Go Worldwide With T. Rowe Price Global Allocation

This one-stop fund provides instant diversification.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

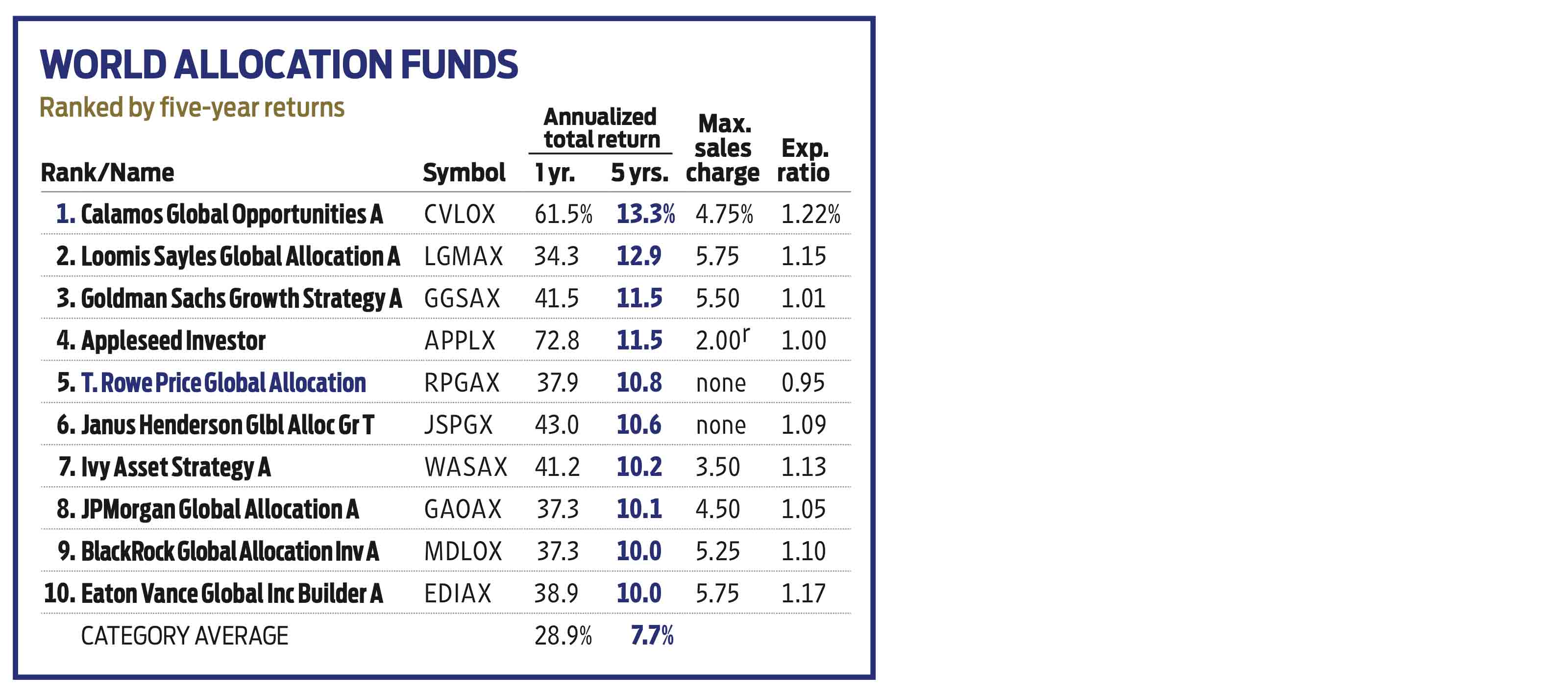

Building a diversified portfolio is a snap with a world allocation fund. These funds, including T. Rowe Price Global Allocation (RPGAX), invest in a mix of stocks and bonds across the globe.

"We view the fund as a core holding," says Charles Shriver, one of the fund's two managers. "It's a one-stop shop."

Shriver and his co-manager, Toby Thompson, make the big-picture calls of how to position the portfolio. They start with a target of 60% U.S. and foreign stocks, 29% U.S. and foreign bonds, and 11% alternative investments, then tilt the fund toward certain asset classes – large- versus small-company stocks, say, or growth versus value, or emerging-markets versus developed-world stocks or bonds – depending on their view of the world.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The managers leave the bond and stock selection to the firm's specialists and a deep bench of research analysts. Alphabet (GOOGL), Amazon.com (AMZN) and Microsoft (MSFT) are the fund’s biggest stock holdings; short- and long-term Treasuries are its biggest bond positions. For small stakes in certain asset classes, Shriver and Thompson may invest in another fund. "In floating-rate loans, for example, a fund offers instant, broad diversification and liquidity," says Shriver.

The system has worked well. Over the past five years, the fund has returned 10.8% annualized, which beat 93% of world allocation funds. In every full calendar year since its launch in mid-2013, the fund's returns have ranked among the top third or better of its peers.

The fund's alternatives segment consists of a hedge fund of funds run by asset management firm Blackstone (7% of assets at the end of 2020) and a stake in T. Rowe Price Dynamic Global Bond fund (4% of assets), which has a flexible investment mandate. The bond fund is a low-volatility diversifier, says Shriver. "In a rising-rate environment, traditional bonds may not be as defensive as they have been historically."

For now, Shriver says the fund has a "modest underweight" position in stocks – 54% of assets – with 33% in bonds and the rest in alternatives and cash. The managers have balanced that with floating-rate loans, which will benefit from rising rates, and short-term inflation-protected securities as a hedge against inflation.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Why I Trust These Trillion-Dollar Stocks

Why I Trust These Trillion-Dollar StocksThe top-heavy nature of the S&P 500 should make any investor nervous, but there's still plenty to like in these trillion-dollar stocks.

-

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market Today

Stocks Close Out Strong Month With Solid Amazon Earnings: Stock Market TodayAmazon lifted its spending forecast as its artificial intelligence (AI) initiatives create "a massive opportunity."

-

Stocks Sink with Meta, Microsoft: Stock Market Today

Stocks Sink with Meta, Microsoft: Stock Market TodayAlphabet was a bright light among the Magnificent 7 stocks today after the Google parent's quarterly revenue topped $100 billion for the first time.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

Why Microsoft Stock Is Sinking After Earnings

Why Microsoft Stock Is Sinking After EarningsMicrosoft is the worst Dow Jones stock Thursday as the tech giant's soft outlook offsets an earnings beat. Here's what you need to know.

-

Stock Market Today: Stocks Struggle After Meta, Microsoft Earnings

Stock Market Today: Stocks Struggle After Meta, Microsoft EarningsAll three major indexes closed lower on Thursday, making for a grim Halloween.

-

Why Microsoft Is the Worst Dow Jones Stock After Earnings

Why Microsoft Is the Worst Dow Jones Stock After EarningsMicrosoft stock is sinking Thursday even after the tech giant reported higher-than-expected earnings for its fiscal first quarter. Here's what you need to know.