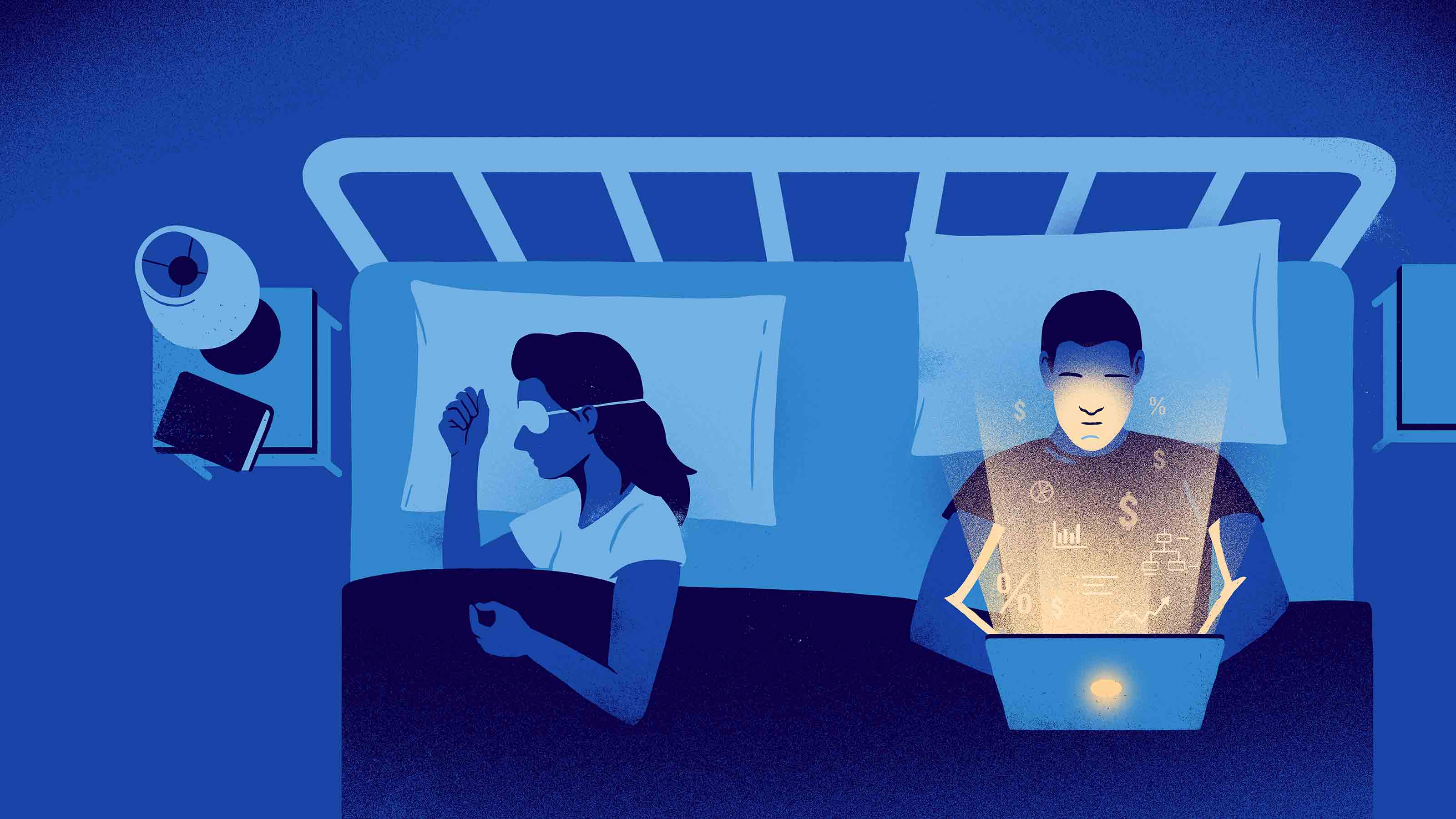

8 Costly Investing Mistakes That Could Ruin You

You’ve got problems. We’ve got solutions to make sure your portfolio isn't keeping you awake, no matter what the market does.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

“If it ain’t broke, don’t fix it” is a mantra that worked surprisingly well for investors for a very long time. After all, we headed into 2020 with a long, robust bull market and a humming economy. Then things got fractured. COVID-19 got much more serious, much more quickly, than many people expected. Stocks plummeted, and the market damage extended to bonds, too.

