Jeffrey Gundlach: The Bond Fund Rock Star

DoubleLine’s Jeffrey Gundlach is the fixed-income guru you’ve probably never heard of. But you should listen to what he says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When Jeffrey Gundlach talks, people listen. The colorful and dynamic fund manager isn’t a household name, but to the cognoscenti of the fixed-income world his word is gold, and they tune in to his regular webcasts to hear Gundlach’s view of the markets and the economy.

Why? Because he’s a brilliant bond investor. Gundlach called the subprime mortgage market an “unmitigated disaster” in June 2007, more than a year before the worst losses of the financial crisis hit. In mid 2016, he correctly predicted that 10-year Treasury interest rates would begin to rise, while others expected them to fall. And he’s steered his most popular funds, DoubleLine Total Return Bond (a longtime Kiplinger 25 member) and DoubleLine Core Fixed Income, to the top of the charts, posting five-year annualized returns that beat 90% of their peers and the bond benchmark, the Bloomberg Barclays U.S. Aggregate Bond index.

But Gundlach, a DoubleLine founder and its chief executive and chief investment officer, is a good listener, too.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Every month, 40 investment team members gather in the so-called Warhol room in DoubleLine’s downtown Los Angeles office (an Andy Warhol original hangs there). It’s the firm’s biggest conference room, but at these meetings, it’s standing room only. The team, led by Gundlach, is there to discuss how the firm’s money will be best put to work in the bond market.

