Stock Market Today: Dow Regains Its Footing, Snaps Five-Session Skid

Reasons for optimism on the COVID front helped lift the Dow Jones Industrial Average and S&P 500 out of their recent funks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Another morning rally lost its energy midway through the session ... but this time, stocks mustered a second wind.

For the first time in a while, COVID-19 news took a turn for the better, with the CDC reporting a seven-day moving average of 136,558 daily new cases, down nearly 13% from the prior average of 156,341.

Wall Street also digested some new tax proposals that Congress released over the weekend. House Democrats proposed plans to raise the top tax rate on corporations and wealthy individuals, hike the top capital-gains rate to 25% from 20%, and add a 3% surcharge on any taxable income over $5 million.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

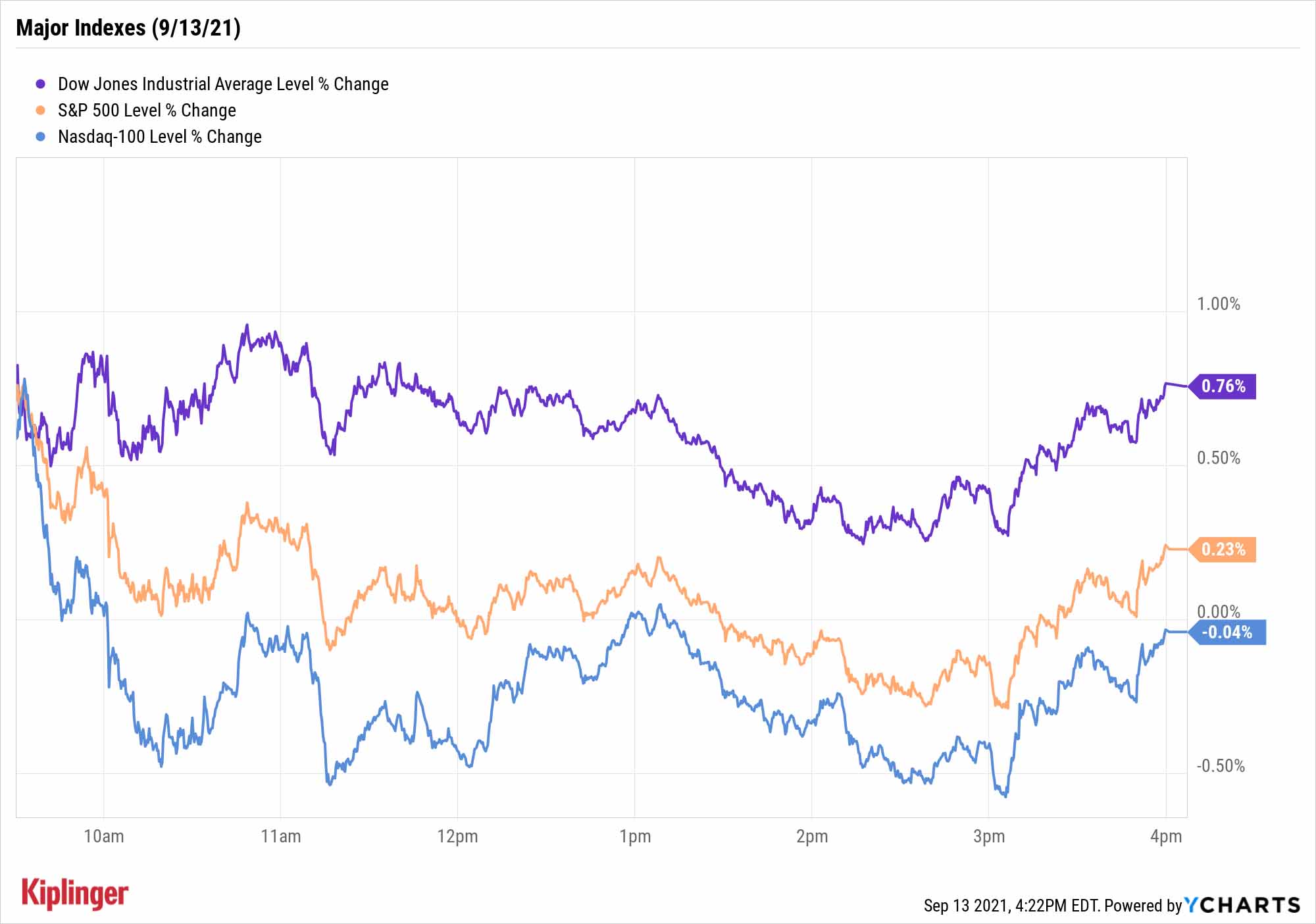

The Dow Jones Industrial Average (+0.8% to 34,869) kept its head above water thanks to UnitedHealth Group (UNH, +2.6%) and Chevron (CVX, +2.0%), with the latter benefiting from a 1.1% rise in U.S. crude oil futures, to $70.45 per barrel, on continued supply issues caused by Hurricane Ida. The Dow snapped a five-day losing streak, as did the S&P 500, which managed to climb out of the red and score a modest 0.2% gain, to 4,468.

However, weakness in stocks such as Adobe (ADBE, -2.1%) and Nvidia (NVDA, -1.5%) sent the Nasdaq Composite (off marginally to 15,105) to its fourth consecutive decline.

Other news in the stock market today:

- The small-cap Russell 2000 also finished in positive territory, improving by 0.6% to 2,240.

- Apple (AAPL) finished near the middle of the pack among its fellow Dow stocks, gaining 0.4% on the day. The tech giant will be in focus tomorrow, however, with the Apple launch event slated to kick off at 1 p.m. ET. Among the expected reveals: the iPhone 13.

- COVID-19 vaccine maker Moderna (MRNA) was a notable decliner, shedding 6.6%. Today's drop came after an article – written by a group of scientists, including a pair of Food and Drug Administration (FDA) officials, and published in peer-reviewed medical journal The Lancet – said most people will not need vaccine boosters at this time. While booster shots could be beneficial to those with weakened immune systems, the authors wrote, broader efforts should be focused on getting shots to those that are currently unvaccinated.