By late summer, the markets had completely recovered—but for many investors, the scars remained. And then, stocks started to wobble again. The 2020 turmoil has served as a wake-up call that a complacent investor is a vulnerable one. After all, uncertainties still abound, for stocks in particular. After a nearly straight-up trajectory since spring, more of a pause may be in store. Some market watchers worry about the vulnerability of the handful of tech stocks that have done most of the heavy lifting; other experts warn that the market has developed a worrisome speculative character. And of course, the coronavirus continues to take its toll.

With that in mind, we looked at some of the portfolio challenges that investors have grappled with in this tumultuous market. If you have any of the portfolio problems below, now is the time to fix them. Prices, returns and other data, unless otherwise noted, are as of September 11.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

You took on more risk than you could handle

Many investors say they can stomach a 20% decline or more in their portfolio. But when it becomes reality, as it did in February and March, some realize they don’t have the risk tolerance they thought they did. The decline in the markets was sharp and shocking—the S&P 500 fell nearly 35% from February 19 to March 23.

The velocity of the decline was unusual, and so was the speed of the rebound. But it’s worth remembering that since 1929, there have been 14 bear markets, defined as a loss of at least 20% from a market peak, with an average decline of 39.4%, according to S&P Dow Jones Indices. “We’re overconfident about our ability to tolerate risk,” says William Bernstein, a neurologist who wrote a book called The Intelligent Asset Allocator. “It’s one thing to say to yourself, ‘I can tolerate a 40% or 50% fall in stocks, as long as it’s temporary.’ It’s another thing to tolerate what’s actually happening.”

Ajay Kaisth, a certified financial planner in Princeton Junction, N.J., had a client who gave into her fears at exactly the wrong time. The 74-year-old went into the spring downturn with a relatively conservative portfolio—70% bonds and 30% stocks—and a separate emergency account with two years’ worth of living expenses. But after watching markets fall for four weeks, she insisted on selling all $733,800 of her stocks and bonds on March 23—the day the market bottomed.

Kaisth’s client illustrates the difference between risk capacity and risk tolerance. She had the ability to take on risk and absorb losses in her conservative portfolio, and to wait for a market rebound. But she lacked the psychological fortitude.

Risk capacity is a product of your time horizon and what, exactly, you need to pay for. Still have children to put through college? You can’t let four years of tuition payments get clipped by volatile markets when your kids are in high school. Ready for retirement in a couple of years? If your portfolio is just big enough to give you the golden-years income you desire, a hit to the principal with little time to make up the losses can keep you working longer than you expected.

Even if your goals are comfortably assured, you may be the kind of investor who feels the sharp claws of a bear market more intensely. In that case, you might need to de-risk your portfolio along the lines of a Wisconsin couple, clients of CFP Brian Behl. The couple, in their early fifties, work in government, so they expect their public-sector pensions and Social Security to cover their retirement needs. Their investment portfolio of $400,000—until recently invested 70% in stocks and 30% in bonds—is extra.

“They are people who track their finances, but they told me they stopped looking at their account because they didn’t want to know how much it was down,” says Behl. In July, the couple decided to scale back the stock portion of their portfolio to 50%, from 70%. In the bond portfolio, Behl selected shorter-term bonds, which are less likely to see sharp price moves if interest rates rise again. A fund we like is Vanguard Short-term Bond ETF (symbol BSV, $83), an exchange-traded fund that holds investment-grade government, corporate and international bonds, or its mutual fund equivalent, VBIRX.

Other de-risking moves might include focusing on high-quality, dividend-paying stocks with bullet-proof balance sheets—or tilting toward so-called defensive sectors, including health care, consumer staples and utilities, and away from industrials, materials, energy firms and companies that provide nonessential consumer goods or services.

You tried to time the market

The evidence is clear that staying invested is better than pulling out and piling in based on what you think a mercurial “Mr. Market” will do next. It’s hard to beat a buy-and-hold approach over time. The worst return for an all-stock portfolio in a single calendar year, going back to 1950, was a loss of 39% (in 2008), according to J.P. Morgan Asset Management. The worst five-year return was a loss of just 3% annualized. The worst 20-year return was an annualized gain of 6%.

