Russia’s War on Ukraine: An Economic Explainer for U.S. Investors

Will sanctions against Russia work? How? Will they drastically impact the stock markets and U.S. investors for a long time? Experts weigh in with answers and some global perspectives.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Russia's invasion of Ukraine has roiled global markets. Inflation and the prospect of higher interest rates were already contributing to market volatility. Now, global sanctions and the day-to-day events in Ukraine have made navigating volatile markets even more difficult.

To understand what the war means globally as well as closer to home, it helps to take a broad perspective. The war in Ukraine is resulting in tragic loss of life and human suffering, as well as causing massive damage to Ukraine’s physical infrastructure. It has sent a wave of more than 1 million refugees to neighboring countries looking for housing, food and safety. Amid these ongoing tragic events unfolding in Ukraine, what is happening, and what are potential scenarios and market implications?

Why Sanctions and Not Miliary Action?

The United States, Europe, Canada, Britain, Japan and other countries have responded to the Ukraine invasion by immediately imposing unprecedented sanctions against Russia. Many countries have publicly stated that they do not want a war with Russia, and President Biden has consistently ruled out the deployment of U.S. troops to Ukraine: “Let me say it again: Our forces are not — and will not — be engaged in the conflict with Russia in Ukraine.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

There is a real concern that sending military forces to the region would risk additional escalation with one of the largest nuclear superpowers in the world. Neither the U.S. nor Russia can hope to “win” a nuclear war.

What Are the Goals of the Sanctions Being Imposed?

Throughout the current crisis, the Biden administration's mantra has been "start high and stay high," meaning that the level and impact of the sanctions should be high right from the start. As a result, these are the strongest sanctions ever levied against Russia.

The U.S. and European allies realize that they will not immediately stop the war. According to Andrea Kendall-Taylor, former Deputy National Intelligence Officer for Russia and Eurasia at the National Intelligence Council and a former senior analyst at the CIA, "Sanctions won't act as a deterrent when dealing with someone like Putin, who is so intent on pursuing maximalist objectives that the economic costs don't factor into his calculus to any meaningful degree. The goal of sanctions at this point is to raise the costs of the conflict, to signal to the Russian people that Putin is taking their country in the wrong direction, and, critically, to strangle Russia's ability to partake in destabilizing activities internationally."

There is hope that sanctions will cause enough damage to Russia to destabilize the country, devastate the economy, and reduce the support of a Ukraine invasion among the oligarchs and the ordinary citizens of Russia, ending the war more quickly.

Financial Sanctions

The U.S. and European allies have limited Russia's ability to transact business in foreign currencies such as dollars and euros. These countries have also frozen the assets of multiple Russian banks and those of Russia's central bank, limiting its ability to access $630 billion of its dollar reserves, crippling the Russian government's ability to fund the war.

Russia's banks are also cut off from the SWIFT messaging system. This system is used to transfer money across the world smoothly. Banks can find other ways to send money across borders than using the SWIFT technology, such as secure emails; however, this will be extremely difficult and inefficient.

Western governments have also targeted some of the wealthiest Russians close to the Kremlin. These individuals, including Putin himself, are sanctioned, and their foreign assets are frozen. As a result, wealthy Russians have a much harder time accessing their assets and have lost billions of dollars of net worth in the last week.

Energy Sanctions

Energy represents roughly two-thirds of Russia's exports and 50% of its budget revenues. So, energy sanctions would be a potent factor in crumpling the Russian economy. To date, sanctions on oil and gas have been ruled out by many because of the effect they would have on Europe. The EU currently imports 25% of its oil and 40% of its gas from Russia.

However, Germany has put the operating license on hold for Russia's Nord Stream 2 gas pipeline to begin operations. The Nord Stream 2 is a 764-mile pipeline that runs under the Baltic Sea, taking gas from the Russian coast near St. Petersburg to Lubmin in Germany. This move demonstrates that Germany is willing to possibly abandon this project to further punish Russia, even though it will have negative economic implications for Germans.

