Stock Market Today: Tech Leads on Turnaround Tuesday

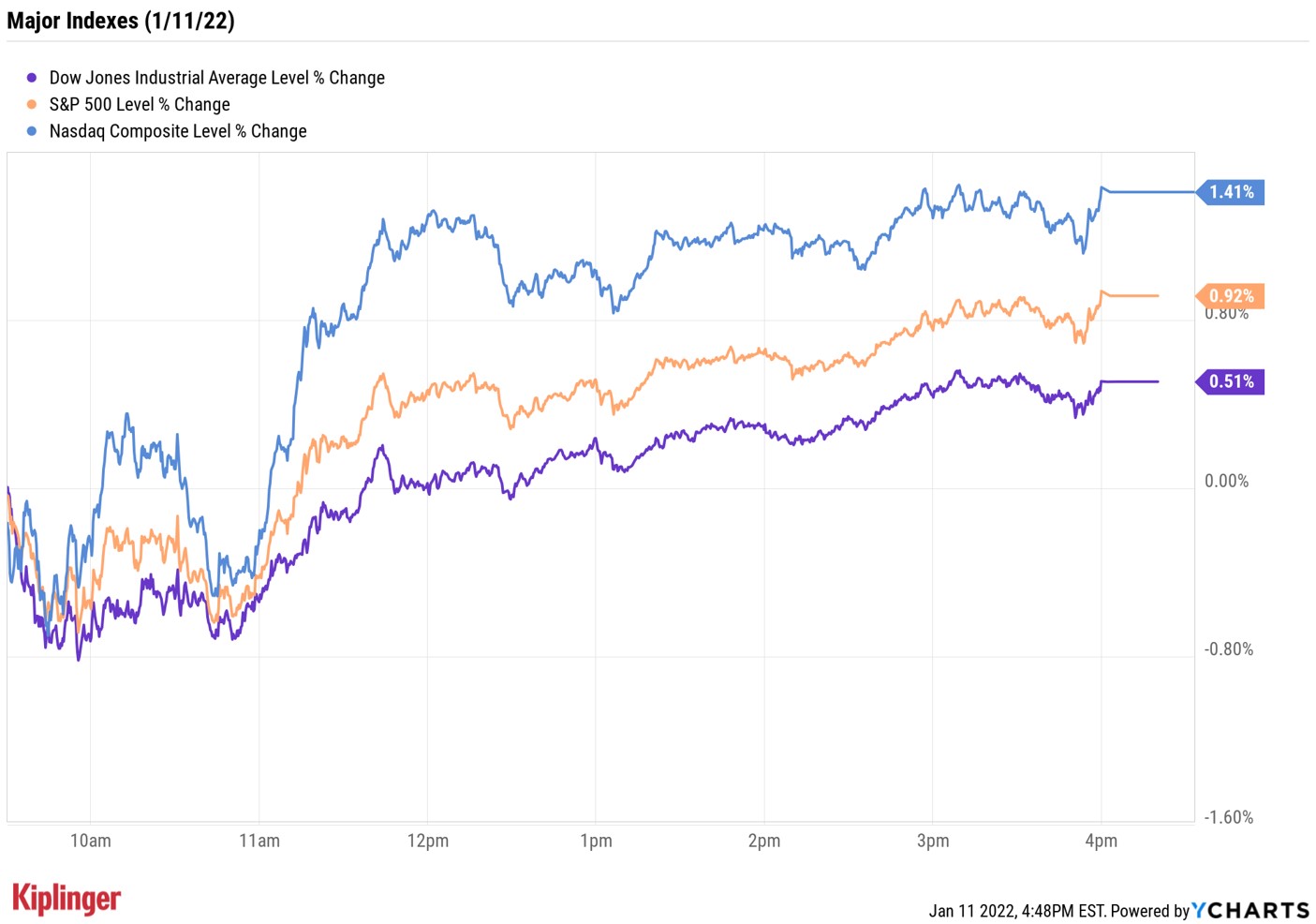

The major benchmarks bounced off their mid-morning lows to end solidly higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Markets opened Tuesday in the red, suggesting another day of selling on Wall Street ahead, but bounced off their mid-morning lows to blaze a trail higher into the close.

One potential catalyst for the rebound in stocks was Fed Chair Jerome Powell's reconfirmation hearing in front of the Senate Banking Committee this morning, where he told lawmakers that the central bank is prepared to "raise interest rates more over time" if inflation continues to run high.

Powell's testimony comes ahead of the latest inflation update: December's consumer price index is due out tomorrow morning. Gargi Chaudhuri, head of iShares Investment Strategy, Americas, thinks the data will show a broad-based increase in prices and come in well above the Fed's comfort level.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"We expect to see core inflation breach 5% – the highest in 30 years – as well as headline inflation above 7%, the highest in almost 40 years," she adds.

The tech-heavy Nasdaq Composite led the charge higher, gaining 1.4% to end at 15,153 – thanks in part to a big earnings boost for genome sequencing stock Illumina (ILMN, +17.0%). The S&P 500 Index rose 0.9% to 4,713, and the Dow Jones Industrial Average added 0.5% to 36,252.

Other news in the stock market today:

- The small-cap Russell 2000 gained 1.1% to end at 2,194.

- U.S. crude oil futures jumped 3.8% to $81.22 per barrel, sparking gains in the likes of Exxon Mobil (XOM, +4.2%) and APA (APA, +8.8%).

- Gold futures also finished solidly higher, up 1.1% to $1,818.50 per ounce.

- Bitcoin spiked 2.6% to $42,818.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- International Business Machines (IBM, -1.6%) was off Tuesday following a downgrade from UBS analyst David Vogt. Despite the company's spinoff of its legacy IT lines in Kyndryl Holdings (KD, +0.7%) to focus on higher-growth businesses, Vogt says "our detailed bottom-up analysis of IBM's remaining segments supports our view that roughly 50% of IBM's top line is unlikely to grow long-term and could decline." The analyst also cited "an elevated valuation that leaves the shares vulnerable over the next 12 months" in cutting the stock to Sell from Neutral (equivalent of Hold) and dropping his price target to $124 per share from $136.

- E-commerce stocks, which have largely been battered over the past few months, enjoyed a brisk relief rally on Tuesday. Amazon.com (AMZN, +2.4%) was the largest such name with the wind at its back; PayPal (PYPL, +4.7%), Chinese e-commerce firm JD.com (JD, +10.3%) and Latin American marketplace MercadoLibre (MELI, +10.7%) were among other notable industry names making advances.

- A day after Moderna (MRNA, -5.3%) popped after its CEO said the biotech firm was working on a vaccine booster targeting the omicron variant, the stock suffered a bout of outsized profit-taking on no other news.

Keep an Eye on Chip Stocks

One of the biggest pockets of strength today was in semiconductors, which surged 1.7%, and there could be more where that came from.

True, chipmakers have sold off alongside their fellow tech stocks in 2022, but several Wall Street firms see big things for the industry.

iShares' Chaudhuri, for one, says "Investors may need to be increasingly selective in their equity allocations, with a preference for value and quality, as well as industries with pricing power, such as semiconductors," adding that "semiconductors are the backbone of powerful emerging technologies including artificial intelligence and digital payments, and the subsector offers a relatively high free cash flow yield."

Meanwhile, BofA Global Research strategists "see a worthwhile 2022 setup" and highlights several "top themes" to watch out for, including cloud – gaming and the metaverse, for instance – and automotive, namely electric vehicles (EVs).

For those looking for opportunity among semiconductor stocks, consider this list of names that are poised for growth this year and beyond. While some are established leaders, others offer investors the chance to find under-the-radar gems.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.