Kiplinger's 2014 Stock Market Outlook: More Gains

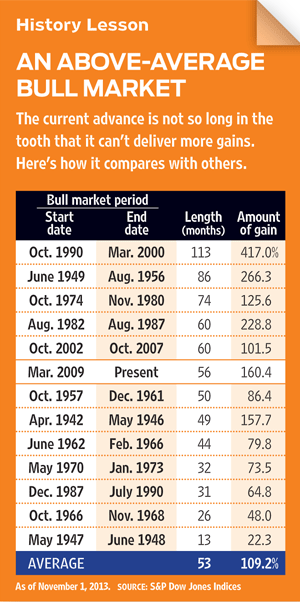

Five years into a powerful bull market, there seems to be little on the horizon to cheer up the bears.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The march to record highs came despite hurdles that might have tripped up lesser bulls. First came a scare courtesy of hints that the Federal Reserve was about to remove the easy-money punchbowl that has kept this party going. That was followed by a government shutdown and then the threat of a U.S. debt default. What’s more, the stock market’s gains materialized despite a lackluster year for corporate profits, often considered the market’s main engine.

So the phenomenal rally raises the question: Where is the market getting its strength? And more important, can this aging bull continue to run? Our answer: Don’t give up on the bull yet—it may be younger than it looks. “We don’t see a bear market coming,” says Henry Smith, chief investment officer of Haverford Trust. “We believe that March 2009 represented a generational low, and that this is the middle of a sustained bull market.”

Another year of gains will be supported by stronger economic and corporate underpinnings, and, just as important, improving sentiment among investors. By most measures, stocks are fairly priced, if not bargains. Given expected earnings growth of nearly 10% in 2014, we think stock prices could rise that much and perhaps more if investors again prove themselves willing to pay more for each dollar of corporate profits, ratcheting up the market’s price-earnings ratio. A reasonable range to expect would be 8% to 12% returns, including dividends. An 8% price gain would put the S&P 500 in the vicinity of 1,944, translating into roughly 17,300 on the Dow Jones industrial average; a 10% gain would put the S&P 500 at 1,980, the Dow a bit over 17,600. With dividends, the S&P’s returns could reach 12%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Despite the wounds inflicted by squabbling lawmakers in Washington, the U.S. economy will continue to improve in 2014, with gross domestic product growing 2.6%, up from our estimate of 1.5% in 2013. For the first time since the Great Recession, consumers will see wages grow faster than inflation, with personal income rising at least 3.5% and inflation about 2%. Companies will continue to add to payrolls, with the unemployment rate fluctuating between 6.9% and 7.2% as more people decide to resume searching for work. To keep the economic wheels greased, the Fed will likely keep short-term interest rates near zero until 2015, but longer-term rates will rise as investors begin to anticipate an acceleration of economic growth. Look for the benchmark ten-year Treasury bond to end 2014 with a yield of 3.3%, up from 2.8% today.

Housing is a pocket of economic strength, with new-home sales expected to jump 16%. Outside the U.S., exports could rise by 4% as Europe’s economy convalesces and China’s slowdown levels out. Economists at IHS Global Insight expect global economic growth of 3.3% in 2014, up from an expected 2.4% in 2013. Among the challenges in the U.S. will be the fiscal uncertainty that bleeds into early 2014 as Congress wrangles with the level of government spending and with raising the debt ceiling (also known as giving Uncle Sam the wherewithal to pay his IOUs).

But the Federal Reserve holds the real wild card. Most Fed watchers expect the central bank to begin cutting back its massive, $85-billion-per-month bond-buying program in the first quarter. Last summer, the market swooned at mere rumors that the Fed was set to taper its stimulus. Dan Morris, global investment strategist for TIAA-CREF, notes that from the time the Fed’s two previous “quantitative easing” programs ended (in March 2010 and June 2011) until the next easing program was hinted at, the S&P 500 fell 9% and 12%, respectively. At taper time, “the markets will take fright, yields will go up, there’ll be volatility,” Morris says. “You could see a 10% correction, but people need to ride through it.”

The upside of fed tightening

That’s because tapering won’t commence until the economy is robust enough to withstand it. Recall the surprise when the Fed confounded market expectations by not tapering last September. The implication, says BMO Capital Markets strategist Brian Belski, is that tapering won’t begin until “there is incontrovertible evidence that the economy has reached escape velocity.” And you can expect much the same Fed policy to continue when Janet Yellen moves from board member to chairman early in 2014.

