Stock Market Today: Trillion-Dollar Tesla Leads Monday Market Charge

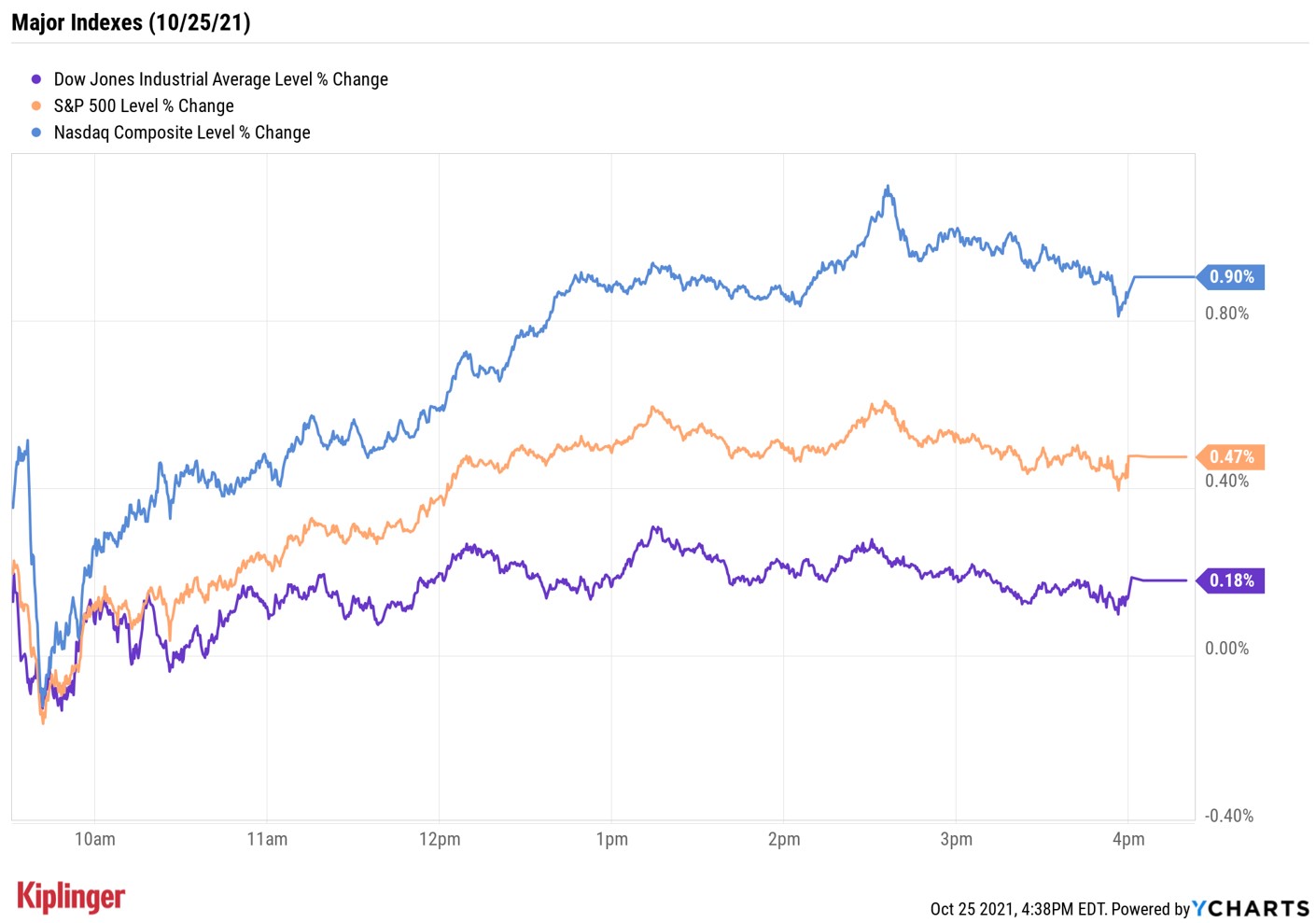

The Dow and S&P 500 notched new highs, while the Nasdaq moved within a chip-shot of its all-time peak.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Dow Jones Industrial Average and S&P 500 Index got the ball rolling on the new trading week with record-high closes amid general earnings optimism.

