Stock Market Today: Stocks Gain Ground as Dow, S&P 500 Hit New Highs

Traders shrugged off a higher-than-expected reading on inflation to power two of the three major indices to record closes.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks climbed higher today, even as this morning's producer price index (PPI) showed the threat of rising inflation is all too real.

A report from the U.S. Labor Department indicated producer prices rose 1.0% in March, up from 0.5% in February. On a yearly basis, wholesale inflation jumped to 4.2% – its highest reading since September 2011.

"The annual rate of PPI inflation is benefiting from strong base effects given last year's weakness at the onset of the pandemic," says Blerina Uruci, senior U.S. economist at Barclays. "But momentum in monthly increases over the past three months has also been robust, pointing at... upside risks to near-term consumer prices as demand comes back online and supply-chain bottlenecks emerge."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

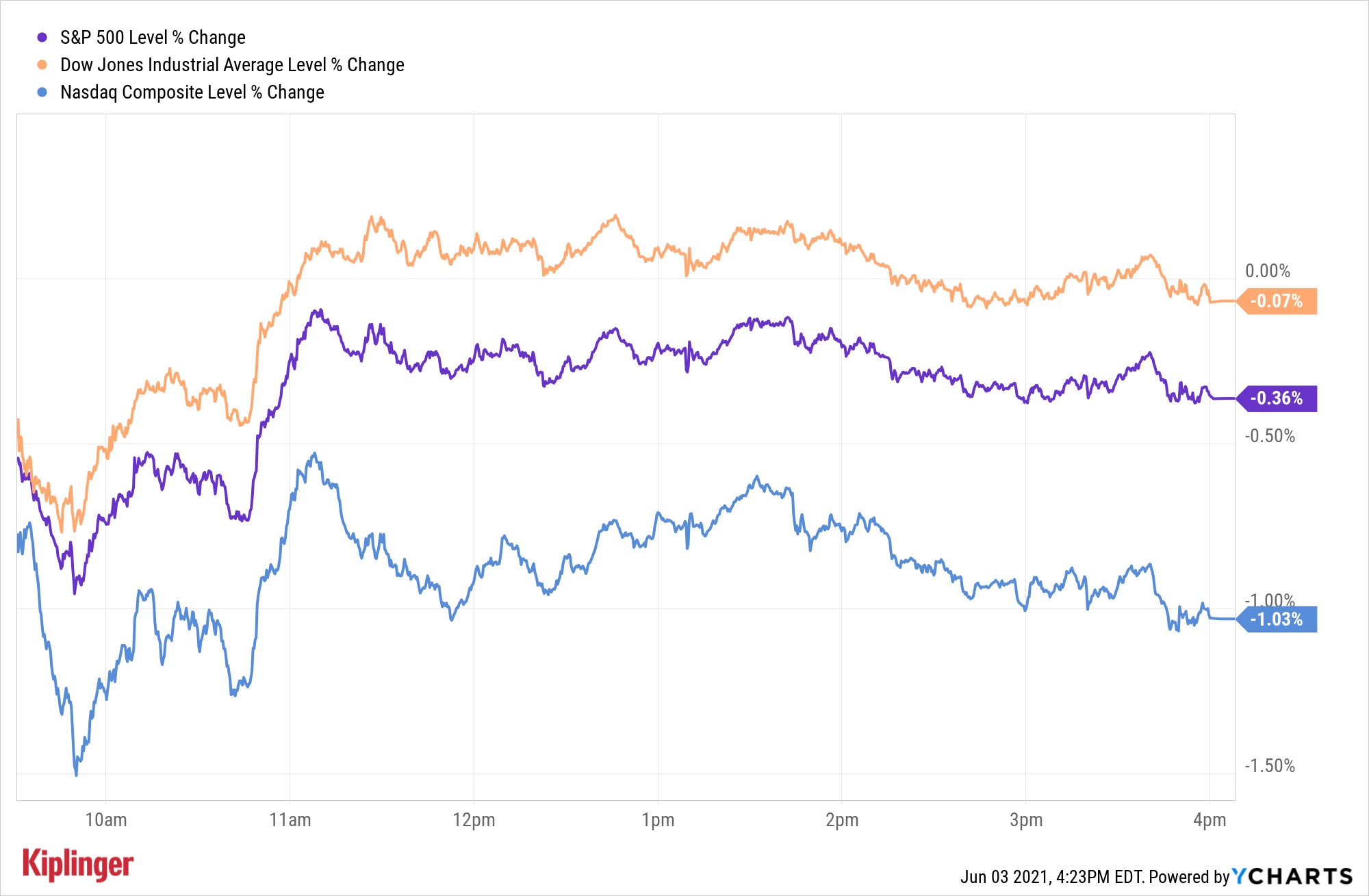

The data didn't shake bulls, though, with the Dow gaining 0.9% to 33,800.60 – a new high – on strength in UnitedHealth (UNH, +3.1%) and Honeywell (HON, +3.2%). The S&P 500 hit a high of its own, adding 0.8% to 4,128.80, while the Nasdaq climbed 0.5% to 13,900.19. All three indices nabbed weekly wins, the third straight for the Dow and S&P.

Other action in the stock market today:

- U.S. crude oil futures fell 28 cents, or 0.5%, to settle at $59.32 per barrel.

- Gold futures gave back $13.40, or 0.8%, to end at $1,744.80 an ounce.

- Amazon.com (AMZN) rose 2.2% to 3,372.20, after employees at its plant in Bessemer, Alabama, voted against unionizing.

- Bitcoin prices tacked on 1.1% to $58,385.80. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

A quiet day for small caps in an otherwise big year

While blue chips spent the entire day in the green, the small-cap Russell 2000 didn't find positive territory until the final minutes of trading, ending fractionally higher at 2,243.47. The index has soundly outperformed its larger-cap counterparts in 2021, up 13.6% year-to-date.

"The U.S. economy is currently trending toward high-single-digit GDP growth in 2021 as COVID-19 vaccine distribution expands and we gradually emerge from the pandemic," says Lule Demmissie, president of Ally Invest. "That environment favors small-cap names, which tend to have a more domestic focus than larger multinational firms."

Here, we call out 7 of analysts' most-loved small-cap stocks that offer compelling valuation and appear poised for impressive growth.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market Today

Nasdaq Takes a Hit as the Tech Trade Falters: Stock Market TodayThe Dow Jones Industrial Average outperformed on strength in cyclical stocks.

-

Dow Hits New High Then Falls 466 Points: Stock Market Today

Dow Hits New High Then Falls 466 Points: Stock Market TodayThe Nasdaq Composite, with a little help from tech's friends, rises to within 300 points of its own new all-time high.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.