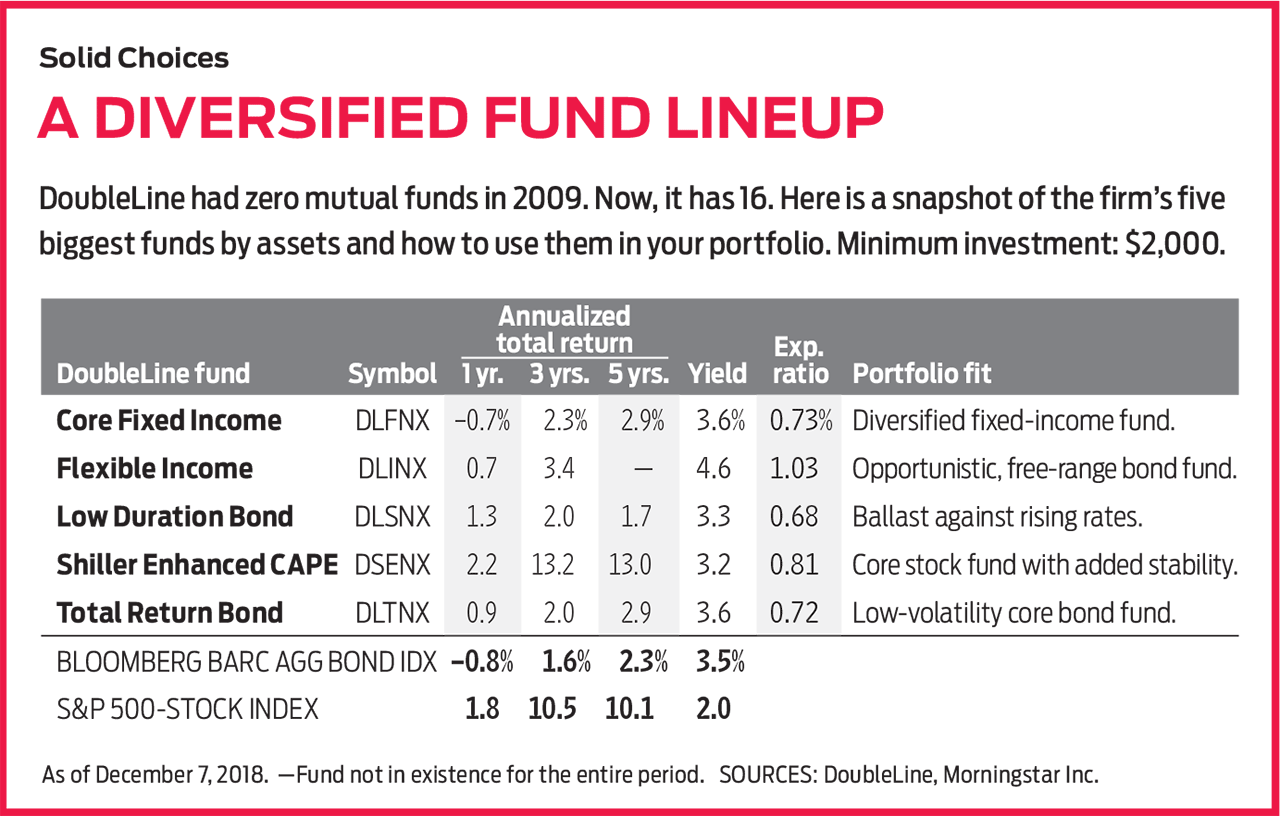

The meeting is a window on the strategy of an actively managed fund shop that, for the most part, is beating its benchmarks—a rarity in the investing world. Of the six DoubleLine funds with five-year track records, four portfolios—Core Fixed Income, Low Duration Bond, Shiller Enhanced CAPE and Total Return Bond—outpaced their bogeys over the past five years on an annualized basis.

The gathering also offers a glimpse into the company’s culture. “Whoever wants to come can come,” says Bill Campbell, who manages the DoubleLine Global Bond fund with Valerie Ho. “Everyone has a voice,” says Jeffrey Sherman, deputy chief investment officer. More important, Gundlach wants to hear what they have to say. “Jeffrey wants people to speak up and hash it out,” says Campbell. “No question is a bad question, and no comment is a bad comment.”

The talk is mostly about the economy and bonds. Is it time to lighten up on high-yield corporate debt and focus on bank loans? Do foreign bonds look more attractive? Any signs of a recession on the horizon? “We’re trying to collectively identify a trend,” says Sherman. “What’s the opportunity set for the next year to two years, and where do we want to be invested?”

Since the middle of 2016, the firm’s view of the bond market has been mostly negative. “DoubleLine is cautious right now,” says Robert Cohen, who comanages the firm’s investments in corporate debt. The crux of the bleak outlook is rising interest rates, which are a drag on bond prices (prices and interest rates move in opposite directions). Gundlach predicts that the 10-year Treasury yield will be 6% by 2021, up from 2.9% recently.

It’s serious stuff, but the meeting is fun, too. “There’s debate and some wit,” says Andrew Hsu, DoubleLine Infrastructure Income comanager. The team reviews a string of technical charts that appear on a large-screen TV in the room. Occasionally an image of a random work of art turns up instead. Then Gundlach, a major collector, has to name the artist. “He nails it every time,” says Hsu.

A Rocky Start

DoubleLine had a dramatic beginning. In 2009, Gundlach was already a bond industry standout when he was unceremoniously fired from fund company TCW for allegedly plotting to start his own firm, taking clients and firm secrets with him. Gundlach, now 59, denies this. But a week or so after he was terminated, he and others from TCW launched DoubleLine. A month later, the firm had just 45 employees, a little more than $1 billion in assets (not enough to generate the fees required to cover salaries) and no mutual fund.

Today, assets have climbed to $123 billion, and DoubleLine has 239 employees, 16 mutual funds and dozens of other investment products. Along the way, Barron’s dubbed Gundlach the “King of Bonds.” He’s a throwback to the days when star fund managers were rock stars.

Gundlach actually played drums in a rock band before he joined the investment world. Now he’s a billionaire with an art collection to match. “I have one of the biggest art collections in the country in terms of importance,” he says. Some of it hangs in DoubleLine’s offices—in the hallways and in conference rooms dubbed the Calder, Judd, Mondrian, Van Gogh and Warhol rooms. There’s a Gundlach original, too. He painted the DoubleLine logo that hangs in the firm’s reception area in the geometric, color-block style reminiscent of Mondrian.

The King of Bonds inspires fierce loyalty. Many fellow managers and longtime analysts at TCW left with him when he was fired. Monica Erickson, now DoubleLine’s Ultra Short Bond fund manager, recalls a sleepless week weighing the pros and cons before joining. Hsu was a newlywed with a baby on the way. “The idea of no salary and no health insurance was daunting,” he says. Given DoubleLine’s trajectory, the decision seems like the best one any of them could have made.

Collaboration is baked into the very structure of the firm. Partners are paid based on DoubleLine’s overall performance, not on the returns of the funds that they manage or assets in their particular funds. The arrangement fosters a sense of common enterprise and encourages communication. On any given day, a high-yield debt manager might walk over to pick the brain of an emerging-markets analyst, for example. At other firms, bond teams typically work in silos by sector and rarely interact. At DoubleLine, says Gundlach, “everybody has their oar pulling in the same direction.”

