Pick up Some Values in Small-Cap Stocks

If you seek value among sectors that are out of favor, you may find it hard to resist small-cap stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Whatever happened to small-cap stocks? The argument for smaller companies used to be simple: Their shares are riskier, on average, than shares of larger companies, but they return more to investors. So, more risk, more reward. That’s a rock-solid principle of investing (and of life, for that matter). Though small-cap stocks may be too volatile for some investors, a small injection of small caps can give a portfolio a nice boost.

One advantage of a stock with a small market capitalization (defined as price times shares outstanding) is that, being small, it may elude the attention of analysts and most investors. Such a stock can be an overlooked bargain. Another plus is that, with a small cap, you have a chance to make gigantic returns on your original investment. If you had bought Netflix (symbol, NFLX) in 2008, when it was a small-cap stock trading at about $4 a share, and you had held it until today, you would have increased your initial investment by a factor of more than 100. If you buy Netflix today, as a mega-cap stock trading at $495 per share, that kind of return is unimaginable—its market cap would exceed the current gross domestic product of the U.S.

(By the way, there is no official definition of a small-cap stock. Some experts put the market-cap limit at $2 billion, but the largest firms in popular small-stock benchmarks have market values of $4 billion to $5 billion.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Large-cap dominance. Despite their benefits, over the past five years, the annual average return of small caps has been roughly half the return of large caps. Large-cap stocks have beaten small caps in five of the past six full calendar years since 2014—and so far in 2020, it has been a massacre. Through August 7, SPDR S&P 500 (SPY), the popular exchange-traded fund linked to the S&P 500 large-cap index, returned 5.0%. But SPDR S&P 600 (SLY), the small-cap ETF, declined 9.8%. (The small-cap ETF is also one-third riskier, according to Morningstar data.)

Investors, naturally, are turned off. The S&P 500 ETF, nicknamed Spider, has $297 billion in assets; the S&P 600 ETF, which ought to be nicknamed Slider, holds $1 billion.

But if, like me, you still seek value among sectors that are out of favor, you may find it hard to resist small caps right now. After all, history shows that small caps are cyclical in their relationship with large caps. One category prevails for a while, then the other one takes over.

Small caps beat large caps in 1979–82 and 1999–2001, but large caps ruled from 1983–90, 2006–08 and, of course, over the past six calendar years.

Why have small caps suffered so much lately? One theory is that investors have driven down their relative prices by favoring index funds geared to the “market,” which typically means the S&P 500, representing about four-fifths of the value of all listed U.S. companies. Another explanation is that a small group of mega-cap stocks, including Apple and Amazon.com, have sucked up so much investing oxygen that small caps were left gasping for breath. A third explanation: To compete in today’s globalized economy, you need to be big. Small companies are simply at a disadvantage. They can, of course, become big, but when that happens (as with Netflix), they’re no longer small caps.

Whatever the reason, the current turn in the cycle has thrown into doubt the entire justification for small-cap investing. From its founding in 1979 through 2019, the Russell 2000, probably the most popular small-cap index, has returned an annual average of 11.4%. But the large-cap Russell 1000 has returned 12%. The small-cap index’s standard deviation (a measure of risk) was 29% greater than that of the large-cap index. So far in 2020, the performance and risk gaps between the Russell 1000 and 2000 have widened.

Find the stock pickers. Low return, high risk—it’s hardly a recipe for success. Even as a value hunter, I have soured on small caps as a category. I have no interest in small-cap index funds. But many individual small-cap stocks are hidden gems. They’re not easy for individual investors to analyze, but a solution is to buy actively managed small-cap funds with records of successful stock picking.

