Should You Invest in the Dogs of the Dow Stocks?

These temporarily out-of-favor stocks can deliver both strong dividend payouts and share-price appreciation in the year ahead.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As an investment strategy, what could be simpler? At the beginning of each year, invest equal amounts in the 10 highest-yielding of the 30 companies in the Dow Jones industrial average. Then sit back, collect your fat dividends, and watch the stock prices of these major American corporations rise, as other investors discover that those high yields were based not just on sweet dividend payouts but on their unfairly depressed prices.

That’s the theory, anyway, behind the Dogs of the Dow.

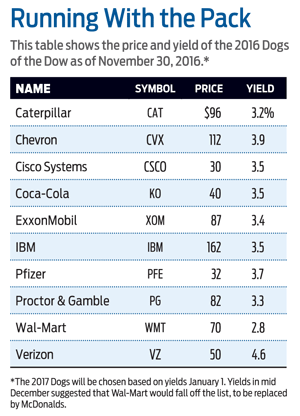

It doesn’t always work to deliver market-beating performance, but in the first 11 months of 2016, the year’s pack produced price gains of 15%—plus an average dividend yield of nearly 4%. And that was before the “Trump rally” drove the stock market to record highs. Over the same period, Standard & Poor’s 500-stock index produced a total return, including dividends, of 9.8%. (In 2015, the Dogs dug out a 2.6% total return compared with just 1.4% for the S&P.) Half of the 2016 group—Chevron, Coca-Cola, ExxonMobil, Procter & Gamble and Wal-Mart—are “dividend aristocrats,” an accolade earned by increasing dividend payments for at least 25 straight years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The 2016 Dogs are presented in the table below and, as the year drew near a close, it appeared the 2017 class will be very similar.

“That constancy is a good thing because it doesn’t alter the leadership of the pack, mainly energy and heavy industry (Exxon, Chevron, Caterpillar) and consumer stuff (Verizon, Coke, Procter & Gamble),” says Jeffrey Kosnett, editor of Kiplinger’s Investing for Income, a monthly sister newsletter devoted to helping subscribers capture the highest cash yields on their investments. “If we get higher incomes and more jobs, and oil and gas activity keeps perking up as we expect, more than half of the Dogs will be front and center.”

Kosnett says the oil-and-gas recovery and strong consumer spending were keys to the Dogs of the Dow’s success in 2016. “This year’s big winner is Caterpillar,” he points out, “with a return of 46.1% through December 1.”

You can find a kennel full of information on the stocks and the strategy at the Dogs of the Dow website, including the composition of the 2017 pack as soon as it is determined and daily pricing and yields.

Investing in the Dogs involves paying commissions on each trade, not only when you initiate your investment but, if you follow the methodology, when you rebalance each year. You’ll sell to realize profits on shares that have been kicked out of the group, often because prices have risen so much that yields no longer make the top 10 list. Because the strategy calls for an equal amount to be invested in each company at the beginning of the year, you’ll also need to do some buying and selling to reset the 10% level for stocks that stay.

An ETF Alternative

You can buy a package of shares that follows a similar recipe for finding high-yielding undervalued stocks with the exchange-traded fund ALPS Sector Dividend Dogs (symbol SDOG). Rather than restricting its search to the 30 companies in the Dow Jones industrial average, the ETF collects the five highest-yielding stocks in each of the 10 sectors of the S&P 500-stock index—consumer discretionary, energy, health care, telecommunications, etc. This gives you broader diversification but the goal is the same: Use high-dividend yields to spot temporarily out-of-favor stocks.

The ETF produced a total return of 34.2% in 2013 and 15% in 2014. It lost 3.2% in 2015 but roared back with a 23% return during the first 11 months of 2016. The fund has a 0.4% expense ratio.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

457 Plan Contribution Limits for 2026

457 Plan Contribution Limits for 2026Retirement plans There are higher 457 plan contribution limits in 2026. That's good news for state and local government employees.

-

Medicare Basics: 12 Things You Need to Know

Medicare Basics: 12 Things You Need to KnowMedicare There's Medicare Part A, Part B, Part D, Medigap plans, Medicare Advantage plans and so on. We sort out the confusion about signing up for Medicare — and much more.

-

The Seven Worst Assets to Leave Your Kids or Grandkids

The Seven Worst Assets to Leave Your Kids or Grandkidsinheritance Leaving these assets to your loved ones may be more trouble than it’s worth. Here's how to avoid adding to their grief after you're gone.

-

SEP IRA Contribution Limits for 2026

SEP IRA Contribution Limits for 2026SEP IRA A good option for small business owners, SEP IRAs allow individual annual contributions of as much as $70,000 in 2025, and up to $72,000 in 2026.

-

Roth IRA Contribution Limits for 2026

Roth IRA Contribution Limits for 2026Roth IRAs Roth IRAs allow you to save for retirement with after-tax dollars while you're working, and then withdraw those contributions and earnings tax-free when you retire. Here's a look at 2026 limits and income-based phaseouts.

-

SIMPLE IRA Contribution Limits for 2026

SIMPLE IRA Contribution Limits for 2026simple IRA For 2026, the SIMPLE IRA contribution limit rises to $17,000, with a $4,000 catch-up for those 50 and over, totaling $21,000.

-

457 Contribution Limits for 2024

457 Contribution Limits for 2024retirement plans State and local government workers can contribute more to their 457 plans in 2024 than in 2023.

-

Roth 401(k) Contribution Limits for 2026

Roth 401(k) Contribution Limits for 2026retirement plans The Roth 401(k) contribution limit for 2026 has increased, and workers who are 50 and older can save even more.