Stock Market Today: Inflation Sinks Its Teeth Into Stocks

April's CPI reading came in hotter than expected Wednesday, fueling inflation fears ... and a sizable selloff in all the major indexes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

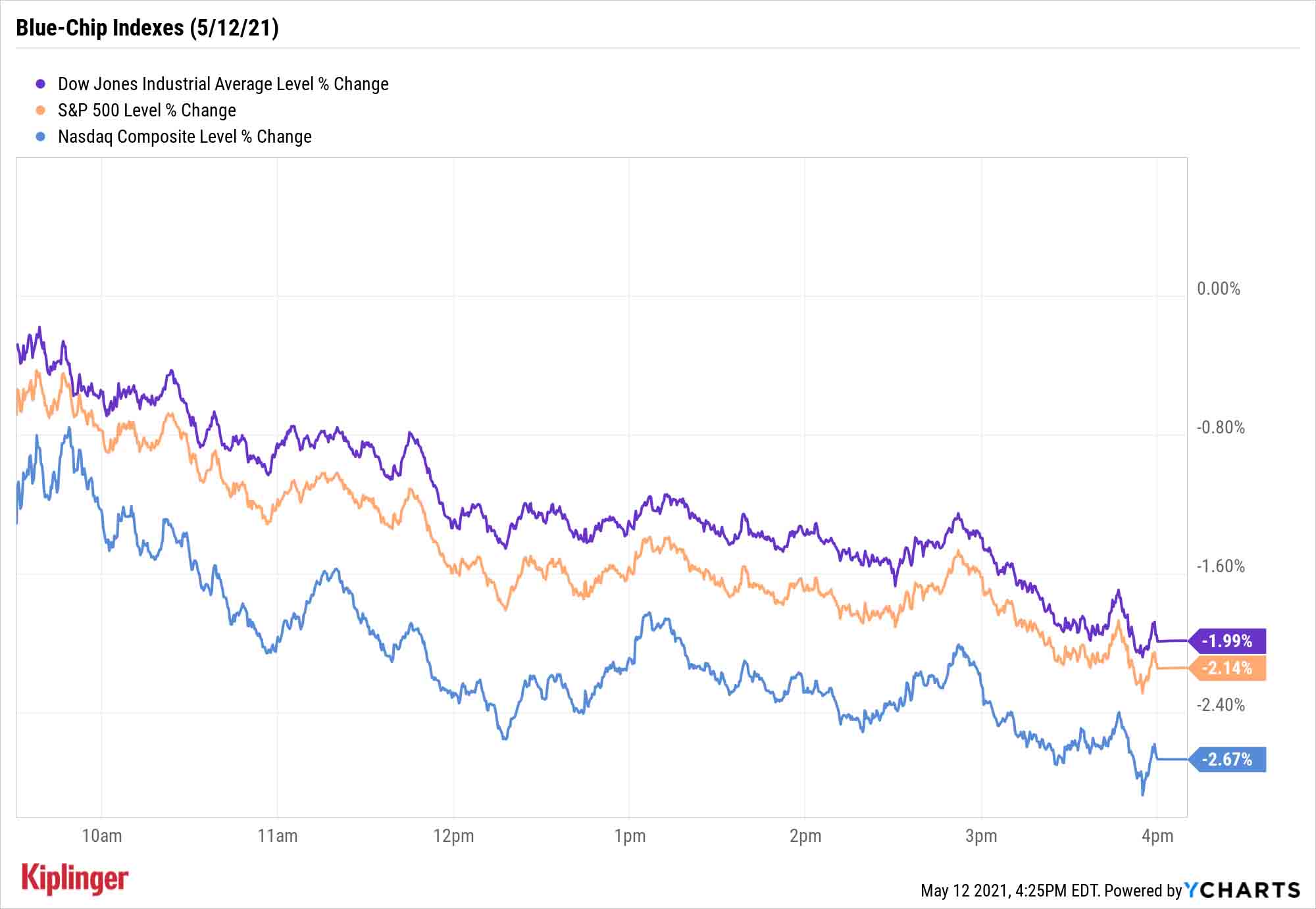

2021's brewing jitters over inflation turned into a proper scare Wednesday, as a higher-than-expected consumer price index (CPI) reading for April had investors making a beeline for the exits.