To further illustrate the perils of market timing, strategists at BofA Securities looked at the performance of the S&P 500 going all the way back to the 1930s. Since then, a long-lived investor sitting out the 10 highest return days per decade would have earned an unimpressive 17% through late August of this year, compared with a return of more than 16,000% for someone who stayed in the market.

Jeffrey Bernfeld, a CFP in Towson, Md., has clients who made an amazing call on the markets in February. The husband works in international sales, and he had business contacts outside of the U.S. who were warning him that the coronavirus was a lot worse than most Americans realized. So, in February, the couple sold all of their stocks and bonds in a retirement account worth nearly $1 million. “When they sold out, I was skeptical, of course,” he says. “By March, I thought, ‘Oh, my God, this guy’s a genius.’ ”

Bernfeld then urged the clients, who had avoided what would have been a loss of more than 20%, to consider getting back in the market at the new, lower levels. Nervous that the worst wasn’t over, the couple declined, even after the market began to turn. At the end of July, they were still 100% in cash—and behind where they would have been if they’d never sold a thing. “With market timing, you have to get two things right: when to get out, and also when they get back in,” Bernfeld says. “Getting one decision right, as they did, is very difficult. Getting two decisions right is almost impossible.”

Getting back into the market can be easier when you don’t do it all at once. In May, a couple who had sold an entire $750,000 portfolio in the coronavirus panic and wanted help getting back in the market came to Jonathan McAlister, a CFP at Kimery Wealth Management, in Memphis, Tenn. On McAlister’s advice, they put 50% of their money back in immediately, and they’re investing the rest every month by dollar-cost averaging—putting a fixed amount into the market at regular intervals. Dollar-cost averaging ensures that you’ll buy more stock when it’s cheap and less when it’s expensive, lowering your average cost per share. And it takes the emotion out of the investing decision.

So far, the couple has recovered about one-third of their losses. “Had they just stayed invested the entire time, they would be even right now instead of down,” says McAlister. Still, reentering the market with just half of what they took out gave the couple a comfort level that allowed them to keep investing at regular intervals in a market that still holds a lot of uncertainty, says McAlister.

You’re not diversified

The way you apportion your investment dollars among different asset classes is driven largely by your age, goals and risk tolerance. The youngest investors have the most time to recover from blips in the market and can afford to take on the risk inherent in stocks. Investors closer to retirement, or with big short-term cash requirements, need to play it safer. Traditionally, that’s meant twentysomethings can put 80% or more of their portfolio in stocks, while older investors may have half or more of their investments in bonds or cash.

Choosing an array of holdings within each asset class is a second layer of diversification. The downside of diversification is that you’ll never match the performance of the single hottest investment, investment style or asset class. The upside is that your portfolio won’t fall as far when fortunes reverse, as they inevitably do over time.

Even for buy-and-holders, a well-balanced portfolio requires some tending. The past decade-long bull market in stocks was a boon for many investors. But those who chose to set their portfolio on autopilot and enjoy the ride may have found themselves overexposed to stocks—just as the bottom fell out of the markets. Consider: A conservative investor with an investment mix of 50% stocks and 50% bonds in 2010 who did no rebalancing would have had a portfolio of roughly 71% stocks and 29% bonds at the beginning of 2020, according to Morningstar Direct.

Moreover, the bull market was essentially a U.S. story, driven by fast-growing companies with sometimes-expensive stocks. Foreign markets couldn’t compete. Large-company stocks mostly beat small-company stocks. And value investing—seeking out underappreciated stocks at reasonable prices—fell out of favor. That has left a lot of investors with too much exposure to large, U.S. growth stocks.

“It’s never too late to course correct,” says Judith Ward, a senior financial planner at T. Rowe Price. But it can take guts. Take, for example, growth investing versus value investing. For the decade ended June 30, value styles have now underperformed across all company sizes—small, mid and large capitalization—by 4% to 5% annually, according to Morningstar. But that doesn’t mean that value won’t be on top again, or that there aren’t opportunities. (For more on value investing, see Street Smart.)

