Bond Funds With Flexibility

Go-anywhere bond fund managers can pick and choose from a complete menu of income investments.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

With the broad bond market down 2% so far this year, it’s easy to see the appeal of a fund that can invest in the corners of the market that are working. That’s where so-called unconstrained bond funds and their cousins, multisector bond funds, can help.

As the name implies, unconstrained funds (classified as “nontraditional” funds by Morningstar) can invest in a variety of fixed-income assets, from investment-grade corporate debt to junk bonds issued by firms with below-average credit ratings to emerging-market IOUs. They can hold outsize slugs of the fund’s assets in the bond sectors they prefer, or they can sell short (a bet that prices will fall) the securities they see headed south. Some of the funds can even hold stocks. Multisector bond funds are nearly as flexible, but some have limits—albeit broad—on how much may be invested in a given sector.

But the increased freedom comes with some extra risk, especially when big wagers go wrong. In one striking example, Janus Henderson Global Unconstrained Bond, the fund run by erstwhile “bond king” Bill Gross, lost 3% in a single day in May, caught off-balance by a bet that German bonds would fall in price relative to Italian bonds (the market moved the other way). There are other caveats. Many of the funds in the two categories don’t have long track records, and expense ratios can be pricey.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

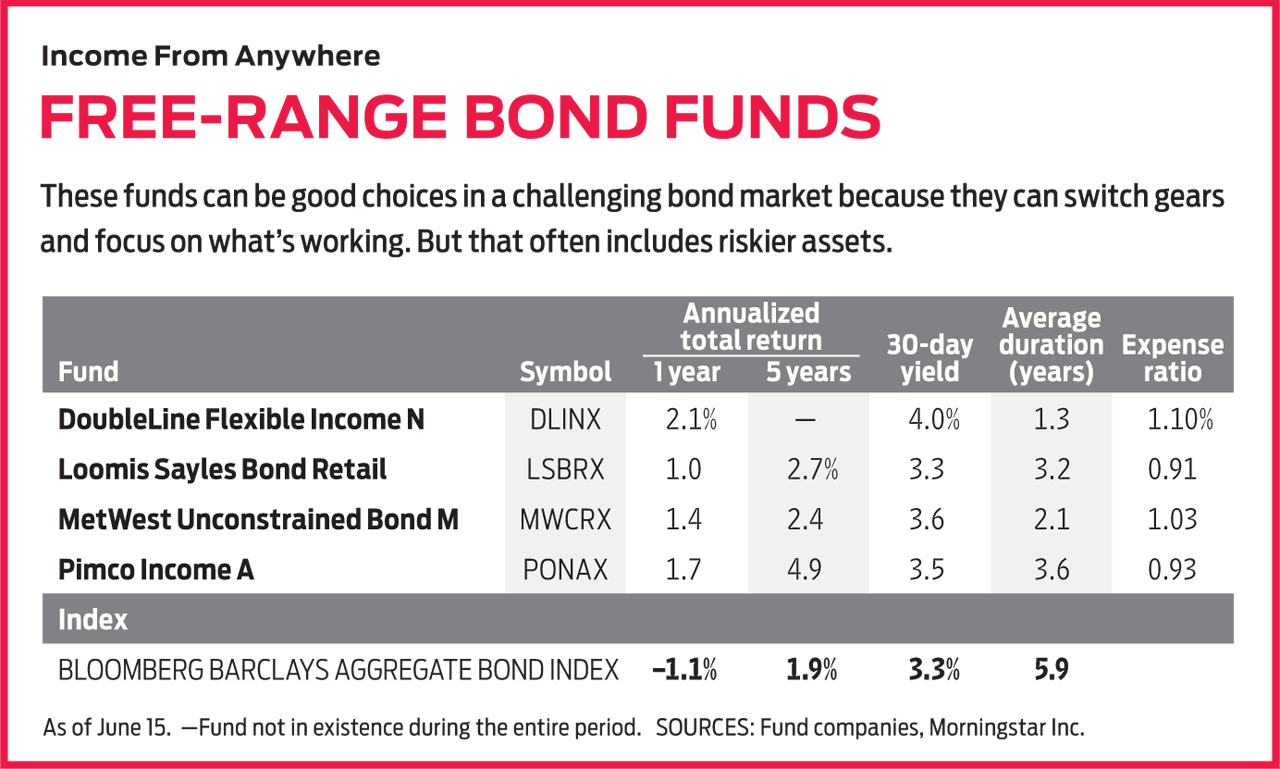

We think the funds below represent the best combination of flexibility and moderate risk. They come with reasonable expenses and have shown they can withstand periods of market volatility. All are geared to prosper as rates rise, and most important, they are run by managers capable of taking full advantage of their freer rein. Returns and other data are through June 15.