- Gold futures settled up 0.1% at $1,794.40 an ounce.

- The CBOE Volatility Index (VIX) dipped 7.5% to 19.37.

- Bitcoin's struggles continued, with the cryptocurrency declining 1.9% over the weekend to $44,759.94. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A Way to Smooth Out Your September?

Stocks remain down in September, but will the month continue living up to its mopey billing?

"September is historically a tough month, and the first week was not a good sign," says Anthony Denier, CEO of trading platform Webull. "Fears of rising inflation contributed to last week's losses and tomorrow the CPI comes out. Wall Street economists expect a 5.3% rise in August. On Friday, the Fed will release data on wholesales prices. If those two reports come out negative, I think there may be rough waters ahead."

Of course, it's volatility – not a bloodbath – that most market strategists foresee.

For instance, Richard Saperstein, chief investment officer of wealth advisory Treasury Partners, says "The next six weeks tend to be seasonally weak for stocks, which is an additional worry for a stock market that is already facing elevated valuations and a lack of near-term upside catalysts." But he adds that despite expecting increased stock market volatility in the near term, "long-term investors should use pullbacks to add to stock exposure."

Happily, investors have ample tools at their disposal to cope with moody markets. For example, the Dividend Aristocrats and their decades of uninterrupted payout growth tend to provide stability amid bouts of volatility. Or for those who’d prefer to get a larger chunk of their returns through dividends, these high-quality high-yielders might be more appealing.

Investors can even go a step further in tamping down risk by owning a bundle of well-respected dividend payers in a single fund. These 11 exchange-traded funds (ETFs) have but one thing in common: They all hold dividend stocks. Past that, each ETF represents a vastly different approach to equity income generation – meaning there's something on this list for just about every type of investor.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.