How to Set the Price to Sell Your Home

When selling your home, don't overprice, or you'll scare away prospective buyers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you're planning to sell your home this summer, there's a lot to consider. From cleaning and repairs to hosting open houses and preparing for your move. But before any of that, you'll need to focus on one of the most important steps: setting the right price.

To set the right price on a home, you should combine an objective evaluation of your property with a realistic assessment of market conditions. In good markets and bad, you are more likely to benefit by determining the fair market value (FMV) and sticking close to it than if you set an unrealistic price and wait for a negative buyer response to reevaluate.

As the housing market inches closer to "normal," setting the right price will be even more important.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Housing inventory is up, but sales are slowing

A "normal" housing market is typically considered to have a five to six month supply of inventory. According to the National Association of Realtors, total housing inventory at the end of April stood at 1.45 million units, a 9% increase from March and up 20.8% from the 1.2 million units available a year earlier.

At the current sales pace, that translates to a 4.4 month supply of unsold inventory, up from 4.0 months in March and 3.5 months in April.

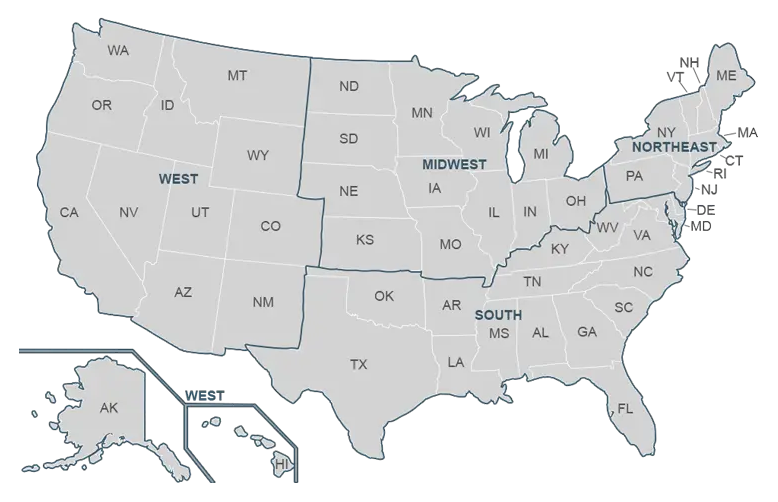

The median price for existing homes in April was $414,000, a 1.8% increase from $406,600 a year ago. Regionally, prices rose in the Northeast and Midwest, while the South and West posted slight declines, reflecting a mixed picture in market conditions across the country.

In the Northeast, existing-home sales dipped 2%. However, the median home price climbed 6.3% year over year to $487,400, the highest among all regions.

The Midwest saw a 2.1% increase in monthly sales, though that figure was still 1% below last year’s pace. The median price rose to $313,300, up 3.6% from April 2024.

In the South, sales were flat from March but fell 3.2% compared to a year ago. The median price in the region was $365,300, a slight decline of 0.1% year over year.

The West experienced the sharpest monthly drop, with sales falling 3.9%. That’s 1.3% below the previous year’s level. Home prices in the region also edged down, with a median price of $628,500, a 0.2% decrease from April 2024.

These shifting market dynamics make it more important than ever for sellers to price their homes realistically from the start.

Don't overprice

The temptation to overprice can be strong. But buyers today are savvy. Chances are anyone who looks at your house — with or without an agent — has spent time both online and offline checking out properties.

Most buyers and real estate agents will know right away if a property is overpriced. This is the main reason homes sit on the market for months, with the price usually coming down to where it should have been from day one.

At an inflated price, your house will be competing against homes that are in a better location and have more bedrooms, bathrooms and square footage. Buyers that would have otherwise bought your home won’t even see it because they are shopping at a lower price point.

By the time a seller wises up, many of their best prospects will have gone elsewhere and bought other houses. This decreases demand by reducing the number of available buyers for the now correctly priced property.

Try RedFin’s home value estimator How much is my house worth? To get an outsider’s opinion of your home’s value and see how it compares to what you think it’s worth.

Study the comparables

Whether you are using an agent or not, you should learn the listing and selling prices of similar properties. Find out how long each took to sell. The local Multiple Listing Services (MLS) is usually the best source of comparable home sales, because the information tends to be the most accurate.

Unless you live in a subdivision where a home builder used similar finishes, layouts and materials in all of the homes, no two housing comps in your neighborhood will be exactly alike — and even when homes are very similar, no comp is perfect.

So how do you identify the best comps? Try to stay as unbiased as possible and set aside your emotional connection to your home and focus on the facts.

A comparable home. To be comparable or comp, the house that sold has to be close to yours in age, style, size, condition and location. When looking at closed sales, try to find at least three comparables no more than six months old or three months old if market values have been rising or falling more rapidly than usual.