DoubleLine Flexible Income (symbol DLINX, 30-day yield 4.0%)

This four-year-old unconstrained fund doesn’t have much of a track record, but its managers sure do. Jeffrey Gundlach is a legend, and his comanager, Jeffrey Sherman, is quickly making a name for himself. Together, they have nearly five decades of asset-management experience between them.

The fund is well fortified against rising rates. It has a low duration—a measure of interest-rate sensitivity—of 1.3 years. A duration of 1.3 implies that if interest rates rise one percentage point, the fund’s net asset value would drop by 1.3%. The typical nontraditional bond fund has a 1.7-year duration, and it’s 5.9 years for the Bloomberg Barclays U.S. Aggregate Bond index, a proxy for the market overall.

Not only that, but Flexible Income’s managers have recently focused on bonds that do well in rising-rate environments. The fund has a 43% allocation to floating-rate debt. These loans pay variable interest rates pegged to short-term interest rate benchmarks that typically reset every 30 to 90 days, rising along with market rates.

Another favorite of late has been mortgage-backed securities. Non-agency mortgage debt—bundles of mortgages that aren’t guaranteed by the U.S. government—make up more than 20% of the portfolio.

But these instruments aren’t without risk. Both floating-rate debt and non-agency mortgage-backed securities are typically rated below investment grade, which means they carry greater risk that the issuers will default on their loan payments.

Since it launched in 2014, Flexible Income has returned 3.1% per year, on average—more than a percentage point better than the Aggregate index, with 32% less volatility.

Loomis Sayles Bond (LSBRX, 3.3%)

The managers of this multisector bond fund—Matthew Eagan, Dan Fuss, Brian Kennedy and Elaine Stokes—love a good bargain and look for promising bonds that have been unfairly punished. The value focus can make for a bumpy ride. In 2015, for instance, the team loaded up on high-yield corporate debt, particularly in the floundering energy sector as oil prices plummeted. That year, the fund posted a 7% loss—an eyebrow-raising decline for a bond fund—as energy bonds continued to flail. But investors who held on were rewarded when Loomis Sayles returned a cumulative 16.2% over the next two years, compared with 6.2% for the Agg index.

The managers maintain hefty positions—currently 44% of the fund’s assets—in the risky territories of high-yield corporate bonds (which come with higher default rates than investment-grade corporates) and non-dollar-denominated bonds (which are sensitive to currency movements). But Loomis Sayles has recently put a foot in the conservative camp, too, with a 30% stake in cash and short-term Treasuries. This pile of liquid assets lowers the fund’s overall sensitivity to interest rates—its duration is currently 3.2 years—and can be put to work quickly when a compelling opportunity arises, says Stokes.

The fund has rewarded patient investors. Over the past 15 years, its 6.3% annualized return bests the Agg index, as well as 84% of multisector funds. Including the first half of 2018, the fund has beaten similar funds in nine of the past 10 calendar years.

Metropolitan West Unconstrained Bond (MWCRX, 3.6%)

The team that manages this fund likes to work under some constraints, despite the fund’s name. They keep the fund’s duration between two and five years, and they stick almost exclusively with bonds, here and abroad, that are denominated in U.S. dollars. The managers say they have no crystal ball when it comes to assessing how interest rates and currencies will move. So they’d rather hunt for undervalued debt within their preferred sectors, says Stephen Kane, a comanager along with Laird Landmann, Tad Rivelle and Bryan Whalen.

Kane says many bond sectors look expensive these days, including emerging-markets debt and low-quality corporate issues. The managers prefer securitized debt: bonds backed by bundles of assets, such as residential or commercial mortgages and student, home-equity or auto loans. Such bonds account for 69% of the portfolio.

