Stock Market Today: Goldilocks Jobs Report Brings Out the Bulls

Stocks gained ground in reaction to the Labor Department's nonfarm payrolls update for May.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

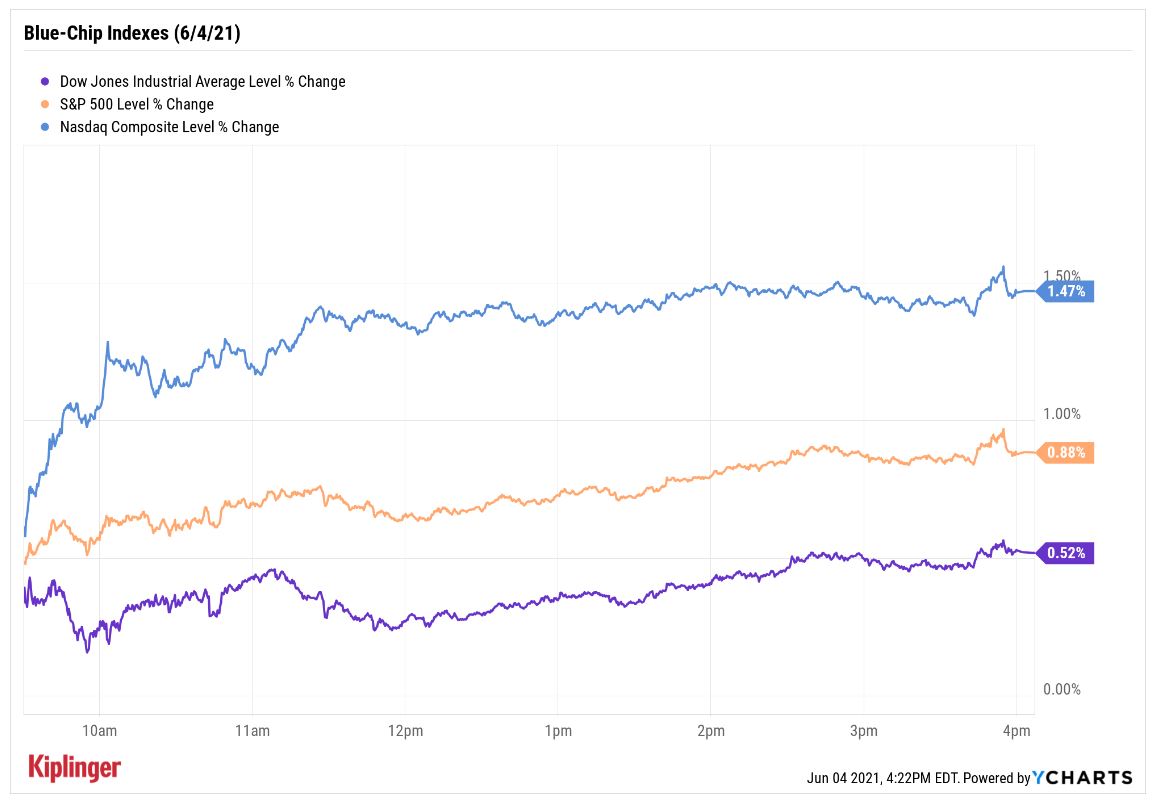

Today's trading was a mirror image to yesterday's session, with indexes rising on what some are calling a "Goldilocks" jobs report (not too hot to spark inflation fears, not too cold to chill economic growth).

Data from the Labor Department showed the U.S. added a lower-than-anticipated 559,000 nonfarm payrolls in May – more than double April's number.

Both the labor participation rate, which tracks those actively looking for work, and the unemployment rate fell slightly from last month's readings (to 61.6% from 61.7% and to 5.8% from 6.1%, respectively) – though the latter is likely a result of less people seeking employment.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Bottom line, the report does very little to settle the overarching debate regarding the recovery and the associated Fed policy, but it does showcase the continued demand for labor," says Alan McKnight, chief investment officer of Regions Private Wealth Management.

"Without settlement of the debate, equity markets can continue to move higher with a backdrop of sustained fiscal and monetary support."

And that's exactly what they did, with the Dow Jones Industrial Average adding 0.5% to 34,756, and the S&P 500 Index gaining 0.9% to 4,229.

Other action in the stock market today:

- The Russell 2000 small-cap index edged up 0.3% to close at 2,286.

- Facebook (FB, +1.3%) today said former U.S. President Donald Trump will not be able to access the social media platform until January 2023, at the earliest. The company initially suspended Trump's account in the wake of the Jan. 6 Capitol Hill riot, saying he incited violence.

- DocuSign (DOCU,+19.8%) was a big mover on earnings. The electronic signature specialist reported a larger-than-anticipated adjusted profit of 44 cents per share in its first quarter, while revenues of $469.1 million also topped estimates.

- U.S. crude oil futures rose 1.2% to settle at $69.62 per barrel.

- Gold futures added 1% to end at $1,892.00 an ounce.

- The Cboe Volatility Index (VIX) fell 9.0% to 16.42.

- Bitcoin prices slumped 4.6% to $36,852. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

How to Prepare for Massive Machine Learning Growth

For all the struggles the Nasdaq has had lately (down 2.3% since its April 26 peak), it had its day in the sun today, rising 1.5% to 13,814, handily outperforming its blue-chip peers.

One notable gainer on the tech-heavy index was Alphabet (GOOGL, +2.0%), which rose alongside the other FAANG stocks.

Canaccord Genuity analysts are targeting even more upside for GOOGL over the next 12 months or so, with a $2,800 price target for the stock – a roughly 17% premium to current levels – in part on expectations for strong revenue growth from digital advertising. "This dynamic, coupled with robust profitability and reasonable valuations, should make [GOOGL] appealing to large-cap investors."

Another tailwind for the tech giant: its investments in artificial intelligence (AI) and machine learning (ML). According to International Data Corporation (IDC), global revenues for AI technologies are expected to top $554 billion by 2025 -- welcome news for Alphabet and this batch of machine learning stocks. Read on as we look at five ML stocks that could benefit from substantial growth in the global AI market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.