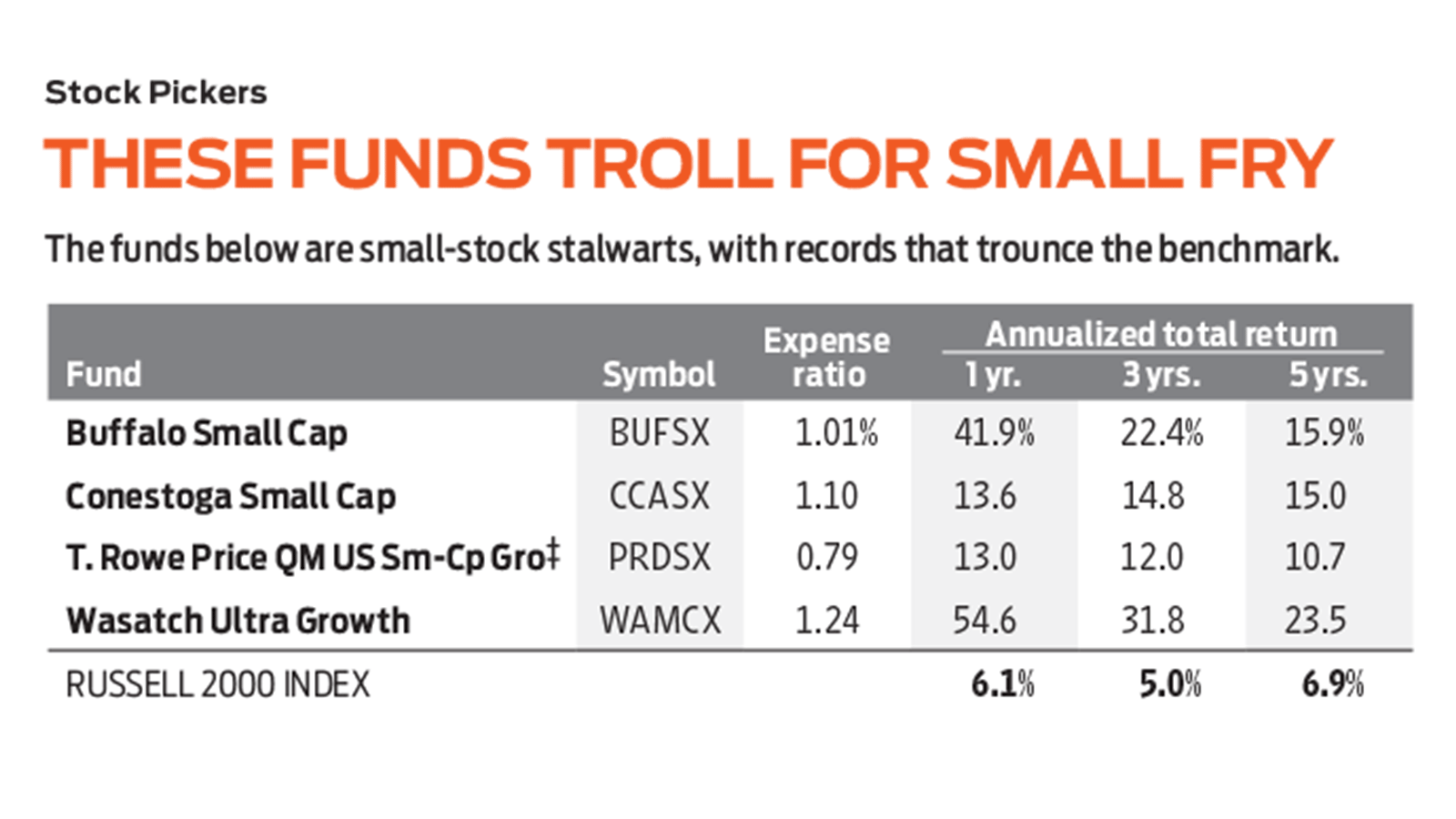

Here, too, there are drawbacks. These funds tend to have high fees, and some of the best of them are often closed to new investors. Currently, among funds open to the public, I especially like Wasatch Ultra Growth (symbol WAMCX), with a lofty expense ratio of 1.24%. But, in this case, you get what you pay for. The fund has an average annual return of 23.5% over the past five years. That compares with 6.9% for the SPDR S&P 600 ETF and the iShares Russell 2000 ETF, and 12.2% for the SPDR S&P 500 ETF. (Stocks and funds I like are in bold; prices and returns are as of August 7.)

