Stock Market Today: Big Tech Bounce Can't Save Dow

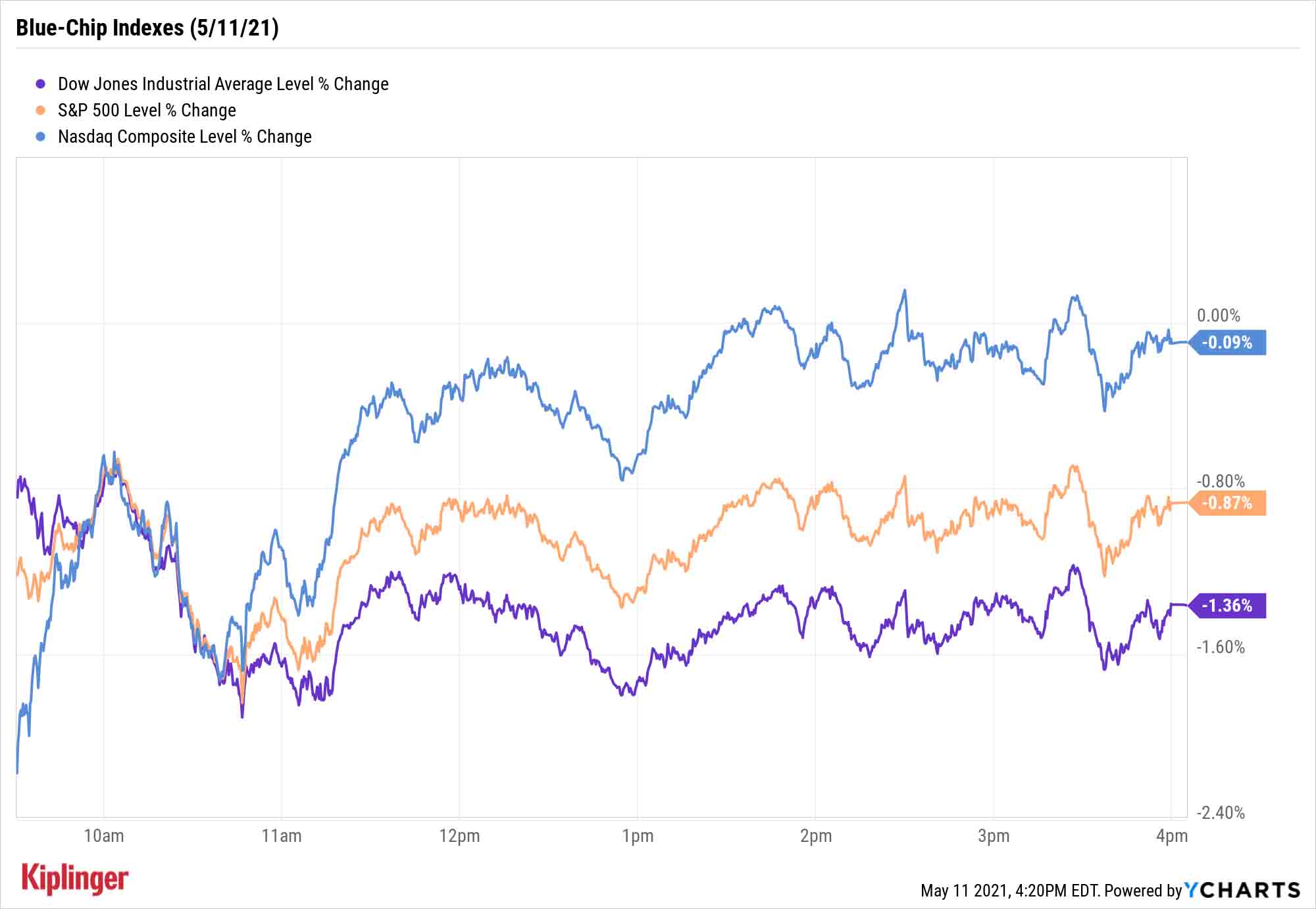

Tech stocks looked primed for another disastrous session Tuesday, but the Nasdaq managed to rebound to marginal losses. The Dow? Not so much.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Tuesday looked like it would be another nasty day for tech stocks, with the Nasdaq Composite plunging more than 2% in early trading. However, the index pared nearly all of these losses – and made a brief push into positive territory – as bargain hunters swooped in.

Cloud stocks in particular benefited from the buy-the-dip trade, swinging higher after a negative start. Among notable gainers in this corner of the tech sphere were Twilio (TWLO, +3.9%), Amazon.com (AMZN, +1.1%) and CrowdStrike (CRWD, +4.0%).

But while the Nasdaq finished down just 0.1% at 13,389, the Dow Jones Industrial Average suffered a much worse fate, slumping 1.4% to 34,269 on weakness in energy stock Chevron (CVX, -2.6%) and consumer discretionary name Home Depot (HD, -3.1%).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"What started in technology earlier this month has finally moved over to the broader markets," says Ryan Detrick, chief market strategist for LPL Financial. "Although we are coming off a record earnings season, continued supply chain and labor shortages are adding to potential inflationary pressures."

"Given that equity markets are still in shouting distance of all-time highs, it is not surprising to see investors hit pause and evaluate the various catalysts for the next move higher in stock prices," adds Brian Price, head of investment management for Commonwealth Financial Network. "For the time being, I think that investors may remain on edge until there is more certainty from Washington regarding fiscal policy.

Other action in the stock market today:

- The S&P 500 fell again, off 0.9% to 4,152.

- The small-cap Russell 2000 suffered only minor damage, declining 0.3% to 2,206.

- Palantir Technologies (PLTR, +9.4%) got a big earnings boost today. The data analytics firm said revenues surged 49% in its first quarter to $341 million – more than analysts were expecting – while adjusted earnings of 4 cents per share matched forecasts.

- Novavax (NVAX, -13.9%) took a hit today after the drugmaker said it will not seek regulatory approval for its COVID-19 vaccine in the U.S., U.K. and Europe until the third quarter of this year – later than initially expected. NVAX also said it will not meet its goal of producing 150 million shots per month until the fourth quarter, missing its initial third-quarter target.

- U.S. crude oil futures rose nearly 0.6% to settle at $65.28 per barrel.

- Gold futures finished fractionally lower at $1,836.10 an ounce.

- The CBOE Volatility Index (VIX) made another big move higher, gaining 9.5% to 21.53.

- Bitcoin prices recovered 1.5% to $56,706.75. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Stick to Stocks With Core Financial Strength

There's a simple explanation for the recent weakness in tech: froth. At least that's according to David Bahnsen, chief investment officer at The Bahnsen Group.

"When a stock's gain becomes dependent on multiple expansion that is driven by a constant flow of new money, new momentum and new popularity, eventually the game ends," Bahnsen says. "Given the froth in tech stocks, investing in cash-generating companies with strong balance sheets is more important than ever."

Good advice, given that cash can make investments shine for a litany of reasons.

Cash helps growth companies fuel the R&D necessary to keep them among the world’s top innovators. It also can help more established companies pay secure (and steadily rising) dividends over time.

And these battleship balance sheets aren’t too difficult to find – as we’ve compiled and reviewed a full 25 of them for you. If you’re looking for a who’s who of companies with A+ financials, and thus plenty of resources to hurdle whatever obstacles the market throws their way, read on as we highlight 25 blue chips that fit the bill.

Karee Venema was long PLTR as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.