Stock Market Today: Microsoft, Alphabet Carry Nasdaq to a Razor-Thin Gain

Two big performances from two mega-caps helped the Nasdaq just barely escape a close in the red Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Corporate earnings continued to dominate the market's motion Wednesday amid a lull in economic data and persistent but nonetheless slow progress on the Democrats' social spending plan.

A pair of mega-cap stocks threw their weight around today. Microsoft (MSFT, +4.2%) cruised after a rousing quarterly report that saw revenues jump 22% year-over-year and net income pop 48%, with both figures exceeding analysts' consensus estimate.

"It appears that software spending continues to be strong; this could be a very good sign for the rest of the tech sector," says Anthony Denier, CEO of trading platform Webull. "The cloud results [Microsoft's Azure and other cloud services grew revenues by more than 50%] also indicate a good quarter for other tech stocks."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Google parent Alphabet (GOOGL, +5.0%) also rocketed higher after announcing wide beats on the top and bottom lines. GOOGL shares are up 66.9% year-to-date to more than triple the S&P 500 and bring the company's market value to just under $2 trillion.

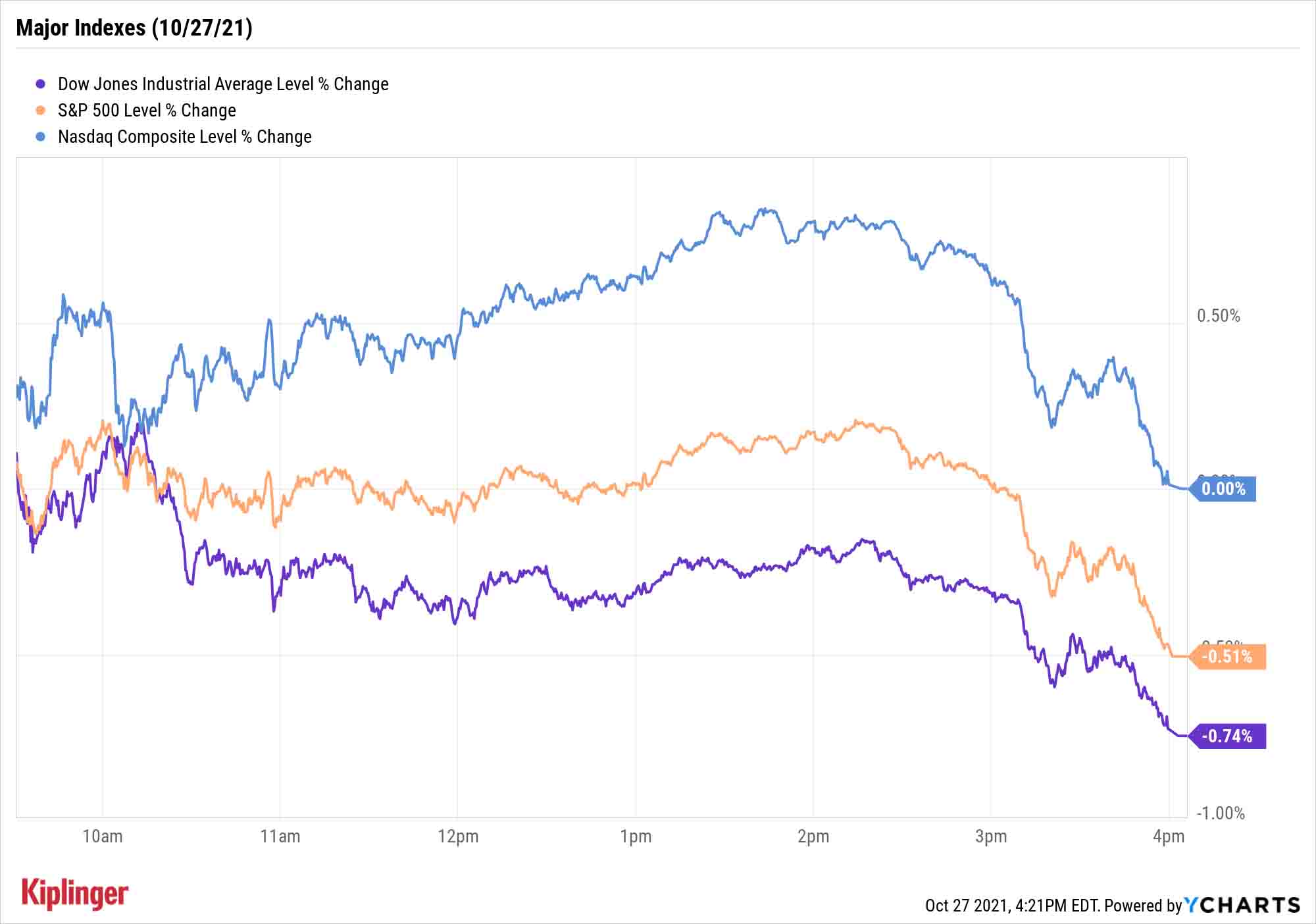

Those performances helped keep the Nasdaq Composite in positive territory, albeit barely (by a fraction of a point, to 15,235) on a Wednesday in which most sectors were underwater.

The Dow Jones Industrial Average (-0.7% to 35,490) slipped from its all-time high thanks in part to Visa (V, -6.9%), which was the average's worst stock today. The credit card concern's fiscal fourth-quarter adjusted earnings of $1.62 per share on $6.6 billion in revenue were higher than Wall Street's consensus estimates, but a lower-than-expected current-quarter and fiscal 2022 net revenue growth guidance caught investors off guard.

Sector peer Mastercard (MA) – which takes its own turn in the earnings confessional ahead of tomorrow's open – wasn't spared from the selling, slumping 6.1% and contributing to the S&P 500's 0.5% decline to 4,551.

Other news in the stock market today:

- McDonald's (MCD) jumped 3.0% in the wake of its earnings report. In the third quarter, MCD recorded adjusted earnings of $2.76 per share on $6.2 billion in revenue – more than the $2.46 per share and $6.0 billion expected by analysts – thanks to a roughly 6% year-over-year increase in menu prices. The fast-food chain also said global same-store sales were 12.7% higher than Q3 2020 thanks in part to solid demand in the U.K.

