Stock Market Today: Market Rebounds, But Many Retail Investors Are Roiled

Trading restrictions applied by Robinhood and other investing platforms sent recent momentum stocks cratering Thursday, but the major indices still made progress.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The market's blue chips largely bounced back, with gusto, on Thursday, but a number of smaller stocks recently thrust into the spotlight by massive short squeezes took a different turn.

The latest twist in the ongoing saga of GameStop (GME, -44.3%) and other stocks pumped higher by a Reddit community: Robinhood and other stock-trading platforms moved to restrict trading on these shares, prompting them to sharply sell off. This sparked backlash not just in the investing community, but even on both sides of the aisle in Washington – Democratic Rep. Alexandria Ocasio-Cortez and Republican Sen. Ted Cruz were among those demanding a fix to, and answers for, the sudden shutdown on retail traders.

GameStop wasn't the only one of these stocks to suffer. AMC Entertainment (AMC, -56.6%), Nokia (NOK, -28.4%), Bed Bath & Beyond (BBBY, -36.4%) and BlackBerry (BB, -41.6%) were among other recent momentum stocks that crashed amid these restrictions.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Manias like this usually end in tears," says Dan Kern, Chief Investment Officer of TFC Financial in Boston, a $1.2B AUM investment management and financial planning firm. "I'm reminded of some of the things I saw in 1999 – people (including business school classmates) telling me they were making more money day trading than from their jobs. By 2001, very few of them were still day-trading."

The broader indices, however, were back to business as usual – climbing higher on news of lower weekly unemployment filings, as well as record revenues from Microsoft (MSFT, +2.6%) with surging cloud and gaming sales.

Not all blue chips were so lucky. Tesla (TSLA, -3.3%) fell on an earnings miss, Facebook (FB, -2.6%) beat expectations but warned of uncertainty, in part due to privacy changes from Apple (AAPL, -3.5%), which also declined despite a profit beat.

