Stock Market Today: Nasdaq Sets New Highs in Polarized Session

A flareup in European COVID-19 cases weighed on financial and energy stocks Friday, but relative strength in tech lifted the Nasdaq.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

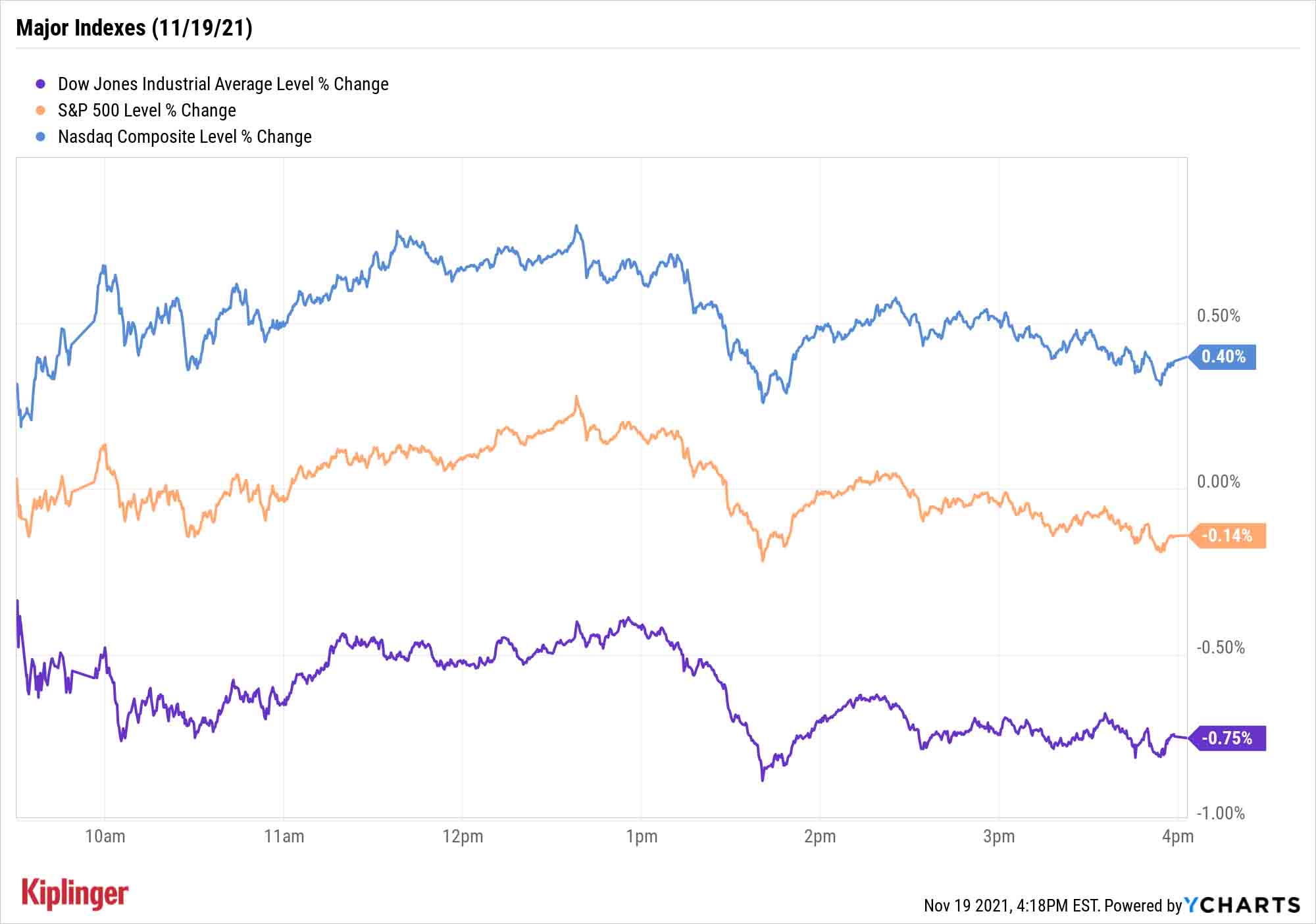

One major market index closed out the week at a fresh all-time high, but that was only part of the story on a Friday that saw COVID-19 creep back into Wall Street's spotlight.

