Stock Market Today: Dow Sinks 433 Points to Start Christmas Week

Rising omicron COVID-19 cases and Senator Manchin's decision not to vote for the Build Back Better bill weighed on stocks today.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

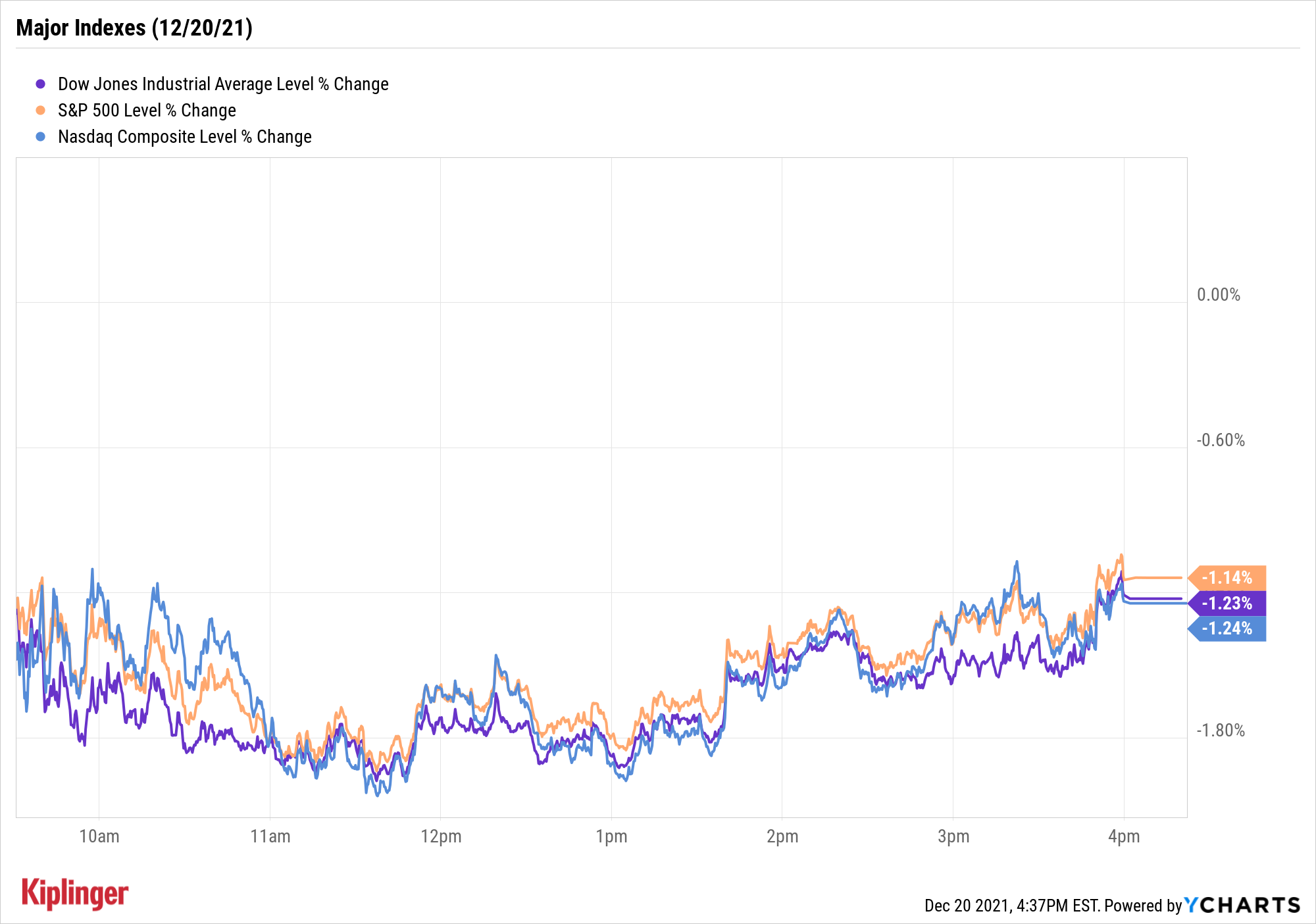

Christmas week started with stocks seeing lots of red as investors hit the exits amid a slew of worries.

Most notably, a spike in the number of omicron COVID-19 cases, which prompted several countries to initiate new restrictions, including lockdowns, ahead of the holiday. (As a reminder, the stock market will be closed Friday for Christmas.)

Additionally, over the weekend, news emerged that Senator Joe Manchin, a Democrat from West Virginia, will not support President Joe Biden's Build Back Better (BBB) bill, putting the nearly $2 trillion social infrastructure package in danger of not making it through Congress.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"A failure to pass BBB has negative growth implications," says a team of economists at Goldman Sachs. As such, "we are lowering our real gross domestic product forecast for 2022: 2% in Q1 (vs. 3% prior), 3% in Q2 (vs. 3.5% prior), and 2.75% in Q3 (vs. 3% prior)."

Just two sectors finished in the green today – utilities (+0.09%) and consumer staples (+0.03%) – with financials (-1.9%) suffering the steepest loss. Energy was another notable decliner, slumping 1.2% as U.S. crude futures fell 3% to $68.61 per barrel.

When the closing bell mercifully sounded, the Dow Jones Industrial Average was down 1.2% at 34,932, the S&P 500 Index had given back 1.1% to 4,568 and the Nasdaq Composite was off 1.2% to 14,980.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 1.6% to 2,139.

- Gold futures slipped 0.6% to settle at $1,794.60 an ounce.

- Oracle (ORCL) slid 5.1% after the enterprise software firm said it will buy medical records company Cerner (CERN, +0.8%) in an all-cash deal valued at roughly $28.3 billion in equity value. The acquisition is the biggest ever for Oracle and is expected to close in 2022. "We think that acquiring CERN would allow ORCL to gain a much larger foothold in the healthcare industry," says Jefferies analyst Brent Thill (Hold). "From a strategic perspective, CERN would bring a massive health records dataset to ORCL and allow ORCL to further expand on the apps business side, while CERN stands to benefit from ORCL's broad suite of front- and backoffice apps to help consolidate its software systems and make a deeper push into the healthcare industry."

- Moderna (MRNA) jumped 8.9% out of the gate after the biotechnology firm said a third booster shot of its COVID-19 vaccine is effective in protecting against the omicron variant. However, the shares moved lower as the session wore on, ending the day down 6.3%.

- Bitcoin rose 1.7% to $47,030.63. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Is Tech Still a Good Bet in 2022?

Techs have taken a hit in the last week or so, but are still set to end the year as one of the best-performing sectors of 2021. At 27.3% gains year-to-date, the tech sector is running neck and neck with the financial sector (27.8%) and perched just behind energy (39.8%) and real estate (34.8%).

And looking ahead to 2022, there will be plenty of opportunities for growth in technology, says Tony DeSpirito, CIO of BlackRock's U.S. Fundamental Active Equities.

One specific area where he sees possibility is 5G technology. "Telecom companies will need to spend on upgrades and create new use cases for stimulating demand for 5G-powered technologies," he writes.

Additionally, he believes companies will continue to spend big on supporting both home and office systems in the new hybrid work environment. This is likely to benefit cloud stocks, which have benefited tremendously during the pandemic – and have a long runway of growth ahead of them.

Read on as we look at seven cloud stocks that could profit from substantial spending and growth in 2022 and beyond.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Rise to the Spirit of the Season: Stock Market Today

Stocks Rise to the Spirit of the Season: Stock Market TodayInvestors, traders and speculators are beginning to like the looks of a potential year-end rally.