Stock Market Today: Tech Stocks Lead in Broad-Market Bounce

Tesla and Microsoft were two notable gainers, while semiconductor stocks also made a big move higher.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Cooler heads prevailed to start the new trading week, with stocks rebounding from Friday's Omicron-related selloff.

While a fuller picture on the latest COVID-19 variant will likely take weeks to emerge, President Joe Biden said this afternoon that Omicron is "not a cause for panic." Additionally, despite several countries putting travel restrictions in place, the market is likely taking solace in a lack of widespread lockdowns, says Michael Reinking, senior market strategist for the New York Stock Exchange.

"In fact, equities extended gains this afternoon following comments from President Biden that lockdowns were not on the table at this point," he adds.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

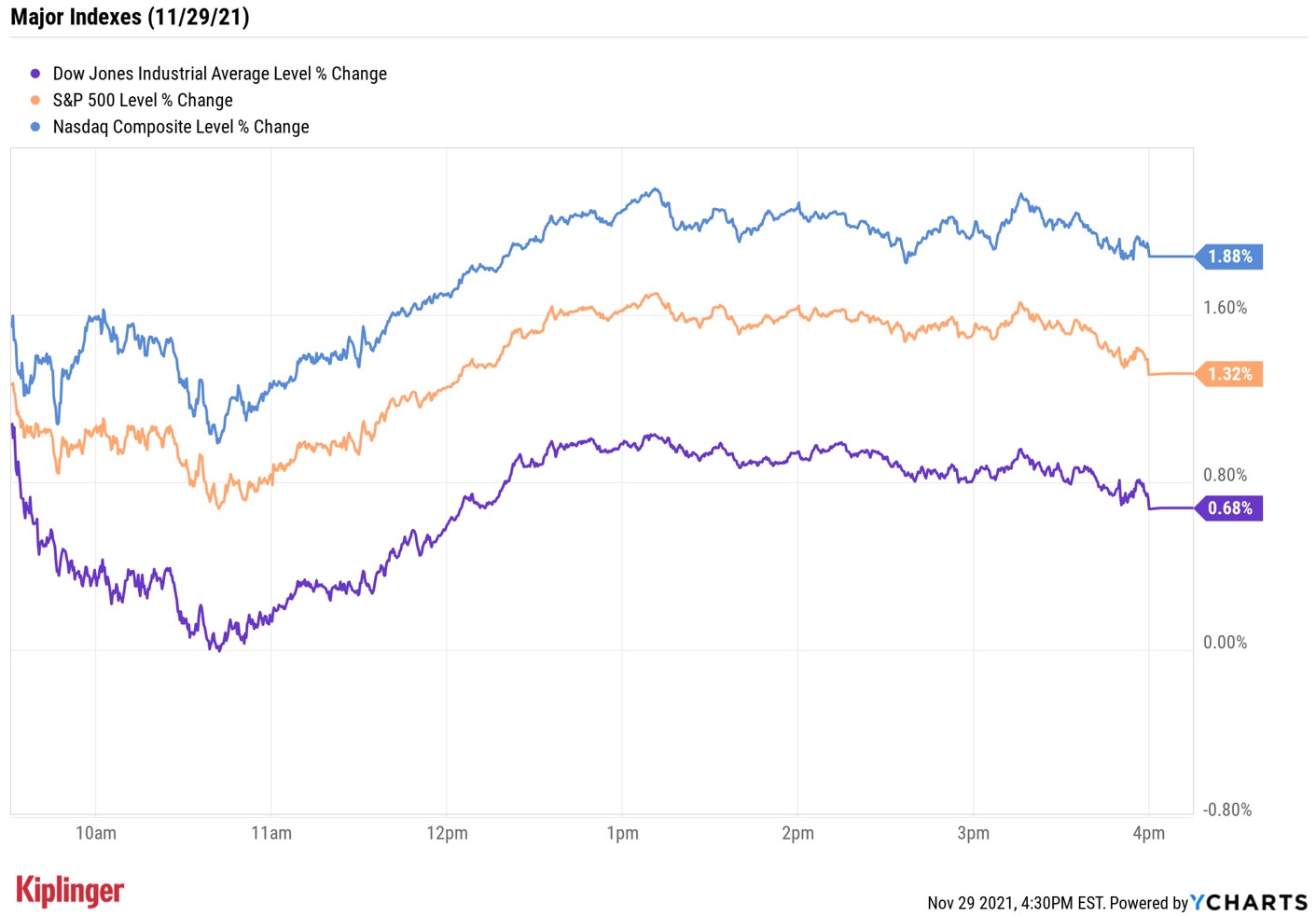

Indeed, after a slow start, the Dow Jones Industrial Average closed up 0.7% at 35,135 and the S&P 500 Index added 1.3% to 4,655.

However, it was the Nasdaq Composite that turned in the best performance of the day, gaining 1.9% to 15,782 amid strength in mega-cap tech stocks Tesla (TSLA, +5.1%) and Microsoft (MSFT, +2.1%), as well as a big rally in semiconductors (+3.5%).

Other news in the stock market today:

- The small-cap Russell 2000 slipped 0.2% to 2,241.

- Gold futures slipped 0.2% to settle at $1,785.20 an ounce.

- Bitcoin jumped 7.1% to $58,125.20. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Twitter (TWTR) shares initially spiked after the company announced founder and CEO Jack Dorsey would be stepping down from his post. He will be replaced at the helm immediately by Chief Technology Officer Parag Agrawal, who has been with the company for more than a decade. "Dorsey's trust in Agrawal is one of the reasons Dorsey felt comfortable making this transition now," says Scott Kessler, vice president and global lead at investment research firm Third Bridge. Agrawal has been with Twitter for more than a decade and has been involved in the key decisions that led to the company's turn-around. Salesforce.com (CRM) President and Chief Operating Officer Bret Taylor will become Twitter's chairman of the board, and Dorsey will remain on the board until the 2022 shareholder meeting. However, TWTR ended the day down 2.8%.

- Merck (MRK, -5.4%) slumped Monday on the back of disappointing news announced late last week that its antiviral drug, molnupiravir, only reduced risk of hospitalization and death among high-risk COVID-19 patients by 30%; it had previously estimated 50%. An FDA advisory panel will meet tomorrow to determine whether it will recommend authorizing the drug. Also Monday, Citi analysts downgraded MRK shares to Neutral from Buy, in part because they believe regulatory concerns could prompt Merck to give up on the clinical advancement of HIV drug islatravir. "We expect the diminishing outlook for islatravir to further expedite Merck's business development efforts," Citi says.

Keep an Eye on Oil

U.S. crude futures closed up 2.6% today to settle at $69.95 per barrel, but remain more than 17% below their late-October highs near the $85 per-barrel mark.

Part of this is due to Friday's drubbing, when futures plummeted more than 13% on fears the Omicron variant would impact global demand.

But Austin Pickle, investment strategy analyst at Wells Fargo Investment Institute, also points to "market anticipation" ahead of last week's announcement from several countries, including the U.S. and China, to tap strategic oil reserves in a coordinated effort to ease price pressures as a catalyst for the recent selloff.

And this week's meeting between the Organization of the Petroleum Exporting Countries and its allies – where the group could reconsider its current 400,000-barrels-per-day production boost – "will have obvious near-term oil price and geopolitical implications," says Pickle. Still, the analyst sees "higher prices by year-end 2022."

Not only would a continued rise in oil prices spell good news for master limited partnerships (MLPs) – which offer the added benefit of higher yields – but also traditional energy stocks. Here's a list of 10 energy stocks that are among the top-rated on Wall Street and could be worth watching should oil prices extend today's surge.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.