On March 8 President Biden signed an executive order banning the import of Russian oil, liquefied natural gas and coal to the United States. This move will deal another economic blow to Putin. In addition, U.S. Secretary of State Antony Blinken recently traveled to Europe for talks with Western allies. They explored the possibility of banning Russian oil imports as well. EU negotiations are continuing, and they are close to an agreement on a plan to phase imports out.

Impact on the Russian Economy

According to Elina Ribakova, deputy chief economist at the Institute of International Finance, "We are looking at a double-digit economic contraction already" in Russia.

So far, the Western-imposed sanctions have had a crippling effect on the Russian economy, with the ruble free-falling more than 30% in one day and the Russian Central Bank responding by drastically increasing interest rates from the current 9.5% to a sky-high 20%. In addition, to high borrowing costs, inflation will further strain the Russian economy and propel it further into a recession.

Impact on U.S. Stock and Bond Markets

The sanctions have inflicted much pain on Russian businesses, as is evident from their collapsing stock prices. While our clients have little to no exposure to Russian stocks, all investors may feel a bite out of their portfolios. The list of businesses announcing partial or full halts to operations in Russia is ballooning, causing fears of lower revenues among their investors. McDonald’s shuttered all 850 locations in Russia and their actions were shortly followed by Starbucks, Coca-Cola and PepsiCo. Apple has halted exports as well. The list of companies boycotting Russia is growing every day, further putting downward pressure of stock market prices.

In addition, there is significant uncertainty in the future, and the stock market hates uncertainty. The increased tension and anxiety caused by the COVID-19 pandemic makes the invasion even more troubling for U.S. stocks. The flight from stocks to safer bonds will continue as investors become more risk-averse and adopt a wait-and-see approach to the market.

We expect increased market volatility over the coming months as the war continues. The choppy markets will continue until investors understand the sanctions' impact on their pocketbooks.

