Stock Market Today: S&P Up 7 Straight Months, But September Looms

The S&P 500 closed August higher, but this relentless bull market is about to butt heads with a seasonal streak-buster.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

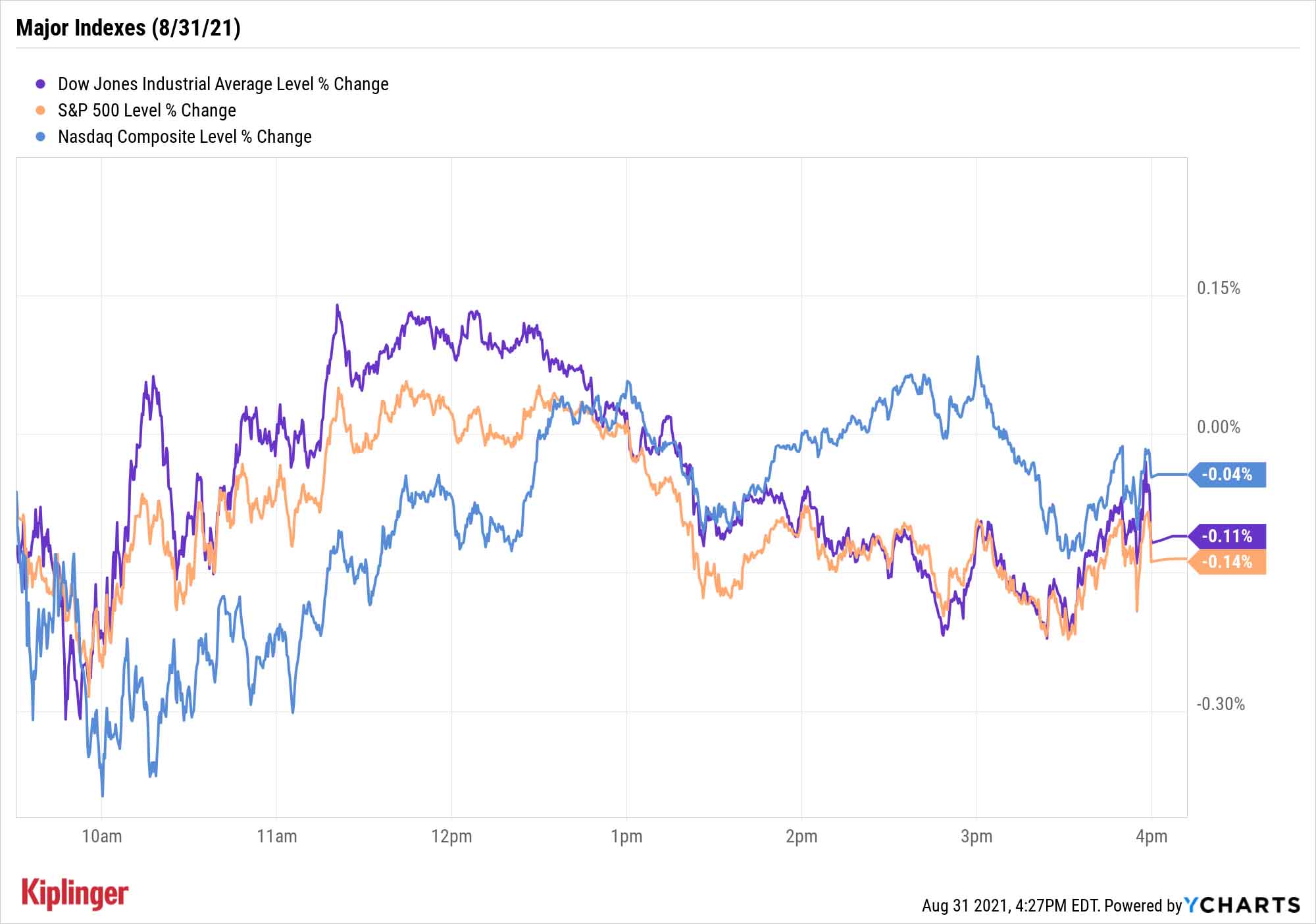

The stock market closed out August with a mellow session that left the major indexes little changed Tuesday. But the S&P 500 still managed to mark its seventh consecutive monthly gain.

