Stock Market Today: Tech Trounced as Fed Elation Fades

Semiconductor stocks and other technology-sector shares took a nosedive Thursday to lead the major indexes lower.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

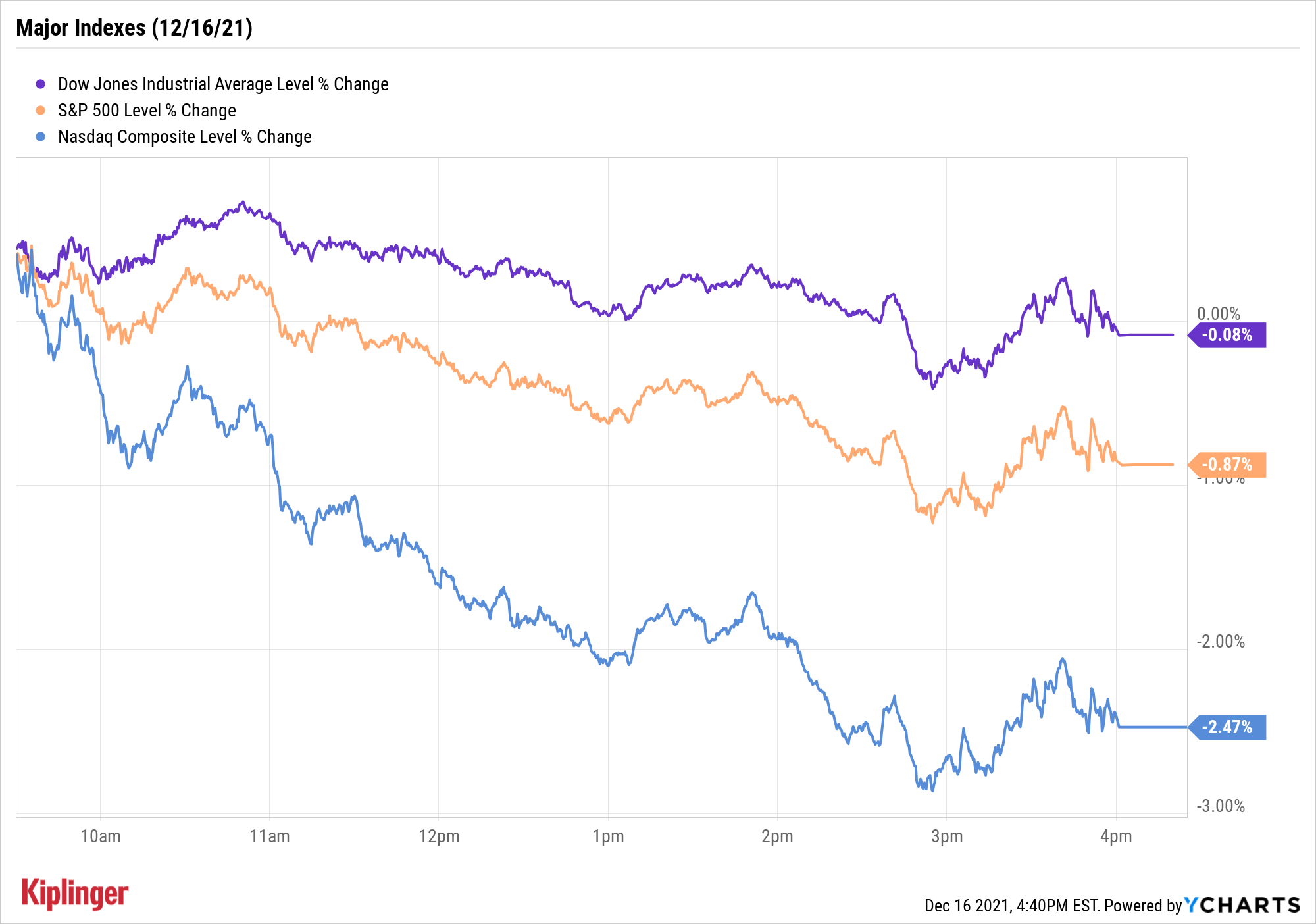

A day after rallying on the Federal Reserve's latest policy announcements, the stock market took a rapid 180, with technology stocks (-2.8%) in particular falling off a cliff.

Giving the sector a bit of a shove Thursday was Europe, where both England and Norway's central banks raised their benchmark interest rates – by 15 basis points to 0.25%, and by 25 basis points to 0.5%, respectively. (A basis point is one one-hundredth of a percentage point.)

That provided a spark for at least some of the selling in technology, which also has been trading at extremely lofty levels of late. At nearly 27 times forward earnings estimates, tech is the second most expensive sector and far frothier than the S&P 500's 20.5 ratio.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Mega-cap names Apple (AAPL, -3.9%) and Microsoft (MSFT, -2.9%) accounted for significant chunks of losses in the major indexes. Chip stocks were brutalized, too.

"Reports that Apple is potentially taking wireless chip production in-house is adding to the weakness in multiple [semiconductor] components," says Michael Reinking, senior market strategist for the New York Stock Exchange. Skyworks Solutions (SWKS, -8.5%) and Xilinx (XLNX, -8.2%) were among the weakest performers in the semiconductor industry.

That led to deep pain for the Nasdaq Composite, which retreated 2.5% to 15,180. The S&P 500 lost 0.9% to 4,668, and strength in cyclical sectors limited the Dow Jones Industrial Average to a marginal decline to 35,897.

Other news in the stock market today:

- The small-cap Russell 2000 sank 2.0% to 2,152.

- U.S. crude oil futures managed a 2.1% gain against the grain, settling at $72.38 per barrel.

- Gold futures gained 1.3% to $1,788.10 after the U.S. dollar shrank back.

- Some of the air came out of Bitcoin, too, with the cryptocurrency declining 2.7% to $47,913.61. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

Look to Real Estate for Stability in 2022

The traditional wisdom goes that rate hikes can adversely affect dividend-yielding stocks. After all, the thinking goes: If you can get comparable income from bonds, which are typically less risky than equities, why wouldn't you opt for the relative safety of debt?

Real estate investment trusts (REITs), however, typically act as the exception, not the rule, with S&P Global noting that during the majority of periods of significantly rising rates, REITs have either matched or beaten the S&P 500.

And there are other reasons to believe that 2022 could be a good year for REITs.

"As commercial activity and day-to-day life normalize, demand for commercial and residential real estate space will continue to recover," says State Street Global Advisors. "Combined with higher rent inflation in 2022, this supports REIT dividend growth and potential valuation appreciation."

In our latest look-ahead for investors positioning themselves for 2022, we explore the real estate sector. Read on as we analyze 12 of the best REITs for 2022 – picks that offer a mixture of below-average valuations, above-average yields and some growth potential.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.