is better than the others):

- Assume the current inflation of 5.9% is going to continue forever.

- Assume your investments will grow faster than inflation, whatever the level.

- Assume a reasonable long-term rate for inflation, just like you do for your other assumptions.

We like the third choice, particularly when you consider the chart below. Despite the dramatically high rate of today’s inflation that affects every result in the chart, the long-term inflation rate over the past 30 years was 2.4%. For the past 10 years, it was even lower at 2.1%.

A Long-Term View Smooths Inflation Spikes

Managing Inflation in Real Time

Whether you build your plan around 2.0%, 2.5% or even 3.0%, it is helpful to realize that any short-term inflation rate will not match your plan assumption. My view is that you can adjust to this short-term inflation in multiple ways.

- Where possible, defer purchases that are affected by temporary price hikes.

- Where you can’t defer purchases, use your liquid savings accounts to purchase the items, and avoid drawing down from your retirement savings.

- If you believe price hikes will continue, revise your inflation assumption and create a new plan. Of course, monitor your plan on a regular basis.

Inflation as Part of the Planning Process

Go2Income planning attempts to simplify the planning for inflation and all retirement risks:

- Set a long-term assumption as to the inflation level that you’re comfortable with.

- Create a plan that lasts a lifetime by integrating annuity payments.

- Generate dividend and interest yields from your personal savings, and avoid capital withdrawals.

- Use rollover IRA withdrawals from a balanced portfolio to meet your inflation-protected income goal.

- Manage your plan in real time and make adjustments to your plan when necessary.

Inflation is a worry for everyone, whether you are retired or about to retire. Put together a plan at Go2Income and then adjust it based on your expectations and objectives. We will help you create a retirement income plan that anticipates inflation and adjusts to the retirement risks you may face.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.