When it comes to corporate earnings, investors should focus less on absolute growth rates and more on the nature of the profits. After strong gains at the start of a recovery, it’s not unusual for earnings growth rates to flatten out. But a profit peak is still years away, says Christopher Hyzy, chief investment officer of U.S. Trust. Conspicuously missing from the profit picture in recent years has been a convincing pickup in revenues; instead, companies have engineered big chunks of profit gains through relentless cost-cutting. That could change in 2014 as consumer and business demand for goods and services finally picks up, and sales become a greater factor in driving profits. The period “is likely to be characterized as the dawn of a new business cycle,” Hyzy says.

[page break]

Growing confidence

Investors certainly have been willing to pay more for their share of corporate profits. A year ago, the S&P 500 commanded a price that was about 13 times the average estimated per-share earnings of its constituents for the year ahead. Now, the S&P trades at nearly 15 times estimated 2014 earnings. A higher P/E reflects investors’ growing willingness to gamble on stocks relative to other assets—particularly bonds. “As we move past the credit crisis and have seen earnings growth and positive market returns, investors are regaining faith in the viability of stocks as an asset class,” says Savita Subramanian, stock market strategist for BofA Merrill Lynch Global Research. “And the quality of corporate balance sheets today is unparalleled, which also warrants higher price-earnings multiples,” she adds. Click here to read our interview with Subramanian.

The shift in sentiment is a key driver for stocks. “We’re slowly starting to rebuild confidence,” says Haverford’s Smith. “This is the first time since the bull market began that there isn’t a constant concern about the next calamity, the next disaster, the next so-called black swan event—which, by definition, rarely comes along. We’ve got a long way to go before we need to worry about fear turning into greed.”

Indeed, a price-earnings ratio of 15 is only about average for the past 30 years, and it’s below the average of 16.5 for the past 15 years. (It is light-years away from the P/Es that reached 25 and higher in the early ’00s.) How high is too high for an overall market P/E? When stocks start trading at 18 times estimated earnings, it’s time to worry—or at least to tread carefully.

For now, it’s a mistake to confuse a bullish mind-set with the euphoria that often signals a market top. But pullbacks are an inevitable part of bull markets, and we’re overdue for one, with the last significant decline having ended in October 2011. Among the red flags that bear watching: the deluge of money into stock mutual funds and exchange-traded funds—$304 billion more than has come out of the funds so far this year through late November, according to market research firm TrimTabs. That sign of growing investor optimism more than reverses net outflows of $123 billion from 2008 through 2012, says TrimTabs CEO David Santschi. “Flows are heavy enough to be worrisome, but they’re a cautionary sign, not a sure sign of a top.”

But surveys by the American Association of Individual Investors show optimism waxing and waning, with 34% of investors recently surveyed saying they were bullish, compared with 49.2 percent a month earlier. The long-term average is 39%. And pros remain notably cautious, according to a monthly survey of Wall Street strategists by Bank of America Merrill Lynch. Normally, strategists recommend an average portfolio allocation of 60% to 65% stocks; during the market peak in 2000 they recommended close to 70%. In the most recent survey, the average stock recommendation was 53%, suggesting that on Wall Street, anyway, exuberance is not yet irrational.

Still, investors need to weigh carefully where to put their money, and portfolios probably need a little tweaking in 2014. Shifting more money into stocks than bonds is appropriate as yields grind higher and bond prices move in the opposite direction. But don’t give up on bonds altogether. Mike Wilson, chief investment officer at Morgan Stanley Wealth Management, entered 2013 recommending that clients who can tolerate moderate risk keep 55% of their assets in stocks and 45% in bonds and cash, then shifted to a 65%-35% split last spring, with the fixed-income allotment focused on short-term maturities and corporate debt.

Within your stock holdings, reexamine your notion of safety, says Russ Koesterich, chief investment strategist at BlackRock. Until recently, risk-averse investors flocked to stocks with low volatility and high, secure dividends, including phone companies, makers of consumer staples (the stuff we use every day, from soap to cereal) and utilities. But in a period of economic growth and rising interest rates, those now-expensive “bond proxies” become the risky holdings. “If the market is under pressure because rates are going up, utilities are the worst place to hide,” says Koesterich. Likewise, sectors traditionally thought of as defensive will lag behind stocks that are more sensitive to economic swings—for example, industrial, manufacturing, commodity, technology and energy companies.

