These Funds Will Benefit from Japan's Rebound

The foreign funds you own likely hold Japanese stocks. But you may want to boost your stake.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

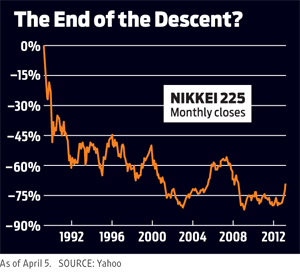

Nothing turns an investor's head faster than a 43% jump in four months. Maybe that's why so many people are talking about getting back into Japanese stocks. It's been a long time coming: The Japanese market has been in decline for nearly a quarter-century, with the Nikkei 225-stock index still 67% below its December 1989 peak. But the arrival of a new prime minister calling for sweeping economic changes has investors thinking that the worst is finally over.

But wait — we've seen this movie before, haven't we? Since the beginning of its infamous fall, the Nikkei has rallied on six occasions by at least 25%. Yet each time, these short-term surges ground to a halt, and eventually the index hit a new low. Meanwhile, despite multiple government programs to stimulate the country's financial system — including cutting short-term interest rates effectively to zero — Japan's economy has been on a downward spiral, burdened by 15 years of deflation that has resulted in lower wages. So what's different this time?

In a word, Abenomics. When new Prime Minister Shinzo Abe (pronounced ah-bay) took office in late 2012, he pledged to do whatever it took to end deflation and bring about inflation (with a target of precisely 2%). In April, the Bank of Japan, led by its newly appointed and Abe-friendly governor, Haruhiko Kuroda, announced a sweeping two-year plan to achieve Abe's goals. The central bank intends to double its holdings in government bonds and double the amount of money in circulation, among other things. To put things in perspective, the bank will buy about 7 trillion yen in Japanese bonds each month — roughly twice the $85 billion worth of U.S. government securities that the Federal Reserve has been buying monthly. All of this is part of Japan's bigger plan to weaken the yen, which will make the country's many export companies more competitive around the world, lift their profits, create more jobs and boost the economy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Of course, whether Abenomics will work is a looming question. Some critics argue that the easy work is done and that long-term reforms to make Japanese companies more competitive — another, probably more crucial element of Abenomics — are required to truly reawaken the economy. In any case, Abe has to stay in power for any real change to occur. His last stint, in 2006–07, ended abruptly after one year. For investors, the outcome of a July parliamentary election is key, for it will determine how much the Diet, Japan's legislature, supports Abe's policies.

Signs of improvement

Some positive changes are already afoot. After a decade of almost no wage increases, several big companies, including Toyota Motor and convenience-store operator Lawson, announced bigger bonuses in early 2013. "It's not huge, but it's change, and that's affecting the psyche of the Japanese consumer, which to me is big," says Taizo Ishida, co-manager of Matthews Japan fund. Indeed, both consumer and corporate confidence are on the rise. And Abe's approval ratings are high, which suggests that he's likely to stay put, at least for now. "It has been fantastic," says Ishida, who says he sensed during a recent trip to Tokyo that people seemed more optimistic. "It's almost a miracle to me." Ishida says that the easy money in Japanese stocks has been made. Nonetheless, he believes the latest rally marks the beginning of a bull market that could last three to five years.

Of course, none of this euphoria can erase the country's bigger problems. The ratio of Japan's debt to gross domestic product is more than double that of the U.S. And analysts see skimpy GDP growth of 1.6% or less a year through 2014. What's more, with Japan's birthrate falling, the population is aging and declining. That has a ripple effect on everything from income tax revenue to car and home purchases.

No question that Japan's stock market has its share of skeptics. Managers of global stock funds have been cool on Japan for seven years, according to T. Rowe Price. At last report, global funds had roughly 5% of assets in Japan, compared with 9% in the MSCI World index of stocks in developed countries. Even the Japanese are wary. Only 10% of the nation's pension-fund assets are invested in Japanese stocks. And the typical household in Japan has just 6% of its assets in stocks; by contrast, the average U.S. household has 27% in stocks, says Stephen Jen, a managing partner at the investment firm SLJ Macro, in London.

