Stock Market Today: Dow Jones Cruises to Record Altitude

The Dow set a fresh high in a calm but optimistic session, buoyed by dovish commentary by Fed Chair Jerome Powell.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Dow Jones Industrial Average surged into record territory Wednesday, as more dovish language from the Federal Reserve and good news on the COVID front drove an unambiguously positive tone on Wall Street.

In testimony before Congress, Fed Chair Jerome Powell said the central bank's focus remained on economic recovery, and isn't in a rush to let interest rates rise.

"Any of the market's (we think unjustified) fear of a taper tantrum are not within eyesight," says Rick Rieder, BlackRock's chief investment officer of Global Fixed Income, "as today's communication was clear that it is not time to communicate any change."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also on Wednesday, the Food and Drug Administration said that Johnson & Johnson's (JNJ, +1.3%) COVID-19 vaccine was both safe and effective. So-called "recovery" plays screamed ahead: Royal Caribbean (RCL, +7.3%) hit one-year highs, while energy stocks such as Chevron (CVX, +3.7%) and Exxon Mobil (XOM, +3.0%) continued to rally.

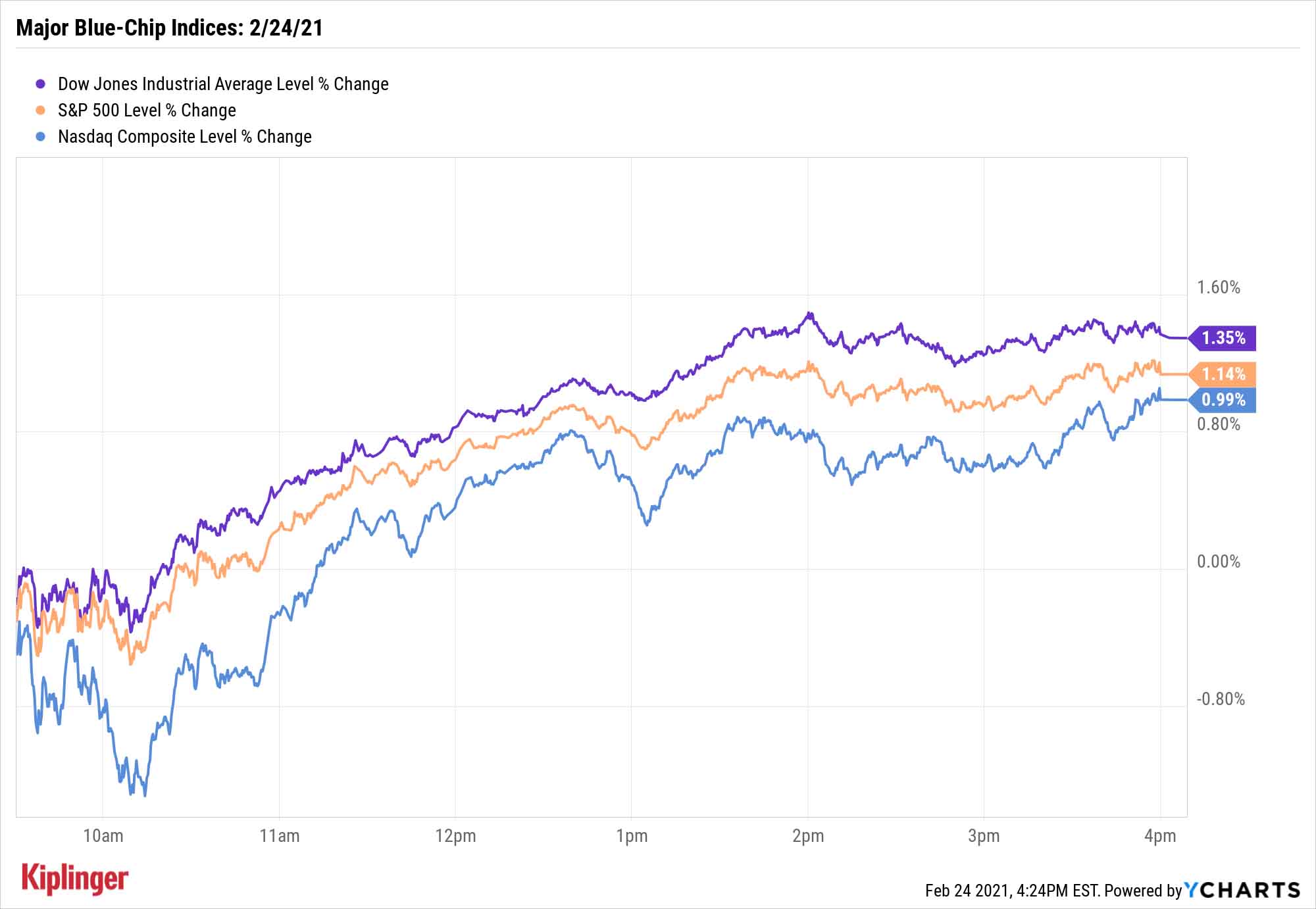

The Dow, up 1.4% to a new high of 31,961, was led by Boeing (BA, +8.1%), which rebounded amid reports that recent issues with its 777 models involved Pratt & Whitney engines, not Boeing engineering. The aircraft maker also forecast strong Latin American demand.

Other action in the stock market today:

- The S&P 500 improved by 1.1% to 3,925, putting it within mere points of its all-time highs.

- The Nasdaq Composite closed 1.0% higher to 13,597.

- The small-cap Russell 2000 rebounded violently, jumping 2.4% to 2,284.

- GameStop (GME, +103.9%) shares were briefly halted after more than doubling by late afternoon in a quick surge on seemingly no news.

- Tesla (TSLA, +6.2%) shares rebounded from yesterday’s selloff, in part on data showing Ark Invest CEO and portfolio manager Cathie Wood’s funds bought more shares on the dip.

- U.S. crude oil futures rocketed 2.6% higher to $63.26 per barrel, a 13-week high.

- Gold futures dipped 0.4% to $1,797.90 per ounce.

- Bitcoin prices, at $47,140 on Tuesday, finished 3.3% higher to $48,712. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Sit Back and Relax With the Pros

For many stock investors, Wednesday was a "mental health" day of sorts – no massive swings, just a nice, gentle updraft throughout the day.

It's the kind of calm more routinely enjoyed by investors who primarily "set it and forget it" with a portfolio of diversified funds.

That feeling is all the more enhanced when you're relying on skilled, seasoned managers to make the tough decisions – a trait shared by a pair of T. Rowe Price mutual funds (one equity, one bond) that have earned independent research firm CFRA's top five-star ratings. (Note: If you're a 401(k) investor, it's possible that your plan doesn't offer these options; that's OK, we've got your back with these widely available T. Rowe products.)

But whether it's T. Rowe Price, Vanguard, or even smaller, more specialized shops, adept active management can help you invest confidently and with a cooler head, regardless of the market's ups and downs. If you're curious about the best such funds the market has to offer, check out our latest iteration of the Kiplinger 25 – a list of our favorite low-cost, actively managed mutual funds.

Kyle Woodley was long BA and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Dow Loses 821 Points to Open Nvidia Week: Stock Market Today

Dow Loses 821 Points to Open Nvidia Week: Stock Market TodayU.S. stock market indexes reflect global uncertainty about artificial intelligence and Trump administration trade policy.

-

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market Today

Stocks Shrug Off Tariff Ruling, Weak GDP: Stock Market TodayMarket participants had plenty of news to sift through on Friday, including updates on inflation and economic growth and a key court ruling.