The lower-grade loans in these bundles are offset by higher-quality IOUs; some, such as student loans backed by the Department of Education, carry Uncle Sam’s guarantee. The overall result, says Kane, is a triple-B-style yield with a triple-A caliber default rate.

Scouting bargains has paid off for the fund in the past. In late 2011, high-yield and emerging-markets bonds were on sale, says Kane, as sovereign debt crises in Europe and headlines about a possible U.S. government default sowed volatility in the broad bond market and roiled riskier assets. The managers put 30% of the portfolio in emerging-markets bonds and high-yield corporate debt. The following year, the fund returned 15.8%, trouncing the Agg index and 98% of unconstrained funds. Since its 2011 inception, the fund’s 5.5% annualized return has beaten the index by an average of 3.4 percentage points per year.

Pimco Income (PONAX, 3.5%)

Managers Daniel Ivascyn and Alfred Murata tackle the vast fixed-income world by dividing the portfolio into two parts. In one portion, they hold high-yielding bonds that will excel in a growing economy. In the other, they hold high-quality debt that the pair expect to perform well when growth slows. They calibrate the two sides of the portfolio depending on Pimco’s current assessment of the economy and the bond market. When the firm sees risks on the horizon, the managers shift more of the fund’s assets into the high-quality group.

The managers have become more cautious recently. Bonds look richly priced, they say, and although global economies still look healthy, the U.S. economic recovery is getting long in the tooth. So they’ve added to the fund’s position in high-quality assets, such as U.S. government bonds, which currently make up about half of the fund. Income still has a big chunk of its assets devoted to emerging-markets and high-yield corporate debt. The managers’ biggest high-yield bet is in non-agency mortgages, which they say should continue to do well in a strong U.S. housing market.Over time, the duo’s balanced approach has paid off. Income has bested the Agg index in nine of the past 10 calendar years, including so far in 2018. The fund’s A shares come with a 3.75% sales charge, but investors can purchase them without paying a load or a transaction fee at online brokers, including Fidelity and Schwab.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Ryan joined Kiplinger in the fall of 2013. He wrote and fact-checked stories that appeared in Kiplinger's Personal Finance magazine and on Kiplinger.com. He previously interned for the CBS Evening News investigative team and worked as a copy editor and features columnist at the GW Hatchet. He holds a BA in English and creative writing from George Washington University.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank Concerns

Stock Market Today: Stocks Struggle on Credit Suisse, First Republic Bank ConcernsChaos in the financial sector stole the spotlight from this morning's inflation and retail sales updates.

-

The 5 Best Actively Managed Fidelity Funds to Buy and Hold

The 5 Best Actively Managed Fidelity Funds to Buy and Holdmutual funds Sometimes it's best to leave the driving to the pros – and these actively managed Fidelity funds do just that, at low costs to boot.

-

The 12 Best Bear Market ETFs to Buy Now

The 12 Best Bear Market ETFs to Buy NowETFs Investors who are fearful about the more uncertainty in the new year can find plenty of protection among these bear market ETFs.

-

Don't Give Up on the Eurozone

Don't Give Up on the Eurozonemutual funds As Europe’s economy (and stock markets) wobble, Janus Henderson European Focus Fund (HFETX) keeps its footing with a focus on large Europe-based multinationals.

-

Vanguard Global ESG Select Stock Profits from ESG Leaders

Vanguard Global ESG Select Stock Profits from ESG Leadersmutual funds Vanguard Global ESG Select Stock (VEIGX) favors firms with high standards for their businesses.

-

Kip ETF 20: What's In, What's Out and Why

Kip ETF 20: What's In, What's Out and WhyKip ETF 20 The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

-

ETFs Are Now Mainstream. Here's Why They're So Appealing.

ETFs Are Now Mainstream. Here's Why They're So Appealing.Investing for Income ETFs offer investors broad diversification to their portfolios and at low costs to boot.

-

Do You Have Gun Stocks in Your Funds?

Do You Have Gun Stocks in Your Funds?ESG Investors looking to make changes amid gun violence can easily divest from gun stocks ... though it's trickier if they own them through funds.