Fidelity Magellan Shows Signs of Life

The onetime colossus is improving, but other choices, such as Fidelity New Millenium, look more appealing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

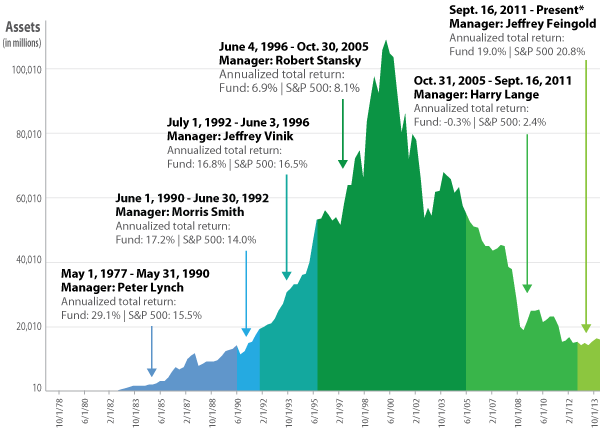

Fidelity Magellan (FMAGX), once the largest mutual fund in the land, is trying for what seems like the umpteenth time to right the ship. It may have finally found the right skipper in Jeff Feingold, who assumed the managerial reins in September 2011 and guided Magellan to market-beating gains in his first two calendar years at the helm.

So is it time to invest in Magellan, which, with $16 billion in assets, should be far easier to run than it was in 2000, when assets peaked at $110 billion? Our answer: No, mainly because we think other large-company funds are more attractive, starting with Fidelity New Millennium (FMILX), which we recently added to the Kiplinger 25.

Magellan today is far from the fund of yore. From 1977 to 1990, under Peter Lynch, it drew investors like bees to honey with an annualized return of 29.1%. That crushed Standard & Poor’s 500-stock index by a stunning 13.5 percentage points per year, on average. After Lynch retired, the fund performed well for a time, but results sagged dramatically with the arrival of a new century. In the 12 years from 2000 through 2011, Magellan trailed the S&P 500 eight times.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Maybe that’s why Feingold wasted little time putting his stamp on the fund when he took over what was then a $15 billion portfolio. In less than four months, Feingold says, he trimmed the number of stocks Magellan held from roughly 250 to about 225. And he steered the fund from one that held mostly fast-growing firms to one holding a more diversified mix of rapid growers (Google and Priceline, for instance). Plus, Feingold added what he calls quality growers, such as T.J. Maxx, and cheaply priced firms with improving results, such as airlines (American Airlines) and financial stocks (Bank of America). “I’m a diversified growth manager,” says Feingold. “I don’t make big sector bets.”

Given Feingold’s approach, investors shouldn’t bet on Magellan crushing the market. Feingold admits as much: “I want to outpace the S&P 500 by 1.5 to 2 percentage points per year.” In 2012 and 2013, the fund beat the index by 2.0 and 2.9 percentage points. In the first four months of 2014, the fund gained 0.9%, lagging the S&P by 1.7 points.

Feingold, 43, is a longtime Fidelity man. Since he joined the Boston-based behemoth in 1997, he has been a stock analyst, headed the firm’s research department, and managed five sector funds and four diversified funds, including Trend and Large Cap Growth. He’s no slouch: At every fund but one (the exception being Select Financial Services, which he ran from 2001 to 2004), Feingold outpaced the funds’ respective peer groups during his tenure.

Volatility concerns

The newsletter Fidelity Monitor & Insight rates Magellan “OK to Buy,” one notch below an outright “buy” rating. Editor John Bonnanzio says he wants to give Feingold a chance, but adds that he’s “a little uncomfortable” that Magellan has been about 20% more volatile than the S&P 500 over the past three years (a time frame that admittedly includes several months during which Feingold was not in charge).

One plus for Magellan is that it charges just 0.51% a year in fees. That’s among the lowest expense ratios for actively managed stock funds. The bargain price stems mainly from Fidelity’s philosophy (rare among sponsors) of basing some funds’ management fees on performance. Fees aside, we’d like to see another year or two of winning results before we would recommend Magellan.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.