Stock Market Today: Persistent Inflation Gut-Punches Tech Stocks

The highest jump for consumer prices in 30-plus years stole headlines Wednesday, but evidence of persistent inflation was the real worry for markets.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stock-market bears got a bit more aggressive Wednesday after a worrisome October inflation report revealed relentlessly rising prices, triggering a spike in bond yields.

The Bureau of Labor Statistics said October's headline consumer price index (CPI) jumped 6.2% over last year's depressed levels – the swiftest such move since 1990 – but more importantly, at a higher-than-expected 0.9% month-over-month, which was its quickest pace since 2008.

Particularly worrisome were signs that climbing consumer costs couldn't just be chalked up to temporary causes such as supply-chain woes.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The details within the report signaled strengthening persistent pressures, though transitory forces also picked up," says BofA Securities. "[Rent equivalents] and rent inflation were a big focus for this month: They printed a 0.4%+ MoM clip for a second time, providing additional confirmation of a reset to a higher trend."

BofA notes that rents are the biggest cyclical driver of inflation and "therefore the most crucial component to monitor for persistent price pressures."

However, some – including Rick Rieder, BlackRock's chief investment officer of global fixed income – remain slightly more optimistic that most of the currently inflationary pressures are temporary.

"It is likely that in time pandemic distortions and extreme base effects will ease, pulling aggregate prices back toward a 2% rate of growth and allowing quantities to continue expanding once supply pressures alleviate," says Rieder, though he concedes "this will take time."

Bond yields immediately responded, jumping roughly 10 basis points to as high as 1.592%. (A basis point is one one-hundredth of a percentage point.) That weighed heaviest on technology and tech-related shares, where higher interest rates can sharply dig into future growth.

"FAANGs" such as Amazon.com (AMZN, -2.6%) and Google parent Alphabet (GOOGL, -2.0%) struggled, and red-hot semiconductor shares including Advanced Micro Devices (AMD, -6.1%) and Nvidia (NVDA, -3.9%) were put on ice.

