Investing for the Politics of NOW

With President Biden and a changing balance of power in Congress, investors have a lot to think about for 2021. Here are some points to ponder.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

We have come out of the most contentious political and election season of our lifetime. How should it impact your investment strategy for 2021?

Despite calls for unity, America remains very divided. With a new president and a power shift in the Senate, Democrats are optimistic about their new majority while Republicans are concerned about the future. Yet the markets have been resilient. In the face of political turmoil, a COVID economy and government restrictions, the markets had a strong 2020.

How should politics impact your investing, and what are the top considerations as we move forward?

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Be as UNEMOTIONAL as possible.

Easier said than done. With such strong political rhetoric, it is easy to be emotional and get whipped up into a frenzy. When it comes to investing, you need a more unemotional approach.

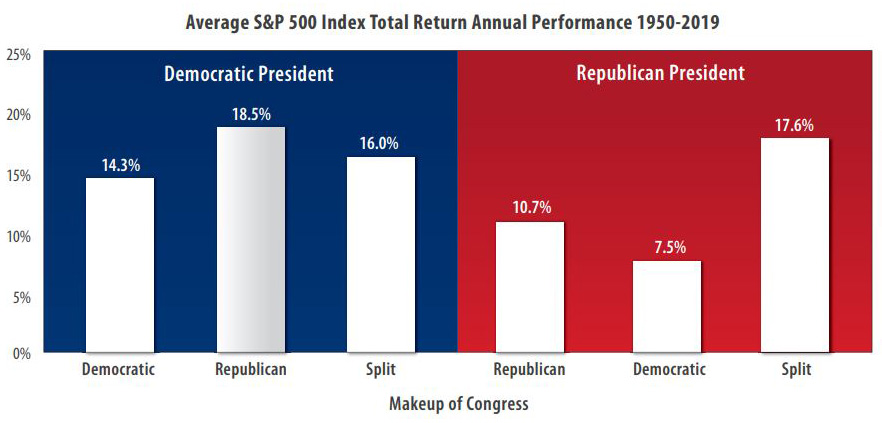

Historically, the markets have been able to post positive performance regardless of which political party held power. According to Morningstar (see chart below), Democratic presidents with a Democratic Congress have had 14% annual total return since 1950. And, while past performance of markets has no bearing on the market going forward, it is good to know that markets have done well in varying political environments.

Consider which sectors of the market might have more upside potential as the result of policies of the ruling party. Which sectors might be more at risk with their policies? Can adjustments be made in your overall allocation to reflect these economic realities?

Watch what they DO more than what they SAY.

Watch presidential executive orders and how they might impact business regulation and commerce. Look at legislation signed into law and how it might impact companies and sectors.

President Biden has prioritized additional federal stimulus, which could boost the economy in the short term. Janet Yellen, poised to become the next Treasury secretary, has promoted the idea of “going big” and helping to boost the economy. How these priorities play out in legislation needs to continue to be monitored. While additional spending can be a boost in the short term, what are the long-term impacts of expanding the federal deficit?

Will tax policy and energy policy be impacted through legislation? While Democrats have made both a priority, the 50-50 split in the Senate and the close majority in the House mean more controversial legislation may have difficulty getting passed.

Look BEYOND politics.

There are many factors that drive markets, and politics is just one of them to consider. What are most important issues to be watching as we move forward?

- Price to earnings: P-E ratios on S&P 500 companies are reaching levels not seen since 1999, meaning stocks are expensive relative to their earnings. Can companies boost earnings to bring those levels down to more acceptable numbers?

- Trade: A new approach to trade relations from President Biden’s administration means likely a more integrated global system. Does that mean new opportunities?

- COVID-19: Vaccines likely to mean a return back to a more normal economy in the second half of the year, but could that return to normalcy be disrupted by delays in distribution or by virus mutation?

- Cash on the sidelines: A typical election year sees $206 billion added to cash holdings, according to Capital Group, and 2020 saw $757 billion added by investors to their cash positions. Often the year after a presidential election sees that capital put back into equities. Could that further impact markets?

Be FOCUSED and FLEXIBLE in your equity allocation.

Last year saw technology and online retail outperform while energy and travel were crushed. This year technology seems to be stalling, and some of the “back to normal” economy names are in vogue. Small caps and value appear to be seeing additional investment, and energy has had a great start to the year.

It paid to be selective and focused on your equity allocation in 2020, and 2021 likely will demand the same. The leading sectors are changing rapidly, and being selective on sectors and individual stocks is more important than ever in this bifurcated market. Being focused and flexible in your equity allocation is critical in this type of investing climate.

Watch out for MANIAS.

A new administration can mean a slew of new speculation on what that might mean for business and industry. Be careful and take some historical perspective. The electric vehicle and self-driving technology are prompting massive speculation in individual companies looking to capitalize. Cryptocurrency is also garnering renewed attention as more and more outlets are available to invest in the asset class.

Do not get caught up in the emotion of a mania investment, one that defies logic and goes way beyond the norms of valuation and business sense. Find ways to get exposure to exciting ideas, but in ways that do not put your retirement security at risk. Get exposure to the upside of the next great idea, without having a failure short-circuit your overall plan.

Get a FRESH perspective.

Times of turmoil or change are great opportunities to get new perspective. Take this time to reflect — maybe take a domestic vacation. Clear your mind and be open to looking at things in a renewed way. Whether you are concerned about the future or optimistic, take time to broaden that perspective. What risks still exist in this environment and how can they be overcome? What upsides are present in this economy and how can I position to capitalize? How can we renew our efforts to be better people, to connect more with loved ones, and to find common ground?

This political environment has shaped so much of our perspective. Let us look to find the opportunities in the year ahead.

Investment Adviser Representative of USA Financial Securities. Member FINRA/SIPC A Registered Investment Advisor. CA license # 0G89727 https://brokercheck.finra.org/

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Scot Landborg has over 17 years of experience advising clients on retirement planning strategies. Scot is CEO and Senior Wealth Adviser for Sterling Wealth Partners. He is host of the retirement planning podcast Retire Eyes Wide Open. Scot is a regular contributor to Kiplinger.com and has been quoted in "U.S. News & World Report," Market Watch, Yahoo Finance, Nasdaq and Investopedia. He also formally hosted the nationally syndicated radio show "Smart Money Talk Radio."