Stock Market Today: The 'Reflation Trade' Kicks Back Into High Gear

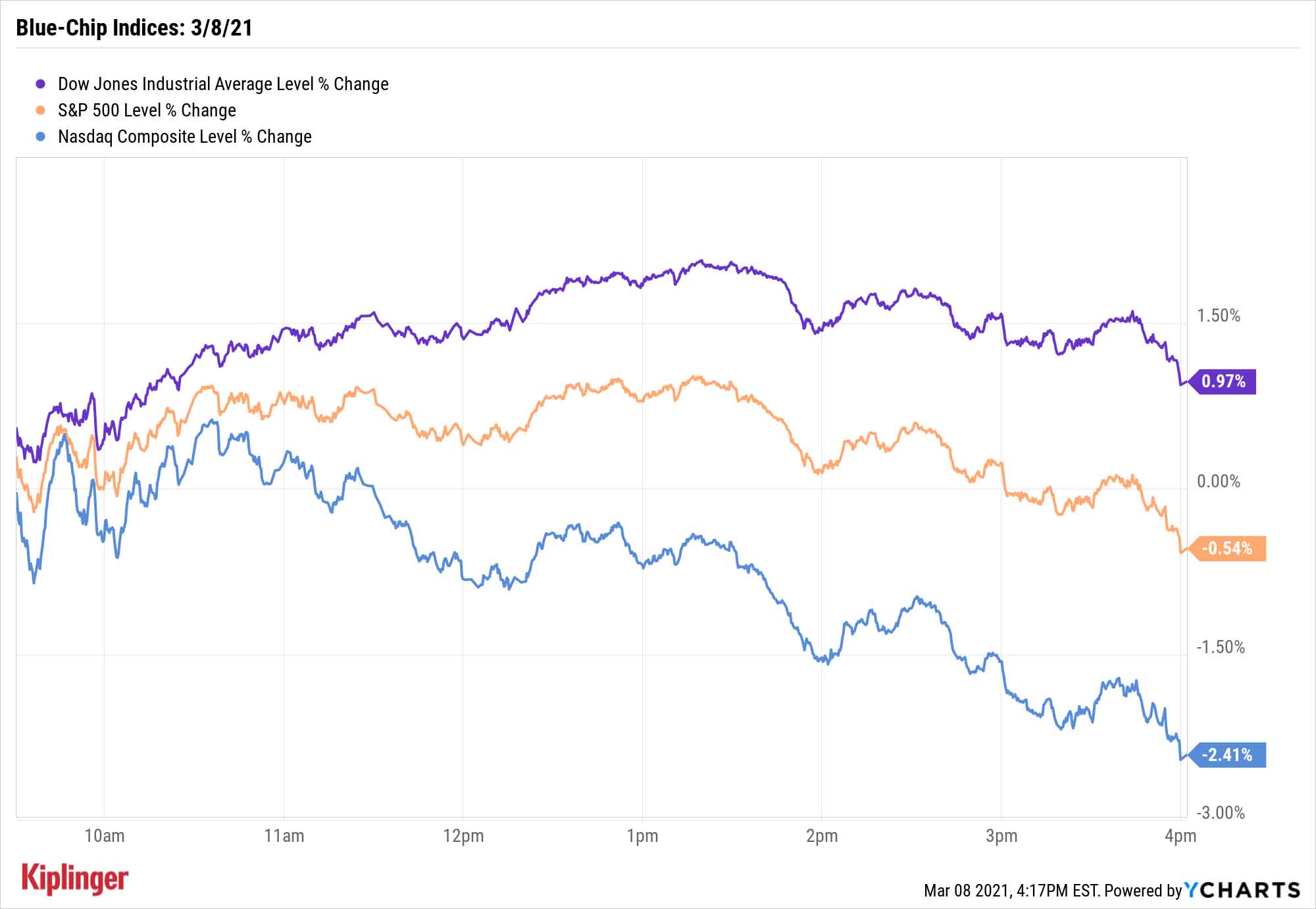

The Dow and Nasdaq grew farther apart on Monday, as the Senate's COVID-stimulus green light sparked another rise in interest rates and another wave of selling in tech.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

One session removed from a wild red-to-green finish for stocks, the market went back into rotation mode Monday, pulling the rug out from underneath the tech sector yet again.

Over the weekend, the Senate passed its version of President Joe Biden's $1.9 trillion stimulus plan, complete with $1,400 stimulus checks (albeit for fewer Americans than the House version). Treasury Secretary Janet Yellen continues to champion the bill, saying it would drive a "very strong economic recovery" that would enable the U.S. to reach "full employment" by 2022.

While she also said she didn't expect the measure to overheat the American economy, bonds continued their recent selloff, prompting the 10-year Treasury's yield to rise above 1.6%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Nasdaq Composite, which clawed out small gains in the morning, finished with a 2.4% decline to 12,609 amid heavy losses for the likes of Apple (AAPL, -4.2%), Tesla (TSLA, -5.8%) and Alphabet (GOOGL, -4.3%). That put the tech-heavy index in correction territory (a decline of 10% or more from a peak) and in the red for 2021.

Meanwhile, the Dow Jones Industrial Average continued its recent spate of outperformance, rising 1.0% to 31,802 on gains from Disney (DIS, +6.3%) and Cisco Systems (CSCO, +2.7%), among others.

Other action in the stock market today:

- The S&P 500 dipped a modest 0.5% to 3,821.

- The small-cap Russell 2000 managed to gain 0.5% to 2,202.

- U.S. crude oil futures receded by 1.6% to close at $65.05 per barrel.

- Gold futures declined yet again, dipping 1.2% to 11-year lows at $1,678.90 per ounce.

- Bitcoin prices improved by 5.3% over the weekend, finishing Monday at $51,800. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

The Reflation Trade

How much longer could this incline in rates continue? John Luke Tyner, fixed income analyst at Aptus Capital Advisors, is among those who believe there's plenty more fuel in the tank.

"Overall we are bullish on the U.S. economy to improve and believe that interest rates (nominal and real) will continue to rise," he says. "The move in rates higher has been global, and the U.S. is one of the only developed countries where yields are still below Covid highs (~1.92%). More stimulus will only help quicken the cause."

That should continue the current rotation into value stocks broadly, and into sectors such as financials and materials specifically – the so-called reflation trade in which a quick bout of inflation "normalizes" interest rates.

Those interested in harnessing this shift have a wealth of options; these seven reflation-trade picks, including both stocks and funds, appear to be juicy opportunities on their own, but also exemplify the areas of the market you should target.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.