Stock Market Today: Stocks Notch Second Straight Day of Gains

A solid reading from the Conference Board on consumer confidence lifted the collective mood on Wall Street.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

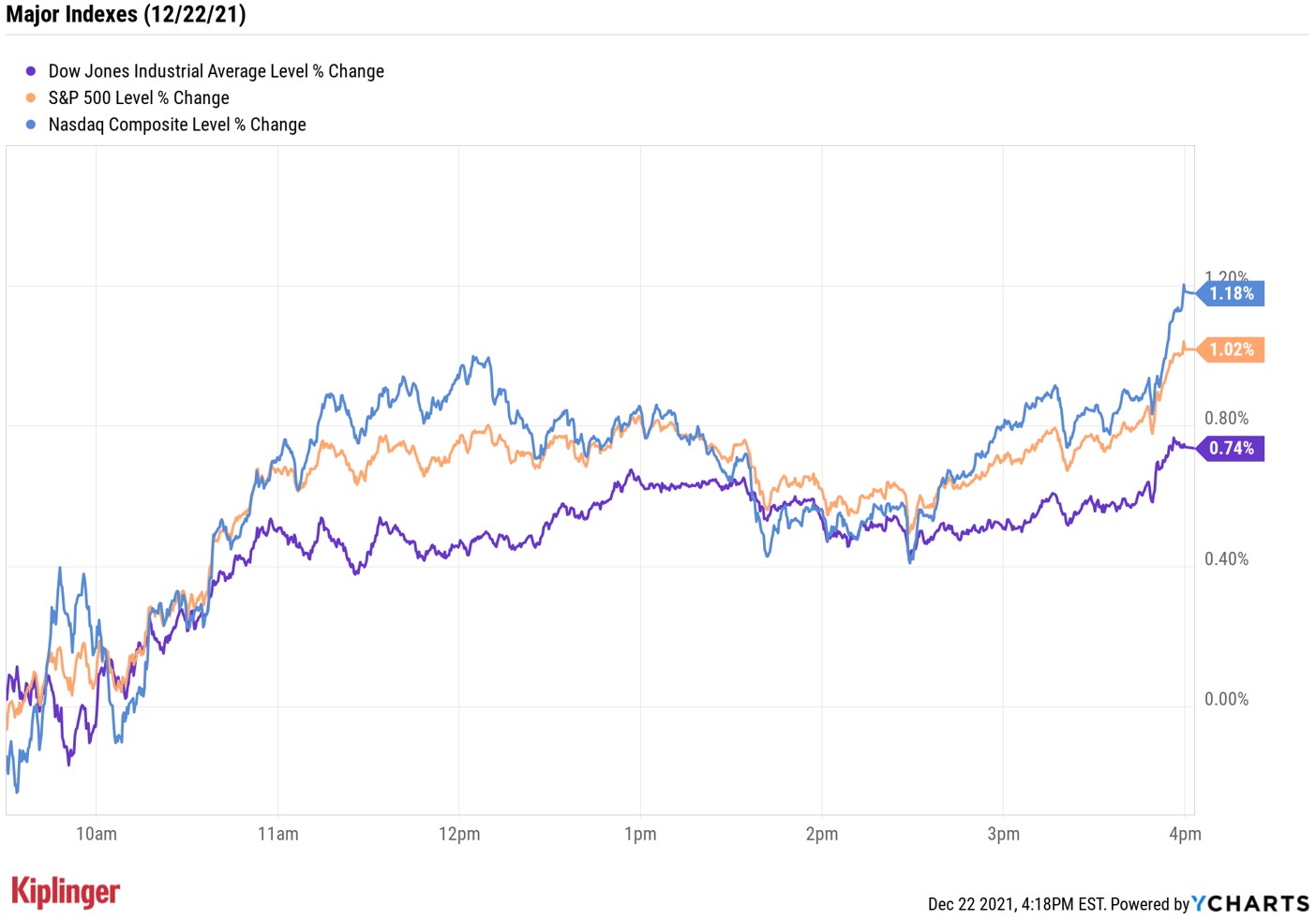

Stocks got off to a slow start Wednesday but rose steadily throughout the session to close higher for a second consecutive day.

Lifting Wall Street's collective mood was a report from the Conference Board that showed consumer confidence – a gauge of how much Americans are willing to spend on goods and services – rose to 115.9 in December from November's reading at 111.9.

Meanwhile, the National Association of Realtors (NAR) said existing U.S. home sales jumped 1.9% month-over-month in November to a seasonally adjusted annual rate of 6.46 million units. Although the reading came in below the 2.5% increase expected by economists, it still puts existing home sales on track for their hottest year since 2006, according to NAR.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Adding to the bullish buzz was news the Food and Drug Administration issued emergency use authorization for Paxlovid, Pfizer's (PFE, +1.0%) pill to treat COVID-19, for high-risk patients 12 and over. Reports from South Africa – where the omicron variant was first detected – showing a 20% reduction in case counts from last week's peak also aided sentiment.

At the close, the Dow Jones Industrial Average was up 0.7% at 35,753, the S&P 500 Index was 1.0% higher at 4,696 and the Nasdaq Composite had gained 1.2% to 15,521.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.9% to 2,221.

- U.S. crude oil futures gained 2.3% to settle at $72.76 per barrel.

- Gold futures edged up 0.8% to finish at $1,802.20 an ounce.

- Bitcoin added 0.8% to $48,982.25. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Tesla (TSLA) stock jumped 7.5% after CEO Elon Musk said in a podcast interview with satirical website Babylon Bee that he sold "enough stock" to meet his plan to unload 10% of his ownership stake. In early November, Musk initiated a Twitter poll asking if he should sell 10% of his total holdings in Tesla. However, the sale of the shares may have already been in the cards, as the CEO had planned on exercising options granted to him as an insider, according to a mid-September Securities and Exchange Commissions (SEC) filing. From its Nov. 4 peak above $1,243 through yesterday's close at $899.94, TSLA stock shed nearly 28%.

- Olive Garden parent Darden Restaurants (DRI, +1.6%) was upgraded to Buy from Hold by Stifel analyst Chris O'Cull. "Shares declined following a strong earnings report last Friday, which we believe was driven by the concurrent announcement of CEO Gene Lee's retirement at the end of May," O'Cull wrote in a note. While he said he wasn't surprised by the reaction, he feels Lee's successor, Rick Cardenas, will continue to guide the company on a path of strategic growth. The analyst also acknowledged that "variant-related sales disruptions are a near-term risk," but believes the shares are trading at "an attractive entry point for a high-quality company."

Sure, There Will Be Risks in 2022, But Also Opportunities

If there's one thing the last two years have taught us, it's to be prepared.

"As we close out 2021, the world looks both different from a year ago and very much the same," says Brad McMillan, chief investment officer for independent broker-dealer Commonwealth Financial Network.

In addition to another wave of COVID-19 underway, rising inflation, supply-chain issues and a challenged global economic recovery create plenty of uncertainty for investors. "Indeed, these risks are still very real," adds McMillan. "But so are the opportunities – and 2022 is likely to see even further improvement from 2021."

The best way for investors to take advantage of these opportunities is to arm themselves with the best investments. You can find plenty of potential in our best stocks for 2022, as well as in our Kiplinger's Investing Outlook.

But stocks aren't the only way to prepare your portfolio for the new year, and exchange-traded funds (ETFs) are investing's Swiss Army knife. Whether you're looking to build a portfolio core, add defensive positions or even protect against market drops, our list of the 22 best ETFs for 2022 likely has something for you. Take a look.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.