Stock Market Today: Stocks Briefly Sputter as Fed Projects Higher Rates in 2023

The Federal Reserve said Wednesday that it anticipates rate hikes might be here sooner than previously expected, providing a brief market shakeup.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The writing on the wall – that the clock is ticking on near-zero interest rates – grew increasingly clear Wednesday as the Federal Reserve projected higher benchmark rates by the end of 2023 in its latest policy announcement.

The Fed's statement, released in the afternoon, showed a median forecast of two 25-basis-point rate hikes in 2023, up from zero increases in March. (A basis point is one one-hundredth of a percentage point.) Moreover, seven FOMC participants forecast at least one hike in 2022, up from five in March.

“As widely expected, the Fed made no changes to its bond buying program or the Fed funds rate and the statement re-affirmed the belief among participants that the recent spike in inflation is largely transitory,” says Anu Gaggar, senior global investment analyst for Commonwealth Financial Network. “However, when you peel the layers, the dot plot is conveying a slightly different story."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The Fed seems to be setting the stage to begin tapering by the end of this year, ending QE by the end of next year, and commencing rate hikes by the end of 2023," adds Michael Gregory, deputy chief economist for BMO Capital Markets.

However, Gregory notes that "even as these events occur, policy will still be very accommodative." Indeed, the Fed maintained its pace of asset purchases for now, and Fed chief Jerome Powell indicated any tapering is by no means imminent.

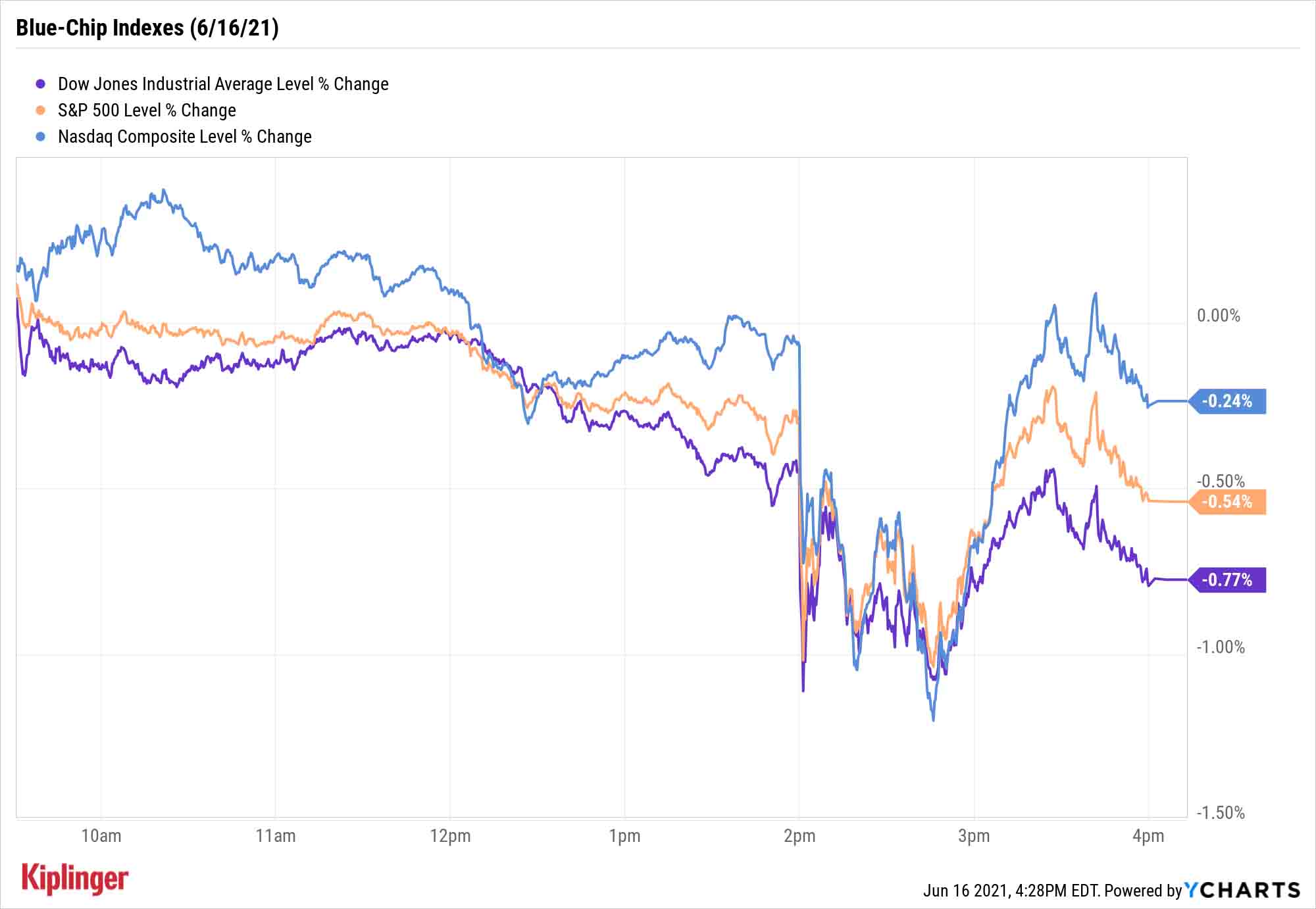

The major indexes briefly stumbled to their lows of the day after the announcement, but recovered at least some of their ground to finish with slight losses. The Dow Jones Industrial Average fell hardest, and even that was a mild 0.8% decline to 34,033. The S&P 500 slipped 0.5% to 4,223, and the Nasdaq Composite retreated by just 0.2% to 14,039.