But unloved stocks are cheap stocks, and that explains why many value investors find Japan intriguing. On a price-earnings basis, Japan trades at 16 times expected earnings for 2013. That's slightly higher than the U.S. market's P/E of 14 and Europe's P/E of 12 (based on estimated profits). But profits in Japan are expected to rise faster — about 30% this year — thanks in part to the weaker yen, says Alec Young, global equity strategist at S&P Capital IQ. On the basis of price to book value (assets minus liabilities), Japan looks like a better buy: It trades at 1.2 times book value, compared with 2.2 for the U.S. market and 1.4 for all developed markets around the globe.

Meanwhile, corporate Japan is on surer footing these days. Companies have spent the past decade cutting costs, moving production centers to lower-cost countries in Southeast Asia, and repairing their balance sheets. Certainly, the weaker yen is boosting profits at many export-oriented firms. But strong demand from emerging markets and moderate growth in the U.S. are helping, too.

Some big-name U.S. firms are urging their clients to buy Japan. Earlier this year, Morgan Stanley Wealth Management lifted its recommended allocation to Japanese stocks from zero to 5%. David Darst, the firm's chief investment strategist, expects another 30% to 40% jump in the Japanese market this year in yen terms (to the extent the yen weakens against the greenback, U.S.-based investors would make less). "Japan is poised to break out of the false-start behavior that we've seen for years," he says.

Fund options

You may own some Japanese stocks already. Vanguard Total International Stock Market Index (symbol VGTSX), which tracks the FTSE Global All-Cap ex-U.S. index, recently had 15% of its assets in Japanese stocks. Some actively managed funds had even more. Among members of the Kiplinger 25 (see Our 25 Favorite Mutual Funds), Matthews Asia Dividend (MAPIX) had 21% in Japan, the most of any fund on our list. Our two diversified foreign funds, Harbor International (HIINX) and Dodge & Cox International Stock (DODFX), had 10% and 12% of assets in Japan, respectively.

Given the market's recent run-up, you should wade in slowly if you're keen to place a bigger bet on Japan. The biggest and oldest Japan-focused exchange-traded fund is iShares MSCI Japan Index (EWJ). The fund, which tracks an MSCI index of 312 stocks, lists automakers Toyota and Honda and financial-services giant Mitsubishi UFJ Financial Group as its biggest holdings. It charges 0.53% in annual expenses. Another ETF, Maxis Nikkei 225 Index (NKY), tracks Japan's best-known bogey, which looks nothing like the MSCI index. Its top three holdings: retailer Fast Retailing, robot-machinery maker Fanuc, and SoftBank, a mobile communications firm. It charges 0.50%. WisdomTree Japan Hedged Equity (DXJ), as its name suggests, hedges against changes in the value of the yen. That will help U.S. investors when the yen is weakening and hurt them when the currency is strengthening. The ETF, which costs 0.48% in annual fees, gained 27.2% over the past year, double the gain of unhedged Japan ETFs (returns are through April 5).

Among actively managed funds, we like Matthews Japan (MJFOX). Co-managers Ishida and Kenichi Amaki divvy up the fund's assets among three kinds of companies: global leaders that will benefit from a worldwide recovery, companies driven by growth in China and Southeast Asia, and small domestic companies that have posted roughly 25% annualized profit growth over the past five years. Matthews gained 9.8% annualized over the past three years, better than 88% of its peers.

Small Japanese companies aren't likely to benefit as much as large ones from a falling yen, but they will gain from a stronger economy. Consider, for example, iShares MSCI Japan Small-Cap (SCJ). Over the past five years, the ETF returned an annualized 3.3%, beating iShares MSCI Japan Index by an average of 4.7 percentage points per year. The small-company ETF charges 0.53% a year for expenses.

Among actively managed small-company funds, the best choice is Fidelity Japan Smaller Companies (FJSCX), which returned 4.7% annualized over the past five years. The average market value of its holdings is just under $2 billion. But in truth, manager Nicholas Price can troll the entire market for ideas. That's why the fund holds some big automakers, such as Honda Motor and Nissan Motor. "I like the midsize- to small-company space, but the big change in the yen made me move into the large-company exporters, because they'll lead the rally in the beginning of the process," says Price. The fund's annual expense ratio is 1.05%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.