Do You Need Insurance for Your Smart Phone?

The limited warranties that come standard with most devices won't cover loss or damage.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When you buy a smart phone, you might get the hard sell to pay a little extra each month for a protection plan for your device. The question, of course, is whether it’s worth it.

Although extended coverage typically doesn't pay off for major appliances and electronics, it might for smart phones. According to Verizon, 25% of Americans lose or damage their wireless phones every year. The limited warranties that come with most smart phones don’t cover loss or accidental damage, which means you would be on the hook for a pricey repair or a replacement phone that could easily cost $600 or more.

Homeowners and renters policies provide protection for possessions, which would include smart phones, but only if they’re stolen or damaged by a covered event such as a fire. However, if your home's insurance deductible is high – a $500 deductible is common – then it wouldn't make financial sense to file a smart-phone claim. And a homeowners policy wouldn't cover the cost of replacing a phone if you simply lose it or damage it, says Jeanne Salvatore, a spokesperson for the Insurance Information Institute.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A phone purchased with a credit card would usually have 90 days of purchase protection, which would cover damage, loss or theft, says John Oldshue, LowCards.com founder and editor. And many cards will extend the manufacturer’s warranty. However, each card network's plan has its own caveats and exclusions. So check your issuer’s policy for details. Regardless, an extension of the manufacturer’s warranty won’t do you much good if that warranty doesn't cover loss or damage.

Here are your options if you want more protection. Whether it's worth the extra cost comes down to personal factors that you will need to evaluate for yourself. Are you especially clumsy or forgetful? If yes, lean toward added coverage that will fix a dropped phone and replace a lost one. More importantly, ask yourself if you can afford to replace a lost or damaged phone? Ironically, it's those who can't afford to shell out $600 all at once for a new phone who might benefit the most from the added protection that can be had for just a few dollars a month.

Extended manufacturer’s warranty. Apple offers an extended warranty, called AppleCare+, for iPhones. For $99, you get two years of technical support and coverage for two incidents of accidental damage (subject to a $79 service fee for each claim). The coverage provides repair or replacement for your phone, battery, included earphones and accessories.

Protection plan from a wireless provider. All of the major carriers – AT&T, Sprint, Verizon and T-Mobile – offer plans that cover accidental damage, out-of-warranty malfunction, loss and theft of a smart phone. To get the coverage, though, you have to enroll within 30 days of the purchase or activation of your phone (just 14 days for T-Mobile). All of the plans limit claims to two a year and have a deductible that varies depending on the phone.

AT&T Mobile Insurance is $6.99 month and has a deductible per claim of $50, $125 or $199 depending on the phone model. For $3 more each month, you can get enhanced customer support, GPS tracking for a lost phone and the ability to remotely lock it with the Mobile Protection Pack.

Sprint Total Equipment Protection covers virtually anything that can go wrong with your device – including loss, theft, damage and out-of-warranty malfunction – for $8 or $11 a month, depending on device. The deductible ranges from $50 to $200.

Verizon’s protection plans range in price from $5.18 a month to $10 a month, and the deductibles vary depending on the phone model. The highest level of protection, Verizon Total Mobile Protection, covers lost, stolen, damaged or defective phones and provides GPS tracking for a lost phone and virus protection.

T-Mobile Premium Handset Protection covers malfunction, damage, loss or theft for $8 a month. The deductible varies depending on the phone model.

Protection from an independent warranty provider. You might pay less for an extended warranty from companies such as SquareTrade and Safeware. SquareTrade charges $5 a month for 24 months (or $99 upfront to cover the entire 24-month period) and has a $99 deductible. It covers damage and malfunction, but it does not cover loss or theft. Protection plans are available only for phones that are 30 days old or less, or that are currently insured by a service provider’s plan. Safeware’s policy cost depends on the amount of coverage you want, the device you insure and the state where you live. It does cover theft, in addition to damage and malfunction.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Award-winning journalist, speaker, family finance expert, and author of Mom and Dad, We Need to Talk.

Cameron Huddleston wrote the daily "Kip Tips" column for Kiplinger.com. She joined Kiplinger in 2001 after graduating from American University with an MA in economic journalism.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

When Tech is Too Much

When Tech is Too MuchOur Kiplinger Retirement Report editor, David Crook, sounds off on the everyday annoyances of technology.

-

I Let AI Read Privacy Policies for Me. Here's What I Learned

I Let AI Read Privacy Policies for Me. Here's What I LearnedA reporter uses AI to review privacy policies, in an effort to better protect herself from fraud and scams.

-

What Is AI? Artificial Intelligence 101

What Is AI? Artificial Intelligence 101Artificial intelligence has sparked huge excitement among investors and businesses, but what exactly does the term mean?

-

Five Ways to Save on Vacation Rental Properties

Five Ways to Save on Vacation Rental PropertiesTravel Use these strategies to pay less for an apartment, condo or house when you travel.

