Stocks to Energize Your Portfolio

Energy stocks that have performed poorly in recent years have now started to perk up. Buy some, but don’t go nuts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If the energy sector tempted you to invest 10 years ago, you would have done better putting your cash under the mattress. The MSCI USA IMI Energy index lost an average of 0.2% per year over the past decade. That compares with a yearly return of 8.5% for MSCI's overall U.S. stock market index. And energy stocks were one-third more volatile than the market as a whole. High risk, low reward—not a great formula for investors. (Prices and returns are as of May 18.)

But energy stocks that have performed poorly in recent years have now started to perk up and represent good opportunities. Don't go nuts, but do buy some. For much of the sector, stock values are linked closely to the prices for oil and gas, and lately those have been rising.

Oil's wild ride. Over the past decade, the price of oil has been sloshing around. Consider Brent crude oil, used as the benchmark for about two-thirds of global contracts (the other popular benchmark is West Texas Intermediate, or WTI). Brent, which comes from oil fields in the North Sea, is petroleum that has light and sweet (low-density and low-sulfur) characteristics that make it relatively easy to refine. At the peak of the global economic boom in the summer of 2008, a barrel (42 gallons) of Brent peaked at a little over $140. When the recession hit, Brent dropped to $34. Brent has never returned to its giddy, prerecession heights, but it was back above $100 by early 2011. Other sharp downs and ups have followed, and today it is about $79.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

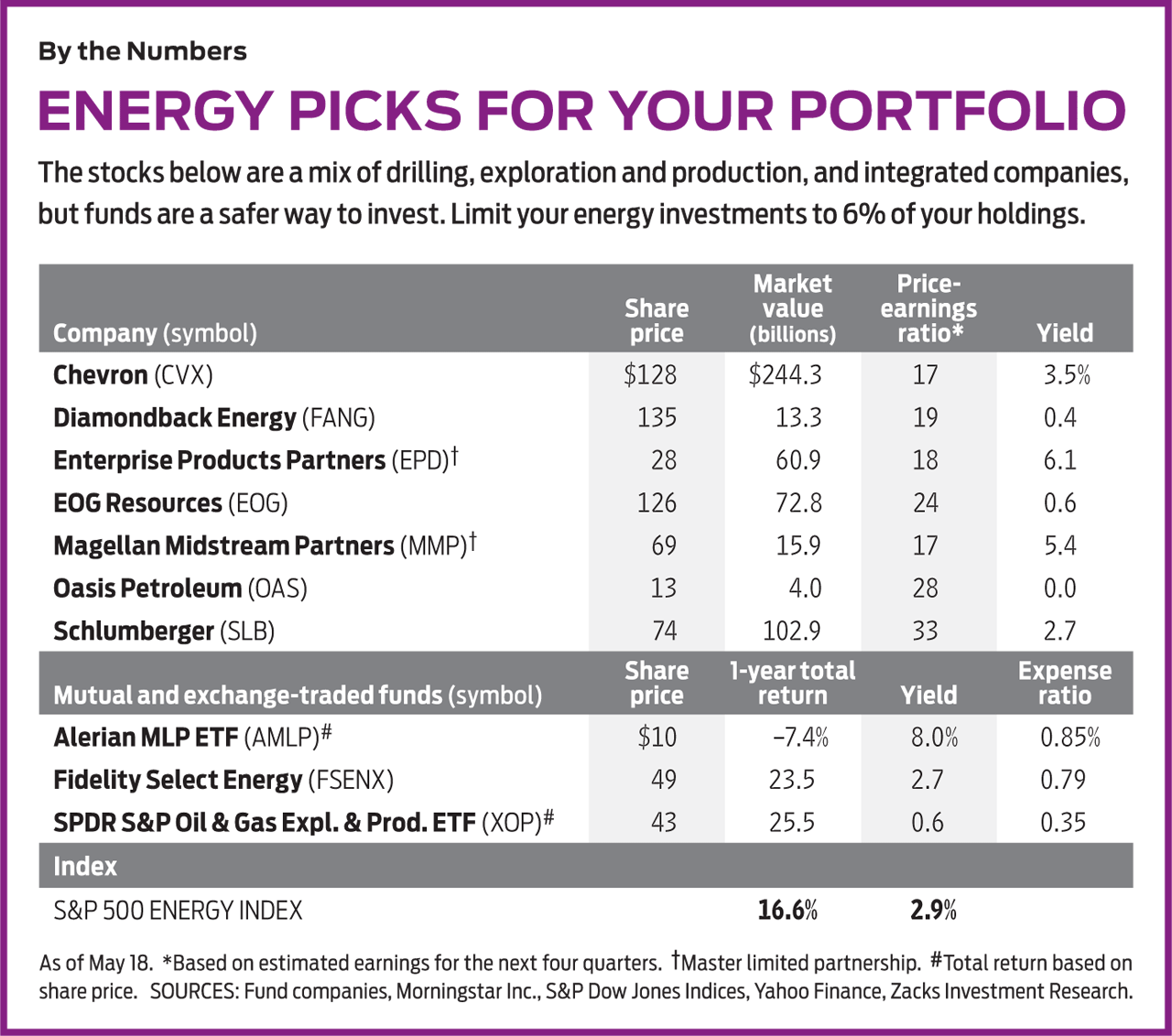

Why the volatility? Demand has bounced around as global economic growth has waned and waxed. China's growth rate fell sharply from 2010 to 2015 and has since leveled off at about 7%. U.S. and European growth have increased, but no one knows how long the expansion will last. Also, new technology has boosted supply because it's easier to extract both oil and gas—through horizontal drilling and fracking—with the U.S. leading the way. In 2017, the U.S. was the world's top oil producer. Finally, the decision by President Trump to exit the nuclear treaty with Iran, the world's number-five oil producer last year, could reduce Iran's production. To see the effects of these forces on energy-stock prices, consider a company such as Schlumberger (symbol SLB, $74), the Houston-based provider of broad services for oil-and-gas exploration companies. (Stocks I like are in bold.) Schlumberger, with a market capitalization (price times shares outstanding) of $103 billion, is the third-most-valuable U.S. energy company of any kind, and its stock is a good indicator of the health of the energy industry in general.

