Balancing Safety and Affordability: Florida’s Condominium Reform Enters a New Chapter

As robust inspections and reserve mandates remain, the state legislature introduces flexibility to ease financial burdens on condo owners.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you own a condominium in Florida, you’re probably familiar with the state requirements that went into effect after the 2021 Surfside condominium collapse.

While those laws were created to enhance safety, they also brought significant financial and logistical challenges for condo owners. The 2025 Florida condo reform bill, which took effect July 1, aims to ease those burdens while preserving key requirements for inspections and reserve funding.

Steep HOA fee increases and surprise repair costs left many condo owners struggling to keep up, fueling concerns about affordability and weakening buyer demand. The new reforms are designed to ease financial pressure and reduce uncertainty for owners while still upholding essential safety measures, creating a more sustainable path forward for Florida’s condo communities.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

What the 2022 Florida condo law required

The 2022 Florida condo law introduced new requirements for licensed inspections, financial disclosures and reserve fund contributions:

- More inspections were required. For example, buildings occupied before 1992 needed to receive a milestone inspection by December 31, 2024. If structural repairs were needed, condo owners had to fund those repairs.

- In addition to requiring milestone inspections, the law required that those inspections be reported to local authorities, condo unit owners and the public, such as when a condo was listed for sale.

- Building associations were also required to budget and collect funds to cover maintenance, such as the cost of a new roof or elevator repairs. That requirement meant that some condo owners faced financial difficulty in paying for repairs while also saving funds for future maintenance.

These requirements not only made owning a condo more complex but also significantly more expensive. Although nearly 2 million people live in Florida condominiums, the added financial pressure contributed to a slowdown in the market.

By 2025, condo sales had dropped, prices declined and demand weakened. Many homeowners associations (HOAs) were forced to raise fees in order to meet the state’s new funding mandates for repairs and maintenance, further increasing the cost of ownership and putting added strain on residents.