There was little new economic data to stir traders. The S&P CoreLogic Case-Shiller US National Index showed that American home prices rocketed 18.6% year-over-year in June – the largest such increase since the index was created in 1987. However, the Conference Board showed consumers were less confident than expected in August, with a reading of 113.8 coming in well below the consensus estimate of 123.0.

"Over the past year or so, confidence has risen sharply, coming off the trough at the start of the pandemic, and was approaching pre-pandemic highs. Both [the Michigan and Conference Board] surveys were saying the same thing," says Brad McMillan, chief investment officer for Commonwealth Financial Network. "Then something started to change. Two months ago, the Michigan number pulled back a bit, before dropping sharply last month. The Conference Board number stayed high, but that disconnect said that something was likely going on and that the numbers were likely to converge again at some point, either up or down.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Well, it didn’t take that long – and the answer was down. This morning, the Conference Board reading was down sharply, meaning that the Michigan number is the better indicator and that confidence has indeed started to slump. We may well be looking at a change in trend on consumer confidence."

Stocks mostly flipped between small gains and losses and broadly finished mixed. The S&P 500 was off just 0.1% to 4,522, giving it a 2.9% gain for August – that extended its monthly win streak to seven, which the index has accomplished just 14 other times since 1950.

The Dow Jones Industrial Average (-0.1% to 35,360) also finished with a monthly gain, of 1.2%, as did the Nasdaq Composite (down marginally to 15,259), up a hefty 4.0% in August.

Other news in the stock market today:

- The small-cap Russell 2000 finished in the black, advancing 0.3% to 2,273.

- Work-from-home darling Zoom Video Communications (ZM, -16.7%) plunged on Tuesday after the company managed to beat second-quarter earnings expectations but signaled that growth is normalizing – prompting a number of price-target reductions among the analyst crowd. "The company is seeing an uptick in customer churn in the <10 employee cohort, with headwinds expected to persist through the year," says Oppenheimer's analyst team, which rates the stock at Perform (equivalent of Hold). "We believe the next 2-3 quarters could present challenges as a new usage 'steady state' is established, and we expect the shares to come under pressure in the near term as shareholders realign their expectations."

- "Big Four" bank Wells Fargo (WFC, -5.6%) also struggled today amid a Bloomberg report indicating that it hasn't sufficiently put its misconduct-plagued past behind it. Specifically, "the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau have warned the firm they may bring new sanctions over the company's pace in fulfilling those obligations, according to people with knowledge of the situation," Bloomberg reports. The bank has been working for years to institute better internal controls and repay victims in the wake of multiple scandals, most notably the opening of millions of accounts on behalf of clients who did not provide consent.

- Worries about a drop in refinery demand in the wake of Hurricane Ida weighed on U.S. crude oil futures, which dropped 0.8% to $68.68 per barrel.

- Gold futures improved 0.3% to $1,818.10 per ounce.

- The CBOE Volatility Index (VIX) improved by 1.8% to 16.48.

- Bitcoin declined 2.8% to $47,295.56. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Watch Out! This Next Month's a Doozy

September is nigh, and apples and pumpkin spice aren't the only things in the air.

The S&P 500 is up 20.4% in 2021 and has set 53 new all-time highs along the way, breaking the 1964 record – but it faces the seasonal brick wall that is September.

"Although this bull market has laughed at nearly all the worry signs in 2021, let's not forget that September is historically the worst month of the year for stocks," says LPL Financial Chief Market Strategist Ryan Detrick. "Even last year, in the face of a huge rally off the March 2020 lows, we saw a nearly 10% correction in the middle of September."

"The S&P 500 hasn't had so much as a 5% correction since last October and with stocks up more than 100% since March 2020, investors should be open to some potential seasonal weakness. The good news is we remain in the camp that stocks will continue to go higher and investors should use any weakness as an opportunity to add to core equity holdings."

One way you can double the benefits of a temporary dip is to buy dividend payers – not only do you get a better entry point, but lower prices also help fatten your yield on cost. So if you're eyeballing high-quality, high-yield stocks, or persistent payers like these monthly dividend stocks and funds, September might present you with a sweeter opportunity.

Same goes for these real estate investment trusts (REITs), which are required to dole out most of their earnings in the form of dividends, typically resulting in loftier yields than most other market sectors. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Stocks See First Back-to-Back Losses of 2026: Stock Market Today

Stocks See First Back-to-Back Losses of 2026: Stock Market TodayRising geopolitical worries and a continued sell off in financial stocks kept pressure on the main indexes on Wednesday.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.