Why Are Gas Prices So High If the U.S. Is Energy Independent?

Unfortunately, energy independence can’t keep U.S. gas prices down, and it isn’t enough to protect your stock portfolio either. Here’s why, and what worried investors should know.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

We’ve all seen the rising cost of oil and its ripple effect through the economy, especially on prices at the pump. You may have also read that the U.S. is energy independent or that we export more oil than we import and that Russian oil only makes up 3% of all U.S. oil imports.

So why are oil and gas prices so high in the U.S.? The national average price for a gallon of regular gasoline was $4.24 as of March 30, up from $2.87 a year ago, according to AAA.

Prices Are Global, Not Local

A fundamental economic concept called the law of one price can help us understand what is going on. In short, this concept explains that even though the U.S. produces more oil than we use domestically, we buy and sell it on the global market. This means that buying pressures and supply shortages in other parts of the world impact the cost here, even if we produce oil here and use it here. In fact, there is money to be made if you can buy oil in the U.S. at a different price. You could buy in the U.S. then sell internationally and profit from the price difference.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

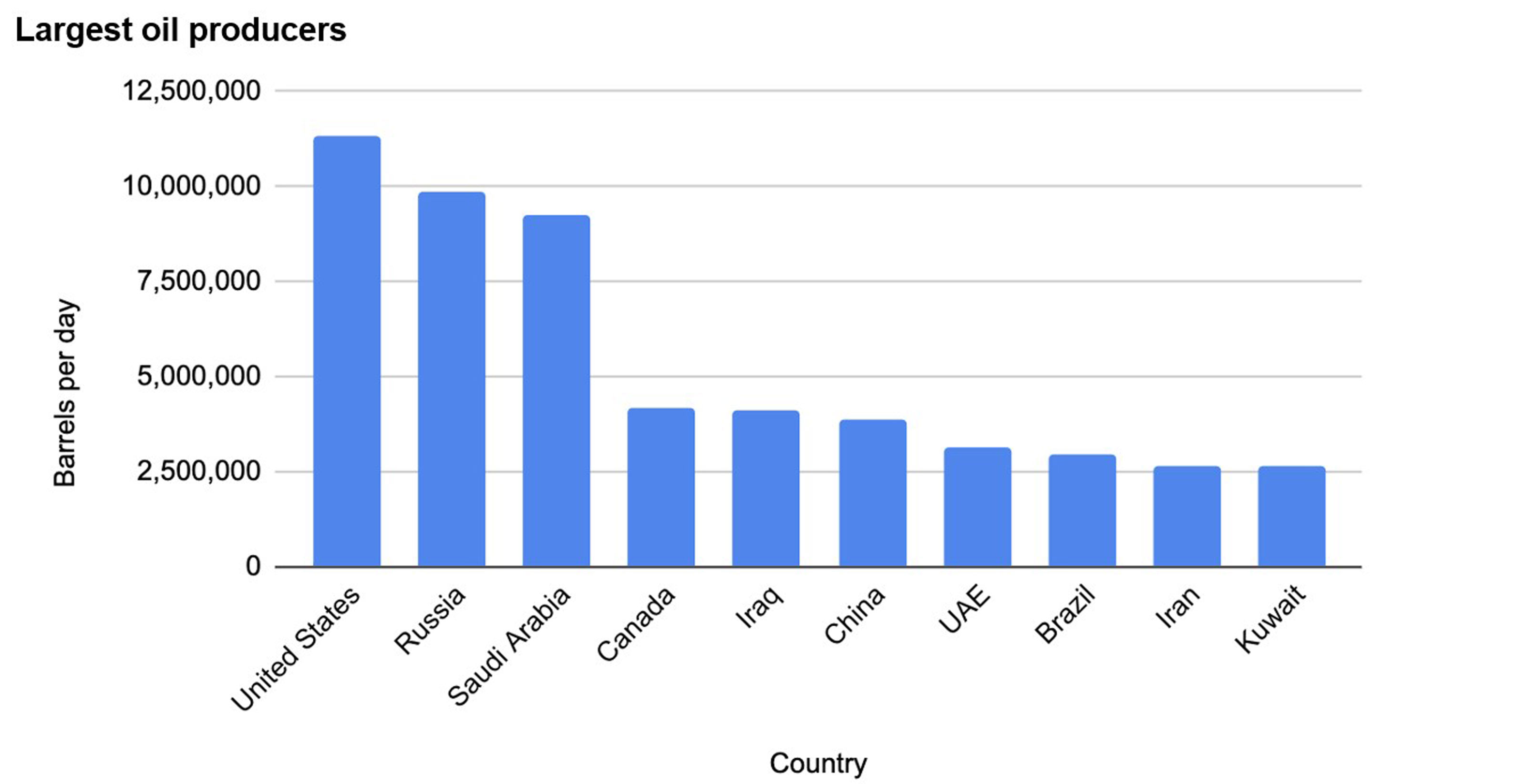

It’s precisely this market force that causes oil — or any other commodity — to trade at one price worldwide. So, even being energy independent, we are still affected by the behavior of the (other) largest oil-producing nations (including Russia, Saudi Arabia, etc.).

Source: U.S. Energy Information Administration

What Does This Mean for Your Portfolio?

Besides the pain at the pump, higher oil prices can erode buying power as input and transportation costs for goods and services rise. Protecting one’s portfolio from inflation can be an imperfect science. Gold, commodities, Treasury inflation-protected securities (TIPS) or even bitcoin all offer some level of peace of mind, but each has its quirks.

While not a direct hedge, investors may also want to consider allocating more dollars to companies involved in renewable energy. Over time, as fuel costs rise, one can expect a greater focus and demand for sustainable energy alternatives.

The implications for sustainable energy go beyond climate impact. Russia’s invasion of Ukraine has cast oil dependence in sharp relief, as oil revenue powers the Kremlin. Less demand for oil can mean less dependence on and funding to Russia, as well as other countries whose practices and policies may not align with investor values.

Natural resources may be randomly distributed around the world, but your investments don't have to be.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Grealish serves as Head of Investments at Altruist, a fintech company on a mission to make great independent financial advice more affordable and accessible. With a career rooted in financial innovation, Adam most recently led Betterment's strategic asset allocation, fund selection, automated portfolio management, and tax strategies. In addition, he served as a vice president at Goldman Sachs, overseeing the structured corporate credit and macro credit trading strategies.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.