Stock Market Today: Apple Sets New High on Mixed Day for the Market

Stocks failed to find common direction on Wednesday as investors digested more signs of surging inflation but also signals that the Fed won't ease policy anytime soon.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks endured another up-and-down session Wednesday amid a deluge of headlines, though unlike yesterday, a couple of the major indexes escaped with gains.

The latest producer price report confirmed what consumer price data told us yesterday: inflation is surging. The headline producer price index rose 1.0% month-over-month, and 7.3% year-over-year, to topple expectations.

"This continued acceleration in prices is consistent with our view that core goods CPI will remain strong this year and continue to outperform its historical trend of the past three decades," says Barclays economist Pooja Sriram.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Regardless, Federal Reserve Chair Jerome Powell indicated in testimony to Congress that easy monetary policies were likely to persist at least in the near term; investors keyed in on Powell's statement that "substantial further progress" in the labor market was still a ways off.

Meanwhile, banks continued their strong second-quarter earnings season, with Citigroup (C, -0.3%) and Wells Fargo (WFC, +4.0%) both beating bottom-line expectations.

And Apple (AAPL, +2.4%) hit a new high after JPMorgan added the stock to its "Focus List" amid boisterous iPhone and Mac sales. Also aiding the stock was a Bloomberg report, citing people with knowledge of the matter, saying Apple has asked suppliers to build up to 90 million next-gen iPhones, marking a significant jump from last year's shipments. AAPL shares are up more than 17% in the past month.

