Is DoubleLine Total Return Bond Fund Too Risky?

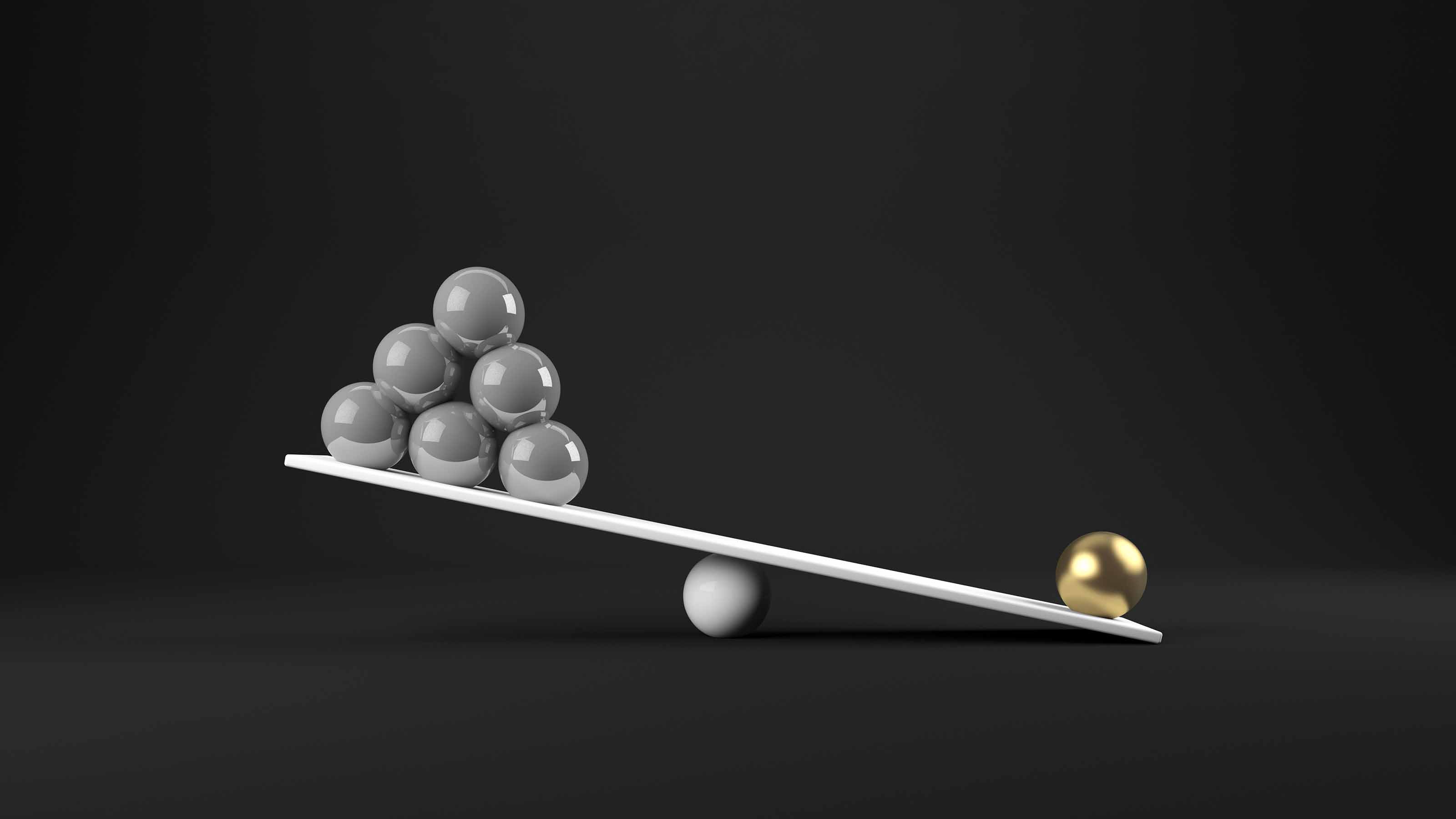

This fund keeps churning out rich returns in an increasingly problematic bond market. But we should be wary of its risks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Going against the conventional wisdom is often the key to successful investing. Consider mortgage-backed securities. Investors flocked to them because of their juicy yields until the bonds blew up during the real estate collapse. Since then, most investors have been unwilling to touch these securities. Who, after all, is crazy enough to invest in subprime mortgages?

Enter DoubleLine Total Return (symbol (DBLTX), an aggressive investor in private mortgages -- that is, those not backed by the government. From its inception in April 2010 through July 27, the fund, a member of the Kiplinger 25, has returned an annualized 13.9%, compared with 7.1% for the Barclays U.S. Aggregate Bond index. Over that period DoubleLine ranks in the top 1% among intermediate-term taxable bond funds, according to Morningstar.

That’s not all. The fund hasn’t lost money in any quarter since its launch. Its 30-day yield is a healthy 5.6%, and its 12-month yield is 7.4%. (The figures are for the fund’s institutional share class, which can be bought through most online brokers and charges 0.49% in annual fees; the retail shares, with the symbol DLTNX, charge 0.74% a year.)

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How do managers Jeffrey Gundlach and Philip Barach churn out such good results with such potentially toxic securities? In a word, carefully. To start with, they currently have two-thirds of the fund’s assets in government-guaranteed mortgages, such as those issued by the Federal National Mortgage Association. The rest is in private mortgages. Gundlach varies the mix, but the fund has never had more than 40% or less than 28% in private mortgages.