The Labor Department revealed that consumer prices jumped last month by 4.2% year-over-year – the fastest such rate since September 2008 and above consensus estimates for 3.6%. Barclays economists Michael Gapen and Pooja Sriram note that outsized jumps in prices for vacation lodging, air travel and used cars pushed the needle but are unlikely to be sustained.

"That said, after excluding these three components, core inflation would have risen 0.4% on the month, slightly higher than our and consensus expectations," they say. "In other words, transitory pandemic influences clearly contributed to the surge in April inflation, but there is some residual firmness in core inflation that is hard to ignore."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Investors certainly didn't give it a pass.

The technology (-2.8%) and consumer discretionary (-3.4%) sectors led the market lower Wednesday, resulting in a deep 2.7% loss to 13,031 for the Nasdaq. Notable losers there included Apple (AAPL, -2.5%) and Microsoft (MSFT, -2.9%), which also weighed on the Dow Jones Industrial Average (-2.0% to 33,587) and S&P 500 (-2.1% to 4,063).

The lone bright spot in the market was the energy sector, which finished up 0.5%. That came amid a 1.2% jump in U.S. crude oil futures, which settled at $66.08 per barrel.

Other action in the stock market today:

- The small-cap Russell 2000 was bludgeoned to the tune of 3.3% to close at 2,135.

- Hertz Global Holdings (HTZGQ, +55.0%) was spared from the broad-market bloodbath, and in fact sprinted in the other direction, after a group of investment firms won a $6 billion shareholder-friendly bid to take control of the car rental concern and fund its Chapter 11 bankruptcy. Knighthead Capital Management and Certares Management were part of the group that submitted the winning offer, which includes a nearly $8-per-share payment to HTZ stockholders.

- Lemonade (LMND, -18.5%) sold off sharply after reporting earnings. While the online insurance company reported higher-than-expected revenue of $23.5 million in the first quarter, it swung to a wider-than-anticipated net loss of 81 cents per share as claims spiked following the massive winter storm in Texas this February.

- Gold futures slipped 0.7% to finish at $1,822.80 an ounce.

- The CBOE Volatility Index (VIX) sharply improved for a third straight day, rocketing 26.3% higher to 27.59, its highest level since early March.

- Bitcoin prices weren't spared from Wednesday's pain, declining 3.7% to $54,588.65. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Don't Panic. Prepare.

While Barclays and other strategists believe most of these inflationary pressures will ease as the year progresses, it's important to at least recognize potential worse-case scenarios.

Consider these thoughts from Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, a registered investment advisor:

"The question isn't whether inflation returns or not … but whether the Fed will act in time to keep it contained. If they time everything perfectly – and we would suggest that even they realize how difficult that would be to do – then inflation won't rise far above 2%, but otherwise we are headed higher than that, and ultimately the Fed will need to tighten monetary policy, which is what will likely cause the next recession and end this bull market."

It might not get that bad, of course.

"Inflation and interest rate jitters are hitting the market today, but for now the sell-off has been orderly," says Cliff Hodge, Chief Investment Officer for Cornerstone Wealth. "Letting some air out of these sky-high valuations is a positive going forward. We're heading to the seasonally slow time of the year, so sell in May is top of mind. We're using the volatility to continue to move up in quality and size."

Regardless of how hot the economy gets, and for how long, one way to protect yourself is by minding your income.

Dividend growth stocks, for instance, help beat back the erosive nature of inflation on spending power by ensuring that your payments increase every year.

And faithful dividend payers with ample yields will help you weather price volatility brought on by inflation worries or other market concerns by ensuring some form of return even when your shares are down on their luck. Here, we take a fresh look at 20 such dividend stocks, each of which boast long strings of uninterrupted payouts thanks to rock-solid financial foundations, and that collectively yield more than 4% on average.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.