How Do Your Tax Deductions Stack Up?

Do you know how you compare with your fellow taxpayers when it comes to the deductions you take? We have the answer.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

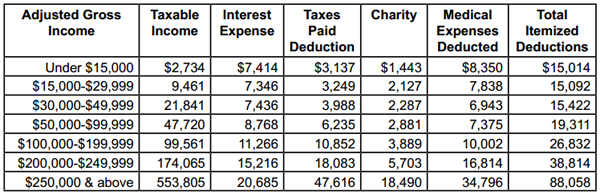

Wonder how your itemized deductions compare with those of other filers? Check the averages in this table. It compares several key write-offs claimed by filers at various income levels, using IRS preliminary data from 2011 returns

Some things to keep in mind about the data: The Total Itemized Deductions column of the table includes miscellaneous itemized deductions plus any casualty and theft losses. The averages for taxes paid include taxpayers in states without an income tax who elect to deduct state sales tax, so the amount in the table may seem a bit low. The averages also include personal property taxes and real estate taxes.

And only medical expenses over 7.5% of AGI were deductible, so relatively few filers ended up taking the write-off. The figures above are the averages for those taxpayers.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

You won’t automatically be audited for having above-average deductions. The IRS knows that people living in states with high individual income tax rates claim larger state tax deductions than folks in states with low tax rates or no tax. And the agency matches mortgage interest deductions with 1098 forms from lenders.

But if your deductions are disproportionately large when compared with your income, your audit risk can go up because that’s a key factor in IRS’ return selection formula.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joy is an experienced CPA and tax attorney with an L.L.M. in Taxation from New York University School of Law. After many years working for big law and accounting firms, Joy saw the light and now puts her education, legal experience and in-depth knowledge of federal tax law to use writing for Kiplinger. She writes and edits The Kiplinger Tax Letter and contributes federal tax and retirement stories to kiplinger.com and Kiplinger’s Retirement Report. Her articles have been picked up by the Washington Post and other media outlets. Joy has also appeared as a tax expert in newspapers, on television and on radio discussing federal tax developments.

-

How to Watch the 2026 Winter Olympics Without Overpaying

How to Watch the 2026 Winter Olympics Without OverpayingHere’s how to stream the 2026 Winter Olympics live, including low-cost viewing options, Peacock access and ways to catch your favorite athletes and events from anywhere.

-

Here’s How to Stream the Super Bowl for Less

Here’s How to Stream the Super Bowl for LessWe'll show you the least expensive ways to stream football's biggest event.

-

The Cost of Leaving Your Money in a Low-Rate Account

The Cost of Leaving Your Money in a Low-Rate AccountWhy parking your cash in low-yield accounts could be costing you, and smarter alternatives that preserve liquidity while boosting returns.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Can I Deduct My Pet On My Taxes?

Can I Deduct My Pet On My Taxes?Tax Deductions Your cat isn't a dependent, but your guard dog might be a business expense. Here are the IRS rules for pet-related tax deductions in 2026.

-

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your Bill

Don't Overpay the IRS: 6 Tax Mistakes That Could Be Raising Your BillTax Tips Is your income tax bill bigger than expected? Here's how you should prepare for next year.

-

Oregon Tax Kicker in 2026: What's Your Refund?

Oregon Tax Kicker in 2026: What's Your Refund?State Tax The Oregon kicker for 2025 state income taxes is coming. Here's how to calculate your credit and the eligibility rules.

-

Will IRS Budget Cuts Disrupt Tax Season? What You Need to Know

Will IRS Budget Cuts Disrupt Tax Season? What You Need to KnowTaxes The 2026 tax season could be an unprecedented one for the IRS. Here’s how you can be proactive to keep up with the status of your return.

-

3 Retirement Changes to Watch in 2026: Tax Edition

3 Retirement Changes to Watch in 2026: Tax EditionRetirement Taxes Between the Social Security "senior bonus" phaseout and changes to Roth tax rules, your 2026 retirement plan may need an update. Here's what to know.

-

IRS Tax Season 2026 Is Here: Big Changes to Know Before You File

IRS Tax Season 2026 Is Here: Big Changes to Know Before You FileTax Season Due to several major tax rule changes, your 2025 return might feel unfamiliar even if your income looks the same.

-

12 Tax Strategies Every Self-Employed Worker Needs in 2026

12 Tax Strategies Every Self-Employed Worker Needs in 2026Your Business Navigating the seas of self-employment can be rough. We've got answers to common questions so you can have smoother sailing.