Stock Market Today: Nasdaq Climbs, Dow Slips After J&J Vaccine Stumble

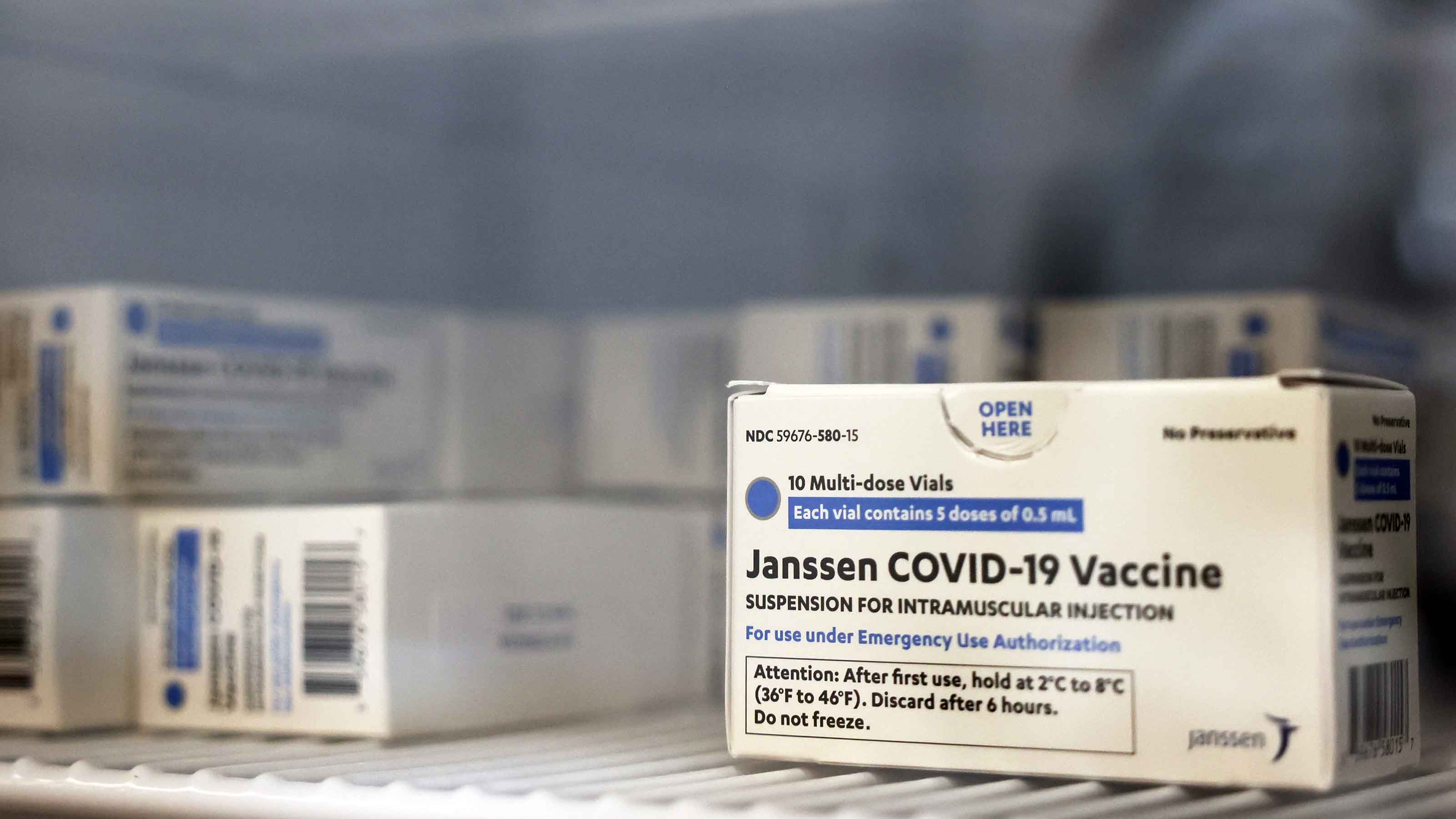

U.S. agencies recommended a pause in use of the Johnson & Johnson COVID vaccine amid rare instances of a blood clotting disorder, rattling the recovery trade Tuesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The "recovery trade" took a breather on Tuesday after a setback on the COVID vaccination front.

Both the U.S. Food and Drug Administration and the Centers for Disease Control and Prevention urged a pause in injections of Johnson & Johnson's (JNJ, -1.3%) single-dose coronavirus vaccine so that the incidence of a blood clotting disorder in six Americans who have received the shot could be studied.

Also Tuesday, the U.S. Bureau of Labor Statistics reported that U.S. consumer prices jumped by 2.6% in March, up from 1.7% in February.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"This morning's U.S. CPI data came in a touch above expectations but were no worse than feared," says Michael Reinking, NYSE senior market strategist. "This, coupled with the potential to push out the vaccination process, has put a bid in Treasury markets."

"That bid strengthened following a strong $24 billion 30-year auction at 1 p.m., with the auction pricing at 2.32% below the 2.338% when issued market. The 10-year yield is down 4.5 (basis points) to 1.63%."