When lookin for real estate comps, aim to find homes that meet the following criteria:

- Location. Limit your search to a quarter- to half-mile from your home

- Look back period. Only include homes that have sold within the past three-to-six months — or less if your market is changing quickly

- Size. Try to stay within about 300 square feet of your home’s size

- Bedrooms/bathrooms. Include homes with the same number of bedrooms and bathrooms as your house

- Condition of home. Factor in things like recent renovations, updated interiors, outdated features or necessary repairs

- Age of home. Homes built around the same time as yours will be the most accurate comps, because major systems like roofs, HVAC and plumbing should be in similar condition

- Price per square foot. Real estate agents use price per square foot to identify comparables. Divide the sale price of a home by its square footage, then compare that number to your own desired price per square foot

What is the MLS? MLSs are private databases that are created, maintained and paid for by real estate professionals to help their clients buy and sell property. It’s important to be aware that the MLS isn’t available to the general public. Instead, if you want to access the MLS in your area, you’ll need to have a real estate license. Access to the MLS is one of the main benefits for sellers who use an agent. Not being able to list a home on the MLS can be a significant disadvantage for a for-sale-by-owner (FSBO) seller .

Only use sold homes. Ignore homes that are currently for sale or pending. Why? Sellers can overprice the home and then end up settling for much lower. Or, sellers can price below market value in hopes of drumming up multiple offers with a bidding war. Until a home sale closes, you’ll never get an accurate read on its value in your local market — it’s only worth what someone ends up paying for it

Adjust for seasonality. Wondering when the best time of year to buy a house is? That depends on your local real estate market, but in general, homes sell more quickly in spring and early summer, and they take longer to sell in the winter. Sellers often try to motivate buyers in slower seasons with a lower sale price, so keep seasonality in mind as you price your home.

Get an appraisal

If you haven’t done so already, give serious consideration to hiring a local appraiser. The appraiser will be able to give you a professional estimate of your home’s value. The appraisal gives you useful information about the property.

It describes what makes it valuable and may show how it compares to other properties in the neighborhood. This helps to ensure that the price you are asking is not way out in left field and unrealistic.

It’s best that you have an accurate picture of what your home could sell for by finding a qualified appraiser in your area before you list a home. A useful site is the Appraisal Institute, where you can search for qualified appraisers in your area. The median price for a typical, single-family home appraisal is $500, according to the National Association of Realtors.

An appraiser determines value by looking at important aspects of the home, such as the square footage and the overall condition of the house. The number of bathrooms or bedrooms can also greatly influence an appraisal, as well as comps in the area.

Bottom line

Pricing your home can be tricky. You have to be careful to not let emotions get in the way of being honest about the fair market value of your home. Your memories are priceless, but they don't add value to a home.

Deliberately over- or under- pricing a home is risky. This strategy could make you look either unrealistic or desperate. Underpricing can backfire and result in losing thousands of dollars if your strategy is not timed right, or buyers don’t respond with competing bids.

If you're overpriced, the house might sit on the market and the listing could go stale. If a buyer is willing to overpay, overpriced houses typically appraise for less, and you'll be forced to either lower the price anyway, or put your house back up for sale after the buyer goes to find another home.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Donna joined Kiplinger as a personal finance writer in 2023. She spent more than a decade as the contributing editor of J.K.Lasser's Your Income Tax Guide and edited state specific legal treatises at ALM Media. She has shared her expertise as a guest on Bloomberg, CNN, Fox, NPR, CNBC and many other media outlets around the nation. She is a graduate of Brooklyn Law School and the University at Buffalo.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Is the Housing Market's 'Lock-In Effect' Finally Starting to Ease?

Is the Housing Market's 'Lock-In Effect' Finally Starting to Ease?As mortgage rates stabilize and fewer owners hold ultra-low loans, the lock-in effect may be losing its grip.

-

What to Watch for When Refinancing Your Home Mortgage

What to Watch for When Refinancing Your Home MortgageA smart refinance can save you thousands, but only if you know how to avoid costly pitfalls, calculate true savings and choose the right loan for your goals.

-

Builders Are Offering Big Mortgage Incentives — What Homebuyers Should Watch For

Builders Are Offering Big Mortgage Incentives — What Homebuyers Should Watch ForBuilder credits and below-market mortgage rates can ease affordability pressures, but the savings often come with trade-offs buyers should understand before signing.

-

Trump Signals Plan to Ban Institutional Investors From Buying Single-Family Homes

Trump Signals Plan to Ban Institutional Investors From Buying Single-Family HomesThe president says the move could improve housing affordability. Here’s what the data show about investor ownership, recent buying trends and what it could mean for homebuyers.

-

How Much Income You Really Need to Afford a $500,000 Home

How Much Income You Really Need to Afford a $500,000 HomeAs home prices increase, the income needed for a house is also climbing. We break down what you need to earn to afford a $500,000 home.

-

How Much Would a $50,000 HELOC Cost Per Month?

How Much Would a $50,000 HELOC Cost Per Month?Thinking about tapping your home’s equity? Here’s what a $50,000 HELOC might cost you each month based on current rates.

-

Should You Tap Your Home Equity Before 2026?

Should You Tap Your Home Equity Before 2026?As borrowing rates and tax law shifts converge, here's what homeowners need to know before pulling equity out of their home.

-

What to Know About Portable Mortgages

What to Know About Portable MortgagesA closer look at how portable mortgages would work, who might benefit and why the concept is gaining attention amid high rates and limited supply.