Doubly Cautious

Central to DoubleLine’s bond-picking approach is a healthy respect for risk. “We’ve always been conservative,” says Gundlach. The firm’s name refers to the solid double yellow lines that mark the center of a two-way road. Don’t cross them; if you do, you do so at your peril. “The most dangerous situation is when you think an investment is safe, and then you wake up one day and you realize it’s not,” Gundlach says. He scoffs at critics who say he sees seven risks for every one that exists. “That’s my job,” he retorts. “My job is not to be a Pollyanna.”

At the top of the firm’s current worry list is a ballooning federal budget deficit and a wave of government bonds hitting the market, putting upward pressure on interest rates. A U.S. government deficit that DoubleLine estimates at close to $1.7 trillion is only going to get bigger. “The one thing Democrats and Republicans agree on is infrastructure spending. So we will have an increase in spending,” says Gundlach, and more government bonds to cover the cost.

At the same time, the Federal Reserve is allowing a portion of the nearly $4 trillion in government debt purchased in the wake of the financial crisis to roll off its books every month, essentially increasing the supply of government debt on the market. “There’s an avalanche of bonds coming,” says Gundlach, and fewer buyers.

Corporate debt is another cloud in DoubleLine’s fixed-income outlook. For starters, yields on many investment-grade corporates aren’t enough to make up for losses they’ll likely sustain as interest rates rise. Currently, the typical corporate IOU rated triple-A to triple-B yields roughly 4% and has a duration, a measure of interest-rate sensitivity, of seven years. A seven-year duration implies that if rates rise one percentage point, the bond’s price will drop 7%.

Worse, a mounting crisis in corporate credit quality could blindside investors. American companies are awash in debt, says Gundlach. Although investors view investment-grade debt as safe, looks can be deceiving, he says. Nearly half of that debt is rated at the low end of the investment-grade spectrum: triple-B. “When the next recession comes,” says Gundlach, “you could have downgrades en masse of investment-grade debt to junk, which is not good.” (For more, see The Rising Risk in Corporate Bonds.)

Standout Funds

Navigating tricky markets is what active bond managers do. And DoubleLine’s portfolio managers have been doing it for years. Though the firm is only nine years old, DoubleLine’s bond pickers have worked together for an average of 16 years, plus many can claim two decades of experience in the industry. They’ve lived through bond market bumps, including the financial crisis 10 years ago and the hiccup in 2013, when Treasury yields surged and the broad bond market sank 2%.

It shows in the long-term performance of DoubleLine’s funds, starting with flagship fund and Kip 25 member DoubleLine Total Return Bond. Gundlach and comanager Philip Barach build a low-volatility portfolio by balancing government-backed mortgage bonds, which carry no default risk but are interest-rate sensitive, with non-agency mortgage bonds, which have higher default risk but are less rate sensitive.

Gundlach’s other U.S. intermediate-term bond fund, Core Fixed Income, which he runs with Sherman, has a similar standout record. It invests in a mix of bonds, including Treasuries, asset-backed bonds, investment-grade and junk-rated corporate bonds, and bank loans. Since the fund launched in mid 2010, it has crushed the Agg index in each calendar year but one.

The best-performing DoubleLine fund isn’t even a bond portfolio, technically speaking. Shiller Enhanced CAPE is essentially an index stock fund with an actively managed low-duration bond portfolio overlay designed to dampen volatility on the stock side of the fund and potentially boost returns. So far, so really good. The fund, run by Sherman, boasts a 13.0% five-year annualized return that wallops Standard & Poor’s 500-stock index by an average of 2.9 percentage points per year and ranks among the top 1% of all funds that invest in bargain-priced, large-company stocks.

Not every fund hits it out of the park. DoubleLine Floating Rate focuses on bank loans with interest rates that adjust every few months. It has been one of the firm’s best performers over the past 12 months with a 2.0% gain, but the fund lags its peers over three years and doesn’t beat its index over five years. Ultra Short Bond is average. Global Bond, launched in late 2015, is below average so far—though it’s early to say so and, to be fair, it’s been a rough stretch for foreign bonds.

The 2016 launch of DoubleLine Infrastructure Income shows how creative and nimble the firm can be. The fund is the first of its kind to focus on a fast-growing sector in fixed income: infrastructure debt, which funds airports, mass-transit systems, toll roads, power plants and renewable-energy projects. The fund has returned 2.3% annualized, which slays the 0.8% gain in the Agg index over the same period, with 13% less volatility.