"The Fed didn’t rock the boat," says Ryan Detrick, Chief Market Strategist for LPL Financial. "They increased their inflation outlook and upped GDP forecasts; everyone expected that. Yes, the first hike will now be in 2023, but again, this shouldn't have been a surprise to anyone."

Other action in the stock market today:

- The small-cap Russell 2000 declined 0.2% to 2,314, extending its losing streak to three days.

- Blue Apron Holdings (APRN, -21.5%) plunged Wednesday after the meal-kit service priced a 4.7-million secondary stock offering at $4.25 per share – a steep discount to last night's close at $5.53.

- Oracle (ORCL, -5.6%) was a notable decliner, too, falling in the wake of the enterprise software maker's earnings report. While ORCL beat on both the top and bottom lines in its fiscal fourth quarter, it gave disappointing guidance for the current quarter and announced plans to roughly double its cloud capital expenditure spending in fiscal 2022.

- H&R Block (HRB, -6.5%) was another post-earnings loser. The tax preparation firm reported higher-than-expected adjusted earnings in its fiscal Q4, but revenue fell just short of analysts' consensus estimate.

- U.S. crude oil futures managed a marginal gain to finish at $72.15 per barrel.

- Gold futures added 0.3% to end at $1,861.40 an ounce, snapping their three-day losing streak.

- The CBOE Volatility Index (VIX) rose yet again, climbing 6.5% to a monthlong high of 18.13.

- Bitcoin prices declined along with stocks, dropping 3.1% to $38,712.79. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Fed Raises Inflation Expectations, Too

While the central bank continued to insist that many inflationary pressures are "transitory," it bumped up its headline inflation forecast for 2021 by a full percentage point, and its 2022 and 2023 expectations by 10 basis points each.

"The economy is making progress," say Mizuho economists Steven Ricchiuto and Alex Pelle. "Growth and inflation forecasts were both upgraded in the short-term, along with an increase in the Committee’s evaluation of inflation risk to the upside. This makes many inflation hawks deeply uncomfortable."

If higher inflation expectations give you concerns about your portfolio, you at least now have some official grounds for worry.

"Persistently high inflation has frequently led to lower stock returns," says Ally Invest President Lule Demmissie, who points out that since 1990, the S&P 500 produced lower one-, six- and 12-month returns when core CPI growth was 2% or higher year-over-year.

But inflation doesn't have to doom your portfolio, Demmissie adds. "Stable dividend payers tend to thrive as investors focus on cash flows instead of growth potential."

She points to the success of the Dividend Aristocrats, which outperformed the S&P 500 by an average of 8.6% (including dividends) in those years. Investors can find similar income stability with the European Dividend Aristocrats or even Canada's Dividend Aristocrats.

As for those who prefer to keep their investments domestic, investors can afford to be choosy about which members of the dividend royalty they embrace. It just so happens that much of the peerage is on sale at the moment. Indeed, several Aristocrats are trading at cheaper valuations than their blue-chip peers – a noteworthy bonus amid what is currently a very expensive market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Ask the Tax Editor: Federal Income Tax Deductions

Ask the Tax Editor: Federal Income Tax DeductionsAsk the Editor In this week's Ask the Editor Q&A, Joy Taylor answers questions on federal income tax deductions

-

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)

States With No-Fault Car Insurance Laws (and How No-Fault Car Insurance Works)A breakdown of the confusing rules around no-fault car insurance in every state where it exists.

-

7 Frugal Habits to Keep Even When You're Rich

7 Frugal Habits to Keep Even When You're RichSome frugal habits are worth it, no matter what tax bracket you're in.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

Stocks Rise to the Spirit of the Season: Stock Market Today

Stocks Rise to the Spirit of the Season: Stock Market TodayInvestors, traders and speculators are beginning to like the looks of a potential year-end rally.

-

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market Today

Nasdaq Leads as Tech Stages Late-Week Comeback: Stock Market TodayOracle stock boosted the tech sector on Friday after the company became co-owner of TikTok's U.S. operations.

-

Nasdaq Sinks 418 Points as Tech Chills: Stock Market Today

Nasdaq Sinks 418 Points as Tech Chills: Stock Market TodayInvestors, traders and speculators are growing cooler to the AI revolution as winter approaches.

-

Stocks Struggle Ahead of November Jobs Report: Stock Market Today

Stocks Struggle Ahead of November Jobs Report: Stock Market TodayOracle and Broadcom continued to fall, while market participants looked ahead to Tuesday's jobs report.