Stock Market Today: S&P, Nasdaq Score New Highs Ahead of Jobs Day

Weekly jobless claims arrived in line with expectations ahead of tomorrow's nonfarm payrolls report.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks gained ground on Thursday as Wall Street digested the latest round of economic and earnings reports.

Ahead of tomorrow's highly anticipated nonfarm payrolls report, data showed weekly jobless claims fell to 385,000 last week – in line with expectations – while continuing claims dropped below 3 million for the first time since March 2020.

"The Fed has made it clear that it wants to see further progress in the labor market before it begins tweaking monetary policy," says Michael Reinking, senior market strategist for the New York Stock Exchange.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Earlier this week Federal Reserve Governor Christopher Waller put some numbers around that," Reinking adds, "saying that if he saw the next two jobs reports between 800,000 - 1 million, he'd be ready to move on tapering."

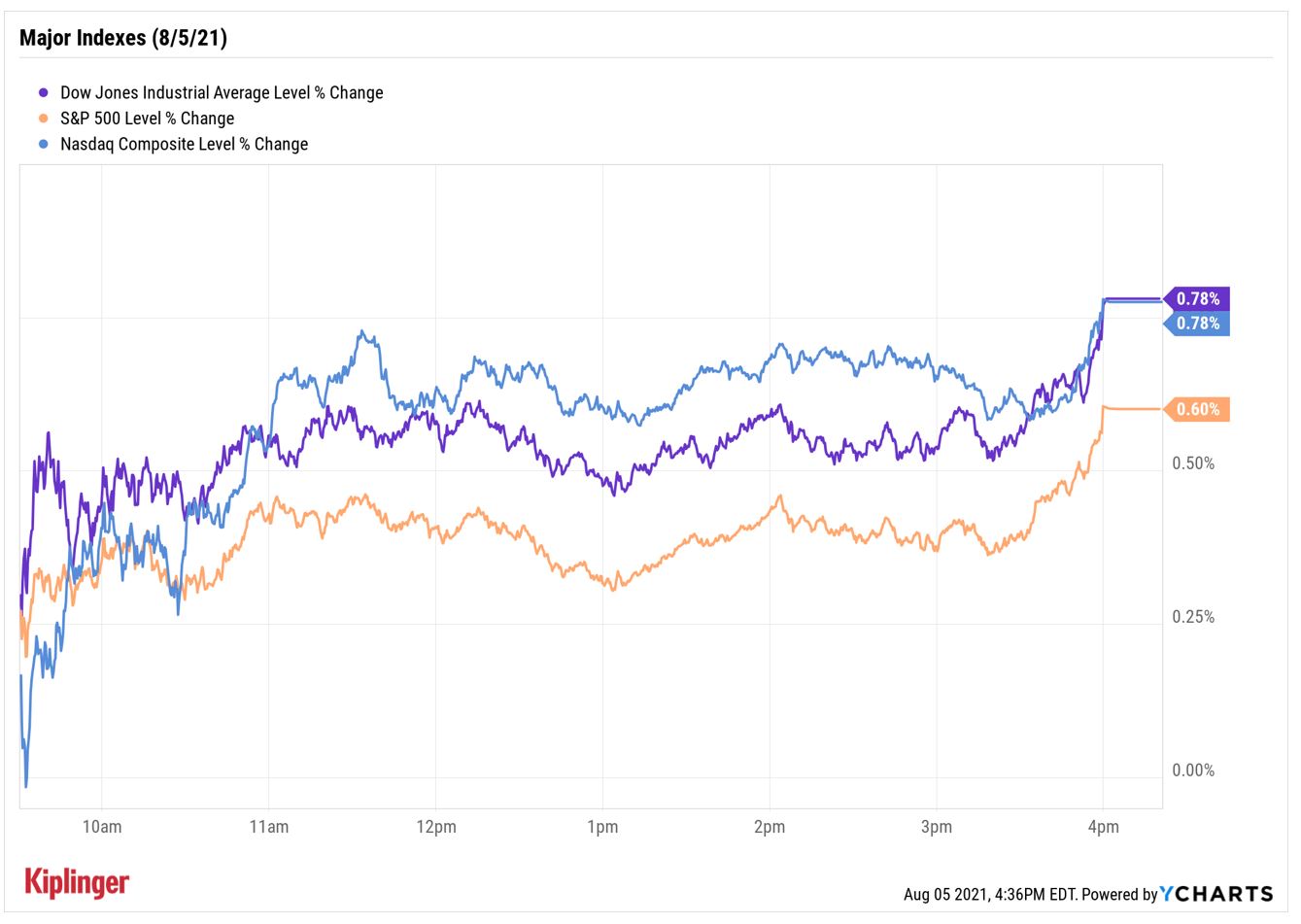

And on the earnings front, a big revenue beat from online travel agent Booking Holdings (BKNG, +5.9%) helped push the Nasdaq Composite up 0.8% to 14,895 and the S&P 500 Index up 0.6% to 4,429.10 – new record highs. The Dow Jones Industrial Average jumped 0.8% to 35,064.

Other news in the stock market today:

- Etsy (ETSY) got knocked after earnings, finishing the session down 9.7%. The online marketplace reported higher-than-anticipated earnings of 68 cents per share and revenue of $528.9 million for its second quarter, but gave current-quarter revenue guidance below analysts' consensus estimate.

- Fastly (FSLY) was another post-earnings loser, shedding 10.4%. The cloud services provider said the fallout from an early June outage negatively impacted its top line in the second quarter, with the $85.1 million it brought in falling short of the consensus estimate. "We expect to see a downstream impact on revenue from the outage in the near-to medium-term as we work with our customers to bring back their traffic to normal levels," wrote Fastly CEO Joshua Bixby in a note to shareholders. However, FSLY did report a slimmer-than-anticipated per-share loss of 15 cents for the three-month period.

- U.S. crude oil futures gained 1.4% to settle at $69.09 per barrel, snapping their three-day losing streak.

- Gold futures ended the day down 0.3% at $1,808.90 an ounce.

- The CBOE Volatility Index (VIX) fell 3.8% to 17.28.

- Bitcoin jumped 7.1% to $40,687.15. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Give Up on Small Caps

Small caps were the big winners today, with the Russell 2000 climbing 1.8% to 2,236.

The benchmark has lagged its larger-cap peers in recent weeks as concerns over the delta variant of COVID-19, rising inflation and supply-chain worries led many investors to reduce exposure to riskier assets.

However, Ken Johson, investment strategy analyst at Wells Fargo Investment Institute, sees many of these uncertainties being ironed out as vaccination rates progress and both labor supply constraints and supply-chain disruptions ease. As such, "We view recent underperformance as an opportunity for investors and remain favorable to small-cap equities," says Johnson.

Those looking to add value plays to their portfolio may want to consider these high-potential small-cap stocks. Or, these 11 top-rated Russell 2000 stocks could fit the bill. All of the names on this list are considered some of the best small-cap stocks to buy now, based on their high analyst ratings and bullish outlooks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have TodayEven with its reliable dividend growth and generous stock buybacks, Coca-Cola has underperformed the broad market in the long term.

-

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have Today

If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here's What You Would Have TodayQualcomm stock has been a big disappointment for truly long-term investors.

-

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have TodayHome Depot stock has been a buy-and-hold banger for truly long-term investors.