How the 2025 condo reform bill eases the burden

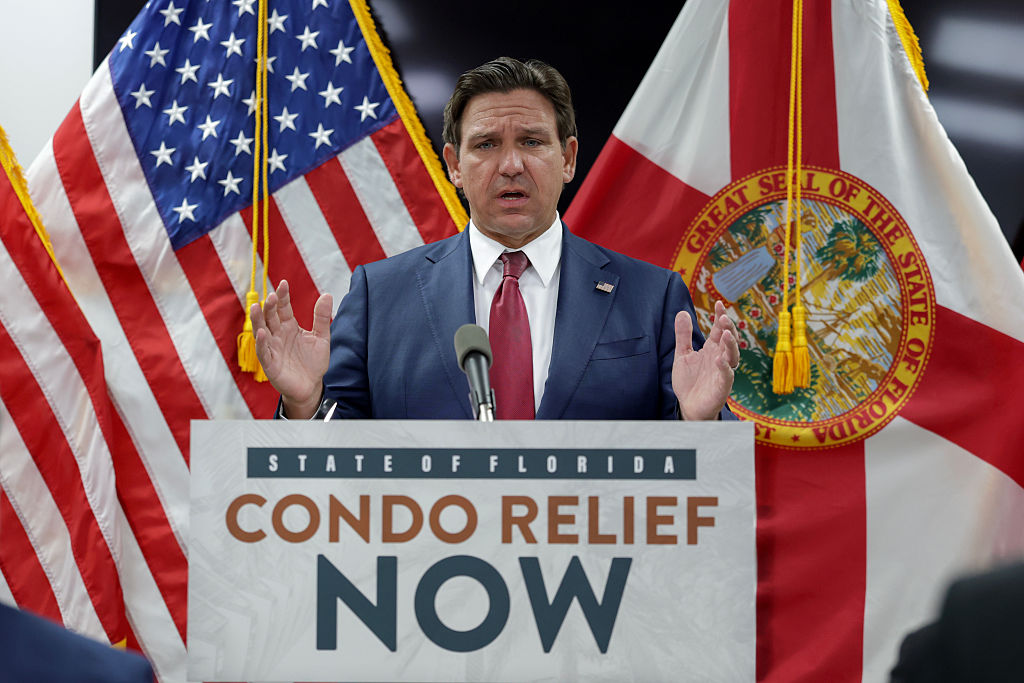

On June 23, Florida Governor Ron DeSantis signed the condo reform bill 2025 to provide relief to condo owners. "Today in Clearwater, I signed legislation to deliver much-needed relief to condo owners across Florida," DeSantis said. "We’ve heard the concerns of condo owners throughout Florida, and we are delivering reforms that will provide financial relief and flexibility, strengthen oversight for condo associations and empower unit owners."

The legislation includes House Bill 913 and HB393.

HB 913 makes several valuable improvements for condo owners:

- Increased reserve funding flexibility means that after associations have performed a milestone inspection and are working on critical repairs, they can pause contributing to their reserve fund for up to two years.

- Rather than having to rely on reserve funds to make repairs, condo associations can explore alternate funding options, like loans or lines of credit.

- Boards and unit owners can terminate contracts if a manager doesn’t follow the state’s condo laws.

- Association managers whose license is revoked by the Department of Business and Professional Regulation cannot hold roles in management firms or be licensed for 10 years.

- Associations must provide more information and records online, so residents can easily access records for their condo’s management.

HB 393 focuses on the My Safe Florida Condo Pilot Program and introduces several important updates. Among its key changes, the legislation:

- Changes the eligible improvements to include replacement of the condo roof covering

- Restricts the program eligibility to buildings that are three or more stories tall and that contain at least two single-family dwellings

Those changes still prioritize condo safety, but they give condo associations and owners more flexibility, especially when it comes to the financial demands of owning and maintaining a condo.

Structural integrity studies and inspection requirements remain in place to help prevent future tragedies like the Surfside collapse. However, the reforms aim to ease the financial strain created by the 2022 law.

With more options for funding repairs and contributing to reserve accounts, HOAs may no longer need to raise fees as aggressively, potentially offering much-needed relief for condo owners.

What Florida condo owners can expect next

With new reforms in place, Florida condo owners may begin to see a better balance between safety and affordability. While key inspection and maintenance requirements remain, the added financial flexibility could ease HOA fee pressures and make condo ownership more manageable. As these changes take hold, the market may stabilize, restoring confidence for both current owners and potential buyers.

Explore your options and compare some of today's best home insurance offers with the tool below, powered by Bankrate:

related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Paige Cerulli is a freelance journalist and content writer with more than 15 years of experience. She specializes in personal finance, health, and commerce content. Paige majored in English and music performance at Westfield State University and has received numerous awards for her creative nonfiction. Her work has appeared in The U.S. News & World Report, USA Today, GOBankingRates, Top Ten Reviews, TIME Stamped Shopping and more. In her spare time, Paige enjoys horseback riding, photography and playing the flute. Connect with her on LinkedIn.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?Learn how timing matters when it comes to choosing the right account.

-

The High Cost of Sunshine: How Insurance and Housing Are Reshaping Snowbird Living

The High Cost of Sunshine: How Insurance and Housing Are Reshaping Snowbird LivingThe snowbird lifestyle is changing as insurance and housing costs climb. Here’s how retirees are adapting and where they’re choosing to go.

-

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your Retirement

How to Turn Your 401(k) Into A Real Estate Empire — Without Killing Your RetirementTapping your 401(k) to purchase investment properties is risky, but it could deliver valuable rental income in your golden years.

-

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.

We're 62 With $1.4 Million. I Want to Sell Our Beach House to Retire Now, But My Wife Wants to Keep It and Work Until 70.I want to sell the $610K vacation home and retire now, but my wife envisions a beach retirement in 8 years. We asked financial advisers to weigh in.

-

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.

We Inherited $250K: I Want a Second Home, but My Wife Wants to Save for Our Kids' College.He wants a vacation home, but she wants a 529 plan for the kids. Who's right? The experts weigh in.