How Much Bitcoin Should I Own? A Mathematical Answer

Bitcoin and other cryptocurrencies hold a certain cutting-edge allure for some investors. If you’re curious about adding bitcoin to your portfolio, here’s a formula to help steer your decision.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Many of us have followed the dramatic rises and precipitous falls of bitcoin, and cryptocurrencies in general, over the past few years. Some may have written them off entirely after 80% declines in 2018, only to see them roar back into investors’ collective consciousness in 2020. Certainly sentiment has shifted over a short two years — more institutional investors are taking a hard look at crypto, and previous naysayers have softened their views.

This all leads to one question: How much cryptocurrency should I own?

Math to the rescue

It goes without saying that this is a hard question to answer. But we can borrow a page from modern quantitative finance to help us arrive at a potential answer. For years, Wall Street “quants” have used a mathematical framework to manage their portfolios called the Black-Litterman model. Yes, the “Black” here is the same one from the famous Black-Scholes options pricing formula, Fischer Black. And “Litterman” is Robert Litterman, a longtime Goldman Sachs quant.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Without getting into too much detail, the model starts with a neutral, “equilibrium” portfolio and provides a mathematical formula for increasing your holdings based on your view of the world. What’s amazing is that it incorporates not just your estimate about how an investment might grow, but also your confidence in that estimate, and translates those inputs into a specific portfolio allocation.

Your starting point: 0.50%

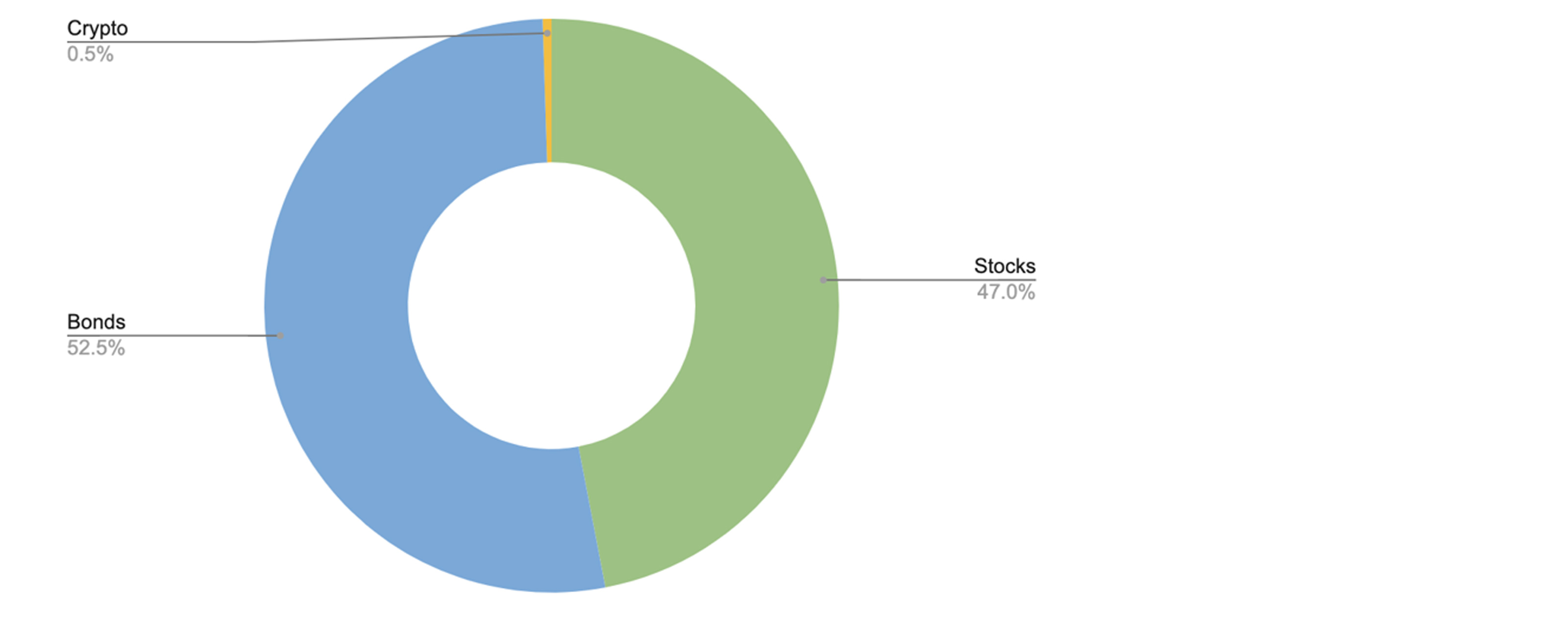

The Black-Litterman model uses the global market portfolio, meaning all the asset holdings in the world, as its starting point for building a portfolio. This means that, if you don’t have any other views on what investments might perform better or worse, this is the portfolio you should consider holding.