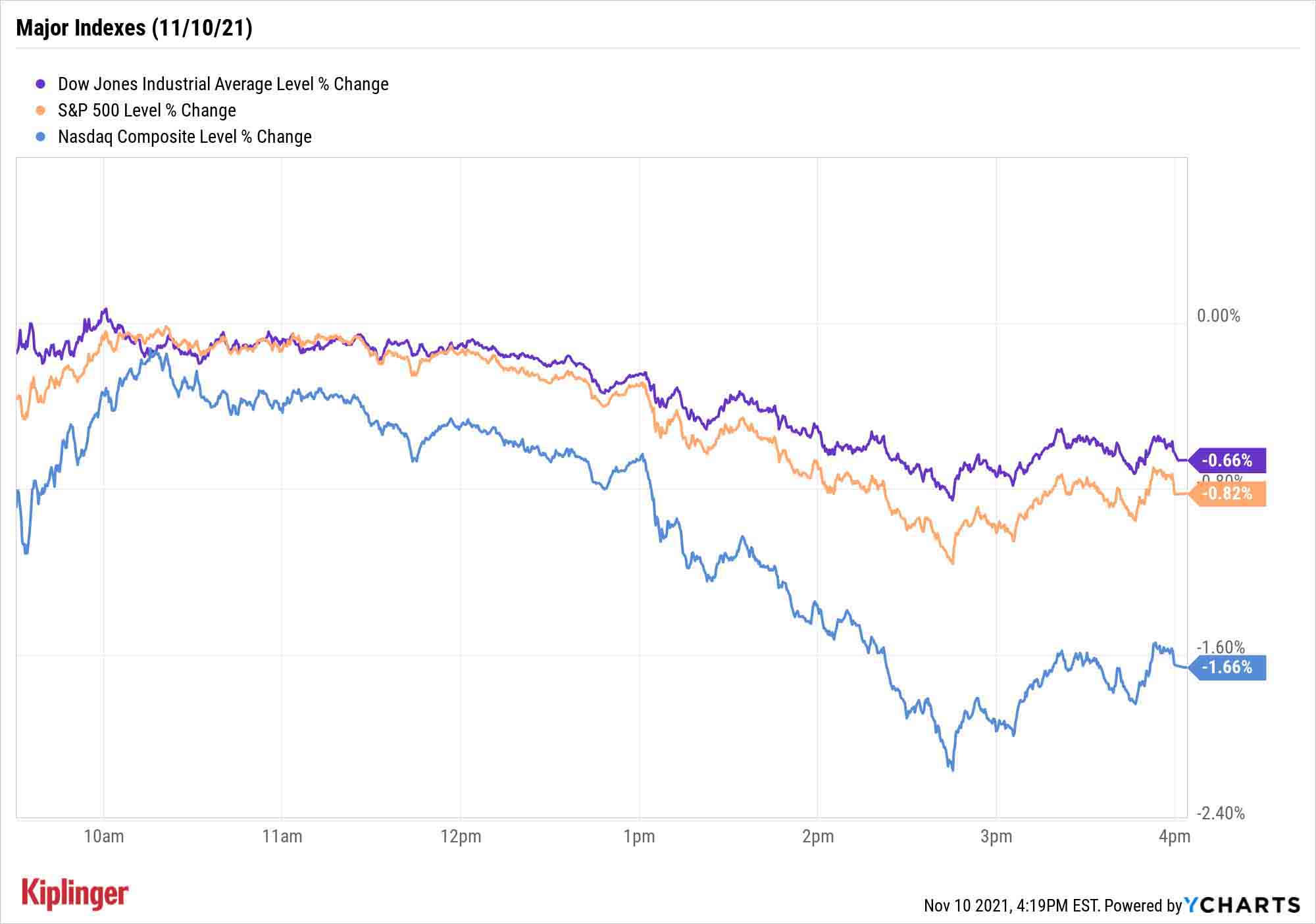

The result? The Nasdaq Composite retreated by 1.7% to 15,622, while the S&P 500 (-0.8% to 4,646) and the Dow Jones Industrial Average (-0.7% to 36,079) sustained somewhat lesser declines.

And a reminder: the stock market is open for Veterans Day.

Other news in the stock market today:

- The small-cap Russell 2000 declined 1.6% to 2,389.

- U.S. crude futures slumped 3.3% to settle at $81.34 per barrel, snapping their three-day winning streak.

- Gold futures gained 1.0% to finish at $1,848.30 an ounce.

- The CBOE Volatility Index (VIX) popped 5.7% to 18.79.

- Bitcoin made another run higher Wednesday, flirting with the $69,000 level today before being repelled. As of the afternoon, the cryptocurrency was off 2.5% from yesterday's prices to $65,622.00. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Electric vehicle maker Rivian Automotive (RIVN), which is backed by the likes of Amazon.com and Ford (F), pulled off the largest U.S. initial public offering (IPO) since 2014. The company raised $11.9 billion, topping every other offering since Alibaba Group (BABA). The EV play priced its shares at $78 and jumped as high as $106.75, eclipsing $100 billion in market value – this, despite that Rivian expects to generate less than $1 million in third-quarter revenue. RIVN closed 29.1% higher to $100.73, at a market value of more than $98 million, which is larger than U.S. giants General Motors (GM) and Ford.

- Mastercard (MA, +3.9%) flashed some green ink amid a sea of red after delivering encouraging projections during an investor-day event. The company said that for 2022-24, it expected to grow net revenues in the high teens (from low teens in 2019-21) and earnings per share in the low 20s (from high teens). The company says it sees "significant untapped opportunity" in the $255 trillion total addressable market for payments. Piper Sandler analyst Christopher Donat maintained his Neutral stance on shares, however, saying that "While we believe that MA has significant opportunities in front of it, many of these opportunities have been available for years."

Protect Yourself From Inflation

The latest CPI report doesn't signal doom for stocks, but it's certainly a hurdle to overcome.

"The bond market is telling you that the [Federal Reserve] is way behind the curve on policy, as short rates rocketed while long rates have taken the release in stride," says Cliff Hodge, chief investment officer for Cornerstone Wealth, who adds that "a flattening curve does not portend well for risk assets into next year."

Chris Zaccarelli, CIO for Independent Advisor Alliance, agrees the Fed might need to speed up their tightening of fiscal policy.

As for stocks?

"We have already been positioning for higher inflation in our investments by using energy companies and higher-quality companies – those with strong balance sheets, a competitive moat around their business and pricing power – as a way to lessen any impact that higher prices will have on profit margins."

Investors have other ways to protect themselves from rising prices – these five mutual funds represent traditional ways to hedge against inflation, though this new ETF with a fresh strategy is worth exploring, too.

Indeed, you might have more options than you think. Our look at how to shield yourself from inflation contains a variety of ideas, including stocks, ETFs, mutual funds and even commodities. Check it out.

Kyle Woodley was long AMD, AMZN and NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies

What Really Happens in the First 30 Days After Someone DiesThe administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nvidia Earnings: Updates and Commentary February 2026

Nvidia Earnings: Updates and Commentary February 2026Nvidia reported earnings after the closing bell on February 25, and the AI bellwether's results came in higher than expected once again.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.