- Robinhood Markets (HOOD) was another post-earnings loser, surrendering 10.4% to close at $35.44 per share – roughly half the company's trading peak above $70 and below the investing platform's initial public offering (IPO) price of $38 per share. Sparking the selloff was a major revenue miss in HOOD's third quarter, with the company reporting $365 million versus the $431.5 million analysts were expecting. Additionally, Robinhood said monthly active users fell to 18.9 million from the 21.3 million the company had in Q2, while average revenue per user declined 36% year-over-year to $65. Still, Mizuho Securities analysts Dan Dolev and Ryan Coyne kept their Buy rating on HOOD stock. "Although results were lackluster, there were a few positives too, including progress on crypto wallet – 1 million waitlist signups – no early lock-up and a more normalized equities/cryptocurrency revenue mix," they wrote in a research note.

- The small-cap Russell 2000 was knocked around to the tune of 1.9%, to 2,252.

- U.S. crude oil futures plunged 2.4% to settle at $82.66 per barrel after a report from the Energy Information Administration showed domestic crude inventories unexpectedly rose last week. Rumors that Iran is ready to revive nuclear deal talks also weighed on crude.

- Gold futures edged up 0.3% to finish at $1,798.80 an ounce.

- The CBOE Volatility Index (VIX) improved by 6.8% to 17.06.

- Bitcoin continued its decline from recent highs, off 4.8% to $59,135.70. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Boom Times Ahead? Historically Speaking, Yes.

And thus ends the best stock-trading day of the year.

No no – today's performance wasn't much to look at. But historically, it doesn't get any better than Oct. 27. Since 1950, an investor buying the S&P 500 and holding for five days would have enjoyed the best returns if they had started on this date, with an average return of 1.59%, says Ryan Detrick, chief market strategist for LPL Financial.

But don't feel bad about missing out – we're also entering one of the best weeks (and months!) for the stock market, too, which we explore more in depth here.

Interestingly, one of the best ways to celebrate this fertile market stretch might be to explore some dried-out names.

BofA Securities recently delivered a note explaining how tax-loss harvesting season – when portfolio managers and retail investors alike dump losing positions to salvage a tax break – can be a great time to pick up fundamentally sound names on the cheap.

The research outfit also outlined a baker's dozen stocks that could be ripe for the picking. We've taken a closer look at each of these BofA picks, and homed in on the bullish cases for holding these names long after tax-loss harvesting season is over.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.