Stock Market Today: Disney Earnings Keep Dow, S&P Afloat

Impressive quarterly results from Disney helped offset a sharp drop in consumer confidence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks were choppy in today's low-volume session, as investors balanced another strong round of earnings against a dismal reading on consumer confidence.

In terms of earnings, Walt Disney (DIS, +1.0%) gained the bulk of headlines after reporting a fiscal third quarter with much higher-than-expected earnings, revenues and Disney+ subscriber numbers.

"The streaming story for Disney remains intact," says Carter Henderson, portfolio specialist and director of institutional development at Fort Pitt Capital Group. Results from Disney's parks and entertainment segment were strong, too, achieving "positive profits when many analysts didn't expect profitability to return until later in 2021 or even next year," per Henderson.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

But this good news was tempered by data from the University of Michigan, which showed consumer confidence plunged to 70.2 in August – its lowest reading since April 2020 – with those surveyed expressing concern over unemployment, inflation and the quickly spreading delta variant.

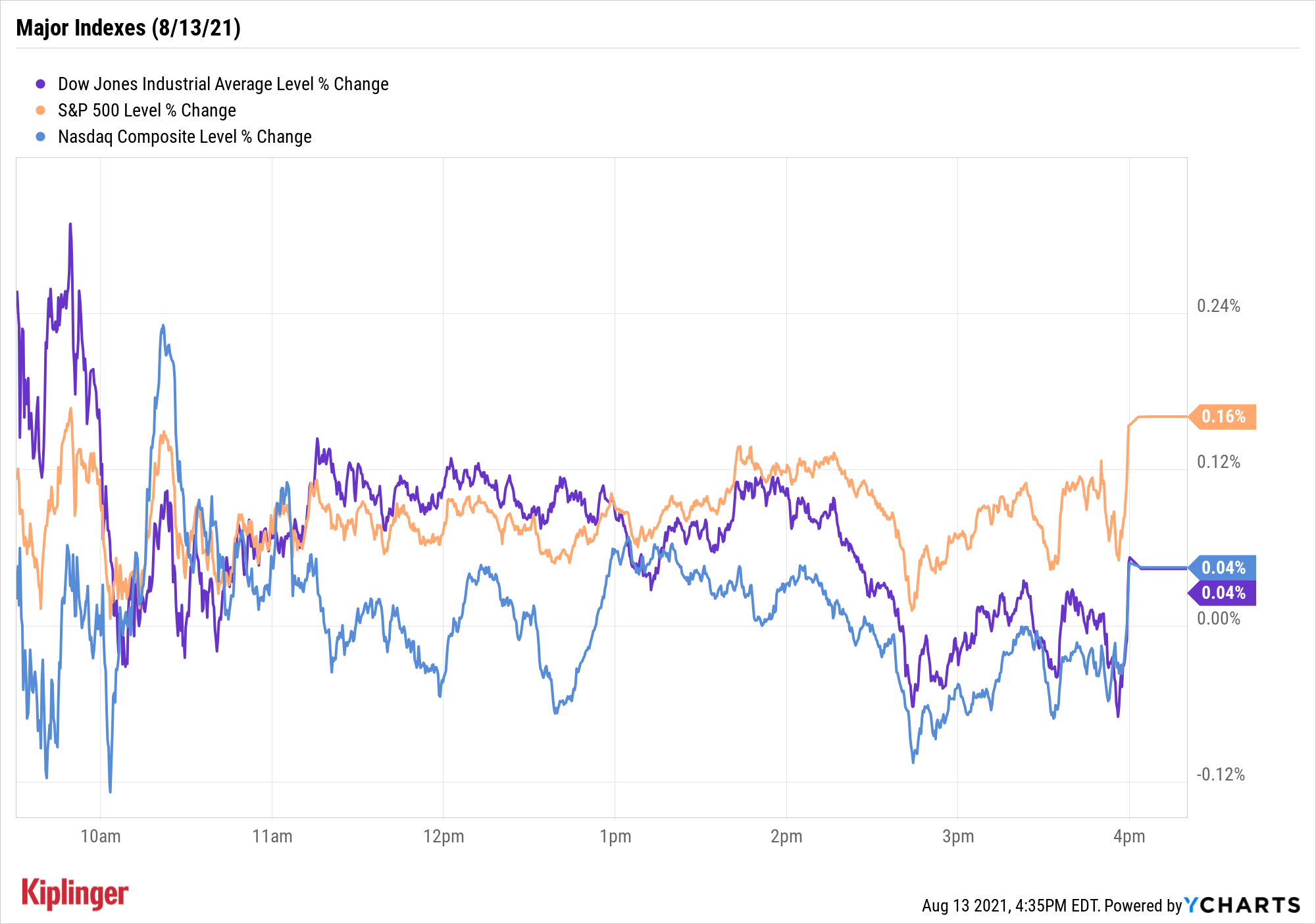

Still, the Dow Jones Industrial Average (+0.04% to 35,515) and S&P 500 Index (0.2% to 4,468) managed to end the week at new highs.

Other news in the stock market today:

- The Nasdaq Composite eked out a 0.04% gain to 14,822.

- Several pharmaceutical stocks moved higher today, after the Food and Drug Administration authorized COVID-19 vaccine booster shots in immunocompromised individuals, including those with HIV and cancer. Among the names getting a lift were Pfizer (PFE, +2.6%), BioNTech (BNTX, +0.9%) and Johnson & Johnson (JNJ, +0.5%).

- Food delivery firm DoorDash (DASH, +3.5%) gained ground in the wake of its second-quarter earnings report. DASH said gross order volume surged 70% from the year prior to $10.5 billion, while revenue jumped 83% to $1.2 billion and adjusted EBITDA (earnings before interest, taxes, depreciation and amortization). While these figures were higher than analysts were expecting, DASH did say in its shareholder letter that it "anticipates a seasonal decline in new consumer acquisition and order rates in Q3."

- U.S. crude oil futures slipped 0.9% to settle at $68.44 per barrel.

- Gold futures gained 1.5% to finish at $1,778.20 an ounce.

- The CBOE Volatility Index (VIX) retreated 0.9% to 15.45.

- Bitcoin rose 4.6% to $46,476.13. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Sweat the Small-Cap Underperformance

In the back of the pack today were small caps, with the Russell 2000 slipping 0.9% to 2,223. This is nothing new, with small caps lagging their larger-cap brethren dramatically over the past six months.

Scott Wren, senior global market strategist at Wells Fargo Investment Institute, says it's nothing to fear, and this underperformance is likely due to the "market getting concerned that future growth expectations are not going to pan out" as a result of a resurgence in COVID-19 cases.

"From our view, this small-cap underperformance is a temporary stumble," Wren adds.

For those investors who share this view that small caps will eventually bounce, we've recently compiled a list of the best small-cap stocks to buy, according to the pros.

And for those who want to add a little oomph to their portfolios, may we suggest these small-cap dividend stocks. While not typically known as income-building investments, this list of names offer hefty payouts for shareholders.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Chop as the Unemployment Rate Jumps: Stock Market Today

Stocks Chop as the Unemployment Rate Jumps: Stock Market TodayNovember job growth was stronger than expected, but sharp losses in October and a rising unemployment rate are worrying market participants.

-

Dow Rises 497 Points on December Rate Cut: Stock Market Today

Dow Rises 497 Points on December Rate Cut: Stock Market TodayThe basic questions for market participants and policymakers remain the same after a widely expected Fed rate cut.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.