[page break]

These “cyclical” stocks have left defensive issues in the dust. From the start of May through early November, cyclicals as a group rose 13%, and defensive stocks just 0.9%, according to BMO Capital Markets. In the near future, cyclicals will benefit from gains in global economic growth, but longer-term themes bode well, too. A manufacturing renaissance is boosting exports and bringing overseas production to the U.S. as it becomes more cost-competitive. Growing supplies of natural gas particularly benefit chemical companies, including Dow Chemical (symbol DOW) and Westlake Chemical (WLK). Low-cost energy producers will also thrive. Scott Armiger, chief investment officer at Christiana Trust, thinks patient investors will be rewarded with shares in Ultra Petroleum (UPL).

Subramanian is a big fan of industrials. She says that although they are often painted as poster children for the old economy, they are among the nation’s most innovative concerns in terms of harnessing data and technology, while also boasting remarkably stable earnings and dividend growth. Industrials she thinks are worth a look include Emerson Electric (EMR) and Illinois Tool works (ITW); analysts at Standard & Poor’s highlight Fluor (FLR) and Jacobs Engineering (JEC). Investors who want exposure to an array of companies can explore Fidelity Select Industrials (FCYIX), a mutual fund, or a low-cost exchange-traded fund, such as Industrial Select Sector SPDR (XLI).

See more stocks with promise in our slide show of 24 Stock Picks for 2014

As long as economic growth remains tepid, you might prefer a mix of cyclical and defensive holdings. Haverford’s Smith likes big drug makers, including two foreign-based, multinational outfits: Sanofi (SNY) and Novartis (NVS). Big Pharma is emerging from a period of subpar performance that goes back more than a decade as companies struggled with a slew of patent expirations. Investors don’t yet appreciate that years of research are about to pay off, Smith says.

Investors who’ve stayed close to home with their money should look overseas again. U.S. stocks may now be “too much of a good thing” in many portfolios, says Koesterich. He recommends that 10% to 20% of stock holdings be invested in European shares and 5% to 8% in Japanese shares. He views those stocks as more reasonably priced than U.S. shares despite generous overseas gains already. Oakmark International (OAKIX) has stakes in both regions. Another good choice: Dodge & Cox International (DODFX), one of the Kiplinger 25. Expect emerging markets to remain dicey and volatile.

What could stall the charging bull? The usual suspects: disappointing employment trends, economic setbacks in Europe or China, geopolitical turmoil in the Middle East, dysfunction in Washington. And, for the first time in a long while, there’s another risk: that too many investors will start believing again too quickly.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Farmers Brace for Another Rough Year

Farmers Brace for Another Rough YearThe Kiplinger Letter The agriculture sector has been plagued by low commodity prices and is facing an uncertain trade outlook.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAA

Over 65? Here's What the New $6K Senior Tax Deduction Means for Medicare IRMAATax Breaks A new tax deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

How Inflation, Deflation and Other 'Flations' Impact Your Stock Portfolio

How Inflation, Deflation and Other 'Flations' Impact Your Stock PortfolioThere are five different types of "flations" that not only impact the economy, but also your investment returns. Here's how to adjust your portfolio for each one.

-

Why I Still Won't Buy Gold: Glassman

Why I Still Won't Buy Gold: GlassmanOne reason I won't buy gold is because while stocks rise briskly over time – not every month or year, but certainly every decade – gold does not.

-

Should You Use a 25x4 Portfolio Allocation?

Should You Use a 25x4 Portfolio Allocation?The 25x4 portfolio is supposed to be the new 60/40. Should you bite?

-

Retirement Income Funds to Keep Cash Flowing In Your Golden Years

Retirement Income Funds to Keep Cash Flowing In Your Golden YearsRetirement income funds are designed to generate a reliable cash payout for retirees. Here are a few we like.

-

10 2024 Stock Picks From An Investing Expert

10 2024 Stock Picks From An Investing ExpertThese 2024 stock picks have the potential to beat the market over the next 12 months.

-

Special Dividends Are On The Rise — Here's What to Know About Them

Special Dividends Are On The Rise — Here's What to Know About ThemMore companies are paying out special dividends this year. Here's what that means.

-

How to Invest in AI

How to Invest in AIInvestors wanting to know how to invest in AI should consider these companies that stand to benefit from the boom.

-

Why I Still Like Emerging Markets

Why I Still Like Emerging MarketsPeriods of global instability create intriguing possibilities in emerging markets. Here are a few.