Several cyclical sectors, energy (-3.9%) and financials (-1.1%) foremost among them, strongly sold off today in reaction to an escalating wave of coronavirus cases.

"A number of countries [have reimposed] restrictions, with a number putting in place specific restrictions for those still unvaccinated," says Deutsche Bank analyst Jonathan Jayarajan. "Austria has gone further still, imposing a full national lockdown starting on Monday, and announcing compulsory vaccinations from Feb. 1." Health officials are considering new measures in Germany, too.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Oil and gas companies such as Exxon Mobil (XOM, -4.6%) and Occidental Petroleum (OXY, -5.0%) were hit particularly hard, with COVID concerns bringing U.S. crude oil prices down 3.7% to a six-week low of $76.11 per barrel.

The Dow Jones Industrial Average slumped 0.8% to 35,601, while the S&P 500 suffered a more modest pullback of 0.1% to 4,697.

The Nasdaq Composite, however, closed Friday with a 0.4% gain to a record 16,057, driven in part by mega-caps Tesla (TSLA, +3.7%) and Nvidia (NVDA, +4.1%). The former surged after Wedbush analyst Dan Ives raised his price target by 27% to $1,400 per share, while the latter continued to rise in the wake of Wednesday's Street-beating Q3 earnings report.

Other news in the stock market today:

- The small-cap Russell 2000 slipped again, shedding 0.9% to 2,343.

- Gold futures slipped 0.5% to finish at $1,851.60 an ounce.

- The CBOE Volatility Index (VIX) headed 2.3% higher to 17.99.

- Bitcoin lost a little ground, declining 0.2% to $57,858.19. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Farfetch (FTCH) slumped 13.9% after earnings. In its third quarter, the U.K.-based online luxury retailer reported a narrower-than-expected adjusted loss of 14 cents per share, but revenue of $582.6 million fell short of the consensus estimate. The company also reported lower-than-anticipated gross merchandise volume (GMV) for its digital platform business and cut its current-quarter and full-year GMV forecasts for the unit. Still, Credit Suisse analyst Stephen Ju maintained an Outperform (Buy) rating on the stock. "Management noted inventory levels remain healthy and demand has been improving throughout the fourth quarter," Ju says. "In addition, contribution margins should improve to 30%-35% in Q4 (vs 27% in Q3) as demand generation expense moderates and shipping costs are passed to the consumer."

- Foot Locker (FL) this morning reported third-quarter adjusted earnings of $1.93 per share and revenue of $2.19 billion, more than the $1.37 per share and $2.15 billion analysts were expecting. However, FL stock fell 12.0% today after Andrew Page, chief financial officer for the athletic apparel retailer, said in today's earnings call that the company expects "global supply chain constraints, including factory shutdowns and port congestion to continue to be a headwind through the fourth quarter and into 2022." CFRA Research analyst Zachary Warring maintained his Hold rating on the stock in the wake of earnings. "In a retail environment where many companies are experiencing massive top-line growth, FL continues to struggle," he wrote in a note. "We see plenty of better opportunities in the space and expect FL sales to remain flat to down over the long-term."

The 30 Best Stocks of the Past 30 Years

"You could invest in 'the next Apple' or 'the next Tesla.'" Chances are, if you read enough financial media, you've been exposed to this phrase at least once, if not a few hundred times.

The reason is obvious: It creates a mental connection to stocks that have delivered mindblowing returns since coming public, minting numerous millionaires along the way.

But tech superstars aren't the only path to riches.

Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University, has produced a study showing that the top-performing 2.4% of firms account for all of the $75.7 trillion in net global stock market wealth created between January 1990 and December 2020 – and those outperforming stocks come from a wide spectrum of industries.

In our "30 Best Stocks of the Past 30 Years," we look at the 30 stocks from around the globe that Bessembinder identified as having generated the most wealth for shareholders. While a number of technology dynamos are on the list, so too are several less flashy companies that used both market returns and consistent dividends to richly reward investors over time.

Kyle Woodley was long NVDA and TSLA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.