The fund owns 80 stocks with a median market cap of $1.8 billion, and it has a relatively low turnover rate. Among the top holdings are Silk Road Medical (SILK, $50), which makes devices to treat carotid artery disease; Paylocity Holding (PCTY, $133), a cloud-based payroll software provider; and Freshpet (FRPT, $102), which sells fresh food for dogs and cats. Freshpet shares have tripled over the past two years. The fund first bought Trex (TREX, $139), maker of wood and plastic products for decks and railings, in 2012, and the share price has since risen 20-fold.

Buffalo Small Cap (BUFSX), comanaged by Robert Male for the past 22 years, has a five-year average annual return of 15.9%. It had a spectacular year in 2019 and has returned 27.2% so far in 2020, more than 30 percentage points ahead of the small-cap indexes. The fund is heavily invested in health care stocks, including CareDx (CDNA, $33), with a $1.6 billion market cap. CareDx makes medical products that improve the lives of transplant recipients.

Another fund led by a long-term manager, Conestoga Small Cap (CCASX), has scored an annual average return of 15.0% over the past five years by concentrating on industrial stocks such as Mercury Systems (MRCY, $79), which makes aerospace and defense components, and Fox Factory Holding (FOXF, $108), which makes suspensions for bicycles, snowmobiles and motorcycles.

T. Rowe Price QM U.S. Small-Cap Growth Equity (PRDSX), a member of the Kiplinger 25 list of favored no-load funds, is a good choice. Note that new investors must buy shares directly from the fund company. The fund’s top 10 holdings include Primerica (PRI, $131), a Georgia-based company offering insurance, savings and legal services to middle-income clients.

And keep a close eye on these superb small-cap funds that are currently closed to new investors: Brown Capital Management Small Company (BCSIX) and Virtus KAR Small-Cap Growth (PSGAX). If small caps take a short-term hit, and assets decline, the funds will likely open up.

Even if you can’t invest in those funds now, you can mine their portfolios for ideas. The Brown Capital portfolio is skewed toward technology companies. Since 2008, the fund has owned Pros Holdings (PRO, $36), a company with a $1.6 billion market cap that uses artificial intelligence to help businesses such as airlines with complex pricing decisions. The Virtus fund’s portfolio includes Grocery Outlet Holdings (GO, $45), a supermarket chain that calls itself “America’s largest extreme value retailer,” with a market cap of $4 billion. It went public in June 2019 and its price has since risen by more than one-third.

Small caps as a sector may have lost their luster, but little companies can still thrive. If you’re not sure where to begin looking yourself, mutual fund managers, charging about a percentage point for their services, can dig them up for you.

James K. Glassman chairs Glassman Advisory, a public-affairs consulting firm. He does not write about his clients. He owns none of the securities mentioned in this column. His most recent book is Safety Net: The Strategy for De-Risking Your Investments In a Time of Turbulence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.

-

An Urgent Need for Cybersecurity Stocks

An Urgent Need for Cybersecurity Stocksstocks Many cybersecurity stocks are still unprofitable, but what they're selling is an absolute necessity going forward.

-

Why Bonds Belong in Your Portfolio

Why Bonds Belong in Your Portfoliobonds Intermediate rates will probably rise another two or three points in the next few years, making bond yields more attractive.

-

140 Companies That Have Pulled Out of Russia

140 Companies That Have Pulled Out of Russiastocks The list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

-

How to Win With Game Stocks

How to Win With Game Stocksstocks Game stocks are the backbone of the metaverse, the "next big thing" in consumer technology.