Of the private mortgages, almost half are considered prime -- meaning the risk of default is minimal. Another 10% are commercial real estate mortgages, most of which are high quality. Only 6% are subprime (2% of the entire fund), and a little more than one-third are Alt-A. Alt-A mortgages were given to borrowers whose credit was better than that of subprime borrowers but not pristine enough to qualify for prime mortgages.

Gundlach and Barach don’t stop there. They have about 30 analysts and traders who examine the individual mortgages inside of a security. They look at each borrower’s credit score at the time the loan was made. They also look at the value of the loan compared with the appraised value of the property at the time the loan was made, and they adjust their assessment based on subsequent changes in the metropolitan area’s property values. They favor bigger loans because, Gundlach says, the borrowers are more likely to refinance or pay off their mortgage.

All that work has boosted returns, Gundlach says. But sector-allocation moves have mattered more. These include changes in the proportion of private mortgages to government-backed mortgages. They also include changes in the mix of private mortgages among prime, subprime and Alt-A loans. Gundlach says he invested more in Alt-A mortgages earlier on than he does now. Today, he’s buying more prime mortgages.

He also closely watches and adjusts the interest-rate sensitivity of the fund’s government-guaranteed mortgages. Rising rates today wouldn’t hurt the fund nearly as much as they would have in the past. The government mortgages in DoubleLine’s portfolio would lose about 4% in price if interest rates on similar securities rose by one percentage point (bond prices generally move in the opposite direction of interest rates).

Gundlach says that the interest-rate sensitivity of government and private mortgages offset each other to some degree. If rates rise, inflation will likely climb, too, and that should increase the value of the private mortgages. Conversely, if the economy weakens, pushing down the value of the private mortgages, the prices of the government-guaranteed issues are almost sure to rise.

Finally, just like cheese and wine, mortgages get better with age, Gundlach argues. People who’ve been paying on their mortgages for five years or more are likely to continue paying. No private mortgages -- that is, mortgages without government backing -- have been issued since 2007.

More big investors have discovered the attractiveness of subprime and Alt-A mortgages in the past couple of years. The “junk” credit rating of these securities means they should continue to produce good returns if the economy strengthens -- unlike higher-quality bonds, which may be close to peaking. (See VALUE ADDED: The Dangers Lurking in Bonds.)

Gundlach has been investing in mortgages successfully since 1985 -- most of that time at TCW Total Return Bond (TGMNX). (A bitter legal battle ensued after TCW fired Gundlach in 2009.) Without question, many of the private mortgages he’s been investing in over the past few years are riskier than the lion’s share of the securities he owned during most of his years at TCW.

Morningstar, the fund rater, worries that DoubleLine Total Return is too risky. Its oversized yield alone raises warning flags, says analyst Sarah Bush. “Swim at your own risk,” reads the title of her latest analysis of the fund. She’s concerned about the fund’s holdings in mortgage-backed derivatives, including inverse floaters, whose yields move inversely to those of ordinary mortgage securities. More to the point, the floaters can be volatile and hard to trade.

I worry about the fund, too. No bond fund that boasts returns and yields as high as this one can do it without taking risks. The fund’s girth -- $29.4 billion in assets -- also concerns me. At the end of the day, making a judgment about DoubleLine comes down to one’s faith in the ability of Gundlach and Barach to navigate mine-infested waters. Their consistently superb returns are impossible to dismiss, and that’s why I recommend DoubleLine Total Return. But it’s a fund that I -- and you -- should watch carefully.

Steven T. Goldberg is an investment adviser in the Washington, D.C. area.

Kiplinger's Investing for Income will help you maximize your cash yield under any economic conditions. Download the premier issue for free.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Bond Basics: U.S. Agency Bonds

Bond Basics: U.S. Agency Bondsinvesting These investments are close enough to government bonds in terms of safety, but make sure you're aware of the risks.

-

Bond Basics: Pick Your Type

Bond Basics: Pick Your Typeinvesting Bonds offer a variety of ways to grow wealth and fortify your portfolio. Learn about the types of bonds and how they work.

-

Time to Invest in Multi-Family Real Estate Stocks? Not So Fast

Time to Invest in Multi-Family Real Estate Stocks? Not So FastThe Fed's aggressive rate hiking is weighing on the housing market, leading many to wonder if it's a good time to invest in multi-family real estate stocks.

-

BlackRock Event Driven Equity Profits from Corporate Change

BlackRock Event Driven Equity Profits from Corporate Changemutual funds BALPX capitalizes on mergers, executive turnover and other events.

-

Double Your ESG Impact With Funds Tied to Charities

Double Your ESG Impact With Funds Tied to CharitiesFinancial Planning A growing number of funds donate directly to causes you might care about. Are they good investments?

-

ESG Gives Russia the Cold Shoulder, Too

ESG Gives Russia the Cold Shoulder, TooESG MSCI jumped on the Russia dogpile this week, reducing the country's ESG government rating to the lowest possible level.

-

When Actively Managed Funds Are Worth It

When Actively Managed Funds Are Worth ItBecoming an Investor For some investment categories, choosing an actively managed fund makes sense.

-

The Truth About Index Funds

The Truth About Index FundsIndex Funds You may think you're diversified by buying an S&P 500 Index fund, but you're making a substantial wager on a handful of stocks.