Similarly, it’s easy to doubt the value of international investing. But although U.S. stocks have beaten non-U.S. stocks in the aggregate for several years, the best-performing stock market in six of the past eight years has been located outside the U.S., according to Fidelity Investments. A combination of international and U.S. stocks has historically lowered long-term risk in a stock portfolio, Fidelity says, because the markets often move in different directions.

James McDonald, CEO of Los Angeles–based Hercules Investments, recommends that investors allocate 15% to 20% of their portfolio to international shares. He likes prospects in Brazil, and he recommends shares in Anheuser-Busch InBev SA/NV (BUD, $56), the Belgian brewer that counts that South American country as its second-largest market. To cut a wider swath through foreign markets, consider an exchange-traded fund such as Vanguard Total International Stock (VXUS, $53). AMG TimesSquare International Small Cap (TCMPX) will beef up your exposure to both foreign shares and smaller companies. The fund is a member of the Kiplinger 25, the list of our favorite no-load, actively managed mutual funds.

It’s worth noting that some index investing now offers an unusual level of concentration risk. The four biggest companies in the S&P 500—Apple, Amazon.com, Microsoft and Alphabet—all sport a market value of between $1 trillion and $2 trillion, with Facebook not far behind. The S&P 500 has returned 4.8% so far this year, but Apple, Amazon and Microsoft have contributed seven percentage points of that return—in other words, absent those stocks, the index would be in negative territory.

You’re overinvested in your employer

In this economy, you have two big employment risks: losing your job and losing an outsize share of your portfolio if you own large amounts of company stock. Your company is already paying your salary, subsidizing your health care and perhaps funding your pension. If its stock also represents a huge chunk of your investment accounts, far too much of your financial future is tied up in the fortunes of your employer.

The appeal is understandable. After all, you know the business—a tenet of sound investing. Many companies go to great lengths to ensure that their most-valued employees are also shareholders. Compensation programs often include stock options, awards of shares and the right to buy stock at a discount. Nor is too much company stock a problem reserved for the executive class. Companies often use their own shares, instead of cash, as matching contributions in a 401(k) or other retirement plan. The 2019 Equity Compensation Survey from financial firm Charles Schwab queried 1,000 workers who participate in stock plans at their companies. Of those surveyed, the average millennial employee had 41% of their net worth in their own company’s stock. Gen Xers and baby boomers had about 20% of their net worth in company shares—a smaller percentage, but still potentially risky. Some 78% of the boomer respondents said they intended to use company shares to finance at least part of their retirement income.

The amount of company stock you hold should depend on your age and the risk. A 60-year-old working for a small firm might want less than 10% of portfolio assets in company stock; a 25-year-old starting out in the tech industry, particularly at a big company, could hold 15% to 20%.

It doesn’t take an Enron-style fraud and bankruptcy to cause a problem. Recent market volatility was too much for one pharmaceutical executive, a client of CFP Robert Falcon in Concordville, Penn. Thanks to a variety of compensation programs, the company shares the executive held made up 28% of his overall portfolio and 36% of his stock holdings. The stock traded at nearly $100 per share at the end of 2019—but fell by nearly 40% by mid March. In just over four weeks, it rebounded, spiking above $100.

Nonetheless, the experience illustrated the stock’s volatility and just how much the executive’s wealth depended on his company. Falcon suggested a couple of solutions to reduce exposure to the stock while minimizing the tax bill from selling.

The first was a donation to charity. By donating shares that had appreciated the most over the years, the executive could get a deduction for their full market value and avoid paying capital-gains taxes that he’d owe by selling them. Falcon recommends using donor-advised funds, which are charitable accounts that allow the donor to get a full tax deduction immediately. The sponsor of the account makes the actual charitable contributions over multiple years (see Smart Ways to Spend $1,000).

Falcon also recommended that the executive make gifts of the stock to his school-age children, which they then sold, putting the proceeds into savings for their education. Falcon picked shares that, when sold, would generate less than $2,200 of capital gains—the maximum amount of unearned income a minor child can receive before paying income taxes.