Impact on U.S. GDP and Growth

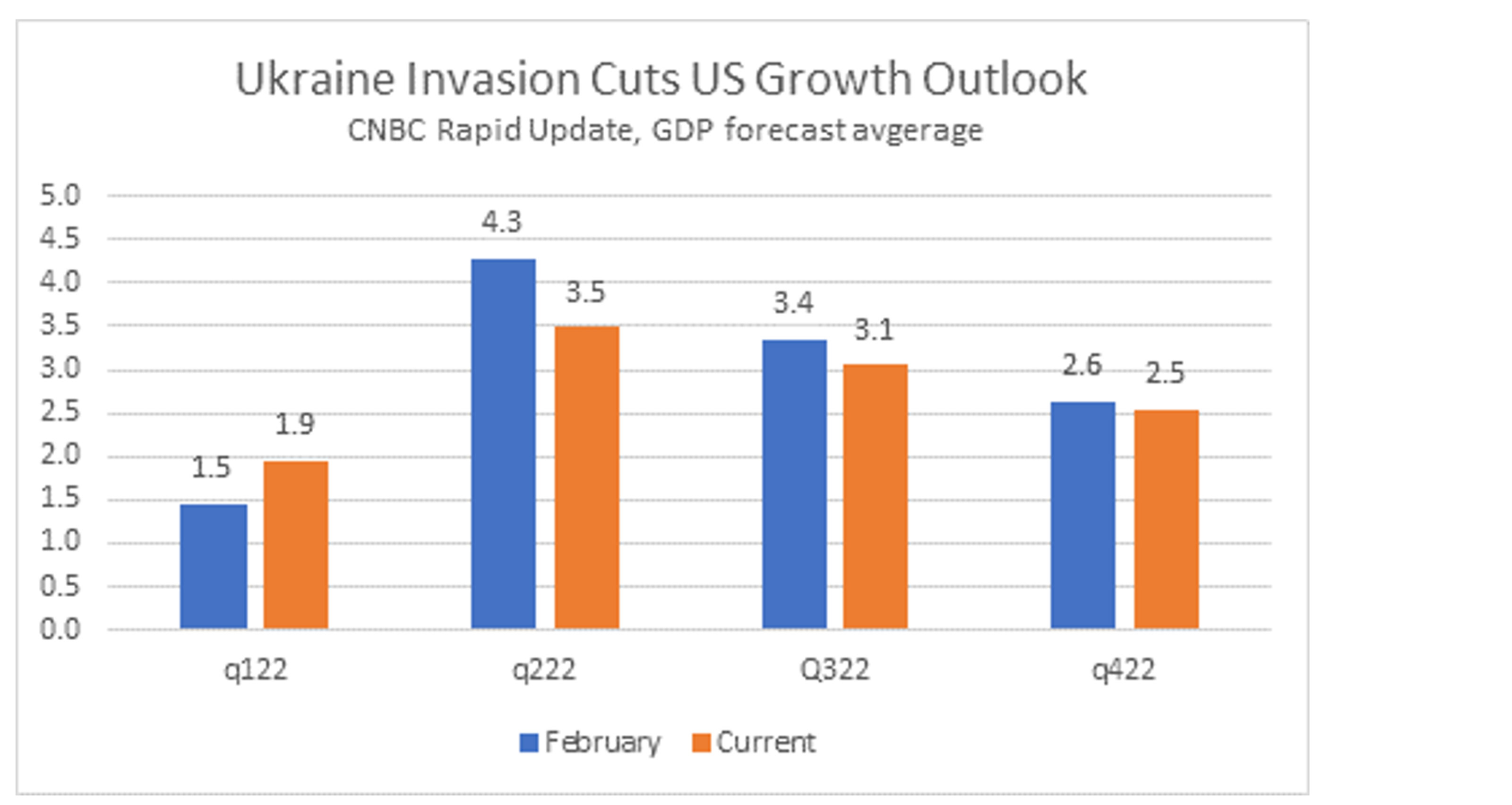

That being said, market analysts still expect strong GPD growth for the U.S. The CNBC Rapid Update, the average of 14 forecasts for the U.S. economy, sees GDP rising by 3.2% this year, which is a very modest 0.3% drop from last month’s forecast in February. The CNBC Rapid Update chart below shows U.S. growth accelerating to 3.5% in the second quarter from 1.9% in the first.

