Should You Still Have Bonds in Your Portfolio?

It’s easy to wonder if how we invest in bonds should change after the past few years. And if you’re taking a long-term view of investing, what should you do?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

As bonds have struggled, producing losses in client accounts over the past couple of years, we have had more clients ask the question: Should bonds still have a role in the portfolio?

Traditionally, the answer has been that bonds provide diversification and income. They zig when stocks zag, providing income for spending needs. In finance terms, bonds have “low correlation” levels to stocks, and adding them to a portfolio would help to reduce the overall portfolio risk. However, over the last two years, as the Fed has worked to aggressively raise rates, this correlation has increased. What we saw in 2022 was the bonds fell right along with (and nearly as much as) stocks.

Compound that with the current state of interest rates. One of the most basic investing truisms is you should pursue investments offering a higher interest rate over investments with lower interest rates for the same level of risk. It just makes sense — of course you would want to earn more interest. Another concept involves how soon you get your investment back (liquidity). All else equal, you would want to make shorter-term loans where you would get your principal back sooner rather than later. The only way that you would be willing to lend your money for longer is if you received more interest to do so.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

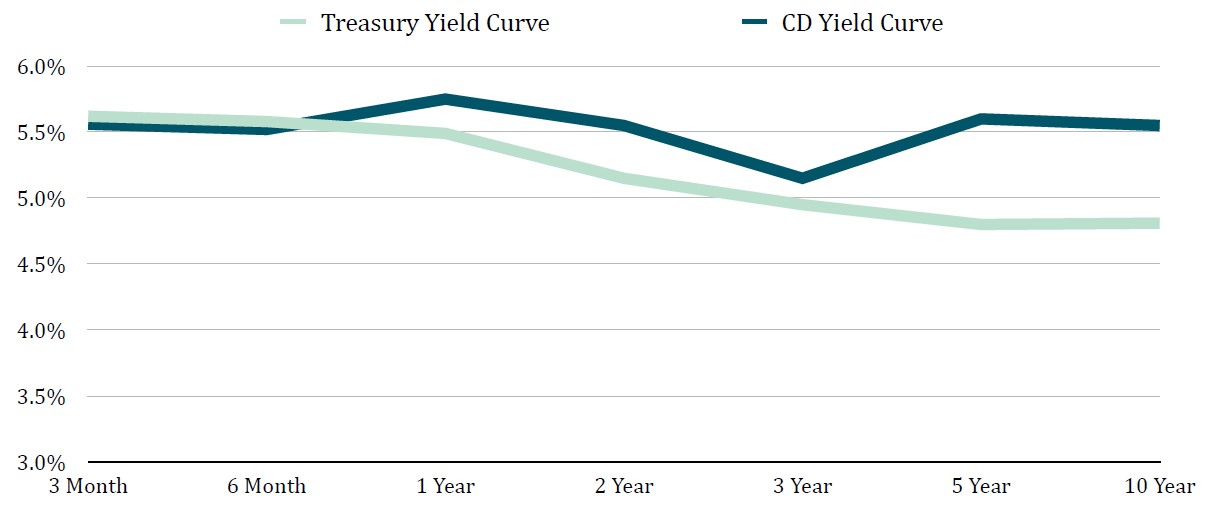

However, in today’s interest rate environment, investors are earning more on short-term bonds than long-term bonds, as you can see in the chart below. And investors are earning even more on federally insured certificates of deposit (CDs). As the chart below shows, one-year CDs currently pay 5.8% compared to only 4.8% for a 10-year Treasury bond.

Given all this, it seems like a no-brainer to invest in the short-term options and receive the higher interest rates and better liquidity that come with them. If bonds aren’t fully dead, why not at least eliminate the default risk of lending to companies and invest only in short-term CDs and Treasury securities? At first glance, this strategy seems brilliant and, frankly, “too good to be true.” And, of course, that is the case. This is where having a long-term investment approach comes in.

What happens a year from now?

To illustrate the point, let’s think about the longer term. What happens 12 months from now when the one-year CD matures? At that point, investors must look to reinvest the proceeds they receive. Most market pundits expect that the previously mentioned aggressive increase in interest rates by the Fed will at minimum slow the economy dramatically, if not push the U.S. economy into a recession.

If that happens, overall interest rates will fall as the Fed looks to reduce interest rates to stimulate economic growth. That makes it highly likely that investors won’t earn the current 5.8% rate if they reinvest their CDs next year.

For those who invested in a two-year CD and accepted the lower 5.1% rate, they don’t have this concern, known as reinvestment risk, for an extra year. The longer term of the current investment, the further investors can push out the concern over reinvestment risk.

When long-term bond prices will rise

Additionally, just as longer-term bonds fell when interest rates went up, the prices of long-term bonds will rise when interest rates go down. That is because investors looking to reinvest the proceeds from their maturing CDs are willing to pay extra for long-term higher rates, which are no longer available in the marketplace.

The result is that bonds in general, and long-term bonds in particular, tend to do very well after the Fed stops raising rates (the Fed left rates unchanged at its latest meeting, in December). A study by Capital Group that looked at how bonds performed after past Fed rate-hiking cycles provides room for optimism — that maintaining a bond position in your portfolio may once again provide positive returns, income and diversification benefits.

According to that study, bonds have provided returns of over 10% in the 12 months following the end of the rate-hiking cycle and have compounded at 7.1% over the next five years, well above the long-term average of 4.8%.

Bonds still play a critical role in portfolios

We still believe that bonds play a critical role in client portfolios and that beginning to shift to longer-term bonds could benefit investors over the long-term, given today’s higher interest rates. It is easy to take a short one- to two-year timeframe and wonder if the world has changed, but successful investing requires a long-term focus of seven to 10 years, incorporating full market cycles.

When you’re working with a financial adviser, they will be there to help you keep that focus and to best position your portfolio to generate the long-term returns necessary to achieve your financial plan. Bonds continue to play an important role in that goal.

Related Content

- 10 Things You Should Know About Bonds

- Should You Buy Bonds Now? What to Consider

- Bond Basics: How to Buy and Sell

- What's the Deal With Bonds Right Now?

- Bond Basics: What the Ratings Mean

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Stacy is a nationally recognized financial expert and the President and CEO of Francis Financial Inc., which she founded over 20 years ago. She is a Certified Financial Planner® (CFP®), Certified Divorce Financial Analyst® (CDFA®), as well as a Certified Estate and Trust Specialist (CES™), who provides advice to women going through transitions, such as divorce, widowhood and sudden wealth. She is also the founder of Savvy Ladies™, a nonprofit that has provided free personal finance education and resources to over 25,000 women.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.