Be thoughtful about what you buy when you replace your company stock. You can undercut your overall plan if you pick sector-specific funds in the industry in which you work. Don’t forget that many index funds that are considered broad-market barometers have significant exposure to certain industries. Tech claims a whopping 27.5% share of the S&P 500, for instance.

Your income disappeared

Market strategists have been warning for years that interest rates were at historic lows and that one day we’d return to normal. Instead, most countries’ central banks have dropped their rates to zero. The yields on bonds, in turn, are in free fall, as investors remain cautious on the economy and have little expectation of troublesome inflation in the near term. The yield on 10-year Treasuries was recently 0.7%; Kiplinger expects the 10-year yield to remain well below 1% for some time.

The slide in rates has been good for bond investors who are willing to sell, because bond prices generally go up when rates fall. But investors who need to buy and hold bonds for income are in another boat entirely—with some, in search of yield, playing a dangerous game of taking on more risk in what should be the safest part of their portfolio. “If you can’t even be confident your investments can keep pace with inflation in a no-risk type of investment strategy, that makes retirement expensive,” says Wade Pfau, professor of retirement income at the American College of Financial Services.

Investors can eke out more income without too much extra risk if they’re choosy. Consider high-quality corporate bonds, municipals (favor debt for essential services, such as schools or water and sewer systems), and selected real estate investment trusts (data centers and cell towers, not retail malls and office space). Funds worth a look include Fidelity Corporate Bond (FCBFX), yielding 1.5%, Fidelity Corporate Bond ETF (FCOR, 1.8%) and Vanguard High-Yield Corporate (VWEHX, 4.0%), a member of the Kiplinger 25, our list of low-fee mutual funds. The Vanguard fund focuses on debt rated double-B, the highest-quality junk-bond rating.

The collapse in bond yields makes dividend-paying stocks a viable alternative for income. Certainly, stocks can decline more sharply than bonds, but there are plenty of high-quality companies whose payouts put Treasury yields to shame. In late August, more than 350 companies in the S&P 500 index sported dividend yields greater than the yield of 10-year Treasury bonds, according to S&P Global Market Intelligence. Of those, nearly half had a yield that topped 2.5%—more like the 10-year Treasury yield from a decade ago.

Colleen MacPherson, the director of research and a portfolio manager at Boston’s Penobscot Investment Management, says her firm recommends dividend-paying stocks to clients who are nearing retirement but who can still take on some risk to obtain income.

MacPherson’s picks aren’t the stocks with the highest yields—often, a high dividend yield is a red flag that indicates investors have knocked down the share price of a struggling company. Instead, she scouts for companies that have raised their dividends at least four times in the past five years, kept total annual payouts to about 50% or less of profits, and have manageable debt levels. “We’re looking at companies to buy and hold,” she says. “If we’re in high-quality companies, we believe that when volatility hits, you won’t see massive price swings.” MacPherson says stocks that meet most of her criteria include consulting firm Accenture (ACN, $235), utility Nextera Energy (NEE, $278) and paint company Sherwin-Williams (SHW, $709).

You’re paying too much

When markets tumbled in February, nearly everything fell in value. As a result, many people looked more closely at their investments and didn’t like what they saw—including how much they were paying for them in fees and expenses.

Avoiding high fees may be the single most important decision an investor can make. An investor with $100,000 who generates a 6% return each year for 20 years but pays 2% in annual fees will end up with $214,111 after paying $62,349 in costs. Cutting annual fees to 1%—roughly equivalent to the average annual expenses of a mutual fund investing in large-company stocks—saves nearly $28,000 in costs and nets nearly $50,000 more under the same assumptions. And an investor who pays just 0.10% of assets each year in a low-cost ETF will have $314,360 at the end of two decades, having paid less than $4,000 in expenses. Fees seem small when expressed as percentages, but they have a big impact over time.

Deborah Ellis, a CFP in Granada Hills, Calif., has a longtime friend (and new client) who learned this lesson the hard way. The friend approached Ellis earlier this year, alarmed at the drop in her account. Half of her $300,000 portfolio was in cash, but the other $150,000 was in high-cost mutual funds and, worse for her, unit investment trusts, or UITs, whose value had fallen by half.