-

How to Avoid Annoying Hotel Fees: Per Person, Parking and More

How to Avoid Annoying Hotel Fees: Per Person, Parking and MoreTravel Here's how to avoid extra charges and make sure you don't get stuck paying for amenities that you don't use.

-

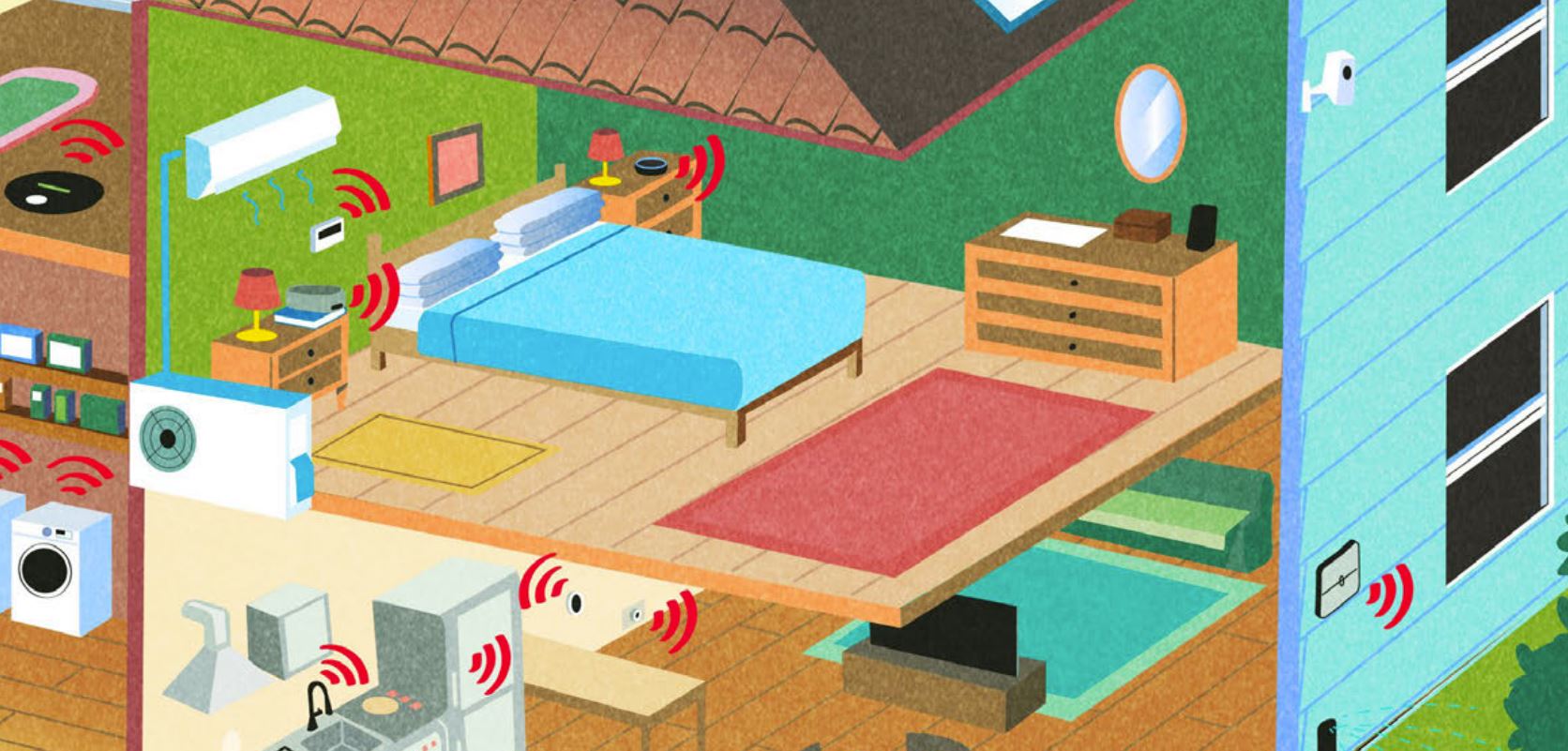

The 27 Best Smart Home Devices

The 27 Best Smart Home Devicesgadgets Innovations ranging from voice-activated faucets to robotic lawn mowers can easily boost your home’s IQ—and create more free time for you.

-

How to Appeal an Unexpected Medical Bill

How to Appeal an Unexpected Medical Billhealth insurance You may receive a bill because your insurance company denied a claim—but that doesn’t mean you have to pay it.

-

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime Membership

Amazon Prime Fees Are Rising. Here’s How to Cancel Your Amazon Prime MembershipFeature Amazon Prime will soon cost $139 a year, $180 for those who pay monthly. If you’re a subscriber, maybe it’s time to rethink your relationship. Here’s a step-by-step guide to canceling Prime.