Stock Market Today: New Infrastructure Hopes Hoist Indexes to New Heights

President Biden's backing of a bipartisan infrastructure spending bill sparked fresh optimism that pushed the S&P 500 and Nasdaq to record closes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

And just like that, it's "Infrastructure Week" again.

Things were already looking good for stocks early Thursday after unemployment claims for the week ended June 19 came in lower by 7,000 filings to 411,000. But the indexes picked up even more steam after President Joe Biden announced his backing of the "Bipartisan Infrastructure Framework" – a $1.2 trillion infrastructure spending compromise backed by a bipartisan group of senators.

While the deal still must pass muster in Congress, investors were clearly cheered by the signs of progress.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Investors liked what they saw, and stocks moved higher on the news," says Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, a registered investment advisor (RIA). "Although the proof will be in the pudding, if the full House and Senate are able to get it across the finish line and the President can sign it into law.

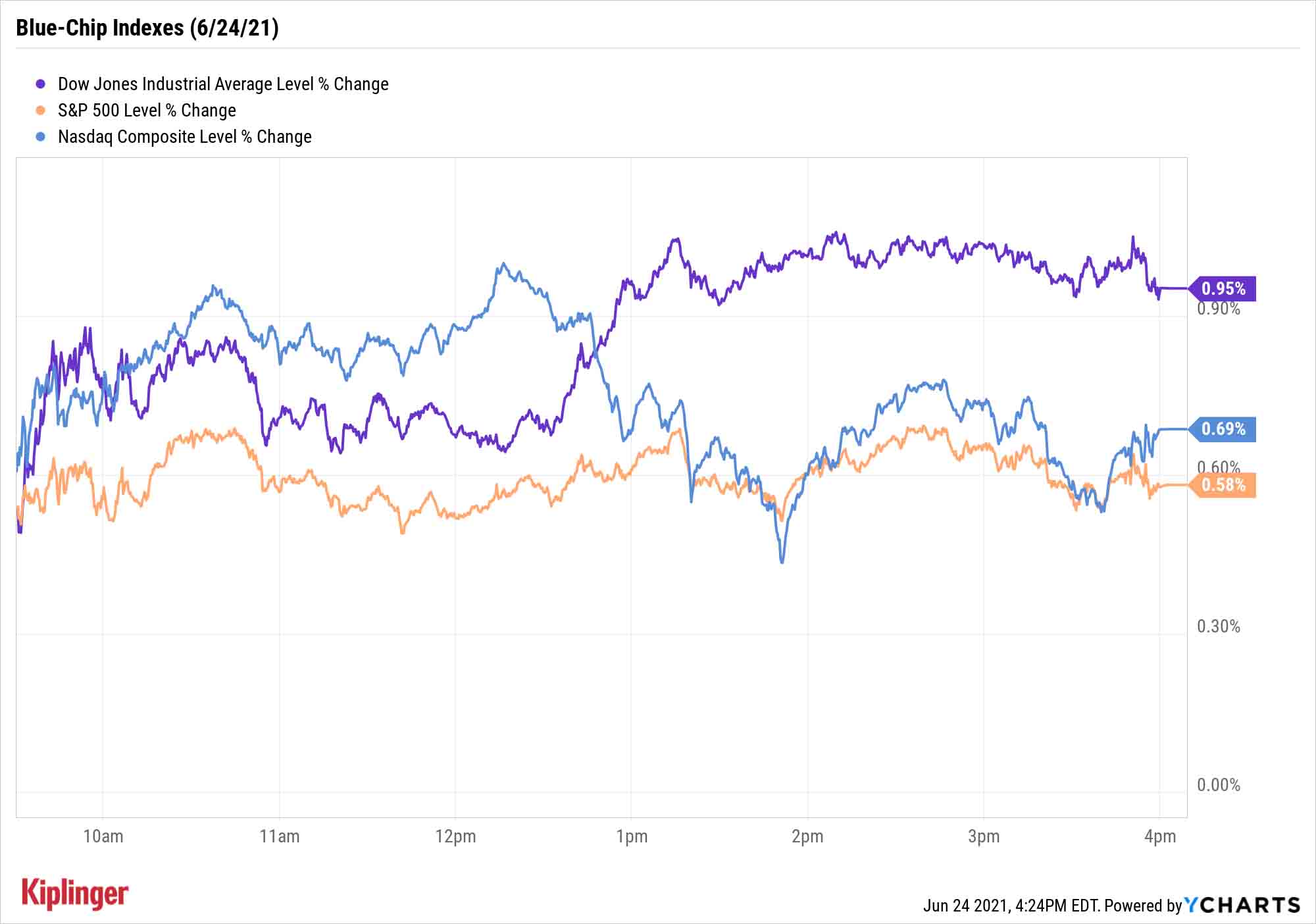

The Dow Jones Industrial Average advanced a healthy 1.0%, to 34,196, led by industrial giants Boeing (BA, +2.9%) and Caterpillar (CAT, +2.6%), as well as financials such as Goldman Sachs (GS, +2.1%) and Travelers (TRV, +1.4%).

"From an asset allocation perspective, value seems to be benefiting most from this news as many of the infrastructure-oriented stocks tend to land in this universe," says Brian Price, head of investment management for Commonwealth Financial Network, another RIA.

The S&P 500 (+0.6% to 4,266) and Nasdaq Composite (+0.7% to 14,369) also finished in the black, and in new record territory to boot.

Other action in the stock market today:

- The small-cap Russell 2000 improved by 1.3% to 2,333.

- Rite Aid (RAD) sat out the day's broad-market rally, sinking 14.5% after the drugstore chain reported earnings. In its fiscal first quarter, RAD reported adjusted earnings of 38 cents per share – above what analysts were expecting – but its $6.16 billion in revenue came up short of estimates.