The woman—in her seventies and retired—bought the UITs at the recommendation of another adviser, expecting little volatility and a generous income yield. But unlike mutual funds or ETFs, which you can hold in hopes of a rebound, the UITs had a set termination date, forcing her to cash out at a steep loss. Moreover, Ellis said that all told, her new client was paying annual fees of somewhere between 2% and 3%.

Ellis’s solution was to put her friend in a new mix of low-cost funds and stocks with strong balance sheets and good cash flow. Portfolio holdings now include ETFs Health Care Select Sector SPDR (XLV, $105), with a 0.13% expense ratio and a 2.27% yield; SPDR S&P Dividend ETF (SDY, $95), yielding 3.10% and charging 0.35%; and iShares Short-Term National Muni Bond ETF (SUB), charging 0.07% and yielding 0.31%, the equivalent of 0.47% for someone paying taxes at the 35% federal rate. High-quality stock selections include Apple (AAPL, $112), Johnson & Johnson (JNJ, $148), Microsoft (MSFT, $204) and Visa (V, $201).

Including Ellis’s management fee of 0.6% of assets, the client’s annual cost is now about half of what she was paying before. Cost-conscious do-it-yourself investors can check out the Kiplinger ETF 20 list of our favorite exchange-traded funds (see Find the Best ETFs for Your Goals). More than half have annual expenses of less than 0.10% of assets. All but two of the mutual funds in the Kip 25 charge less than 1% of assets.

You bought into a scam

The market gyrations of 2020 have created an environment in which financial scammers thrive. The sharp drop in the market bred fear, and its rapid rebound created FOMO, or fear of missing out. Add in COVID-19—any potential solutions to a global pandemic could create billions of dollars in economic value—and the investing climate is ripe for fraud.

By August, the Securities and Exchange Commission had filed a number of COVID-related enforcement actions and suspended trading in nearly three dozen stocks for releasing inadequate or inaccurate information about how their products could combat the virus.

The rule with investments is always this: If it sounds too good to be true, it probably is. And that goes for advisers, too. Be wary of anyone promising returns that dwarf the average. “There’s no magic bullet or magic investment,” says Carolyn McClanahan, founder of Life Planning Partners, in Jacksonville, Fla.

For years, financial professionals and regulators have struggled to craft a “fiduciary rule.” At its essence, such a rule would mean that advisers or planners need to put their clients’ needs ahead of their own—particularly if they or their firms stood to make more money if they recommended a specific financial product. Countless comment periods, rule-making procedures and court challenges later, the Department of Labor and the SEC have put out new rules—but investor advocates say they’re not strong enough to prevent potentially dangerous conflicts.

“The burden is on you to choose a financial professional who voluntarily structures their business in a way to minimize conflicts of interest and adheres to a fiduciary standard,” says Barbara Roper, director of investor protection for the Consumer Federation of America. “And the good news is that those people do exist.”

There are several resources available for vetting advisers, brokers and financial planners. Members of the National Association of Personal Financial Advisors are fee-only planners who take a fiduciary oath, which includes providing written disclosure to clients of any financial conflict of interest. A separate group, the Committee for the Fiduciary Standard, has a fiduciary oath that you can download (www.thefiduciarystandard.org) and ask an adviser to sign. It’s not legally binding, but reluctance to sign could be a red flag, says Roper.

The Financial Industry Regulatory Authority, or Finra, operates the BrokerCheck website, where you can see whether someone is registered to sell securities and whether they have a disciplinary record or customer complaints filed against them. The SEC has a site to search financial advisers, as well as a look-up tool to find individuals who have been named as defendants in SEC federal court actions or respondents in the agency’s administrative proceedings. The Certified Financial Planner Board allows you to verify whether someone is certified by the board and whether it has ever disciplined them.

These databases can warn you away from someone who has a checkered background, but it can take a long time for an adviser’s problematic behavior to turn into a paper trail. In the end, there’s no substitute for having a certain amount of skepticism and asking questions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Milstead joined Kiplinger Personal Finance as senior associate editor in May 2025 after 15 years writing for Canada's Globe and Mail. He's been a business journalist since 1994 and previously worked at the Rocky Mountain News in Denver, the Wall Street Journal, and at publications in Ohio and his native South Carolina. He's a graduate of Oberlin College.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.