When oil and gas prices are down and prospects are gloomy, drilling slows substantially. An oil driller can shut down rigs, and oil-services firms suffer accordingly. As crude-oil prices rose sharply in 2014, Schlumberger's stock price soared to a record $118. Oil prices then collapsed, and Schlumberger fell, too—down to $61 last November. More recently, the stock has rallied, though not by much. In mid May it traded 37% below its high of four years ago.

Oil-and-gas exploration and production (E&P) companies, which find the oil and gas and extract it, have followed a similar pattern—though, for many, the volatility has been even more extreme. Shares of Oasis Petroleum (OAS, $13)—an oil-and-gas producer with resources in Montana, North Dakota and Texas—jumped 51% in just a month following a first-quarter rise in production and a spike in the average price of petroleum sold. Still, the stock is 77% below its 2014 high.

A third, and more diversified, kind of energy company—with upstream (finding and producing), midstream (transporting) and downstream (refining and selling to consumers) operations—tends to be less volatile. When oil prices fall, so do upstream profits, but downstream profits can rise as consumers boost demand for cheaper gasoline. Examples of these integrated energy companies are ExxonMobil (XOM, $81) and Chevron (CVX, $128), the two largest firms in the sector.

Guessing the future price of oil is tough, but people try. Goldman Sachs sees Brent peaking at $83 by the end of July, then falling back to $75—a big increase from $45 in mid 2017. A better question is whether energy stocks are appropriately priced. In general, they seem undervalued because the increases in stock prices haven't caught up with the increases in Brent prices.

If you don't have energy in your portfolio, this is a good time to buy—and hold—the sector. Energy currently represents 6% of Standard & Poor's 500-stock index, and that's about how much you should own, too.

Best ways to buy. Sector exchange-traded funds or mutual funds are the safest ways to invest. One problem with most index-based ETFs is that they are too heavily weighted toward Exxon and Chevron. A good alternative is SPDR S&P Oil & Gas Exploration & Production (XOP, $43), which holds 69 E&P stocks that are roughly equally weighted, with none exceeding 3% of assets. I also like Fidelity Select Energy (FSENX), a managed fund that does have 8% in Chevron but also has 7% in EOG Resources (EOG, $126), a large global E&P firm, and 5% in Diamondback Energy (FANG, $135), a hugely successful U.S. producer. (Diamondback's stock has returned 32.6% over the past 12 months, while the average E&P stock has returned 27.7%.) The Fidelity fund's drawback is an expense ratio of 0.79%, compared with 0.35% for the SPDR.

Another way to invest is through a master limited partnership. MLP shares, or units, trade like stocks, but similar to real estate investment trusts, MLPs do not pay corporate taxes and instead transfer the liability directly to unit holders. MLPs generally make good-size distributions, consisting of both returns of capital and earnings, on a regular basis to unit holders—though, of course, the payouts are not guaranteed.

MLPs also generate pesky K-1 tax forms for you to file each year. But that's not a problem with one popular ETF called Alerian MLP (AMLP, $10). It holds parts of 26 separate energy-infrastructure MLPs, including Magellan Midstream Partners (MMP, $69), which owns the country's longest pipeline network, and Enterprise Products Partners (EPD, $28), a longtime favorite of mine.

Alerian MLP has underperformed other energy stocks lately for two reasons: First, as a longer-term infrastructure play, its price is not so closely linked to short-term movements in the price of oil (whose direction recently, of course, has been up), and, second, the new tax law was more helpful to conventional corporations than to MLPs. But I expect that the ETF will bounce back, and it's a good long-run pick. The current yield is a whopping 8.0%.

No, I didn't mention renewable-energy investments, such as solar power and wind. Oil and gas represent 63% of all U.S. energy consumption. That will change, but not for a while.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

5 Big Tech Stocks That Are Bargains Now

5 Big Tech Stocks That Are Bargains Nowtech stocks Few corners of Wall Street have been spared from this year's selloff, creating a buying opportunity in some of the most sought-after tech stocks.

-

How to Invest for a Recession

How to Invest for a Recessioninvesting During a recession, dividends are especially important because they give you a cushion even if the stock price falls.

-

10 Stocks to Buy When They're Down

10 Stocks to Buy When They're Downstocks When the market drops sharply, it creates an opportunity to buy quality stocks at a bargain.

-

How Many Stocks Should You Have in Your Portfolio?

How Many Stocks Should You Have in Your Portfolio?stocks It’s been a volatile year for equities. One of the best ways for investors to smooth the ride is with a diverse selection of stocks and stock funds. But diversification can have its own perils.

-

An Urgent Need for Cybersecurity Stocks

An Urgent Need for Cybersecurity Stocksstocks Many cybersecurity stocks are still unprofitable, but what they're selling is an absolute necessity going forward.

-

Why Bonds Belong in Your Portfolio

Why Bonds Belong in Your Portfoliobonds Intermediate rates will probably rise another two or three points in the next few years, making bond yields more attractive.

-

140 Companies That Have Pulled Out of Russia

140 Companies That Have Pulled Out of Russiastocks The list of private businesses announcing partial or full halts to operations in Russia is ballooning, increasing economic pressure on the country.

-

How to Win With Game Stocks

How to Win With Game Stocksstocks Game stocks are the backbone of the metaverse, the "next big thing" in consumer technology.