With the bond market rocky these days, the flow of money overall into DoubleLine funds has slowed. That doesn’t bother Gundlach. “I’m not interested in turning into a trillion-dollar money manager,” he says. “We don’t have to expand every year. I don’t care if we expand at all.” In other words, he doesn’t want to be the next Pimco. The rival bond shop, with $1.7 trillion in assets, nearly became the supernova of fixed-income investing. In 2014, after some market misses and lumpy performance, Pimco cofounder and erstwhile bond guru Bill Gross ignominiously departed.

Nonetheless, DoubleLine continues to open new funds and is broadening its reach overseas. A Tokyo office opened in 2016, and the firm recently established a unit to sell DoubleLine mutual funds in Europe. Over the first nine months of 2018, international assets—about 9% of the firm’s total assets—increased 56% from the end of 2017, compared with an increase in U.S.-based assets of less than 1%. Says Ignacio Sosa, whose job is to build international relationships, “The world is our playground.”

Back in L.A., the trading floor at DoubleLine still has a small-operation feel to it. Fund managers and analysts perch in rows of desks, staring at a phalanx of screens. They talk with each other across desks and over the rows. Some have private offices, but they hardly ever use them. Even Gundlach is usually found at his desk on the trading floor. “I like where we are,” he says of his kingdom. “I like the way it is.”

The Bond Star Speaks

Gundlach has been asked to weigh in on everything from where interest rates are headed to which bonds to buy now to who’s going to win the Super Bowl. Investors (and football fans) have come to learn that he’s more often right than not. Below, a few bon mots from the influential bond investor.

The best investment advice: Buy low, sell high. [chuckle] It’s hard because it’s not just numbers. It’s about remembering how it feels when a market is really, really sold out and everybody’s bearish. You’ve got to understand that’s the bottom. And the opposite is true when the market starts to fall and people are in denial. That’s when you should get an uh-oh feeling.

The best way to build your retirement nest egg: Spend less than you make and save a lot. It’s the Chinese model. I save about 80% of my income every year.

Active versus passive management: For stock investing, people believe now that passive is the answer. But at the same time, there has been tremendous demand for the most active management possible in bonds: unconstrained funds. So people simultaneously love and hate active management, which is illogical.

Why he has nearly all of his money invested in DoubleLine funds: I don’t trust anybody to run my money but me.

On criticism that DoubleLine’s success is tied to him: Critics say there’s key-man risk. Isn’t it key-man reward? Is an NFL team not going to draft the best quarterback because he might get injured? That’s a crazy argument.

On his massive art collection: I’ve been collecting for years. You get to a point when you realize, What am I going to do with this stuff? I can’t give it to anybody. The taxes would be punitive.

Whether he’ll take DoubleLine public someday: We’re never going public. As long as I’m CEO, I’m never selling. I’m never going to work for anybody again. Ever. Never, ever, ever.

Why he hasn’t retired: I could have quit a long time ago and been fine. But this is not working, really. It’s just living.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Best Banks for High-Net-Worth Clients

Best Banks for High-Net-Worth Clientswealth management These banks welcome customers who keep high balances in deposit and investment accounts, showering them with fee breaks and access to financial-planning services.

-

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank Concerns

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank ConcernsChaos in the financial sector stole the spotlight from this morning's inflation and retail sales updates.

-

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street Holidays

Stock Market Holidays in 2026: NYSE, NASDAQ and Wall Street HolidaysMarkets When are the stock market holidays? Here, we look at which days the NYSE, Nasdaq and bond markets are off in 2026.

-

Stock Market Trading Hours: What Time Is the Stock Market Open Today?

Stock Market Trading Hours: What Time Is the Stock Market Open Today?Markets When does the market open? While the stock market has regular hours, trading doesn't necessarily stop when the major exchanges close.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

The Current I-Bond Rate Is Mildly Attractive. Here's Why.

The Current I-Bond Rate Is Mildly Attractive. Here's Why.Investing for Income The current I-bond rate is active until April 2026 and presents an attractive value, if not as attractive as in the recent past.

-

What Are I-Bonds? Inflation Made Them Popular. What Now?

What Are I-Bonds? Inflation Made Them Popular. What Now?savings bonds Inflation has made Series I savings bonds, known as I-bonds, enormously popular with risk-averse investors. How do they work?

-

This New Sustainable ETF’s Pitch? Give Back Profits.

This New Sustainable ETF’s Pitch? Give Back Profits.investing Newday’s ETF partners with UNICEF and other groups.