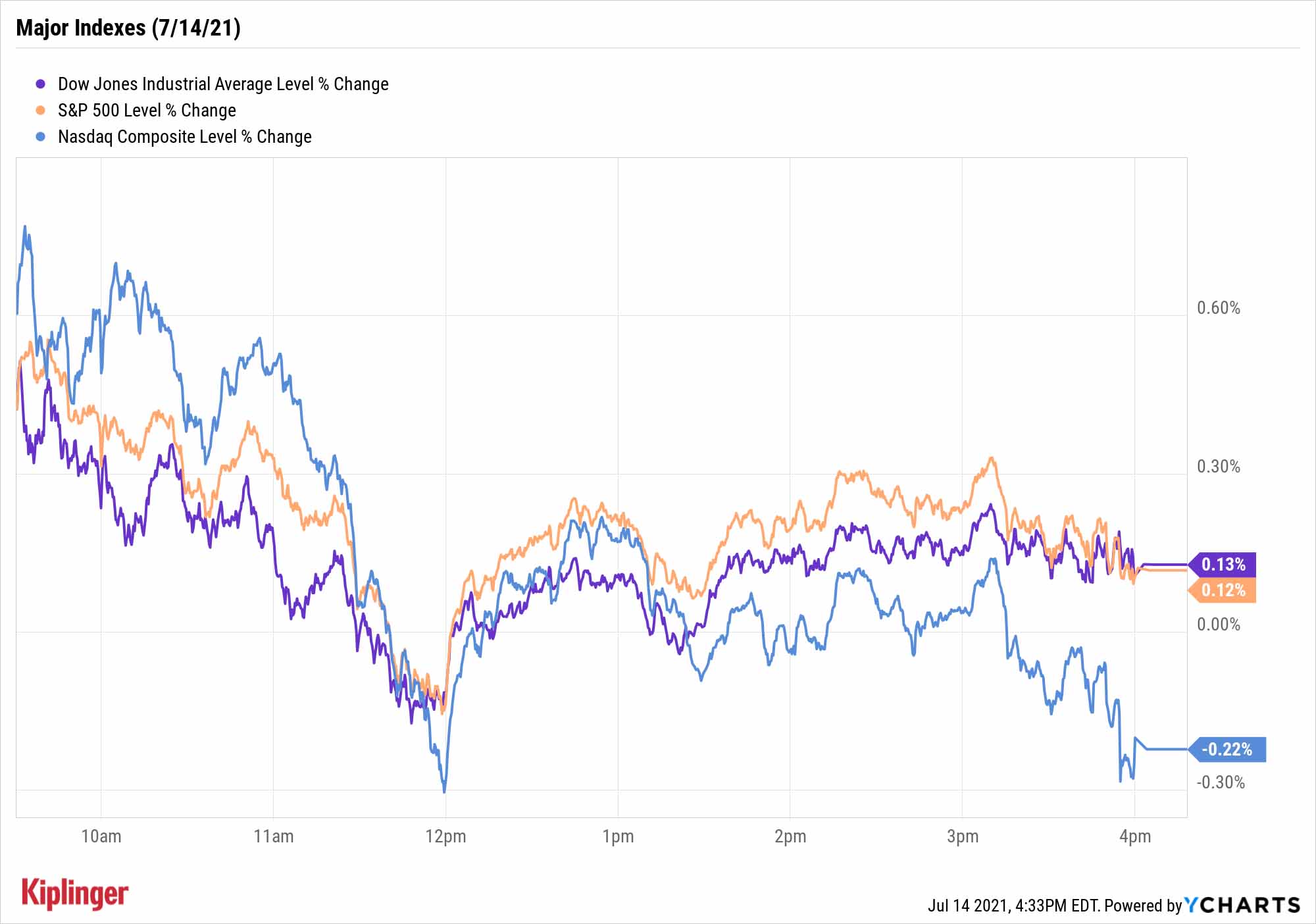

The major indexes enjoyed modest gains, led by the Dow Jones Industrial Average (+0.1% to 34,933). The S&P 500 also gained 0.1% to 4,374, while the Nasdaq Composite finished down 0.2% to 14,644. Small caps continued their recent struggles, with the Russell 2000 off 1.6% to 2,202.

Other action in the stock market today:

- Delta Air Lines (DAL) gave back 1.6% in the wake of its second-quarter earnings report. For the three-month period, the major airline reported net income of $652 million, its first profit in six quarters. Excluding the $1.5 billion in federal payroll aid it received during the quarter, DAL recorded an adjusted per-share loss of $1.07, though that was slimmer than analysts were expecting. Delta's $7.1 billion in revenue also beat the consensus estimate.

- In non-earnings news, AMC Entertainment (AMC) continued to decline amid a broad selloff in meme stocks. AMC shed 15.0% today to bring its month-to-date loss to more than 30% (though it's still up mor ethan 1,440% for the year to date). Some other notable Reddit stocks that slumped today include GameStop (GME, -6.9%), Clean Energy Fuels (CLNE, -7.8%) and BlackBerry (BB, -3.8%).

- U.S. crude oil futures fell 2.8% to end at $73.13 per barrel. "Oil prices have been moving lower following a report ahead of the open that Saudi Arabia has reached an agreement with the United Arab Emirates to boost their baseline," says Michael Reinking, senior market strategist for the New York Stock Exchange. "Since then, there have been multiple reports that this does not necessarily have the full support of other members yet."

- Gold futures rose 0.8% to settle at $1,825.00 an ounce.

- The CBOE Volatility Index (VIX) slipped 4.6% to 16.33.

- Bitcoin rebounded 1.3% to $32,724.50. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Real Estate Keeps Raking It In

One of the S&P 500's best sectors of 2021 remains one of the few places to find high yield. The real estate sector was one of Wednesday's top gainers at 0.9%, extending its year-to-date total returns to 27.1%, behind only energy stocks (+41.0%) in 2021.

Despite that recovery after a dreadful 2020, the S&P 500 real estate sector still offers up a yield of just more than 3%, dwarfing the broader index's 1.3%. However, while most real estate investment trusts (REITs) have been red-hot this year, a few bargains remain.

Investors typically benefit by paying less for good stocks, but especially in the real estate sector, value is a potent one-two punch – not only do undervalued stocks have greater potential for price appreciation, but they also offer higher dividend yields on their original cost basis too.

Here, we have highlighted seven value-priced REITs that offer a combination of fair prices, improving profits and sturdy fundamentals.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.