In early 2021, the global market for stocks totaled $95 trillion and the global bonds market reached $105 trillion. The cryptocurrency market as a whole was valued at roughly $1 trillion. This means that cryptocurrency represents 0.5% of the global market portfolio.

Just as there are plenty of arguments to hold more cryptocurrency, there are also many arguments to hold less. However, from the model’s standpoint 0.5% should be your starting allocation.

Now add your views

This is where the mathematical magic comes into play. For any given growth rate in cryptocurrency (or any investment for that matter), the Black-Litterman model will return the amount you should hold in your portfolio. What’s more, you can specify your level of conviction in that assumed growth rate and the model will adjust accordingly.

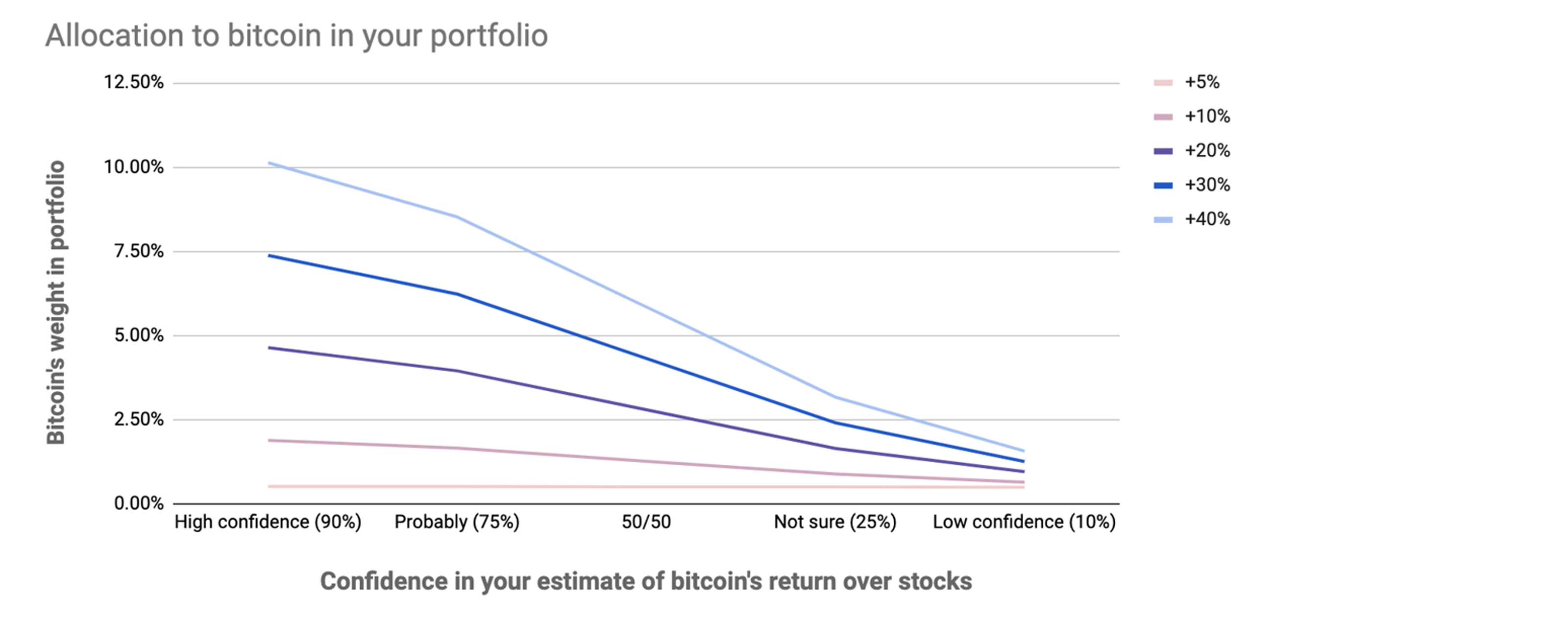

In the below chart are the portfolio allocations to bitcoin derived from the Black-Litterman model. This chart can serve as a useful guideline when thinking about how much cryptocurrency you might want to hold.