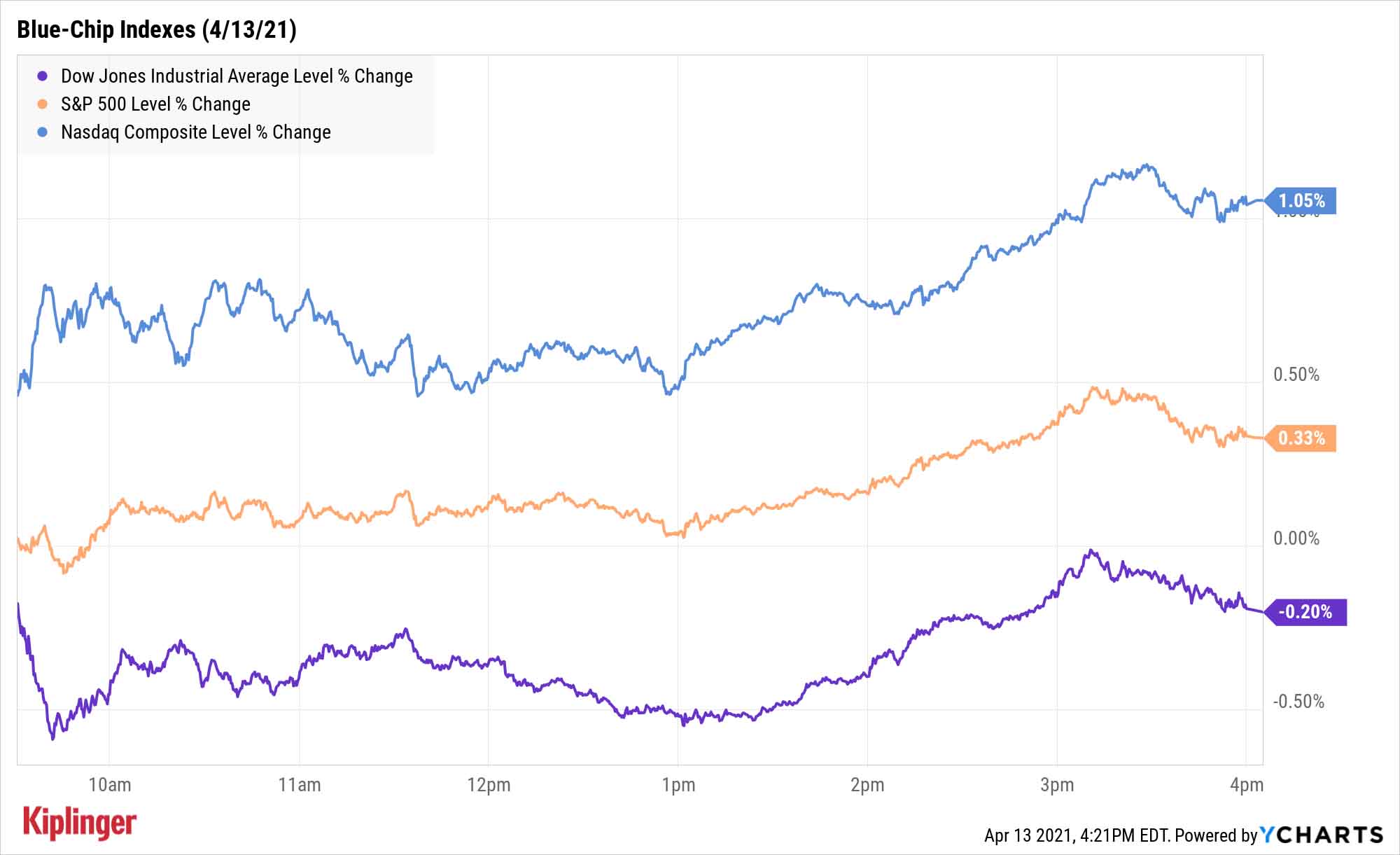

This easing in yields, combined with virus concerns, helped boost technology and tech-adjacent stocks – Nvidia (NVDA, +3.1%), Apple (AAPL, +2.4%) and Tesla (TSLA, +8.6%) contributed to a 1.1% gain in the Nasdaq Composite, to 13,996 – as well as utility stocks (+1.2%), which led all sectors Tuesday.

The S&P 500 gained 0.3% to set a new record close at 4,141, and the Dow Jones Industrial Average finished slightly lower, off 0.2% to 33,677.

Other action in the stock market today:

- The small-cap Russell 2000 slipped 0.2% to 2,228.

- U.S. crude oil futures improved by 0.6%, settling at $59.70 per barrel.

- Gold futures declined 0.9% to $1,747.60 per ounce.

- The CBOE Volatility Index (VIX) declined 1.5% to 16.65.

- Bitcoin prices hit an all-time high of $63,707 ahead of the Coinbase direct listing Wednesday. Bitcoin cooled to $63,023 by the afternoon, but that still represented a 4.9% improvement on Monday's price. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Attack of the SPACs

One of Tuesday's biggest market headlines centered on a company located 9,000 miles away – but it also continues a growing story here at home.

Grab Holdings, a multinational ride-hailing, food-delivery and payments-solutions technology firm based in Singapore, announced it would go public via a $39.6 billion deal that would see it merge with California-based special purpose acquisition company Altimeter Growth (AGC, +9.9%) – the largest such "SPAC" deal in history.

That extends what has been an explosive 2021 for SPACs – a method of bringing private companies public without them having to go directly through the initial public offering (IPO) process. After raising $13.6 billion in 2019, SPAC deals generated an incredible $73 billion in 2020 … only to be eclipsed in just the first three months of 2021, when nearly $88 billion was raised.

Investors need to exercise caution, as this newly red-hot corner of the market is garnering increasing scrutiny from regulators. But those looking for a potential growth booster should take a look at our new "SPAC list": a regularly updated list of these acquisition-minded companies that are currently on the hunt for merger targets.

Kyle Woodley was long NVDA as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.