A Foreign Fund Gets a Fast Start

Gerstein Fisher Multi-Factor International Growth uses a variety of measures to find well-priced overseas growth stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

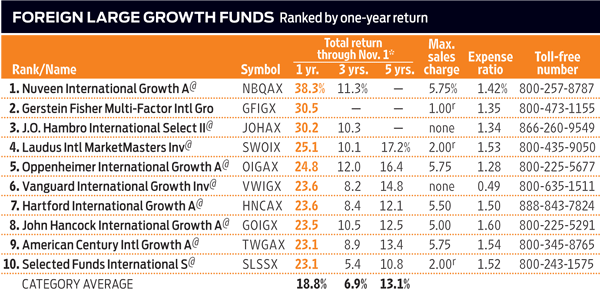

Gerstein Fisher Multi-Factor International Growth (symbol GFIGX) is just shy of two years old, but manager Gregg Fisher has earned successful results over the past decade with a similar strategy at his New York City advisory firm. Over the past year through November 22, Multi-Factor International Growth has crushed 97% of funds that focus on large, growing foreign firms, with a 34% return. The fund topped its benchmark, the MSCI EAFE index, which tracks foreign stocks in developed lands, by 8 percentage points, and its peers by nearly 12 points.

More than a dozen of the 196 stocks in the fund posted triple-digit gains, helping to boost the fund’s performance. Among them were Japanese firms such as Fuji Heavy Industries, the maker of Subaru cars (the stock climbed 212% over the past 12 months), and Daiwa Securities, an investment bank (up 183%). A handful of European stocks in the fund, including Bank of Ireland and EADS (a global aerospace and defense firm known for its Airbus jetliners), also more than doubled over the past year.

When picking stocks, Fisher looks at multiple measures—hence, the fund’s name. These factors include a company’s book value (assets minus liabilities), stock market value and share-price momentum, as well as total capital outlays (the less, the better). “We apply a certain value-factor set of characteristics within our growth strategy,” says Fisher. His screens tend to turn up profitable firms that trade at lower valuations than the typical foreign company. Indeed, his fund has a price-earnings ratio of 15 (based on estimated earnings), compared with an average P/E of 16 for its peers. Multi-Factor’s average price-to-book value ratio is also lower, at 1.6, compared with 2.1 for the typical fund in its category.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As a quantitative manager, Fisher says he prefers not knowing the names of stocks in the fund. “I don’t own a company because I like it,” he says. “I own it because it meets a certain set of criteria.” When a stock no longer does so, Fisher unloads. He also trims when a stock exceeds 5% of the fund’s assets (currently $100 million), or when exposure to a single country grows to more than 10% of the portfolio. Fisher thinks his so-called “country rule” helps him avoid following the crowd too closely, which is often dangerous for investors. “It allows me to stay away from the ‘growthy’ big countries and steer toward the more value-oriented smaller countries.”

These days, Multi-Factor has about 70% of its assets in Europe and 30% in developed Asian countries. It has just a smidgen (0.4% of assets) in emerging-markets stocks. The fund has a turnover ratio of about 50%, implying that it holds each stock for an average of two years. At last report, its largest holdings included reinsurer Swiss Re, casino operator Galaxy Entertainment and beer behemoth Anheuser-Busch InBev.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.

-

How to Choose a Mutual Fund

How to Choose a Mutual Fundmutual funds Investors wanting to build a portfolio will have no shortage of mutual funds at their disposal. And that's one of the biggest problems in choosing just one or two.