Impact on U.S. Inflation

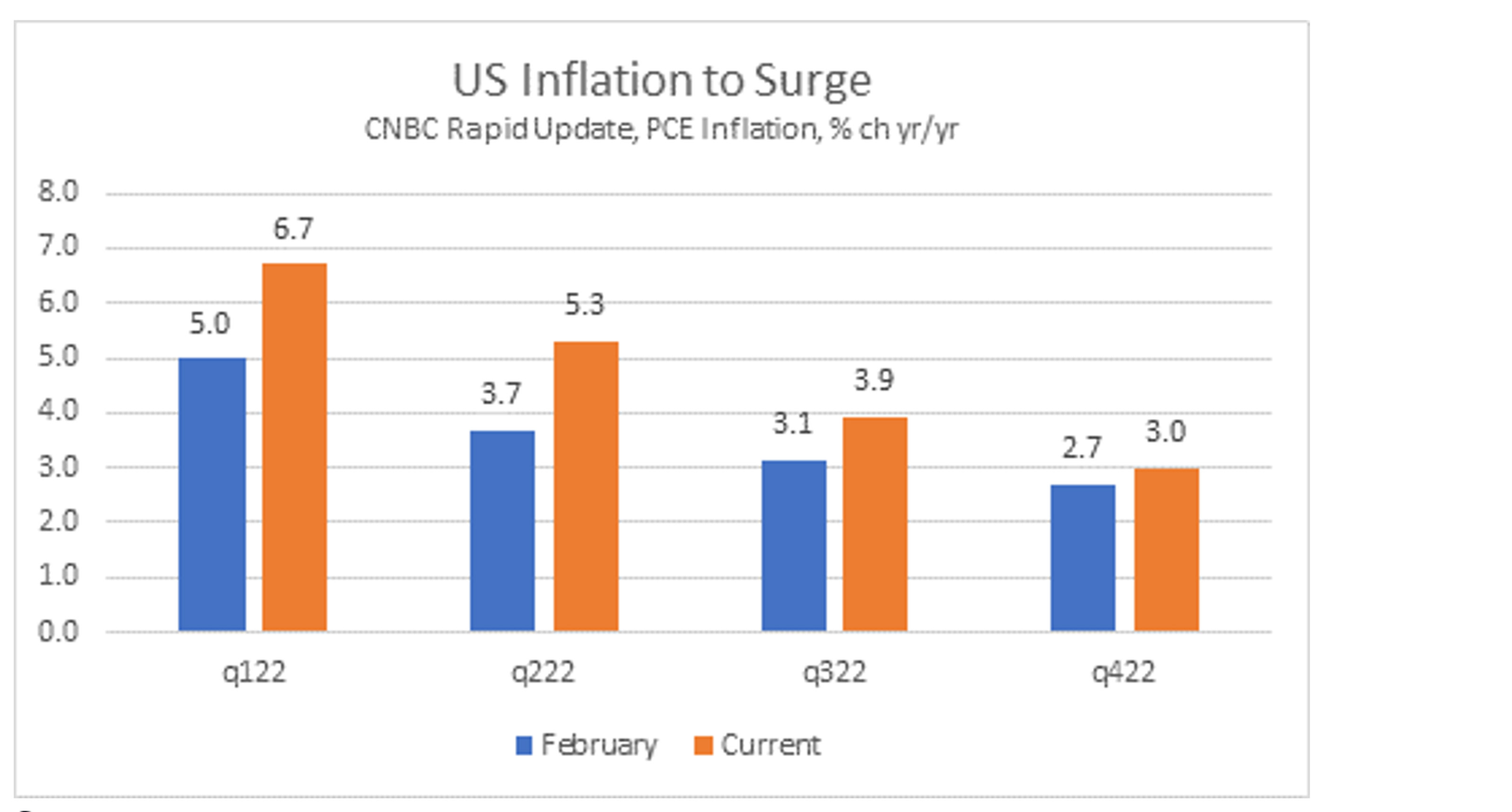

We believe spillover from the Russia/Ukraine crisis is likely to have the most material impact on energy prices, causing inflation to creep up even higher. Gas prices have already shot up in anticipation of future disruptions. According to new data from GasBuddy, the national average cost just reached over $4.30 a gallon. Economist Stephen Stanley, with Amherst Pierpont expects that much of the price run-up seen in recent days will recede within a few months, which means the gas price spike should have a short-term impact on growth and inflation.

Some analysts expect the current inflation surge to peak in Q1 2022 at 6.7% and the core PCE inflation to fall to 3.0% by end-2022 (although Kiplinger’s experts see it ending the year at 6.5%). As inflation normalizes later this year, consumers will get a welcome reprieve. Overall, inflation is expected to become more reasonable, and U.S. economic growth is seen persisting despite the Russia-backed invasion of Ukraine.

Investor Outlook

While our clients’ and most investors’ direct exposure to Russia and Ukraine is extremely small, the sanctions imposed on Russia and a renewal of the Cold War conflict are causing fears in the stock market. When emotions run high, looking toward the long-term is more important than ever. A well-diversified portfolio with a wide array of asset classes across different countries, industries and sizes can help reduce investment risks. But, of course, a diversified approach will not protect a portfolio from experiencing short-term losses at a time like this, with massive wartime market volatility.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Stacy is a nationally recognized financial expert and the President and CEO of Francis Financial Inc., which she founded over 20 years ago. She is a Certified Financial Planner® (CFP®), Certified Divorce Financial Analyst® (CDFA®), as well as a Certified Estate and Trust Specialist (CES™), who provides advice to women going through transitions, such as divorce, widowhood and sudden wealth. She is also the founder of Savvy Ladies™, a nonprofit that has provided free personal finance education and resources to over 25,000 women.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.