How to use it: Select how much you think bitcoin will overperform stocks, from +5% to +40%. Each return expectation corresponds to a line on the chart. For example, if you think that bitcoin will outperform stocks by 20%, this corresponds to the purple line. Now, follow the line left or right based on how confident you are. If you’re at least 75% confident (a solid “probably”), the purple lines up with a 4% allocation to bitcoin.

One of the most interesting things to note is how high your return estimate needs to be and how confident you need to be in order to take a sizable position in bitcoin. For example, for the model to tell you to hold a 10% allocation you need to be highly confident that bitcoin will outperform stocks by 40% each year.

Also of note, it does not take much to drive the model’s allocation to 0% allocation, i.e., no crypto holdings. If you don’t think that there’s a 50/50 chance that bitcoin will at least slightly outperform, the model says to avoid it entirely.

How we got here

The inputs to the Black-Litterman model tell an interesting story in and of themselves. The main inputs into the model are global market caps, asset volatility and the correlation between assets.

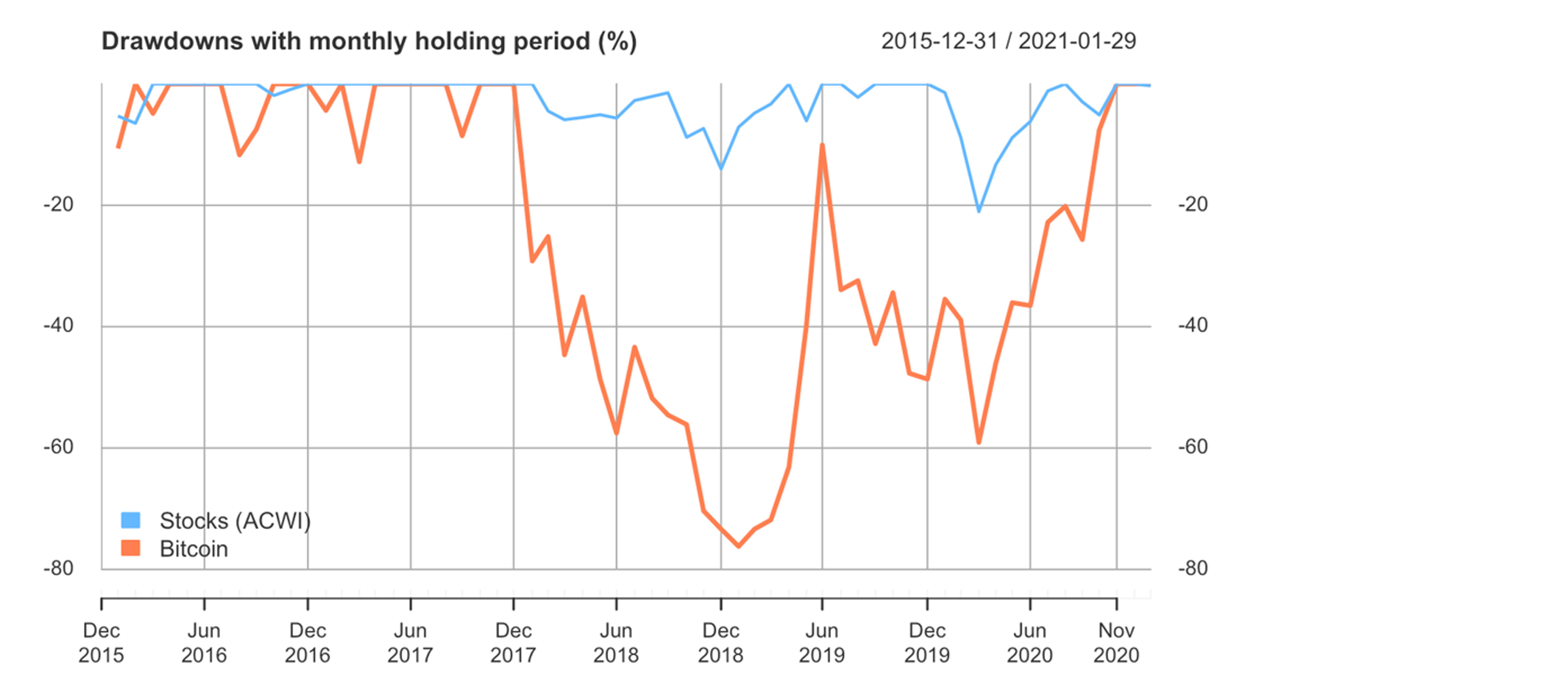

It goes without saying that cryptocurrencies are risky. Over the last five years, bitcoin’s volatility was six times that of stocks and 30 times that of bonds. At its worst, the digital coin saw an 80% drop in value, while stocks were down 20%. Other cryptocurrencies fared even worse.