But the showstopper today was a single stock – Tesla (TSLA, +12.7%) – which extended its recent rally with a number of significant milestones. Rental car company Hertz Global Holdings (HTZZ, +10.0%) on Monday announced the single-biggest order for electric vehicles – 100,000 Tesla vehicles, which should translate into more than $4 billion in revenues.

That continued a rally recently built on record third-quarter deliveries and blowout Q3 earnings, sending Tesla above $1,000 per share – and above $1 trillion in market value, putting it in an exclusive club with just four other companies: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL) and Amazon.com (AMZN).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Tesla's booming performance helped lift the Nasdaq Composite 0.9% to 15,226; the index needs a gain of just 1% from here to reach its Sept. 7 high. TSLA also boosted the S&P 500, up 0.5% to a record 4,566. The Dow's modest 0.2% gain to 35,741 was enough to rewrite the record books, too.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.9% to 2,312.

- U.S. crude oil futures settled unchanged on the day at $83.76 per barrel.

- Gold futures gained 0.6% to finish at $1,806.80 an ounce.

- The CBOE Volatility Index (VIX) retreated 1.2% to 15.24.

- Bakkt Holdings (BKKT, +234.4%) stock was one of the biggest percentage gainers today after the cryptocurrency asset platform and Intercontinental Exchange (ICE) subsidiary unveiled a pair of high-profile partnerships. One is a deal with Mastercard (MA), where the two firms will offer cryptocurrency debit and credit cards. This will not only allow businesses to issue branded credit cards backed by crypto, but also offer digital coins as rewards in loyalty programs. BKKT also entered into a strategic partnership with Fiserv (FISV) that will allow cryptocurrency to be used more broadly thanks to the fintech's ability to connect consumers and businesses via its digital commerce and mobile payment services.

- Bitcoin prices jumped 2.9% to $62,716.48. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- Looking ahead, earnings season continues, with several massive stocks reporting results over the next few days, including the other members of the trillion-dollar club. Michael Reinking, senior market Strategist for the New York Stock Exchange, says that, as far as an impact on the major indexes is concerned, "mega-cap tech will be the swing factor."

Stock Picking Isn't For Everyone

Does that sort of news – even when it's good – give you heartburn? That's okay: Stock picking isn't for everyone.

Don't take it just at our word – consider that U.S. investors alone have allocated tens of trillions of dollars to mutual funds, exchange-traded funds (ETFs), closed-end funds (CEFs) and other pooled investments. And many of those investors want talented stock pickers on their side.

Enter Fidelity, which celebrates good stock picking – in fact, its portfolio managers even engage in friendly competitions with each other to see who can develop the best investment ideas.

We continue our annual look at the most popular funds in 401(k) plans – which we started with Vanguard – by taking a look at Fidelity's actively managed and target-date funds that make the list. This group of more than a dozen funds largely leans on the expertise of talented stock pickers including Sonu Kalra and Joel Tillinghast, though their gifted bond managers provide some oomph to Fidelity's balanced offerings. Read on as we explore the ins and outs of Fidelity funds that often show up in corporate 401(k) plans.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

The Tool You Need to Avoid a Post-Divorce Administrative Nightmare

The Tool You Need to Avoid a Post-Divorce Administrative NightmareLearn why a divorce decree isn’t enough to protect your retirement assets. You need a QDRO to divide the accounts to avoid paying penalties or income tax.

-

When Estate Plans Don't Include Tax Plans, All Bets Are Off

When Estate Plans Don't Include Tax Plans, All Bets Are OffEstate plans aren't as effective as they can be if tax plans are considered separately. Here's what you stand to gain when the two strategies are aligned.

-

Relying on Real Estate in Retirement? Avoid These 3 Mistakes

Relying on Real Estate in Retirement? Avoid These 3 MistakesThe keys to successful real estate planning for retirees: Stop thinking of property income as a reliable paycheck, start planning for tax consequences and structure your assets early to maintain flexibility.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.