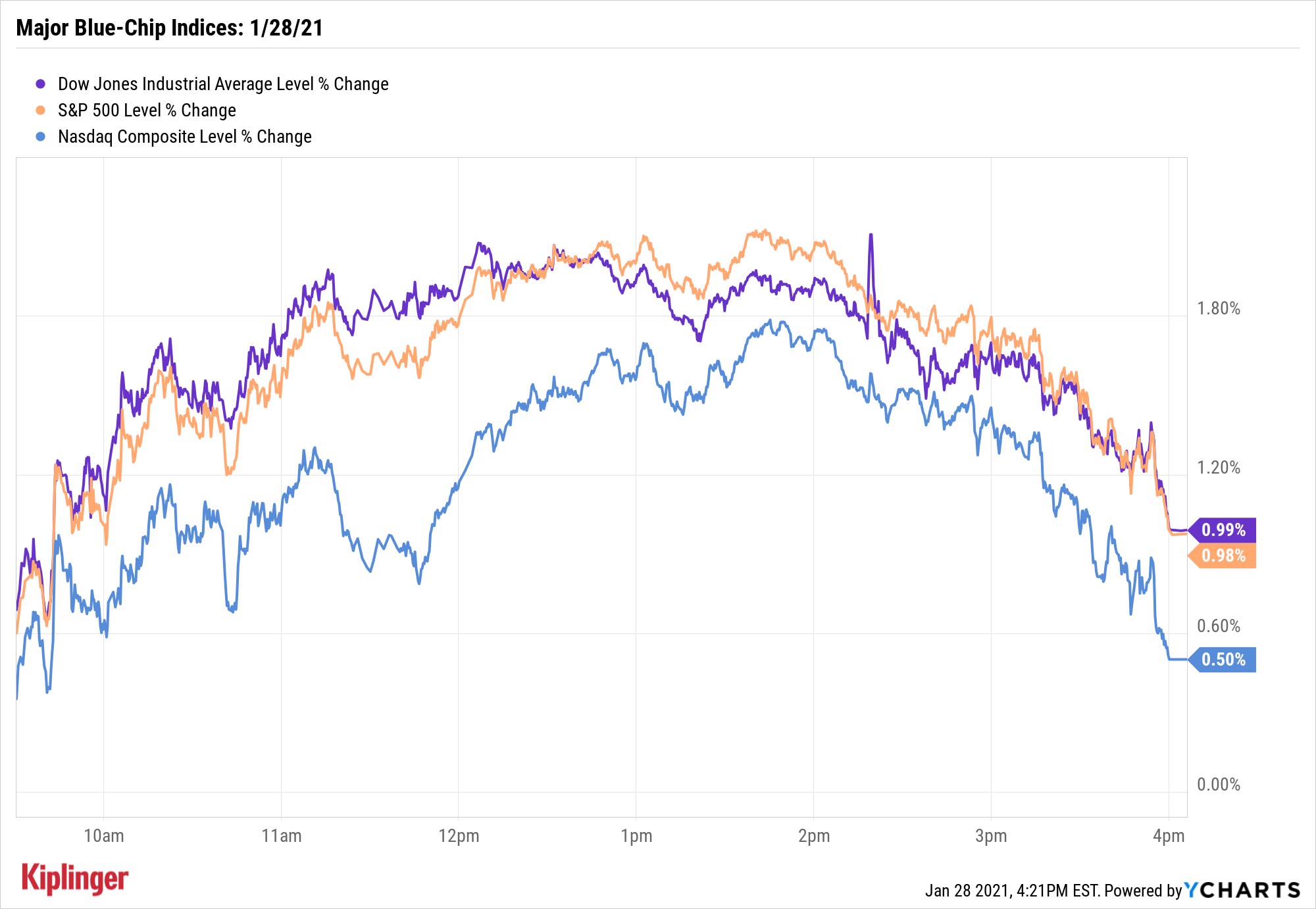

Nonetheless, the Dow Jones Industrial Average gained 1.0% to 30,603; the S&P 500 was up similarly to 3,787.

Other action in the stock market today:

- The Nasdaq Composite gained 0.5% to 13,337.

- The Russell 2000 slipped 0.1% to 2,106.

- Gold futures continued their streak of declines, falling 0.4% to 1,837.90 per ounce.

- U.S. crude oil futures slid 0.5% to $52.57 per barrel.

- Bitcoin prices, at $31,629 on Wednesday, enjoyed a 3.1% bounce-back to $32,608. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

Disaster Averted?

That "whoosh" you just heard was likely the collective sigh of relief from investors fearing a broader market-bubble burst after yesterday's 634-point drop in the Dow.

That said, while plenty of experts are anticipating some sort of dip or even a correction as the market digests the rally of the past few months, few are fearing a bigger pop.

"Some of my more bearish colleagues in the industry see what's happening with GameStop and AMC as signs that an investment apocalypse is coming and that we're headed to another dot-com bust," Kern says. "I disagree but understand the concern."

"Current valuations, while high, are not necessarily unsustainable and not driven solely by investor sentiment," says Brad McMillan, chief investment officer for Commonwealth Financial Network. Still, he warns, "Does this mean we won't see a market decline? Of course not. Even in the absence of a bubble, markets can drop significantly, as we have seen multiple times in the past decade. Bubble or not, we can certainly expect more volatility, because whatever happens with interest rates or sentiment, that is one thing that will not change about markets."

There are various ways to keep sailing smoothly through rough waters, of course, not least of which is a steady drumbeat of dividend payments. Dependable income stocks such as these 25 names, or rarer monthly dividend payers, are a couple of ways to fill that need.

But you could also consider the high-yield diversification of closed-end funds. You can learn more about CEFs here, but, in short, their unique construction provides them with certain advantages compared to their larger mutual-fund and ETF brethren. Read on as we examine 10 of the best such CEFs for the year ahead.

Kyle Woodley was long MSFT, NOK and Bitcoin as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.