- Several digital advertising stocks gained ground after Alphabet's (GOOGL, +0.3%) Google postponed plans to end support for third-party tracking cookies, with the search engine now expecting to begin this initiative in mid-2023 versus early 2022. Among the big movers today were Trade Desk (TTD, +16.0%), Magnite (MGNI, +8.2%) and PubMatic (PUBM, +13.0%).

- U.S. crude oil futures rose 0.3% to settle at $73.30 per barrel.

- Gold futures slipped 0.4% to finish at $1,776.70 an ounce.

- The CBOE Volatility Index (VIX) slipped for a fourth consecutive day, by 2.8% to 15.85.

- Bitcoin continued to rebound, improving by 5.6% to $34,786.42. (Cryptocurrencies trade 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Play Renewed Infrastructure Hopes

The sudden traction on any sort of infrastructure bill is a favorable sign for equity investors.

"Infrastructure spending strengthens an already very strong economic growth outlook," says Jeff Buchbinder, equity strategist for independent broker-dealer LPL Financial. "We will very likely get more than $2 trillion in additional spending this year – including this bipartisan agreement and a partisan 'social infrastructure' deal later this year, which bolster the outlook for corporate profits and should keep this bull market going strong well beyond 2021."

As far as the Bipartisan Infrastructure Framework itself goes, it pares down many of Biden's hoped-for initiatives, but a few remain. The plan calls for providing high-speed internet to all Americans, which should be a boon to 5G-related stocks, and it also targets climate, electric vehicles and other green initiatives, potentially providing more lift for clean energy stocks.

Though, those industries might have been just fine either way.

"The prospect of legislation is clearly positive, but the reality is that infrastructure investment is going to be strong going forward regardless of what happens on Capitol Hill," says Josh Duitz, portfolio manager of the Aberdeen Standard Global Income Infrastructure Fund (ASGI). "The green energy and 5G revolutions are already happening and this bill would simply accelerate infrastructure spending."

And naturally, the core goal remains: improving and building out the nation's infrastructure – from roads and bridges to electricity grids and water systems.

Nothing is set in stone, but this sudden spurt of progress bodes well for these 14 infrastructure stocks, each of which stands to benefit from at least one provision of Washington's potential compromise.

Kyle Woodley was long BA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.