If an asset is volatile, and one is not able to diversify that volatility away, then investors will require a higher rate of return on that investment, otherwise they will choose not to invest. The fact that bitcoin is so volatile, but has such a small number of investors (relative to stocks or bonds) suggests that many investors still do not see the potential returns worth the risks. On the other hand, cryptocurrencies are at their core a new technology, and new technologies always have an adoption curve. The story here may be less about expected return versus risk and more about early adoption versus mass appeal.

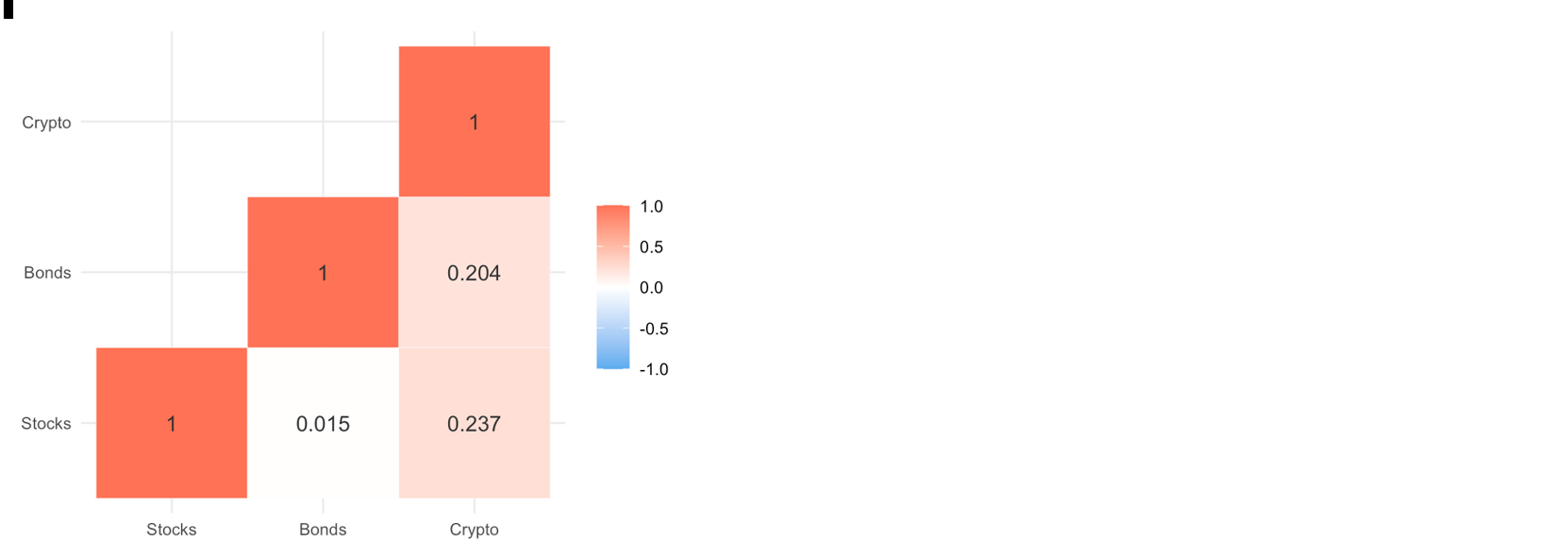

The final ingredient in the model is bitcoin’s correlation with stocks and bonds. Below you can see that bitcoin has some correlation with both stocks and bonds, meaning that when stocks go up (or down), bitcoin may do so as well. The lower the correlation, the greater the diversification an asset provides to your portfolio. Bonds have a low correlation with stocks (1.5%), which makes them a good ballast against turbulent markets. Bitcoin’s correlation is higher (23.7%), meaning that it can provide some diversification benefit to a portfolio, but not to the same degree as bonds.

Correlation heatmap

While we aren’t able to tell you if bitcoin will be the next digital gold, this mathematical model can help you think about what kind of allocation to crypto might be appropriate for you and what assumptions about risk and return might be underlying it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Adam Grealish serves as Head of Investments at Altruist, a fintech company on a mission to make great independent financial advice more affordable and accessible. With a career rooted in financial innovation, Adam most recently led Betterment's strategic asset allocation, fund selection, automated portfolio management, and tax strategies. In addition, he served as a vice president at Goldman Sachs, overseeing the structured corporate credit and macro credit trading strategies.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.